Summary:

- Spaniards account for only 30% of AENA's passengers, a geographic breakdown of traffic for the first nine months of 2018 has revealed;

- Western Europe is the main source but the British - the largest country group - are in decline while the United States of America (USA) grew quickly from a small base;

- Madrid still handles the highest percentage of passengers but five big tourist resort airports handle over 30% collectively.

Spaniards accounted for 30% (61.2 million, but a larger increase, of 10.5%). While tourism remains crucial to Spain's economy, thereby accounting for the majority of passengers being Europeans, the increase in the share of Spaniards may suggest an improvement in the economy. There are mixed signals in that respect and this is one of them.

One surprising statistic is the slim contribution from Latin America, given that Spain's largest airport, Madrid Barajas, is the major gateway by some margin between Europe and Latin America. Only 2.8% of passengers (5.7 million) were from that loosely defined area, though the increase did reach 6.3%.

The contribution from North America was even smaller at 4.6 million (2.3%), even though that includes Mexico. However, it was the second largest increase, at 16.3%. Africa and the Middle East both registered just 1.2% of passengers though the increase was over 8% in both cases. The largest increase was Asia and 'others', which accounted for only 0.4% of the total but that increase came in at 27.2%

The statistics suggest that Europe continues to be a mature market, while there are few flights, but some opportunity, to and from the Middle East, Africa, and especially Asia Pacific. Regarding individual countries, Spain's 61.2 million is the highest total, while the UK is still second by some margin over Germany. But the UK's total fell by 4.4%, which has had an impact in some tourist resorts such as Benidorm, while all other countries apart from Switzerland recorded an increase.

TABLE - AENA passenger traffic by origin and destination country for the nine months ended 30-Sep-2018 Source: AENA

Source: AENA

The largest increase from Europe came, surprisingly (considering both have similar tourist and cultural offers) from Italy (overtaking France) and Portugal, while the largest single increase altogether came from/to the US, which contrasts with the small 'North America' figure highlighted above.

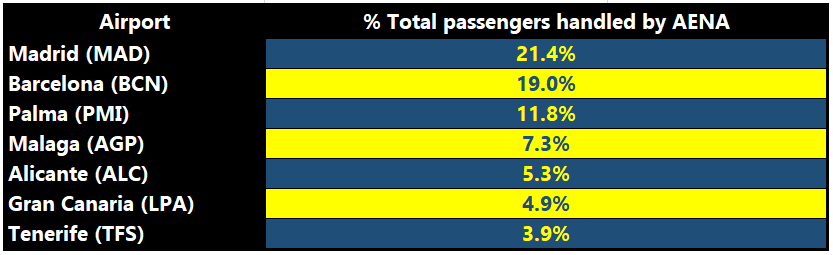

There was no great surprise in the list of the busiest airports. Barcelona's El Prat airport had been narrowing the gap on Madrid Barajas but the latter grew by 8.4% in the full-year 2018, compared to 6.1% at Barcelona. Thus in the nine-month period that AENA is reporting here, Madrid accounted for 21.4% of all passengers, and Barcelona 19%.

TABLE - AENA's busiest airports were all situated in Spanish tourist destinations Source: AENA

