The main gateway to the state capital and fourth most populous city in Texas and the eleventh most populous city across the entire United States, Austin-Bergstrom International Airport is firmly positioning itself onto global route maps. New direct flights into Europe and Latin America are proving popular with Aeromexico and British Airways introducing larger equipment and Condor boosting frequencies, helping boost traffic to record levels.

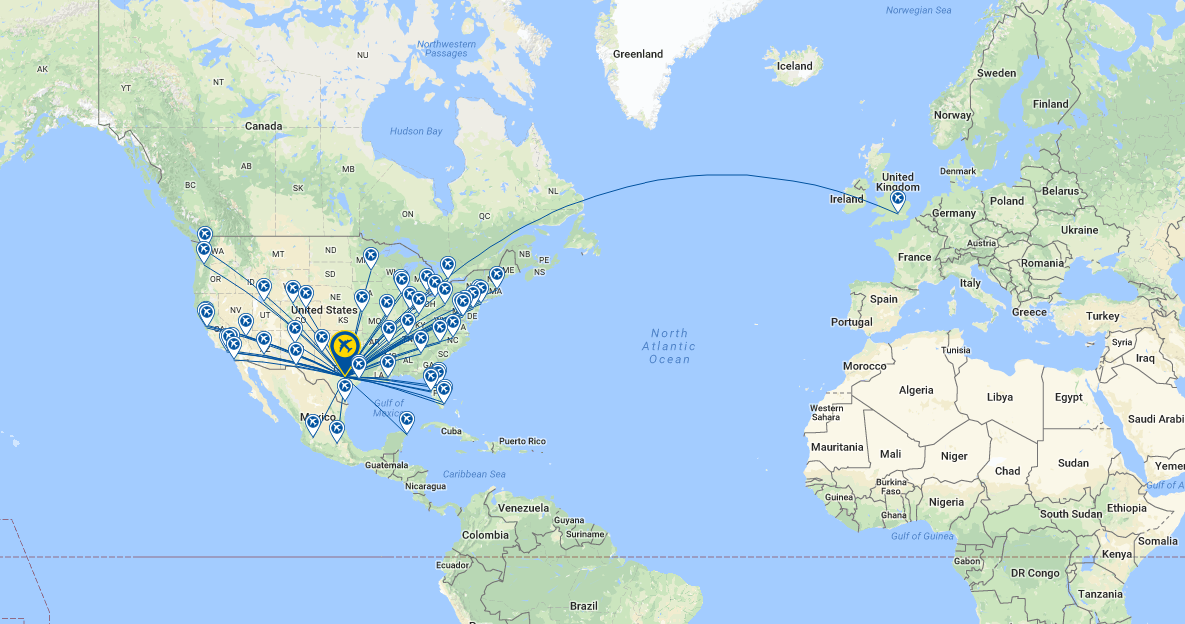

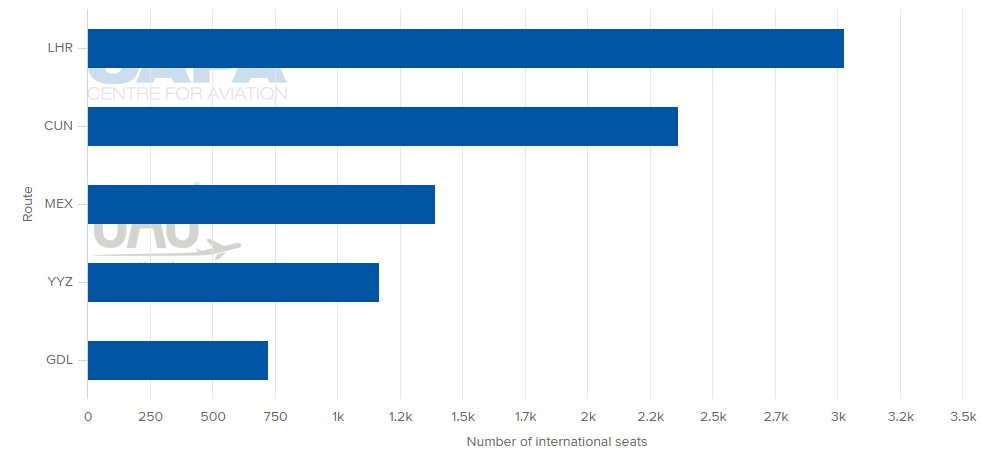

NETWORK: According to flight schedules from OAG for the week commencing 01-Jan-2018, Austin-Bergstrom International Airport is directly linked to 56 destinations, with British Airways' London Heathrow link standing out as its sole year round long haul eastbound market. This is complemented by a seasonal Condor schedule to Frankfurt, while Delta Air Lines (Amsterdam) SAS Scandinavian Airlines (Stockholm) will offer limited schedules in Mar-2018 to coincide with the South by Southwest tech, film and music festival. Predominantly a domestic airport (97.4% capacity share), its other international markets currently consist of Toronto, Canada; and Cancun, Guadalajara and Mexico City, Mexico.

