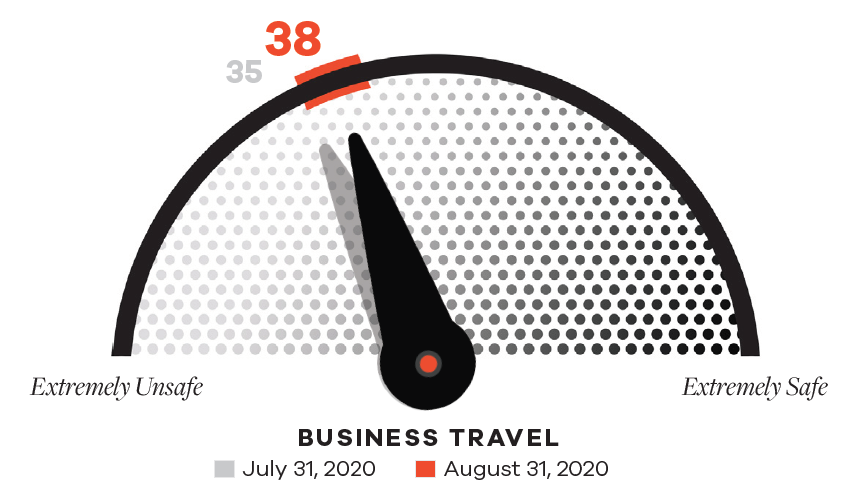

In the United States it appears that time is now. After months of stagnation, the Business Travel Safety Barometer, linked to MMGY Travel Intelligence's Travel Intentions Pulse Survey (TIPS) shows a modest increase to 38 at the end of Aug-2020, up from 35 points at the end of Jul-2020. Admittingly, the score remains low, but it does show positive movement.

With the exception of the Cruise Safety Barometer Score, all category barometer scores proved to be the highest MMGY has observed since the pandemic hit the US back in Mar-2020. The Transportation Safety Barometer continues to lead the pack with a score of 65 (on a 1-100 scale), influenced largely by travellers' strong sense of relative safety in traveling by personal vehicle.

CHART - The mood among US travellers to business travel has started to see some positive movement, but still scores some way below general transportation (65), lodging (50) and dining and entertainment (45) (Source: MMGY Travel Intelligence's Business Travel Safety Barometer)

While Americans continue to feel safest traveling in their own cars, the latest findings also illustrates that they're also perhaps starting to feel somewhat more confident traveling by air and even by train/ rail. The safety barometer score for domestic air travel increased again to 41 (0-100 scale), which is up from 38 last month - a gain of 11 points since early May. The barometer score for travel by train/rail jumped five points from last month. Both of these scores are the highest recorded since the beginning of the pandemic.

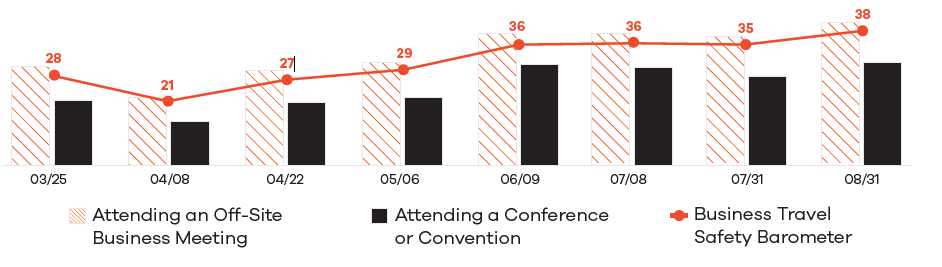

In a good sign for the corporate travel industry in the US, travellers' perceptions of safety increased for both attending an off-site business meeting and attending a conference or convention in Aug-2020. A closer look at the Barometer's performance shows these scores have been relatively flat now for months as business travellers has been pretty much substituted by videoconference technology. However, consistent with other travel segments, MMGY now sees the barometer reach new pandemic heights.

CHART - There has been positive movement in business travellers attending off-site meetings (up to 41) and attending a conference or convention (up to 30) during Aug-2020 (Source: MMGY Travel Intelligence's Business Travel Safety Barometer)

The safety barometer score are linked heavily to MMGY's TIPS survey which monitors the impact of Covid-19 on the travel intentions of US business and leisure travellers. The survey measures current and future traveller sentiment amid the Covid-19 pandemic and tracks trends and shifts in travel intentions.

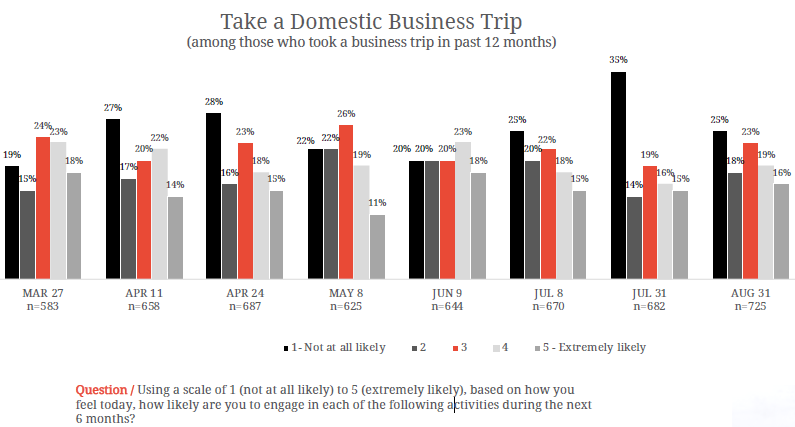

The latest monthly findings - Wave VIII, based on responses from 1,200 US residents who have taken an overnight trip for either business or leisure in the past 12 months between 21-Aug-2020 and 31-Aug-2020 - found the likelihood of taking a domestic business trip during the next six months increased from 31% in Jul-2020 to 35% in Aug-2020.

Importantly, it also seems more people who thought business travel was going to be totally out of the picture this year now see it as a possibility. The percentage of business travellers who said they were not at all likely to take a business trip during the next six months declined significantly from 35% to just 25%.

CHART - The percentage of travellers likely to take a domestic business trip during the next six months increased in Aug-2020 (Source: MMGY Travel Intelligence's Travel Intentions Pulse Survey)

Around one in ten respondents (11%) said they would travel within the next 30 days and a further 17% said that would be in the next three months. The majority though still see a return of domestic travel occurring in early 2021 with more than a quarter (26%) saying travel will return within six months, while just under a quarter (24%) say it would be within the next 12 months. Around one in ten (12%) still believe it could be beyond 12 months from now, while a similar level (11%) have no business travel expectation.

Even respondents' likelihood to take an international business trip during the next six months increased over last month, reversing a two-month downward trend. Levels jumped from 13% in Jul-2020 to 17% in Aug-2020, just below the level likely to take an international leisure trip (18%),but notably below the domestic travel figures from business travel (25%) and leisure travel (41%).

On the whole, these are all positive movements in sentiment, but the fact that the majority of respondents to TIPS remain concerned about contracting Covid-19 - more than half (54%) score in 4 or 5 on a scale from 1= not at all concerned to 5= extremely concerned, with 31% scoring it 5 - it highlights the ongoing barrier we will face for the recovery of business travel until we can get a better hold on the current global health crisis.