These are the main findings from the latest poll from The Global Business Travel Association (GBTA), the 21st in a series tracking the pulse of its membership of global travel buyers and suppliers and how the travel industry overall is managing the return to business travel, post pandemic.

This latest poll shows a 12% increase compared to last month in companies opening travel and fewer companies suspending or cancelling all travel. Domestic business travel is now "widely allowed" and corporate bookings and travel spend "continues to rise month-on-month," says GBTA.

Now, three in four (77%) GBTA members and stakeholders feel their employees are 'willing' or 'very willing' to travel for business in the current environment. However, half (52%) report that government policies and restrictions relating to international business travel continue to impact their companies' ability to conduct important business functions such as networking, business prospecting, planning and sales meetings.

"There is clearly an appetite to resume non-essential business travel and in-person meetings to promote collaboration, networking and business opportunities," notes Suzanne Neufang, CEO GBTA, but government policies and restrictions on international travel "continue to hinder progress in pursuing activities so important to conducting business," she adds.

GBTA says the responses to the latest poll indicate "strong demand for business travel's return". Respondents continue to be optimistic about the industry's path to recovery. Half (54%) report they feel more optimistic compared to a month ago whereas two in five (40%) say they feel the same. Only 6% say they feel more pessimistic about the industry's path to recovery.

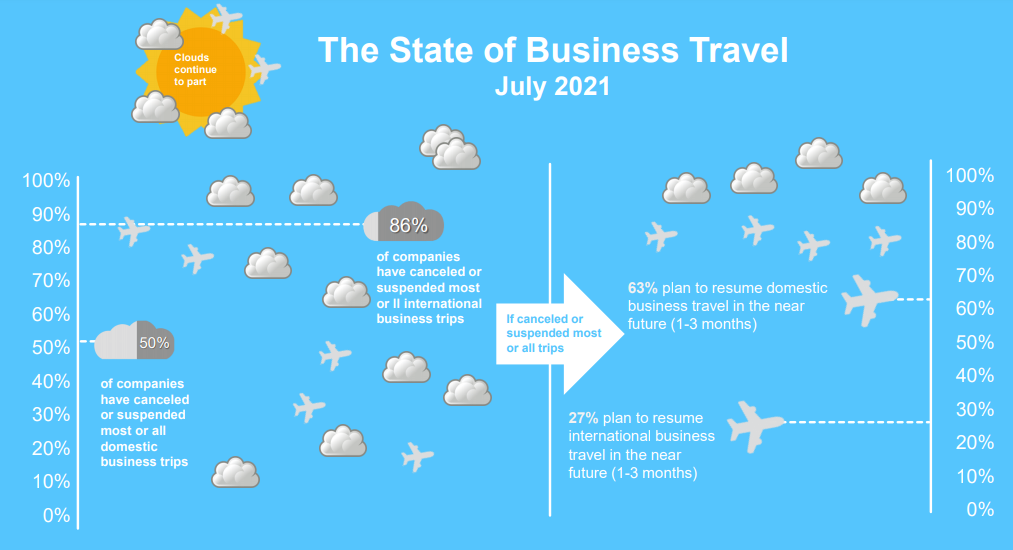

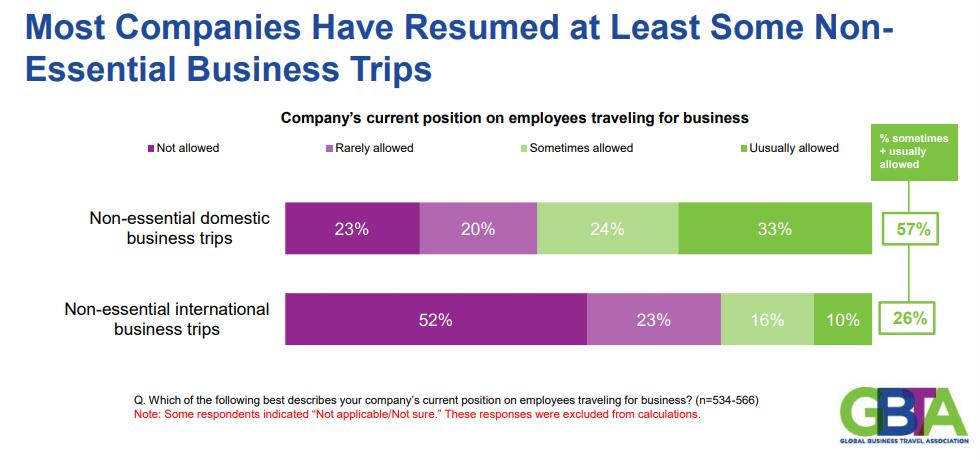

Corporate positions concerning business travel vary. Desire to serve customers is a key driver, with greater willingness to travel for sales and account management (59%) and service trips (56%), while GBTA respondents report that 57% of non-essential domestic business trips are usually or sometimes allowed, compared to 26% for non-essential international business trips. Of the companies that suspended most domestic business trips, nine in 10 plan to resume domestic travel in the near future or are considering resuming domestic travel but have no definite plans.

Three in ten also plan to resume international travel within 1-3 months and half are considering resuming international travel soon but have no definite plans. One in ten do not plan to resume international business travel in the near future.

Government policies and restrictions relating to international business travel continue to impact GBTA member companies and their ability to carry out important business functions. Over half (52%) of GBTA member and stakeholders report that networking, business prospecting (51%) and business planning and strategizing (50%) are impacted by these policies.

Respondents based in Europe were more likely to cite the impact of government policies and restrictions on key business functions compared to those based in North America. And it was significantly higher regarding the ability to network, conduct sales meetings and train or develop employees.

The poll shows that over half (57%) of GBTA respondents are usually or sometimes allowed to conduct non-essential domestic business travel. Two in ten are rarely allowed (20%) or not allowed (23%). Non-essential domestic business travel that can help generate revenue for the company is the key reasons for company travel requests.

Seven in ten of sales/ account management trips are usually or sometimes allowed, similarly seven in ten service trips are usually or sometimes allowed. Over half of non-essential trips are for sales, account management and service trips, according to the research.

Non-essential international business travel continues to lag, with one in four (26%) GBTA members and stakeholders usually allowed or sometimes allowed to conduct non-essential international business travel.

With sentiment and demand rising, so too is spending. Seven in ten (72%) of those surveyed report their company's business travel spending increased 'somewhat' to 'a lot' in Jun-2021 compared to the prior month, whereas one in five (20%) report spending remained 'the same.' Less than one in ten (6%) report travel spend decreased or are unsure (1%). Among those respondents who note their Jun-2021 travel spend increased from May, the average increase was 41.8%.

Seven in ten (70%) suppliers report their bookings from corporate customers have increased from the previous week, whereas one in four (27%) report their bookings have remained the same from the previous week. Less than one in ten (3%) report their bookings have decreased.