While the type was expected to return to the air in the spring, it now appears that Jun-2020 is a more likely date and American Airlines has this week said it expects to resume scheduled commercial service with its MAX fleet from 04-Jun-2020. The airline says it "expects to gradually phase in the MAX for commercial service and will increase flying on the aircraft throughout the month of June".

Like American, Southwest has had to pull back plans for a re-entry of the MAX into service multiple times as work continues by Boeing to ensure the MCAS software update meets regulatory requirements. Now the airline has pulled the MAX jets from service through mid Apr-2020, which results in the culling of 300 flights per day from a peak day schedule of more than 4,000 flights.

At the end of 3Q2019 Southwest's management explained that the airline would have a deficit of 68 MAX jets by YE2019, and that includes 41 jets that were scheduled for delivery in 2019. At that time, company management remarked that it would have 75 aircraft "to ingest into the fleet when the grounding is lifted".

That number of aircraft could shift, depending on the exact timing of the MAX's return to service. But at the end of 3Q2019 Southwest's management said that once the aircraft were approved for operations it would take 30 to 40 days to get the company's manuals updated, and that it could manage the induction of about five to 10 aircraft per week, which would imply that it would take two to four months before all of its 2019 deliveries and prior MAX jets would return to service.

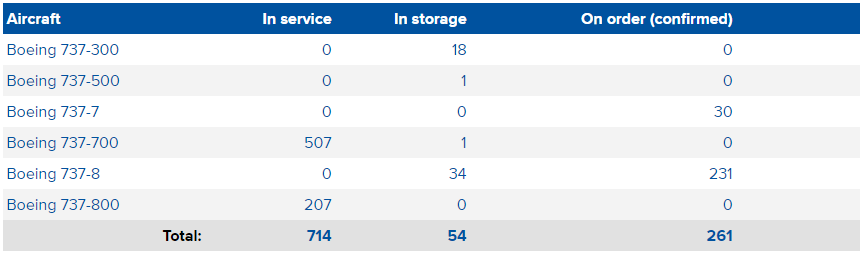

CHART - Southwest Airlines was the largest operator of the Boeing 737 MAX when the type was grounded last year Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

From a commercial perspective, Southwest has faced major network challenges as a result of the MAX grounding, including postponing the launch of services to Hawaii and being more surgical regarding changes to the rest of its network.

The airline has opted to trim longer haul flying to bolster some of its connecting traffic and to invest in more short to medium haul operations, particularly in Denver and Baltimore (its first and third largest bases measured by departing frequencies) and, to a lesser degree, at Houston Hobby.

At the end of 3Q2019 Southwest CEO Gary Kelly said that "we have taken some long haul segments out and have tried to serve those city pairs on a one-stop basis". He also added that, "…We're not happy with the fact that we're eight points below where our capacity would have been, and clearly we're temporarily losing some share, which we don't like".

