Air India has declared plans to begin flights to Israel from 22-Mar-2018 with a New Delhi - Tel Aviv route flown using one of its Boeing 787-8 Dreamliners. It marks its return to Israel having previously operated between Mumbai and Tel Aviv between Jan-1996 and Apr-1998.

The cit pair, though significant, pales in comparison to a key distinction which could place Air India ahead of its competitors. That is, authority to operate through Saudi Arabian airspace. It will be the first time a commercial air service will be permitted to overfly Saudi Arabia onward to Israel.

El Al Israel Airlines has approached both the Israeli Government and ICAO, among other international organisations, in a call for reciprocity. El Al refers to the authorisation as "discriminatory" and as preventing equal and fair opportunities, warning it could harm the company's operations.

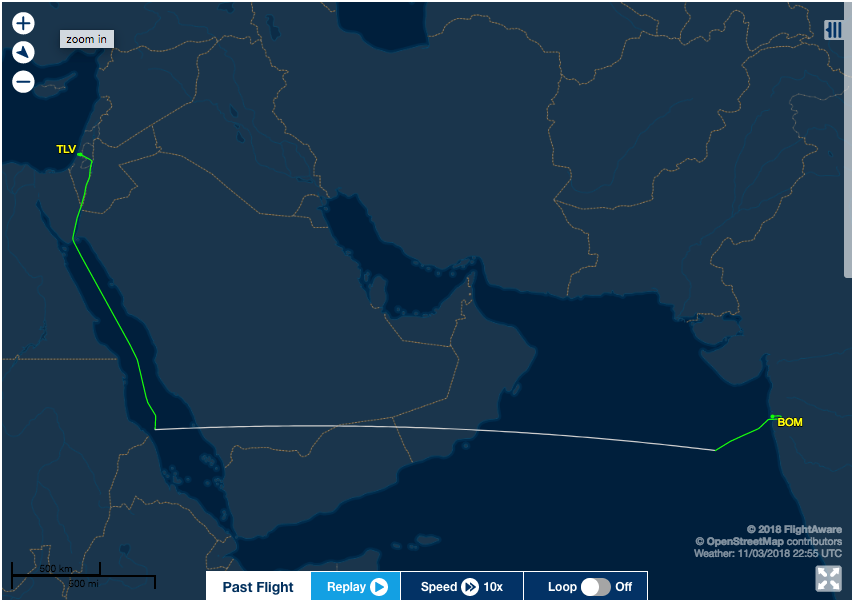

MAP - El Al currently operates a four times weekly Tel Aviv-Mumbai service, which operates via a diversionary track to avoid flying over Saudi Arabia Source: FlightAware

Source: FlightAware

For Air India, the approval means its New Delhi - Tel Aviv service can operate through the airspace of Oman, Saudi Arabia and Jordan to reach Israel. The streamlined routing delivers a total flight time of around seven hours and 10 minutes, almost two hours and 10 minutes shorter than El Al's Tel Aviv-Mumbai service.

Overall, El Al's rather centrally geographic base in Tel Aviv is operationally limited by airspace constraints. The carrier's services particularly to South and Southeast Asia are the routes losing out due to the highest levels of political constraint - with the carrier's Bangkok flight also forced to divert more south to avert overflying Saudi Arabian airspace.

This development exemplifies how geopolitical tensions and uncertainty are directly affecting airspace usage and liberalisation - with the Middle East being a persistent example. Though often unintended, the commercial businesses of bordering airlines are usually placed at a disadvantage.

An example of a more deliberate airspace dispute lies in Qatar, where an airspace blockade of the country by its Persian Gulf neighbours continues since Jun-2017. Collectively implemented by Bahrain, Egypt, Saudi Arabia and the UAE, Qatar Airways had its network and financial stoutness directly confronted overnight. CEO Akbar Al Baker has confirmed the carrier will report a "very large loss" for FY2017/18 (ending 31-Mar-2018), and was initially forced to find new streams of financing to survive since it has no access to the equivalent of US Chapter 11 bankruptcy protection.

Qatar Airways involuntary embarked on a widespread route and network reorganisation, a gargantuan task which could have led to the demise for the carrier. Instead, Qatar Airways has replaced routes in the blockaded countries with 16 new destinations in 2018/19, including plans to become the first Gulf carrier to begin direct service to Luxembourg. The blockade also had a relatively positive impact on Qatar's cargo business, according to Al Baker, who said in mid 2017 "the blockade has had quite the opposite impact on our [cargo] business to the one intended".

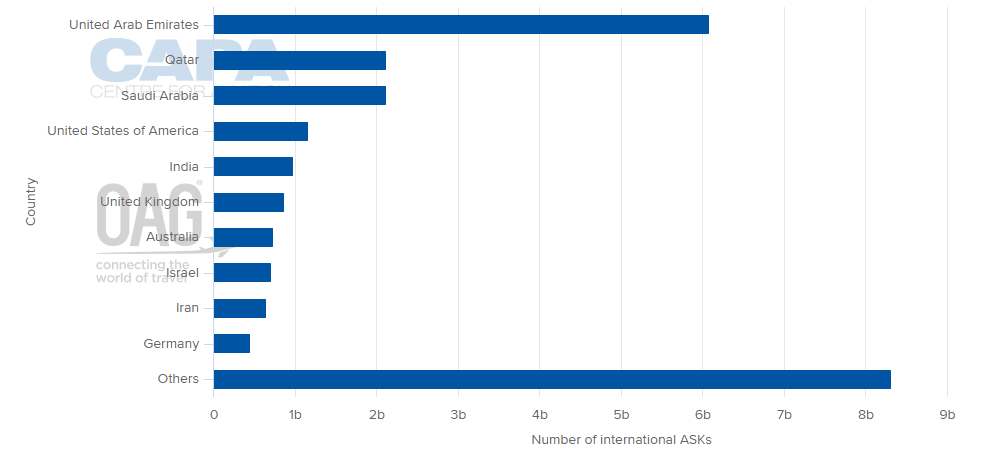

CHART - Despite the impact to Qatar Airways, Qatar as a country is still the second largest in the Middle East in terms of available seat kilometres. Doha's Hamad International Airport is also the second largest after Dubai in terms of seats offered Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

For Qatar Airways the blockade has forced the airline to readjust its strategy and re position itself into new markets - notably it is the sole operator on all 16 of its planned new routes. These new services include popular holiday destinations like Thessaloniki and Malaga, giving the airline an increased leisure exposure. It is different in the case of El Al which is in direct competition with Air India's shortened flight times, a significant bargaining chip that is not often able to be played in a world of competitive flight schedules.

Ultimately, airspace and its sovereign management by States will continue to be a wildcard for the aviation industry and the general economy - and not just in the Middle East, but across the globe.