Source: AENA

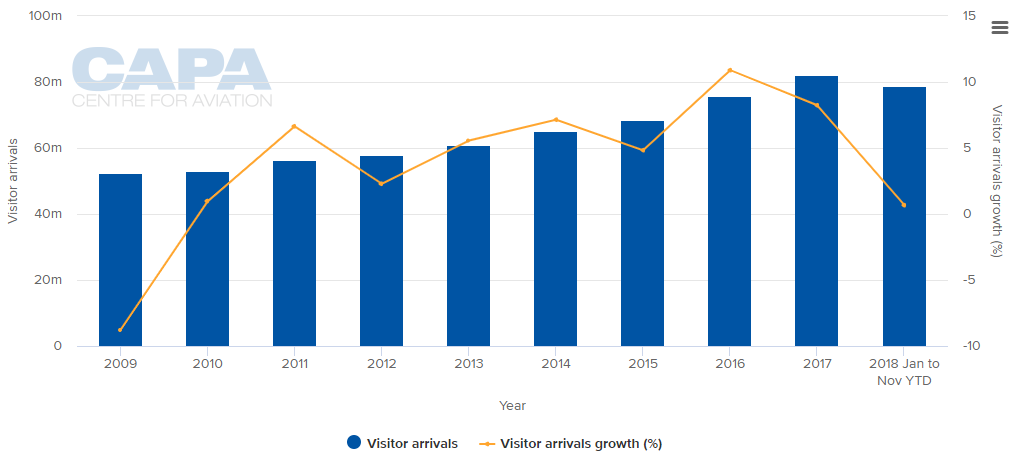

This statistic again underlines the importance of tourism to Spain, as the five airports are all in tourist areas, on the mainland, in the Balearic Islands or the Canary Islands. But tourism arrival levels have slowed in 2018 to just 0.7% year-on-year for the first eleven months, mainly owing to the slowdown from Europe the AENA data highlights, likely driven by vacationers - especially those from the UK - returning to alternative destinations such as Turkey, Egypt and Tunisia.

CHART - Annual visitor arrivals in Spain slowed in 2017 after strong growth the previous year, but dropped to just 0.7% across the first eleven months of 2018 Source: CAPA - Centre for Aviation, Spain's Ministry for Industry, Energy and Tourism and Instituto Nacional de Estadistica

Source: CAPA - Centre for Aviation, Spain's Ministry for Industry, Energy and Tourism and Instituto Nacional de Estadistica

It also suggests why, when the privatisation of AENA was first mooted in 2011, it was considered that it might be in blocks, with strong anchor airports from this second tier behind Madrid and Barcelona being the main attraction in each block. AENA also released data on the main airlines, the number of passengers they carried, the increase compared to the previous period, and the percentage of the total.

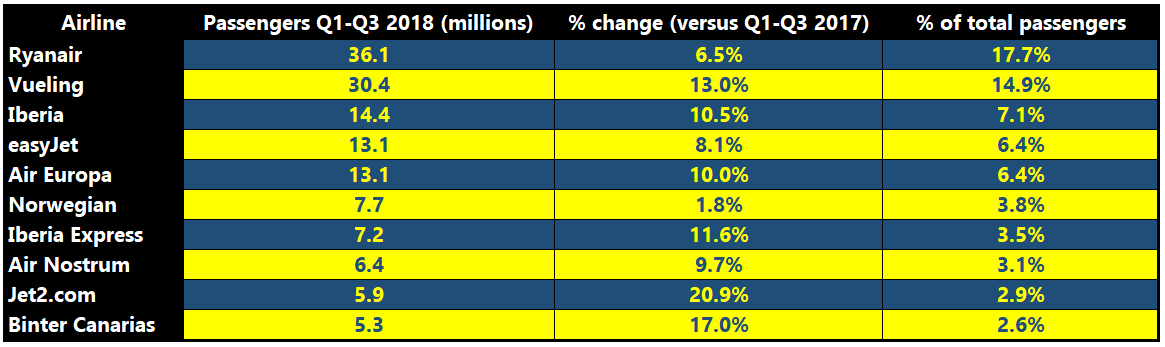

TABLE - LCCs dominate in the Spanish market with Ryanair and Vueling alone accounting for almost a third of the traffic Source: AENA

Source: AENA

It may seem strange that the national carrier should be only third in the table of market share but six of the airlines in it are LCCs and CAPA - Centre for Aviation data based on OAG schedules shows that in Jan-2019 and Feb-2019 50% and 47.7% respectively of all seats in and out of Spain are on LCCs.

Ryanair used to rule the roost and it is still the largest carrier, but its growth rate was the second smallest of all those mentioned. Spanish LCCs such as Vueling are narrowing the gap but the biggest increase of all came from the UK LCC Jet2.com, which has a revamped, unashamed 'holiday' offer backed by a comprehensive package holiday product.