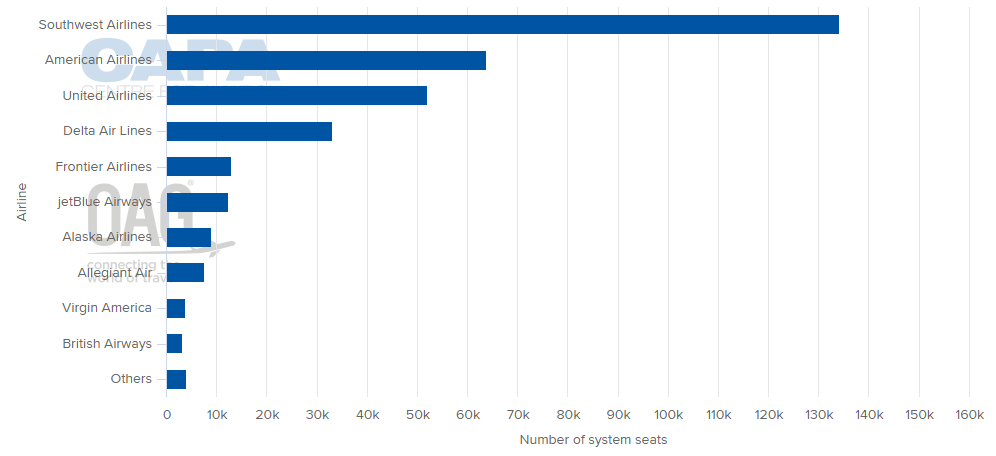

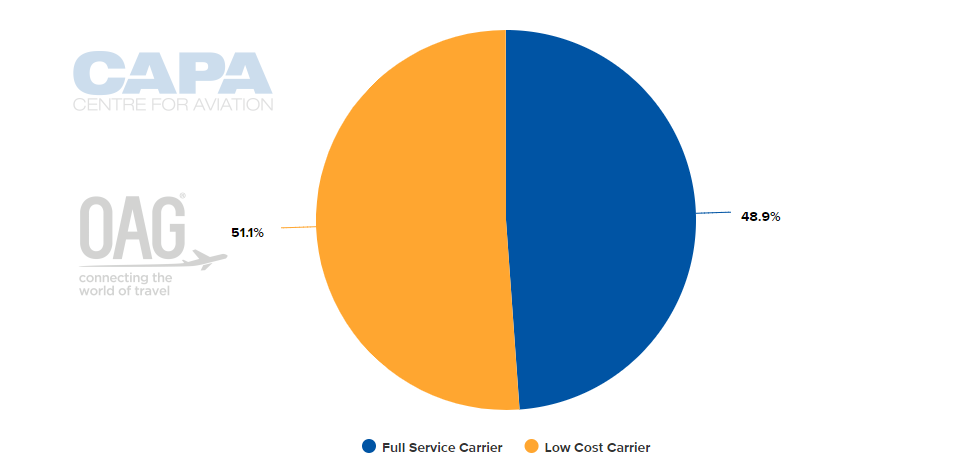

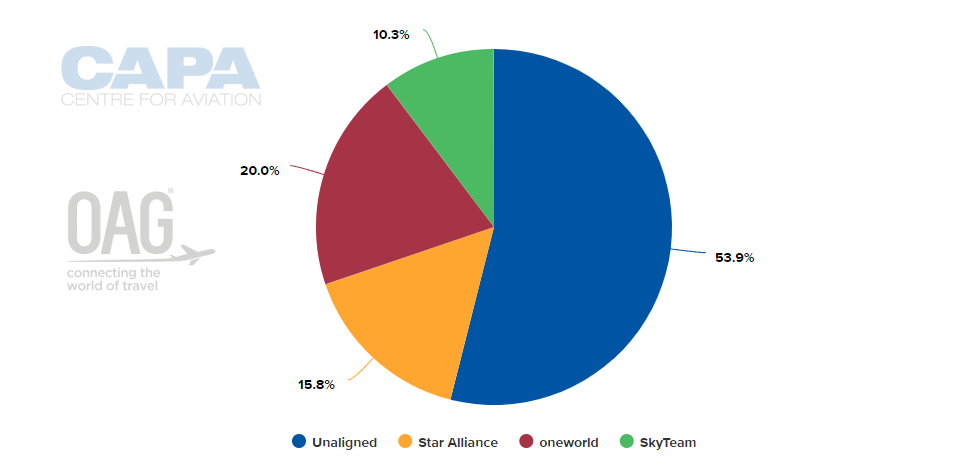

AIRLINES: Southwest Airlines is the largest operator from Austin-Bergstrom International Airport with a 40.1% share of departure seats during the analysis period, ahead of US majors American Airlines (19.0%), United Airlines (15.5%) and Delta Air Lines (9.9%). The dominant position of Southwest Airlines and with both Frontier Airlines and jetBlue Airways among the six largest operators means that LCCs have a 48.9% share of departure capacity and that none of the major alliances have a dominance: oneworld leads with a 20.0% capacity share ahead of Star Alliance with a 15.8% share and SkyTeam with a 10.3% share.

