Summary:

- Macquarie sells Brussels Airport stake and reduces its airport portfolio again as new investor entrants to the airport business emerge;

- Vinci Airports' majority acquisition of Gatwick Airport holding company stake has been approved;

- All the existing co-investors with GIP there are out; but what does that say about Gatwick's prospects?

The sale of Macquarie Infrastructure and Real Assets (MIRA)'s 36% stake in Brussels airport for a reported EUR2 billion, having previously exited Copenhagen Airports in 2017, marks a milestone in several ways. Firstly, it reduces, again, Macquarie's exposure to the airport sector. Indeed, post-Brussels, Macquarie's funds are now limited to four direct airport investments - Hobart airport where it appears to want to dispose of its holding and three regional airports in the UK - Southampton, Glasgow and Aberdeen, plus Westchester airport in the US, which is an 'on hold' deal with no signs of a positive outcome.

SEE RELATED REPORT: Macquarie Group is prepared to sell Hobart Airport stake

Secondly, for the emergence of alternative pension asset managers and private equity/hedge funds such as the Netherlands' APG, which together with QIC, the third largest institutional investment manager in Australia, acquired 16.8% each of the Brussels Airport management company from Macquarie. They saw off a bid from Canada's established OMERS and CPPIB pension funds along the way, while another one, OTTP, did not take up its option to acquire MIRA's stake. There appears to be a trend developing in which these new participants are playing an increasing role in the airport business while the established ones take a back seat.

Finally, for the emergence of an entirely new 'player' altogether, the insurer Swiss Life AG. While it only dipped its toe in the water with 2.4% of the equity it shows the industry can still attract newcomers. At the same time, it must be said that Brussels Airport is, for now at least, a safe bet.

Another airport investor which went to sleep, over a decade ago, is Vinci Airports, which was reduced at one time to little more than a longstanding interest in three Cambodian airports. You would hardly believe that now. Vinci's sectoral interests today run to almost 50 airports, in 12 countries, and it is one of the biggest operators in the world.

Its busiest airports in which it has a financial interest, as opposed to just a management one, are in the 30 million per annum passenger range (Lisbon, Osaka) but there are few of those. (It has an 8% interest in Groupe ADP, which could increase, but momentarily that is a minority interest in the operator of the Paris airports).

Acquiring the Cayman Islands-based Ivy Topco, the holding company of London Gatwick Airport, by way of a 50.01 stake, certainly elevates Vinci in the Premier League of operators. Gatwick handled 46 million passengers last year.

The GBP2.9-billion (EUR3.3-billion) deal was announced in late Dec-2018 and the European Commission this month delivered its approval to the deal, stating it "would not raise any competition concerns, given the limited overlap between the trading activities of the merging parties" (i.e. Vinci has few other airport interests in the UK, only Belfast International Airport).

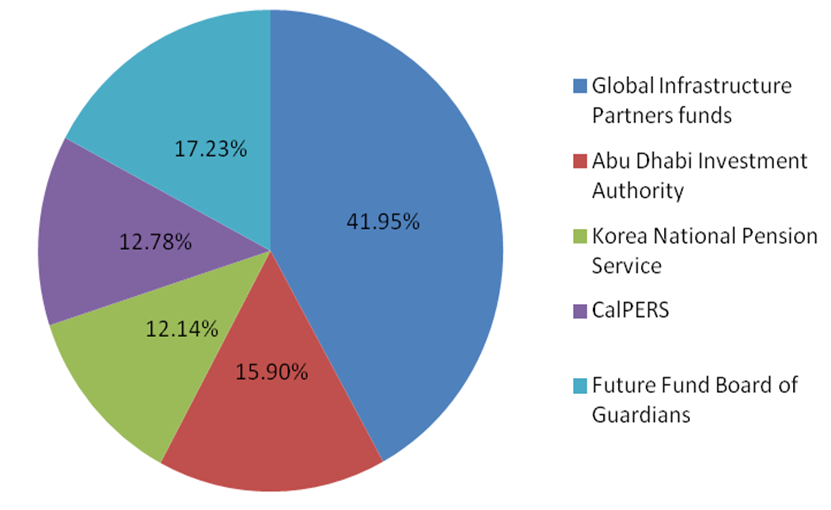

CHART - The current ownership structure for Ivy Topco, the holding company of London Gatwick airport, ahead of the Vinci Airports acquisition

It is perhaps of even greater interest to observe which organisations are collectively selling this stake. It has been assumed that the selling party, subsequent to the failure of Gatwick Airport to acquire government approval for a second runway there, would be Global Infrastructure Partners (GIP), which has also been linked frequently with a sale of Edinburgh Airport, which it owns fully.

However, it appears that Vinci has agreed to purchase the stake from a group of investors "including sovereign wealth funds in Australia and the United Arab Emirates", which means Future Fund and Abu Dhabi Investment Authority, which account for 33.13% of the equity. It has not been made clear which other co-investors are selling up, but presumably they must include CalPERS (USA) and Korea National Pension Service.

There are two obvious ways of interpreting the deal. Either Vinci and GIP have called it correctly and Gatwick, the world's busiest single-runway airport, will continue to flourish, or perhaps that the existing co-investors know when their time has come, Gatwick faces a bleak future and they don't want to be part of it, thank you. Time will tell who is right.