Summary:

- While intra-African capacity has grown +3.0% over the first five months of the year it continues to be overshadowed by extra-Africa capacity growth, which was more than double the rate at +8.0% for the same period;

- While extra-African growth is credible, it is the intra-African market that needs to be developed to allow the Continent to fulfil its development potential and where its greatest opportunity exists;

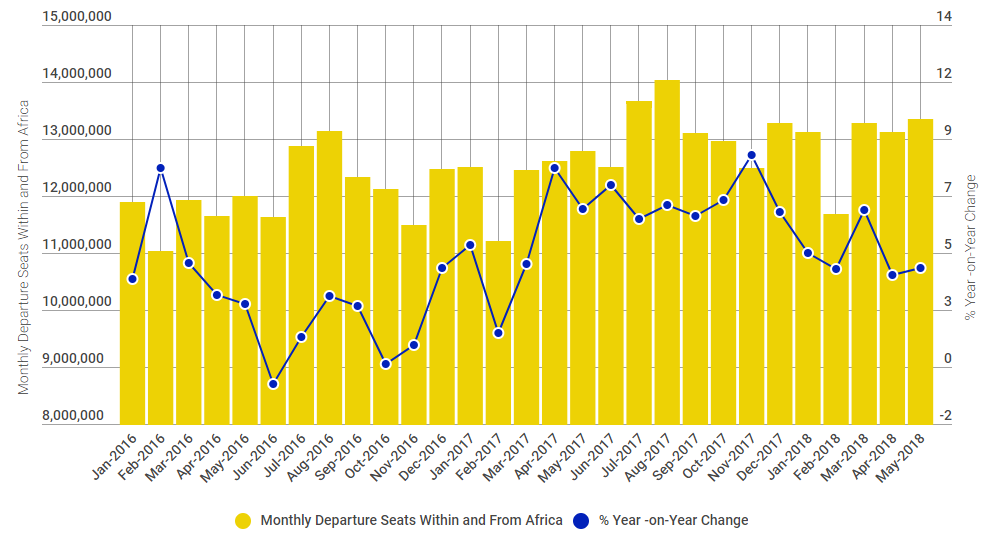

- Africa continues to record capacity gains: in fact since Jun-2016 it has recorded 23 consecutive months of year-on-year capacity growth;

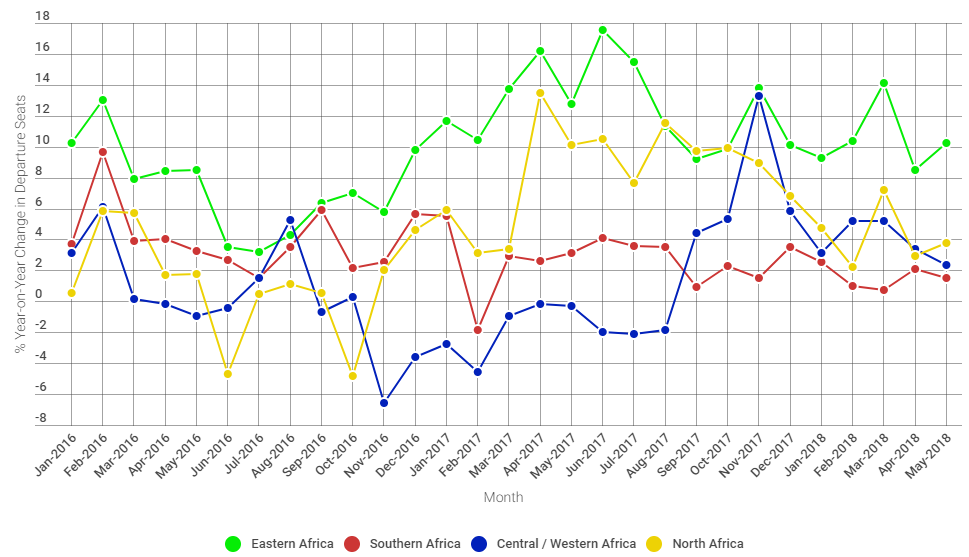

- While all regions of Africa have seen capacity growth over the first the first five months of 2018, the rate varies significantly - +1.6% in Southern Africa, +3.8% in Central/Western Africa, +4.2% in North Africa and +10.5% in Eastern Africa.