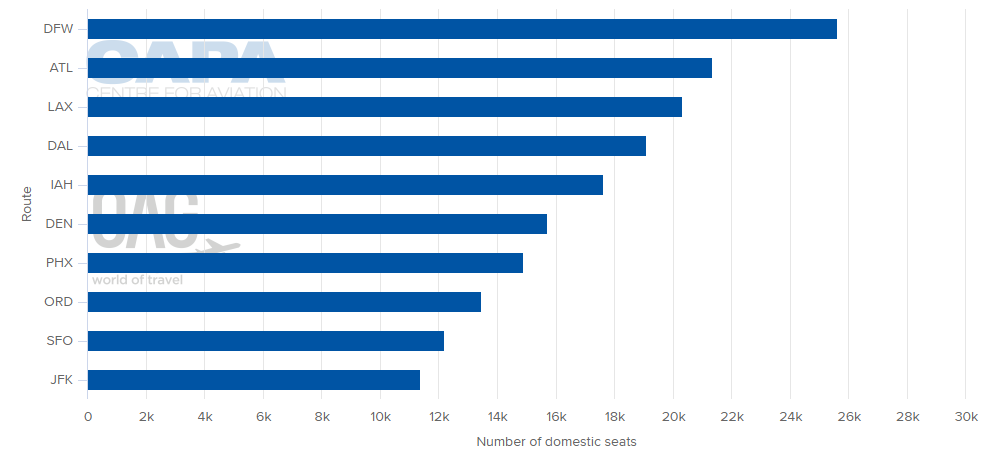

DESTINATIONS: Dallas is the largest market linked to Austin-Bergstrom International Airport with over 280 departing frequencies per week split between Dallas/Fort Worth International and Dallas Love Field airports. Important hub connectivity means that alongside the Dallas market, Atlanta Hartsfield-Jackson International, Los Angeles International and George Bush Houston Intercontinental airports have the largest share of departure capacity. An increase in gauge on the British Airways London route from the 787-8 to the 787-9, 777 and 747-400 means that the UK capital is the largest international market by capacity ahead of the Canadian and Mexican routes.

