The decision this past weekend by the UK government to require all arrivals from Spain to complete a 14-day quarantine when they arrive in the country highlights how fluid the current situation is. The new travel restriction was introduced with just hours notice as many UK citizens were just jetting out to destinations across Spain's mainland and popular holiday islands under the illusion they were relatively safe from risk and enjoying the ability to use one of the many airbidges for international travel that have been established.

It is true to say that areas in Spain are seeing a rise in Covid-19 infections and similar situations are evident across other European nations, including France and Germany. The what has been described by observers as "heavy-handed tactics" from the UK government underlines that fine line that exists between balancing risk and reward along the recovery path.

Border restrictions have been generally lifting, but the approach taken to reopening varies hugely between regions and by country. This will determine the shape of the recovery and in Europe at least it is clear that many nations are on a mission to save the summer, a trading period that is key to businesses across more than just the hospitality and travel and transport sectors.

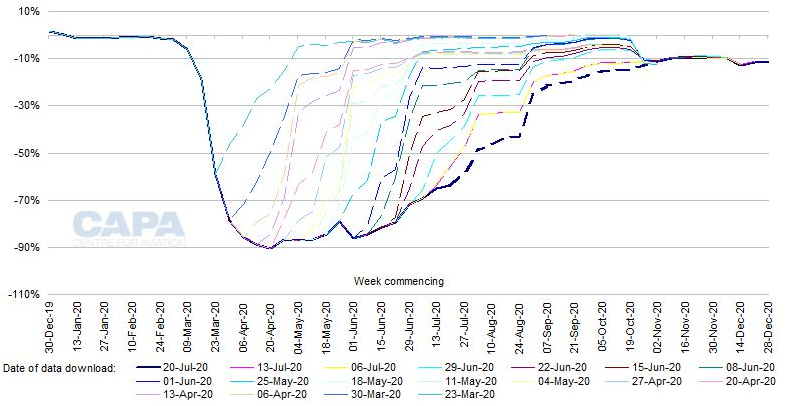

Right now though there remains a clear divide between capacity and demand. Europe's airlines continue to grow capacity in the market, continuing the climb from Apr/May-2020, when the underlying trend was approximately -90% below 2019 levels. Last week Europe's total capacity was scheduled to be 13.3 million seats in the week commencing 20-Jul-2020 - the highest since mid Mar-2020. Alternatively, the year-on-year reduction of -63.8% is the narrowest since mid Mar-2020.

But, traffic data shows demand is still not returning in line with capacity. In early Jul-2020 ACI Europe cut its forecast of passenger growth for this month from -70% to -81% year-on-year. This was based on early indicators of traffic for the month. Those early indicators must have been significant to see a -14% readjustment.

A recent analysis report from CAPA - Centre for Aviation - European airlines' capacity growth out of sync with demand - has highlighted the optimistic recovery based on airline future schedules to, from and within Europe and how Europe's airlines are hanging on to schedules until the last minute to maximise capacity flexibility, reflecting uncertain demand patterns.

CHART - Europe's optimistic recoveries: year-on-year percentage change in airline seat capacity, with outlook at different dates Source: CAPA - Centre for Aviation and OAG (Note: dashed lines indicate future data as anticipated at the date of download indicated)

Source: CAPA - Centre for Aviation and OAG (Note: dashed lines indicate future data as anticipated at the date of download indicated)

The uncertain demand patterns before have now been even further skewed by the UK's new travel restrictions for arrivals from Spain. There may have been a strong sentiment for travel - airlines had reported strong bookings - but immediately those same airlines are now being overrun with cancellations and refund requests.