Within Africa, The Blue Swan Daily analysis of OAG schedule data shows that seat capacity rose +3.0% across the first five months of the year versus the same period in 2017. Year-on-year growth peaked at +4.0% in Mar-2018, but had slipped down to +2.2% this month, the weakest growth period this year. Looking at capacity outside of the Continent, seats from Africa grew at a much faster rate of +8.0% across the first five months of 2018 with monthly growth fluctuating between +5.7% in Apr-2018 and +11.2% in Mar-2018.

The intercontinental market might be growing from a lower base and it is credible that African destinations are enhancing their connectivity outside of the Continent, something that has been highlighted by among others confirmation of new flights from Cathay Pacific linking Hong Kong to Cape Town and most recently from British Airways relaunching its London - Durban service and Ethiopian Airlines adding Manchester to its European network. However, it is the intra-African market that needs to be developed to allow the Continent to fulfil its development potential and where the greatest opportunity exists.

It is clear that Africa's leading airlines are attempting to boost connectivity within the Continent with Ethiopian Airlines, Kenya Airways and RwandAir the most positive examples. But there is still significant work to be done. The LCC revolution that has taken the world by storm still remains in the evolution stage in Africa, and while the Continent is waking up to the phenomenon that has already changed the way people fly in all other parts of the world, its penetration remains low, albeit is actually starting to grow.

African governments retain an affinity with their national carriers and ongoing talks of new national carriers in Uganda and Nigeria highlight this. The arrival of widebodies into the fleet of RwandAir has been a challenge for the East African carrier, the ex-Malaysia Airlines 777 that has already arrived in Harare for Zimbabwe Airways sits idle on the ground, and we are even now seeing images of a first Dreamliner for Air Tanzania near completion at a Boeing manufacturing plant.

These will not solve Africa's connectivity problem, but could instead simply deliver further losses to the world's only unprofitable region of the airline business. IATA predicts African carriers are expected to continue to make small losses of USD100 million in 2018 following a collective net loss of USD100 million in 2017. This is despite stronger forecast economic growth in the region expected to support demand growth of +8.0% in 2018, slightly outpacing the announced capacity expansion of +7.5%.

But all is not equal across the vast African continent, which continues to see clear regional variations. Looking at departure capacity data - both internally within Africa and outside the Continent -we generally see stable growth across the Continent as a whole. In fact since Jun-2016 it has recorded 23 consecutive months of year-on-year capacity growth, although rates have slipped a little from the highs recorded through Q2, Q3 and Q4 last year.

CHART - Network capacity growth within and from Africa has shown stability, although 2018 rates have slipped a little from the highs recorded through much of last year Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

However, when the delve down to a regional level we can see notable variations in capacity metrics. While all regions of Africa have seen capacity growth over the first the first five months of 2018, the rate varies from just +1.6% in Southern Africa, via modest +3.8% and +4.2% rises in Central/Western Africa and North Africa to the +10.5% double-digit rise in Eastern Africa.

The strongly performing Eastern African market, dominated by Ethiopian Airlines, Kenya Airways and the expanding RwandAir, saw ten months of double-digit year-on-year growth rates in 2017 (and the two exceptions were +9.2% and 9.9% in Sep-207 and Oct-2017) and these have continued into 2018 with three of the five months also recording double-digit year-on-year growth.

The North African market, the largest African region thanks to its proximity to Europe and the Middle East and also a level of market liberalisation, has seemingly overcome the geo-political issues that hit it particularly hard through 2016 and has recovered to record positive rates of monthly year-on-year growth since Nov-2016.

Southern Africa is the most stable of the markets with very little variation in the rate of capacity growth, albeit challenges at South African Airways (SAA) could see capacity levels shrink as it restructures its business and could impact heavily on future regional performance.

The Central/Western Africa region has shown the biggest differentiation in capacity growth over the region with an almost 20 percentage point variation in its seat offer between Nov-2016 and Nov-2017. After ten months of capacity declines stretching back to Nov-2016, the tide turned for this region in Sep-2017 when it returned to growth with year-on-year capacity up +4.4% for the month. It has remained positive through to this month, albeit it is worth noting that this month's rate is the lowest recorded since it returned to growth.

CHART - There are clear variations in capacity growth across Africa when you start to look more closely at the Continent on a regional scale Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG