Summary:

- Work to extend Brussels South Charleroi airport's runway has commenced and it is due for completion in Jun-2021;

- The additional 650 metres will facilitate potential passenger and cargo long-haul opportunities;

- But a carrier that has already tried to establish scheduled long-haul flights hasn't proved successful in its goal.

Runway extensions usually go hand-in-hand with a desire to attract long haul flights which typically (though increasingly not always) use wide-bodied aircraft which usually require longer (and sometimes wider) runways, especially when operating at maximum payload. The future 3200m length is regarded as 'intercontinental level', would cover almost every operational eventuality for future long-distance passenger and freight flights.

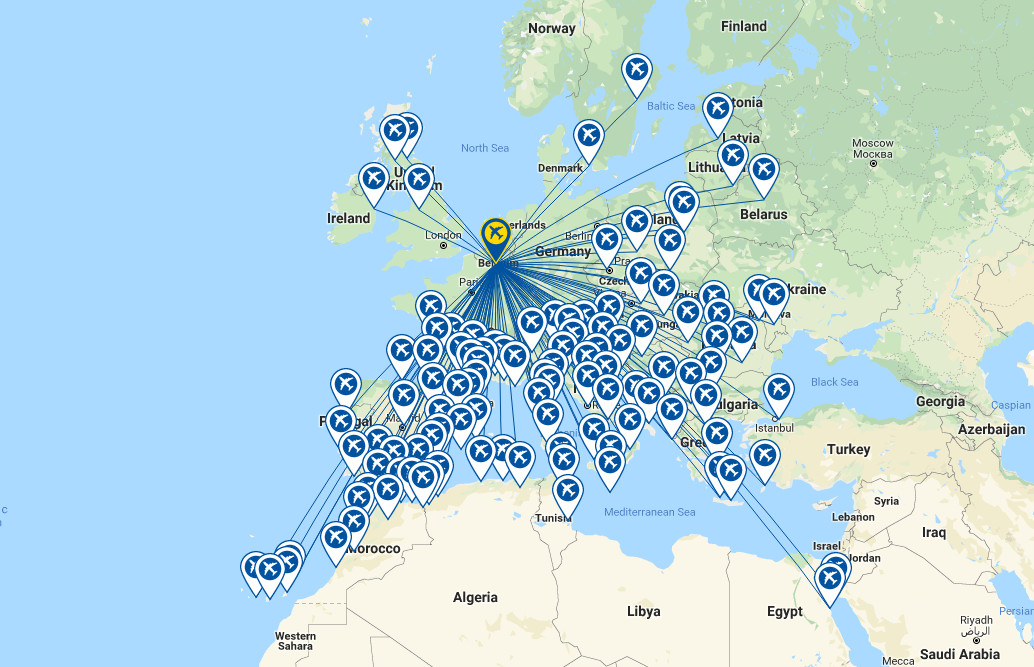

The airport's current route map demonstrates a significant short-haul bias with flights across Europe and extending into North Africa. CAPA -Centre for Aviation analysis of weekly OAG schedule data shows the bulk of seats (59.7%) are to/from Western Europe with 32% to/from Eastern Europe and just 8.4% to/from North Africa. Short-haul low cost predominates (98.7%) with Ryanair having 77.8% of that for itself.

CHART - The Brussels South Charleroi network currently extends to over 100 destinations, thanks mainly to the operations of LCC Ryanair Source: CAPA - Centre for Aviation and OAG (data: w/c 20-May-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 20-May-2019)

It is a very different story for Brussels Airport, the main gateway in the country, which has extensive global services a network map that spreads east, west and south with direct intercontinental connections into Asia, Africa and the Americas.