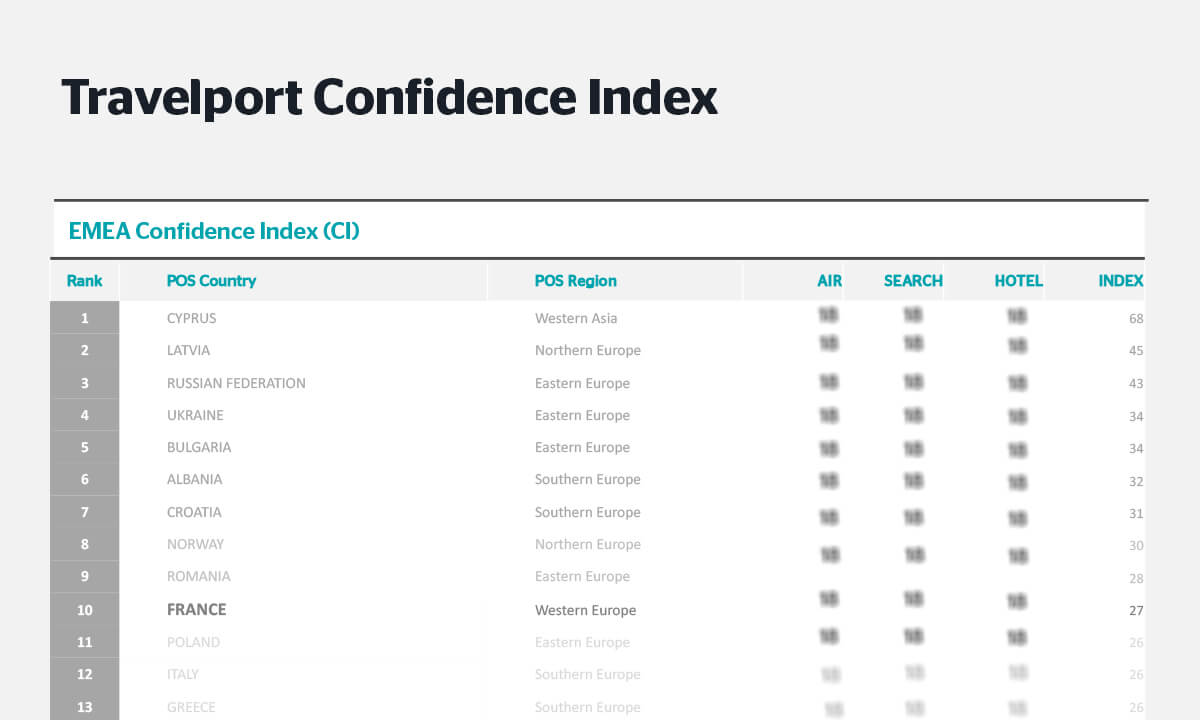

To try and understand the market travel and tourism industry distribution, technology and payment solutions specialist Travelport has developed an interesting Confidence Index which measures a market's appetite for travel, based on indicators on search and booking data.

CHART - Cyprus is leading the path to recovery. It's number one in Travelport's Confidence Index, which in EMEA sees it a long way ahead of any other nation Source: Travelport's Confidence Index

Source: Travelport's Confidence Index

The data provides insights on where travellers are going, when they are travelling, and who is likely to be travelling, which it claims can be both a broad market view, but can go right down to different individual traveller personas.

The tool was created using some insight from activity from previous years, plus a week-over-week indexed view of gross traveller behaviours, transacting through the GDS for air and hotel products. It ranks the Mediterranean island of Cyprus as leading the path to recovery, but notes some common trends that are starting to appear worldwide.

Most notably there are consistent signs of travel recovery as markets are reopening and border policies change, albeit pretty limited to domestic or for VFR and leisure purposes for international. As you would expect, the stage of the recovery journey varies greatly by region - and likewise, within that region, observes Travelport with some countries performing better than others.

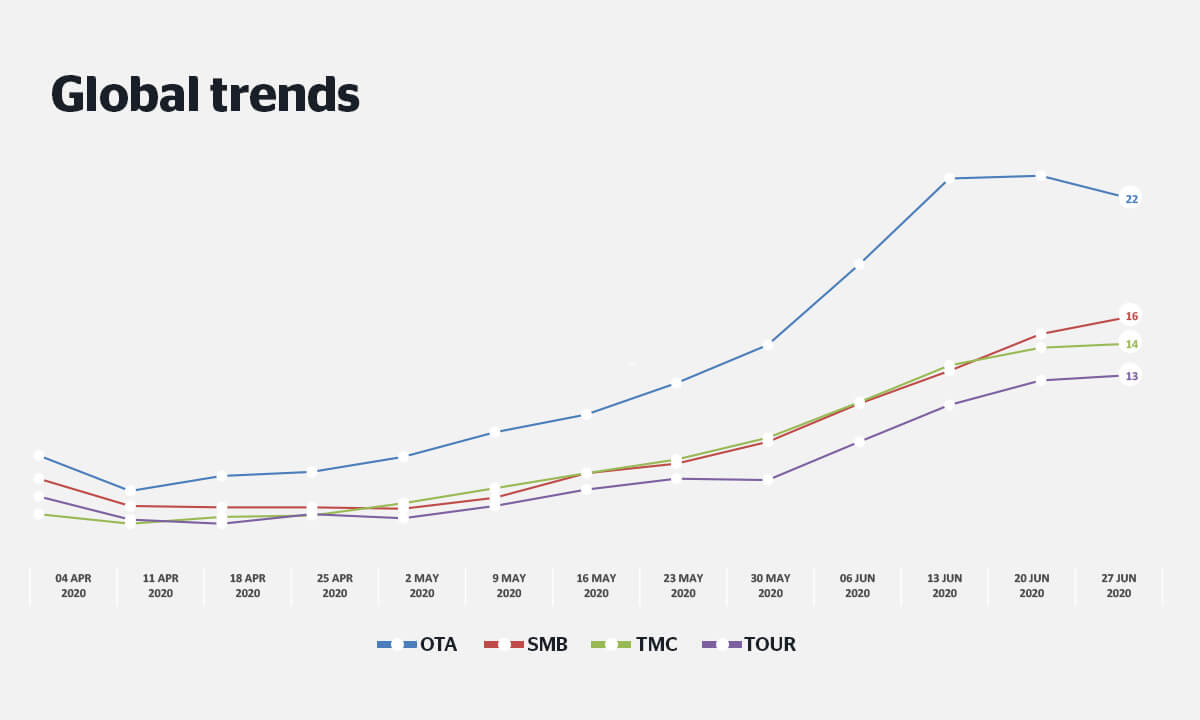

Its search and booking data also notes that OTAs are showing the strongest signs of recovery first. "As offline travel agencies have been forced to close their stores during lockdown, the value of being able to retail online is more evident than ever," it explains. The data illustrates that the OTA market is currently around 40% above the recovery position of other travel retailers.