In a recent statement, Zimbabwe's Civil Aviation Authority (CAAZ) said a budget of approximately USD253 million has been set aside to develop and upgrade the country's airports, in a bid to meet rising demand and international standards. The budget will exclude Victoria Falls International Airport, which recently underwent extensive renovations to handle up to 1.5 million ppa, three times the previous total and which was, ironically, inaugurated by President Mugabe in Nov-2017, in what may have been his last official function.

The agency may consider the PPP model to fund reconstruction of smaller domestic airports. Which begs the question, "who are the potential 'private' investors in the PPP equation"?

MAP - Zimbabwe is land locked and neighboured by Botswana, Malawi, Mozambique, Namibia, South Africa and Zambia Source: Google Maps

Source: Google Maps

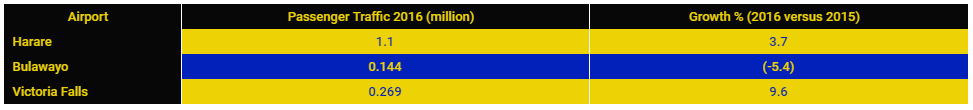

There are 21 airports in Zimbabwe but only three of them host commercial air services on scheduled airlines: Harare, Bulawayo and Victoria Falls, which is the main tourist airport. Two of them, Harare (which is still named after the ex-President) and Victoria Falls, have experienced fairly consistent and in some years high levels of growth during the last nine years, while Bulawayo's growth has been somewhat more of a staccato nature.

Judging from this evidence, Bulawayo would not be as attractive to investors, but that single statistic disguises the fact that in the previous three years the average growth there was 47.8%, which is considerably higher than at Harare and Victoria Falls.

Bulawayo is still regarded by some as the industrial centre of Zimbabwe, and it occupies a strategic position near the much richer countries of Botswana and South Africa. Apart from Bulawayo's claims, the airports of greatest interest to private investors, be they African or international, would probably be Harare and Victoria Falls. But even then, with only just over one million passengers per annum, Harare is only at the minimum level for likely profitable operations according to academic research. The other two are nowhere near that benchmark.

TABLE - Traffic figures for 2016 (the last full year of data) highlights the low passenger levels recorded at Zimbabwe's largest airports Source: CAPA - Centre for Aviation and Civil Aviation Authority of Zimbabwe

Source: CAPA - Centre for Aviation and Civil Aviation Authority of Zimbabwe

Harare has just 12 non-stop destinations, all of them are in Africa (10) or domestic, with the exception of Dubai, which is Zimbabwe's gateway to the world. But the lack of European and North American services in particular is a negative for investors; even West Africa is not represented. Travel to many destinations is possible via Johannesburg, as it is via Nairobi and Addis Ababa, but direct flights are the open sesame to increased trade.

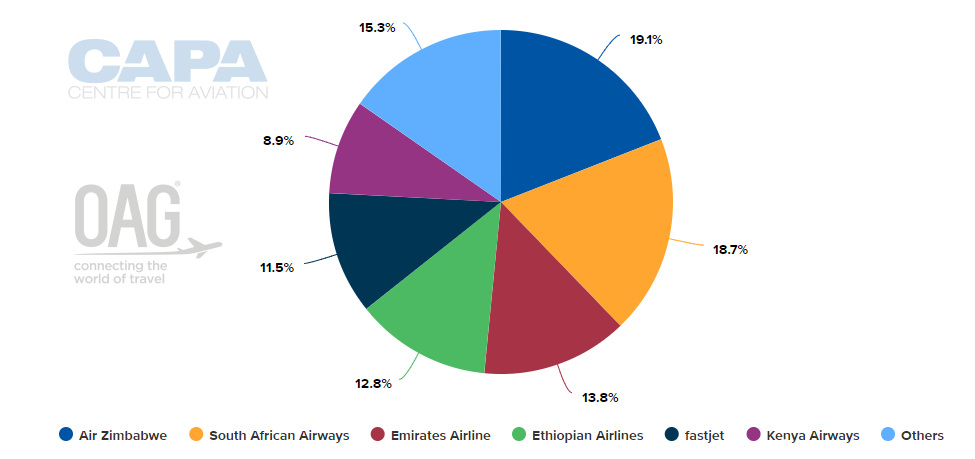

Air Zimbabwe is currently the largest carrier as measured by seat capacity but only just ahead of South African Airways. There are no sanctions in place specifically to prevent air services being initiated but other economic sanctions and lack of economic prospects for operation count against many airlines' decision on whether or not to operate there.

CHART - Air Zimbabwe remains the largest operator at Harare Robert Gabriel Mugabe International Airport, but foreign airlines have been growing their presence in Zimbabwe over recent years as it has adopted a more liberal approach to air services Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Many of the same airlines are operating, albeit with significantly less frequency, at Victoria Falls Airport, while Air Zimbabwe dominates at Bulawayo, where it is one of only three carriers.

The economy, which is dependent heavily on mining and agriculture sectors, has defied expectations in recent years, recording real growth of more than 10% per year in the period 2010-13, before falling back below 3% in the period 2014-17, due to poor harvests, low diamond revenues, and decreased investment during a poor climate for it. If a new government can reduce stratospheric public sector wage expenses and relieve some of its crippling external debt it might have a fighting chance.

But the bigger problems for potential investors, especially those from abroad, apart from infrastructure and regulatory deficiencies, will be those that typically occur throughout Africa - the actual or mere threat of the misappropriation of funds, lack of oversight, inefficient management, lack of transparency and concerns about non-aeronautical revenue generation.

While it may be 1,600 miles away from Harare, the success or failure of the Bugesera International Airport in Rwanda, a USD818 million PPP project at Kigali that should open in 2019, will go a long way to determining the degree of investor interest in PPP activity at Zimbabwean airports.