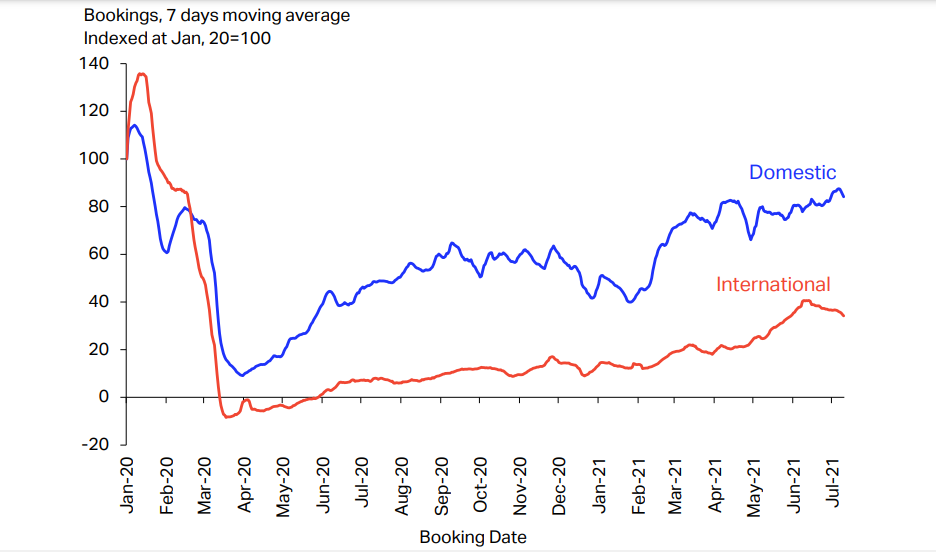

While we are seeing movement in the right direction, particularly in some key domestic markets, the situation for international travel is nowhere near where IATA expects. "June should be the start of peak season, but airlines were carrying just 20% of 2019 levels," said Mr Walsh as IATA revealed performance data for the month.

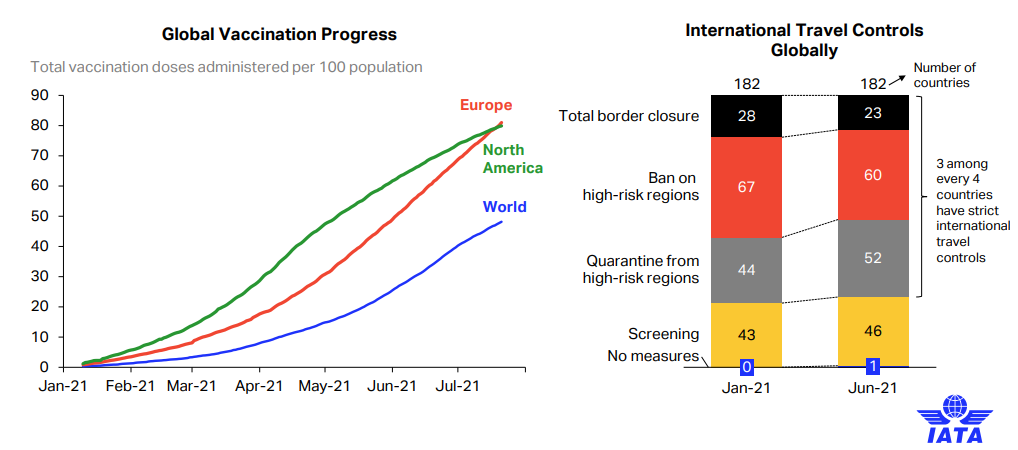

The performance for Jun-2021 showed a very slight improvement in both international and domestic air travel markets, but demand remains significantly below pre-COVID-19 levels owing predominantly to the international travel restrictions. "Vaccination progresses but travel controls remain strict," says IATA with 75% of countries still retaining strict requirements beyond screening.

Total demand for air travel in the month (measured in revenue passenger kilometres or RPKs) was still down -60.1% compared to Jun-2019, albeit a small improvement over the -62.9% decline recorded in May-2021 versus May-2019. International passenger demand was -80.9% on Jun-2019, an almost five percentage point improvement from the 85.4% decline recorded in May-2021. All regions with the exception of Asia-Pacific contributed to the slightly higher demand.

It remains domestic demand that is still pushing the recovery, but traffic performance is levelling out. Total domestic demand was down -22.4% in Jun-2021 versus pre-crisis levels (Jun-2019), a slight gain over the -23.7% decline recorded in May 2021 versus the 2019 period. The performance across key domestic markets was mixed with Russia reporting robust expansion while China returned to negative territory, reports IATA.

It is Africa that is showing the strongest international recovery, based on the month's data. African airlines' traffic fell -68.2% in Jun-2021 versus the same month two years ago, an improvement from the -71.5% decline in May-2021 compared to May 2019. Jun-2021 capacity contracted -60.0% versus Jun-2019, while load factor declined 14.5 percentage points to 56.5%.

