Summary:

- Another Canadian pension fund may make a bid for a stake in Brussels Airport;

- Other financial institutions with no experience of the sector are joining forces with such funds;

- Brussels is a good investment for those seeking 'riskless' stability but risks come in many forms.

The current owner and operator is Brussels Airport Company NV/SA, comprising of Ontario Teachers Pension Plan (OTPP) (39%), Macquarie European Infrastructure Fund I and Macquarie European Infrastructure Fund III (36%) and the Belgian State (25%), since 2011.

It was during 2017 that the Macquarie Group appointed JP Morgan to market its 36% stake in the airport. Ontario Teachers' Pension Plan (OTPP) was then reported to be interested in the stake. Then in Sep-2018 Belgium's Flanders Government was reported to be considering the acquisition of Macquarie Group's stake in the airport through Flemish Government investment company PMV, which would partially renationalise it. Nothing more has been heard of that proposal.

Since then, apart from OMERS, other organisations and consortia have entered the fray. OMERS will compete with a consortium formed by APG and QIC. The former manages the pension assets of around 4.5 million Dutch citizens and invests in fixed-income securities, property, hedge funds, private equity and infrastructure. The latter is the Queensland Investment Corporation, established in 1991 by the Queensland Government to manage its long-term investments, and now the third largest institutional investment manager in Australia.

A second consortium has also sprung up, comprising the Canada Pension Plan Investment Board (CPPIB) and PGGM, a privately owned Dutch investment manager covering pension funds, public equity and debt markets and private equity, real estate funds, commodities, and infrastructure markets across the globe. Earlier, in Nov-2018 it was reported that PGGM aimed to form a consortium with Allianz, AG Insurance and Canada Pension Plan Investment Board to bid to acquire the 36% stake. As it happens, Allianz appears to have dropped out, leaving CPPIB and AG Insurance, a Belgian insurance company, as the other members of this consortium.

These developments highlight the increasing propensity of financial sector investors to dabble in airports, beyond the well-established players - mainly pension funds - from Canada (such as OTTP, CPPIB, OMERS etc) and Australia. However, it is rare that these new entrants choose to 'go it alone', usually preferring to attach themselves to the coattails of the established organisations.

These funds are increasingly involved with high-volume, full-service airline dominated major city airports at different levels, often allowing existing management to continue in situ while retaining an arms-length diligence function.

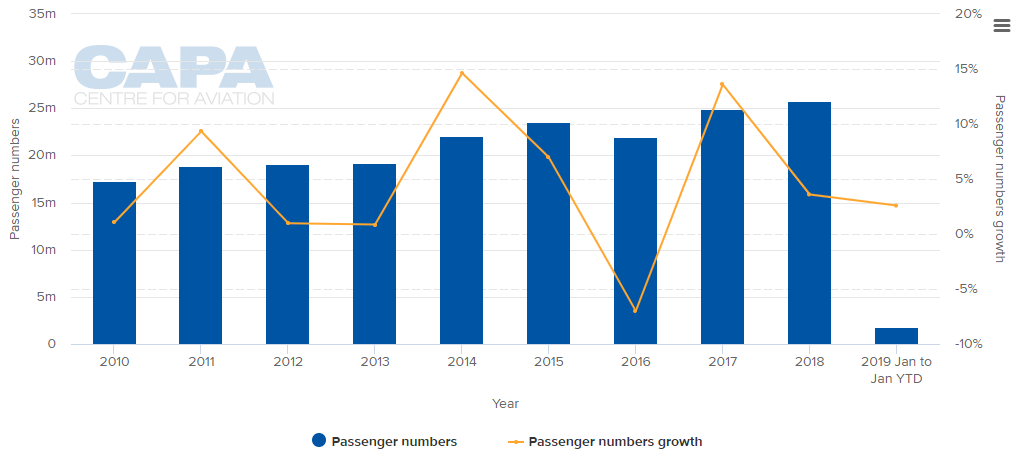

So what do they see in Brussels Airport? Belgium's main air gateway appears to have recovered operationally from the terrorist attack of Mar-2016. Passenger traffic fell by 7% that year, the same margin it grew in the previous year; then increased by 13.6% in 2017, but by only 2-3% in 2018 and 2019 to date. Capacity has been added in every year since 2014, and in the case of cargo capacity, since 2017. DHL has a major hub there.

CHART - The terrorist attacks of Mar-2016 and the airport's closure meant traffic level feel in 2016, but has been preforming well since then, boosted by the hub activity of anchor tenant Brussels Airlines Source: CAPA - Centre for Aviation and Brussels Airport reports

Source: CAPA - Centre for Aviation and Brussels Airport reports

Yet with 25.6 million passengers (2018) Brussels airport is smaller than European provincial regional airports such as Düsseldorf and Manchester. Brussels Airlines is dominant with almost 40% of seat capacity and between 33% and 43% of movements, depending on the time of day, but that is not taking 'dominance' to extremes.

Low-cost, led by Ryanair, which has a major (and its first-ever international) base at nearby Charleroi Airport, has risen to 18.8% of capacity, giving the airport a good traffic mix, but the investors will be attracted more by the four-fifths of capacity held by full-service carriers.

The network aspect of the airport is further reflected by the fact that only 27% of capacity is on unaligned carriers, while Star Alliance, of which Brussels Airlines is a member holds a 61% share.

The airport is in the midst of a USD600 million master plan development through to 2020. Taking these factors into account, together with the economic and political gravitas the city currently has makes it an easily identifiable location for funds wishing to benefit from stable traffic flows without undue risk.