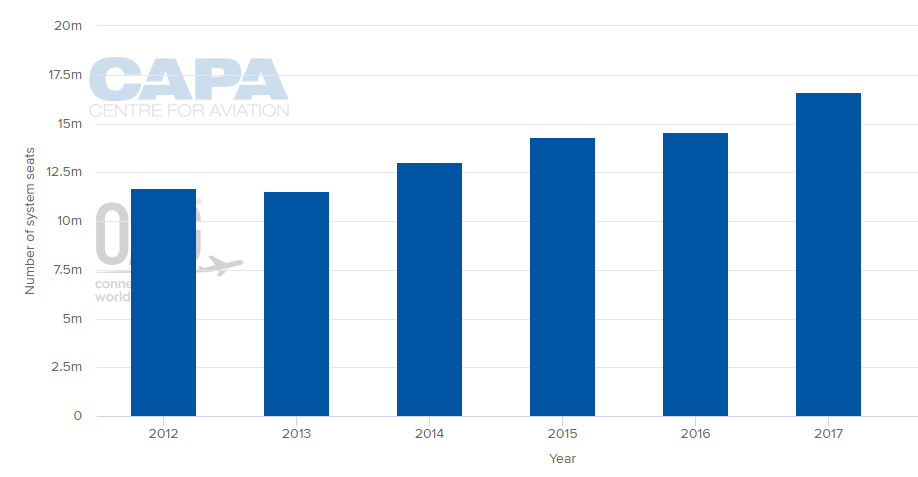

CAPACITY: A notable +14.2% growth in system capacity was recorded at Austin-Bergstrom International Airport in 2017, to over 16 million seats. This was the fourth successive year of annual capacity gains third at a double-digit level. After seeing a small -1.2% decline in 2013, capacity growth of +12.6% and +10.0% was recorded in 2014 and 2015, before slipping to a more modest +1.6% growth in 2016.

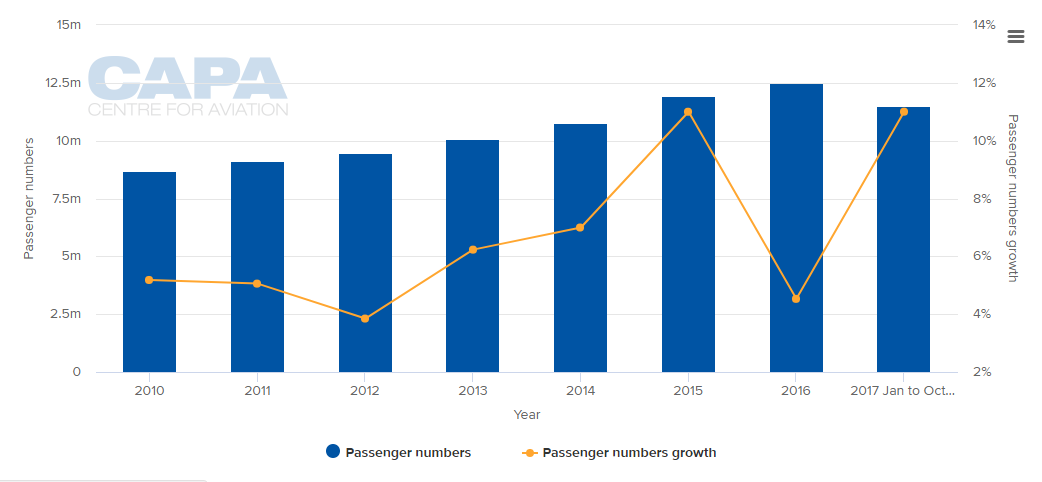

TRAFFIC: Enhanced connectivity has helped drive traffic growth at Austin-Bergstrom International Airport and it is on track to report a record year in 2017. As at the end of Oct-2017, year over year passenger levels had grown +11.0%, matching the rate of growth reported in 2015 as the fastest rate this decade. With almost 11.5 million passengers handled over the first ten months of the year, the airport is on track to hit the 13.5 million milestone for the full year.

VISIT CAPA - Centre for Aviation to find out more about the benefits of a CAPA Membership.