North American airlines saw a -69.6% drop in Jun-2021 international traffic, Latin American airlines a -69.4% drop, European carriers a -77.4% fall, and Middle East airlines a -79.4% decline on Jun-2019. Asia Pacific remains the weakest performing region for international traffic, down -94.6% compared to Jun-2019 and pretty much unchanged from the -94.5% decline in May-2021 versus May-2019.

Among some of the world's largest domestic markets, the Russian Federation continues to show strong performance with capacity and demand levels up a third on pre-pandemic levels. Capacity levels (measured in available seat kilometres or ASKs) were up +39.4% and RPKs up +33.0% in Jun-2021 versus Jun-2019.

IATA's data shows a return to negative territory in Jun-2021 for China's domestic traffic, falling -10.8% compared to Jun-2019, following a +6.3% growth in May-2021 versus the same period in May-2019. This has been likely influenced by new local restrictions following COVID-19 outbreaks in several Chinese cities.

At the other end of the spectrum, US domestic traffic improved from a -25.4% decline in May-2021 versus the same month in 2019, to just a -14.9% decline in Jun-2021. Life in the US is starting to see some normalcy following the easing of measures and the rapid rollout of the COVID-19 vaccination.

There are many positives from the monthly data, but Mr Walsh highlights that "with each passing day the hope of seeing a significant revival in international traffic during the Northern Hemisphere summer grows fainter," with many governments "not following the data or the science" to restore the basic freedom of movement.

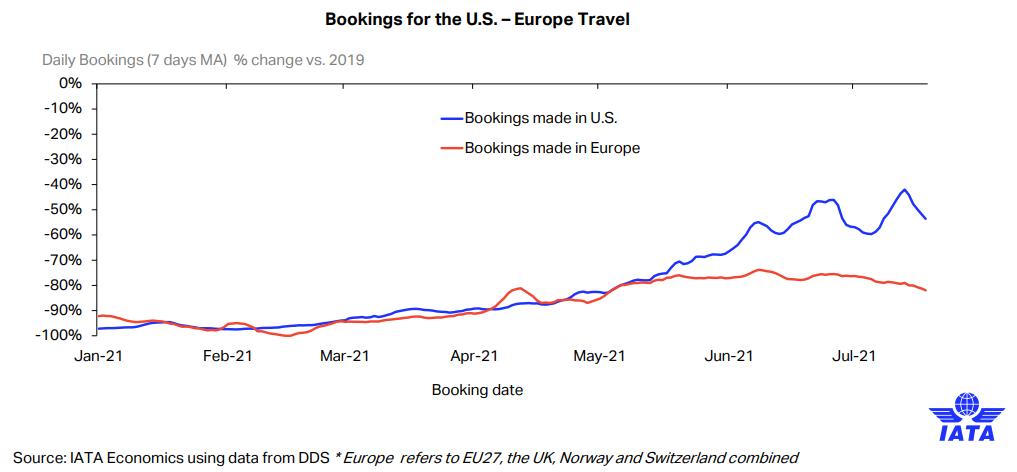

Despite growing numbers of vaccinated people and improved testing capacity, Mr Walsh says we are "very close to losing another peak summer season on the important trans-Atlantic market," one important market that continues to suffer at the hands of government policy. Connectivity across North Atlantic remains limited, according to IATA data - down -73% in Jun-2021 versus Jun-2019 - and governments remain "risk averse despite rapid vaccination on both ends," it says.

North Atlantic routes are key for many European and the US full-service operators and IATA data shows that booking levels indicate a strong pent-up demand for travel with bookings made in the US jumping in recent months with the opening-up expectations. This observation has also been made by leaders at the US majors in recent 2Q earnings calls.

Studies into traveller confidence are promising, indicating that there remains a strong and increasing demand to travel. The results of IATA's own passenger survey for Jun-2021 show nearly 60% of the respondents plan to take a flight within a month or two, and other 30% plan get on the plane within six months or so.

But challenges remain. The number of COVID-19 cases has been rising in many regions amidst the spread of more contagious variants such as Delta variant. New travel restrictions in the likes of Australia and China have swiftly reversed positive demand and capacity developments in these countries and IATA says highlights just how "fragile air travel recovery is amidst the pandemic uncertainty". There is also the issue of the still slow pace of vaccine rollout globally that will continue to impact the pace of international recovery particularly.

Looking into Jul-2021 and domestic and international bookings for future travel diverged in the month, says IATA. On domestic routes, net ticket sales continued to "trend modestly upwards," driven largely by "improvements in some of the key domestic markets.

On the international side, bookings had been trending upwards until early-Jun-2021 but more recently the recovery has paused. "The deterioration partly reflects the latest pandemic developments," says IATA. As a result, the rise in summer bookings - an important source of revenues in the past - "has stopped on some important routes," notes IATA.