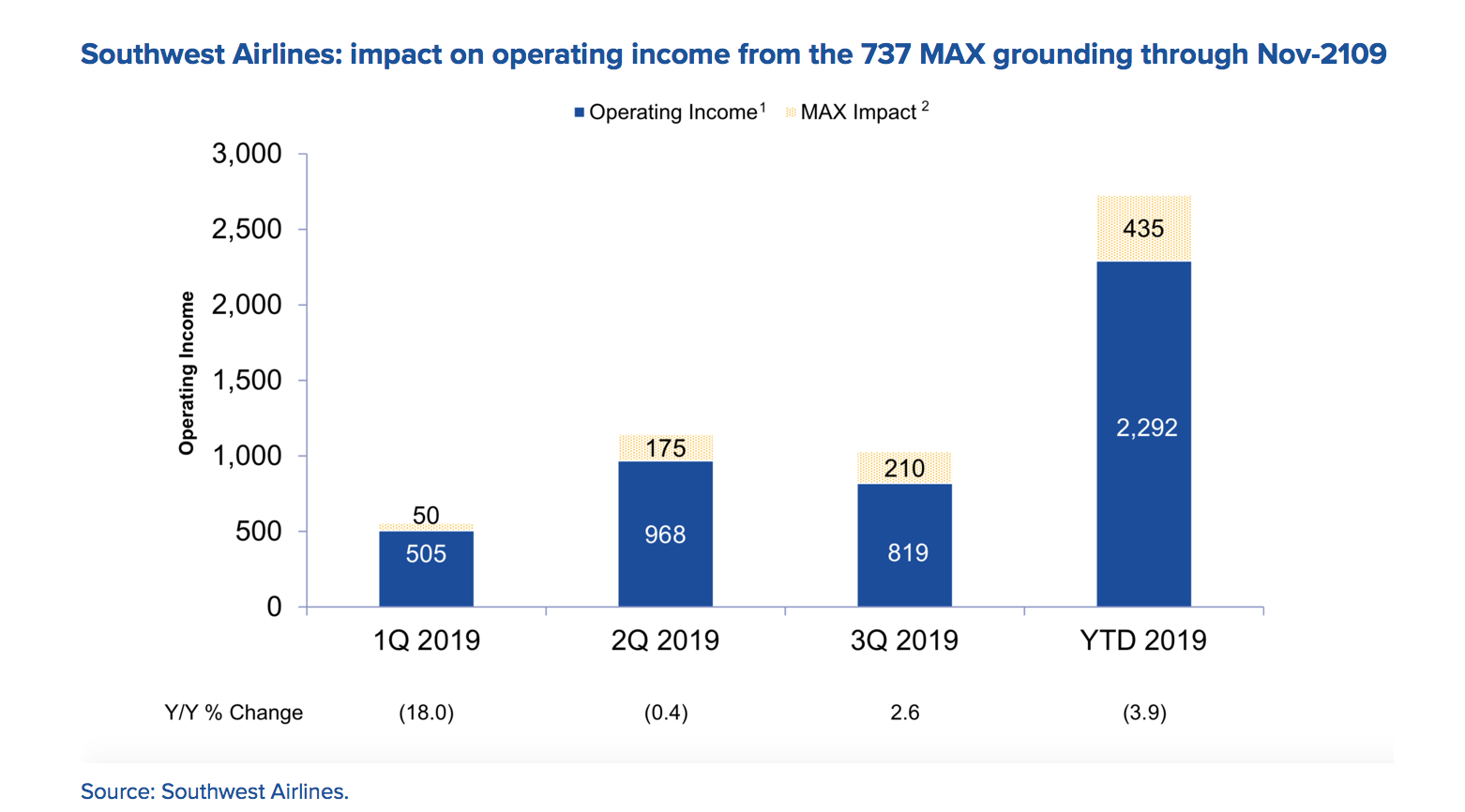

There's also the obvious negative financial effects for Southwest and all the other operators of the MAX. Southwest has calculated that the MAX grounding has reduced its operating income by USD435 million through YTD2019, as of Nov-2019.

Meanwhile, Delta Air Lines is not an operator of the Boeing 737 MAX, which as of Mar-2020 will have been out of service for a year. And while the airline had "some benefit [from the MAX grounding], no question about it, in the year", said Mr Bastian, he stressed that the grounding of the aircraft was not a big source of Delta's projected 7% rise in topline revenue for 2019, "…And I don't think it's going to be a material risk to us as we look into 2020 either".

Since US MAX operators have had to pull back MAX schedules a couple of different times due to uncertainty over the aircraft's recertification, Delta president Glen Hauenstein remarked that: "…We have a pretty good visibility as to where the MAX's are going, and generally, they're not going to places that are of key importance to us".

There is likely to be some "flow pressure this summer as those planes come back, and depending on how they come back", Mr Hauenstein said. However, he stated that Delta was feeling confident that the aircraft were not to be operated in markets "that are going to impact our revenue streams directly".