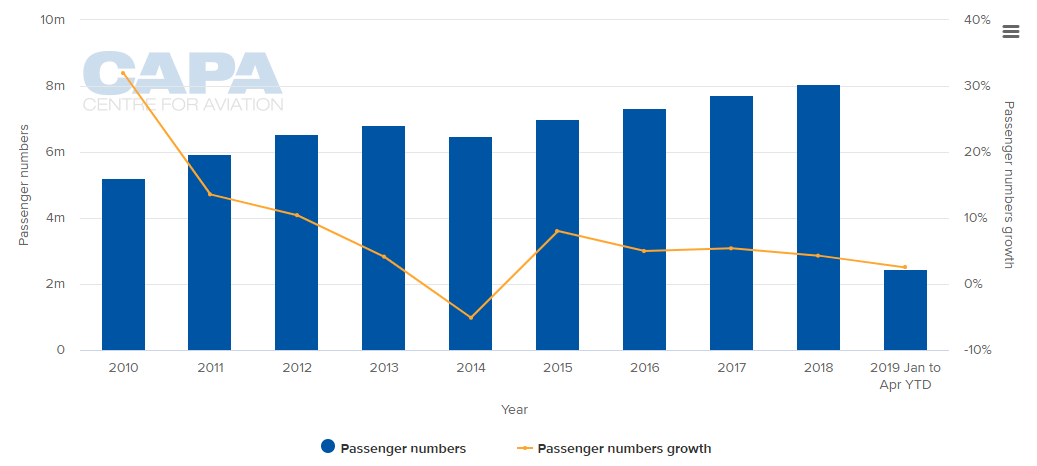

It is rare for the 'second' airport of cities of the importance of Brussels not to have at least some long-haul flights (Paris Orly and London Gatwick as clear examples). Charleroi airport has been growing quite strongly although that growth has been tailing off. In Apr-2019 it recorded just a 2% rise in traffic, in line with forecasts.

CHART - After entering the decade with rapid growth levels, Brussels South Charleroi Airport has seen rates slow, a trend that has continued into the start of 2019 Source: CAPA - Centre for Aviation and Brussels South Charleroi Airport reports

Source: CAPA - Centre for Aviation and Brussels South Charleroi Airport reports

Despite this declining growth the airport management has committed to infrastructure enhancements. Increasing the retail area makes sense, the runway extension is perhaps a little questionable. There have been recent long-haul scheduled services, operated by Air Belgium, which was formed in 2016 to offer services from Brussels to Hong Kong, Beijing, Shanghai, Xi'an, Wuhan, Zhengzhou and Taiyuan.

It had been expected to launch from Brussels's main gateway, but shifted its operational base to Charleroi because of the lower charges and easier accessibility. A new, dedicated terminal was provided for business class and premium passengers. It started flights in Mar-2018, but its debut was initially as a capacity provider flying for Suriname Airways from Amsterdam to Paramaribo as scheduled services were delayed by it not having the rights to operate in Russian airspace.

Scheduled services did eventually commenced from Charleroi to Hong Kong but a second aircraft was leased to Air France for a daily service between Paris-Charles de Gaulle and Libreville. Then the Hong Kong service was suspended for the winter (2018) so that the 'focus' could switch to charter operations.

Air Belgium has not restarted its own schedules, albeit its management has openly declared its intent to work towards starting new services to mainland China in mid-2019 and the Americas in late 2019 or early 2020. Its website currently states, "discover soon our new destinations" but no bookings are possible.

But the airline remains a going concern offering ACMI services to others. LOT Polish intends to use it for transatlantic charters this summer and it is already flying for British Airways (BA) from London to New York Newark and Toronto while BA's 787-9 fleet's engines are inspected.

While a short Charleroi runway might have influenced its decisions a bigger problem for Air Belgium could have been its fuel-hungry A340s, with fuel costs again rising. It had pitched itself as a 'lower' if not exactly 'low'-cost carrier.

It hasn't given up on Charleroi. Only a few days ago it was reported to be considering commencing Brussels South Charleroi-Fort de France service, operating twice weekly. The route would be the only non-stop service between Belgium and Martinique, according to OAG.

But unless either Air Belgium can get a sustainable network under way - scheduled and/or chartered - or another carrier can be found to fly where there is demonstrable long-haul demand, questions will remain about the outlay on the runway extension.

There are a couple of benefits not related specifically to long-haul operations, though. Firstly, up to 1,500 jobs will be created just during the construction phase. Secondly, there will be noise-related benefits as short-haul aircraft will be able to take-off further up the runway, thus reducing the impact on local residents.