Summary:

- Passenger demand is Brazil up 2% in first nine months of 2017 after plummeting 7.1% in 2016.

- General consensus among Brazil's largest airlines during 2017 is leisure demand is rebounding quicker than business traffic.

- GOL Airlines estimates corporate clients represent roughly 70% of its revenues.

Brazil's system passenger levels plummeted 7.1% year-on-year in 2016, with domestic numbers contracting 7.8%. Prospects for 2017 look slightly more promising, with total passenger growth reaching 2% year-on-year for the 9M ending Sep-2017.

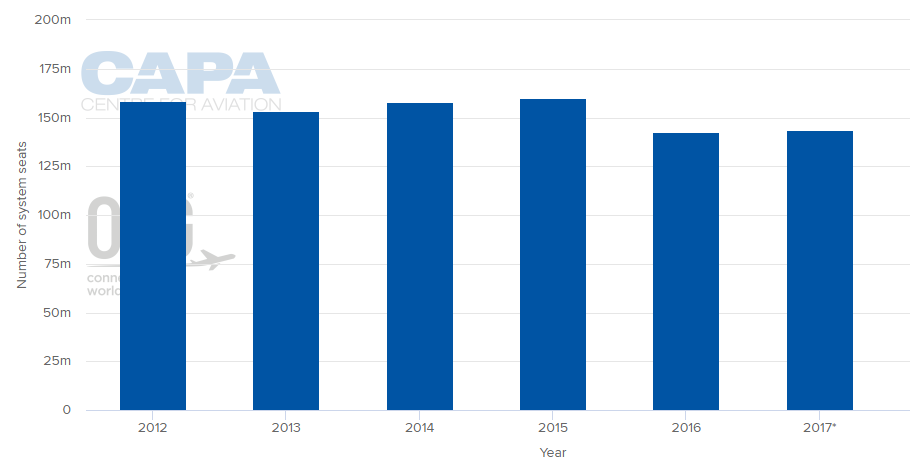

CHART - Brazil has quite clearly turned the corner following its financial crisis, but system seats in 2017, while up on last year will still be down -10.3% on levels recorded in 2015 Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

The general consensus among Brazil's largest airlines during 2017 is leisure demand was rebounding quicker than business traffic. At the end of 2Q2017, Azul highlighted an acceleration in domestic demand, driven mostly by the leisure segment.

Azul's rival GOL drew similar conclusions at that time, but was encouraged that trends were moving in the right direction. In mid-2017 GOL's share of corporate revenue in Brazil was 32%, compared with 30% for LATAM Airlines Brazil 30% for Azul and 9% for Avianca Brazil.

Both airlines continue to see positive trends in high yielding corporate demand. Azul executives recently cited "really good" corporate demand in Sep-2017.

"I think we can say that with some certainty after a long time that we are seeing corporate demand pick up," Azul stated. "We had a good close in demand in September and we saw it in October as well."

GOL has estimated corporate clients represent roughly 70% of its revenues. The company's management recently concluded the airline has seen flat to slightly positive volume growth in the corporate sector during 2017, but it has been able to achieve much better pricing in that passenger segment. GOL's average fare grew 11.6% year-on-year in 3Q2017 to BRL288.41. Azul's average fare increased 7.6% during the same time period to BRL308.

The airline explained that business demand in Brazil could range from 5% to 6% in 2018 based on a formula that growth in corporate traffic is usually two times GDP. GOL was basing those calculations on projected GDP growth in Brazil of 2.5% next year.