The coronavirus pandemic significantly curtailed business travel worldwide, but there are now increasing signs of recovery. In Europe, booking figures are increasing significantly again, albeit maybe too late for the important summer season. In China, international travel may still be curtailed, but within the country, even more people are now traveling than before the pandemic.

According to information from the corporate payment specialist AirPlus International, the number of flights taken within China in the first five months of this year was +9.5% higher than over the same period in 2019. Compared to 2020, when COVID-19 travel restrictions were already in place, there was more than a threefold increase. The figures show that companies in China are openly sending their employees on trips again, within the country at least.

The AirPlus International data, an evaluation of the AirPlus Business Travel Index that evaluates bookings settled via the payment service provider, shows flights between Shanghai and Beijing were the most in demand, together accounting for 7% of domestic business trips, followed by connections between Shenzhen and Shanghai with a combined 6%.

China was the first country to be hit by the coronavirus pandemic but was also the first to contain the spread of the virus last year. Case numbers there have been at a low level since then and travel, at least within the country, has - as the data illustrates - been pretty normalised.

Nevertheless, there are still some key differences compared to 2019: bookings still much more spontaneous now than they were before the pandemic, notes AirPlus International. While an average of 5.8 days elapsed between booking and departure in 2019, even for domestic flights, the figure was only 3.8 days between January and May this year.

Business trips also currently take less time than they did in 2019. Two years ago, 4.3 days elapsed between departure and arrival back at the starting point for domestic flights, whereas today the figure is just 3.8 days.

A survey conducted by AirPlus in Jun-2021 among 750 board members and managing directors worldwide highlights that business travel remains an important tool. It found that on average four in five (80%) consider personal contact with customers and suppliers to be indispensable. This is just as many as before the pandemic, when a similar survey was conducted by AirPlus in Nov-2019.

The figure rises as high as 86% in the USA, while China, France, Germany and Italy share the average sentiment level. A slightly less emphasis on personal contact is shown among UK managers but still almost three out of four still consider face-to-face customer meetings to be necessary.

The survey findings show top managers are particularly concerned about not losing out to the competition. In response to what the three most important topics are for their companies right now, pressure from competitors was the second most cited factor, following the economic impact of the coronavirus pandemic and ahead of health and hygiene measures due to the pandemic.

The last time this information was collected in Nov-2019, pressure from competitors was ranked fourth. On top of that, the coronavirus pandemic brought declines in sales revenue at many companies while also pushing up costs, an effect that 59 percent of top managers surveyed report seeing. They are now pushing a process of recovery and catching up, with hopes of returning to a more visible presence with customers.

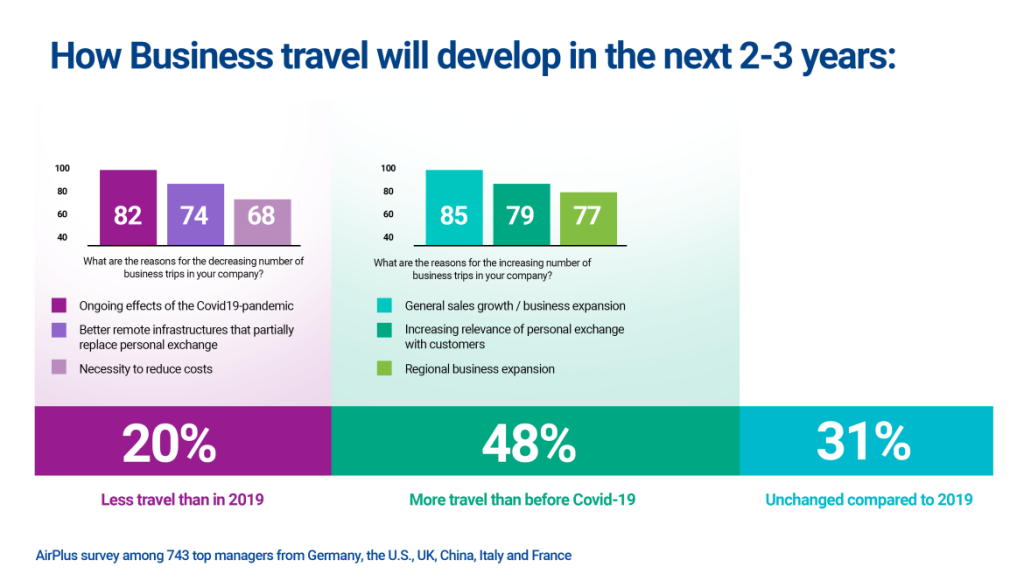

The great importance of personal dialogue with buyers and clients prompted nearly half of those surveyed to respond that they believe business travel will rebound over the next two to three years to levels even beyond those seen in 2019. Among those who expect more travel, 79% cited this as a reason for the increase in business travel, while 85% pointed to general growth in sales.

Nearly one-third (31%) of all respondents believe the number of trips will return to at least the pre-pandemic level in the medium term. Still, there are also factors curbing this trend as well. One in five of the top managers surveyed expects to see fewer business trips than in 2019. For one thing, many are sceptical about the further course of the pandemic. Four in five give this as a reason for their views. About three in four of those who expect there to be less travel also see improvements in technical infrastructure, and especially videoconferencing, as a reason to replace in-person meetings.

There are already signs of a significant upturn in business travel. In May-2021, European AirPlus customers alone took more than a third more flights than in the previous month, and the number increased almost fivefold compared to the same month last year, according to its internal data. The increase in intra-European flights was disproportionately high (almost 50%) compared to Apr-2021, while business travel on domestic flights rose by a third, it says.

In Germany, business travellers flew 38.5% more in May-2021 than in the previous month, according to AirPlus. Here, too, flights to other European countries were in particular demand, with an increase of 52.3%.

However, unlike China's domestic market, Europe is still a long way from pre-pandemic figures: in May, the total number of flights by business travellers in Europe was around one-tenth compared with 2019, notes AirPlus. However, the booking figures suggest that demand in Europe will also increase significantly again in the coming months.