Results:

Air New Zealand reported (23-Aug-2017) the following financial highlights for 12 months ended 30-Jun-2017.

Operating costs and Revenure:

- Operating revenue: NZD5109 million (USD3638 million), -2.3% year-on-year;

- Passenger: NZD4376 million (USD3116 million), -2.3%;

- Cargo: NZD335 million (USD239 million), -4.0%;

- Contract services and other revenues: NZD398 million (USD283 million), -0.7%;

- Operating costs: NZD3844 million (USD2737 million), +4.2%;

- Labour: NZD1261 million (USD898 million), +2.9%;

- Fuel: NZD827 million (USD589 million), -2.2%;

- Operating profit: NZD1265 million (USD901 million), -18.0%;

- Net profit: NZD382 million (USD272 million), -17.5%;

Passenger numbers:

- Passengers: 16.0 million, +5.2%;

- Domestic: 10.4 million, +6.7%;

- Tasman and Pacific Islands: 3.6 million, +1.6%;

- International: 2.0 million, +4.3%;

- Passenger load factor: 82.6%, -1.1ppt;

- Domestic: 80.5%, -0.1ppt;

- Tasman and Pacific Islands: 81.3%, -2.0ppts;

- International: 83.8%, -1.0ppt;

- Passenger revenue per ASK: NZD 10.6 cents (USD 7.55 cents), -6.4%;

- Domestic: NZD 21.3 cents (USD 15.17 cents), -2.3%;

- Tasman and Pacific Islands: NZD 9.3 cents (USD 6.62 cents), -5.8%;

- International: NZD 8.2 cents (USD 5.84 cents), -10.2%;

Yield and assets:

- Yield: NZD 12.8 cents (USD 9.11 cents), -5.0%;

- Domestic: NZD26.5 cents (USD 18.87 cents), -2.2%;

- Tasman and Pacific Islands: NZD 11.5 cents (USD 8.19 cents), -3.4%;

- International: NZD 9.8 cents (USD 6.98 cents), -9.1%;

- Total assets: NZD7171 million (USD5106 million);

- Bank and short-term deposits: NZD1369 million (USD975 million);

- Total liabilities: NZD5185 million (USD3692 million). [more - original PR]

*Based on the average conversion rate at NZD1 = USD0.712008

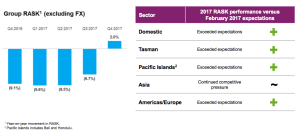

RASK movement saw marked improvement in the second half of the year

Source: Air New Zealand

Air New Zealand experienced a 10% year-on-year increase in the carrier's 2017 full year dividend. A 2017 final fully imputed dividend of NZD0.11 (USD0.08) per share has been declared, bringing the full year declared ordinary dividends to NZD0.21 (USD0.153) per share. The decision to increase the dividend was "based on the airline's strong financial position, future capital commitments and improving trading environment, the Board felt it appropriate to increase the dividend" said Air New Zealand chairmen Tony Carter.

Network growth plans and opportunities

Air New Zealand reported it will "continue growing its comprehensive domestic network" over FY2018. The airline sees opportunity coming from inbound tourism as well as strong domestic tourism. Following the rollout of the Northland marketing campaign in 2016-2017, a key element of Air New Zealand's growth strategy will involve continued support to regional stakeholders in developing attractive tourism propositions. In international markets, Air New Zealand will focus growth on the Japan market with the addition of Tokyo Haneda, as well as increasing services during peak season across routes in the Pacific Islands and North America and South America. Air New Zealand CEO Christopher Luxon stated that recent announcements regarding competitor capacity rationalisation support the airline's view of a stronger revenue environment in the coming year.

Air New Zealand reports 16% growth in loyalty programme

Air New Zealand reported its 'Airpoints' loyalty programme continued to grow at an impressive rate over FY2017, with more than 2.5 million members, up 16% year-on-year. Australia is the largest offshore market for Airpoints members, and has grown by more than 17% in the past 12 months.

Air NZ competition from international airlines grows in FY2017

Air New Zealand CEO Christopher Luxon commented the carrier "faced an unprecedented increase in the level of competition from some of the world's largest airlines and effectively rose to the challenge" during the FY2017 period. Internationally, the airline's strategy is to enter key markets with the help of revenue-sharing alliance partners. It stated that strong market development plans has helped drive successful expansion.

Air New Zealand optimistic about outlook for 2018

Air New Zealand reported it is "optimistic about the overall market dynamics" for FY2018. Based upon current market conditions and assuming an average jet fuel price of USD60 per barrel (the average over the past two months), the airline is aiming to improve upon 2017 earnings of NZD382 million (USD277 million). The company also announced it expects aircraft capital expenditure of NZD1.5 billion (USD1.1 billion) over the next four years.

Hear directly from Air New Zealand CEO Christopher Luxon

The Blue Swan Daily recently caught up with Air New Zealand CEO Christopher Luxon (prior to the release of the results) at the 2017 CAPA Australia Aviation & Corporate Travel Summit, 3-4 August. Mr Luxon discussed the future of Air New Zealand, innovation and capacity.