The report, 'The Journey Ahead: How the Pandemic and Technology Will Change Airline Business Travel', assesses business travel by trip purpose, rather than industry category. It warns that 2021 could be more of a challenge for the airline industry than 2020. Even though the outlook is more positive for the year ahead the industry enters "after a nine-month drought that has drained financial coffers dry," it warns.

Business travel plays a crucial role in many airlines' strategies and is known to contribute as much as half of some airlines' passenger revenue. While some pockets of recovery are evident, international business travel remains subdued with technology becoming the new normal for those road warriors who generally spent more of their time in the air than on the ground.

The majority of business travel will return as the pandemic recedes but its now widely accepted that a portion of airline trips will be replaced by technology, but that remains a magic number that many are predicting could be anything as high as over 50%. See: Pick a number, any number! Bill Gates says we could lose over 50% of business travel: it would take the potential scale of the COVID crisis to new heights for the corporate travel sector

This is a factor "that's important to identify as airlines plan for the recovery of travel," acknowledges the report. "Airlines want to know if they should reduce capacity, lower fares, or reconfigure aircraft interiors to address lower demand," it says.

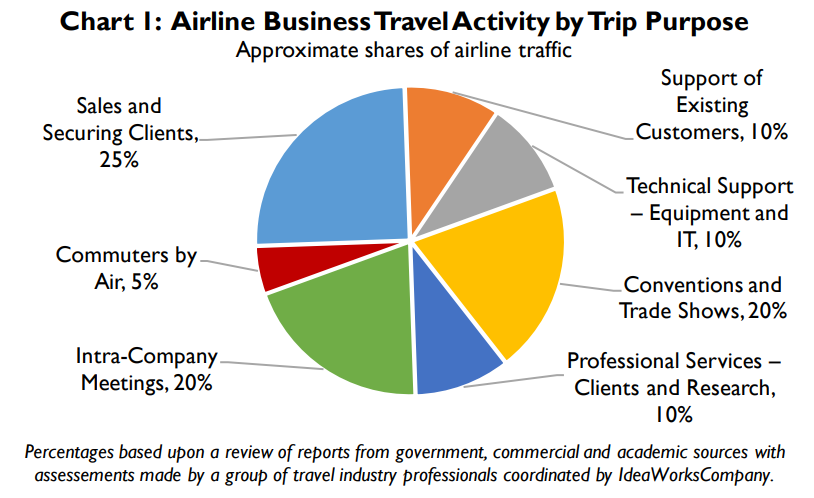

To add some science behind its projections, IdeaWorks Company has broken down business trips by travel activity. It estimates that 65% focus on a customer audience with sales and securing clients accounting for a quarter of all business excursions, while around a third (35%) are for internal audiences. For each of these it has projected the scale of likely business travel loss.

At the bottom end of the scale, the sales and securing clients category is projected to see between a 0-20% trip loss, as "business development will stay consistent with pre-pandemic levels … because 'being there' remains an important attribute for sales". Meanwhile, intra-company meetings could see a loss of between 4% and 60% and "a strong candidate for cost savings and in-person activity will be condensed to fewer events".

Similarly, commuting by air is projected to see a similar loss range as the need to be always present in the office, courtesy of a weekly trip, "will diminish in the era of remote working" as commuters are effectively "reclassified as remote workers with fewer trips to headquarters".

The analysis reveals a potential overall loss of airline business trips ranging from a low of 19% to a high of 36%. As it highlights "that's a potential for one out of three airline business trips to be permanently lost as employers continue the technological replacements adopted during the pandemic".

Even accounting for the loss of business travel, the recovery will be slow. Business travel booked by US corporate travel agents had a 95% year-over-year plunge in transaction value at the beginning of the pandemic in Mar-2020; this had only slightly improved to an -85% drop by Nov-2020, according to figures cited in this report.

As such, it urges airlines to proactively transform "to fly smoothly in the future" and offers a six-point checklist of observations for the year ahead, namely enhancing leisure travel retail efforts, boosting ancillary revenue, reducing lie-flat seat capacity and adding premium economy seating.