Summary:

- The traditional car rental model is coming under increasing pressure from disruptive influences, a new study from American Express GBT has highlighted;

- Costs are rising but the car rental companies are restricted in their ability to respond by raising rates due to overcapacity, and the increased competition.

- Its new report, The Ground Monitor 2019, predicts that any rate changes that occur in the year ahead are likely to be minimal.

The prediction comes despite the industry facing higher costs as new technology and safety features - such as rear cameras, sensors and collision-prevention automatic breaking - make cars more expensive to buy and maintain. The report is the latest in the regular Monitor series developed by the Global Business Consulting team at American Express GBT to help travel buyers optimise their travel policy and programme. The next edition will analyse the hotel sector and will be published in July 2019.

The report is based upon seven years of car rental data, combined with key macroeconomic variables including local GDP, inflation, and employment rates to predict how car rental costs will evolve into 2020.

While most business trips begin and end with ground segments, it traditionally has not always featured fully as part of managed travel programmes. It has become one of the most innovative and fast-evolving areas in travel, with disruptive new platforms and players emerging all the time.

The study provides some insights for buyers to take a more strategic approach to potentially buying ground transport with a geographical breakdown of market trends.

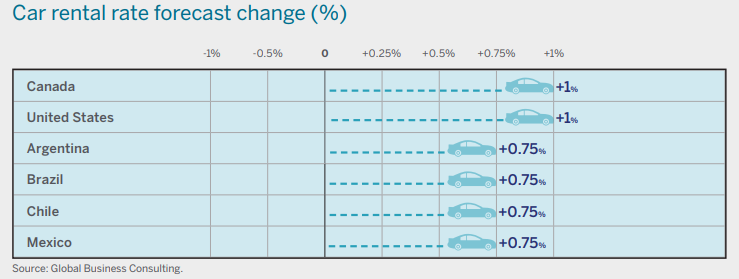

In the US and Canada, the report predicts a +1% increase in car rental rates. After almost a decade of low-to-no growth, car rental providers in North America are experiencing rising demand, but additional technology and safety features will be likely passed onto customers at the growth stage with the modest rate rise.

In Latin America, buyers in Argentina, Brazil, Chile and Mexico can expect to see prices increasing by up to 0.75%, according to the report. The big story for Latin and Central America is ride-hail, it says, with companies experiencing double-digit growth across the regions.

As the ride-hail sector continues to expand, fares are predicted to remain stable through 2019 and into 2020, but it warns increased regulation "may push fares up in the longer term" and in some countries, safety concerns could mean "corporations may want to limit ground transportation options to vetted chauffeured services".

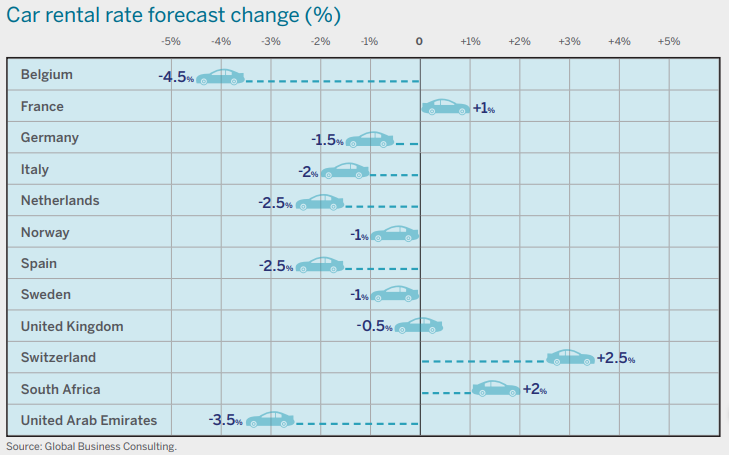

Into Europe, the report predicts car rental rates will fall slightly in many key business destinations, with declines ranging from -0.5% in the UK to -4.5% in Belgium. However, other countries will see increases with France and Switzerland forecast to see price rises of +0.5% and +2.5% respectively.

Europe's car rental companies are contending with "rising fleet and maintenance costs," according to the report, driven by the increasing technological sophistication of cars and tightening environmental rules. Operating on tight margins, these companies naturally want to increase rates, but with economic uncertainty across the Continent, this may be hard to achieve.

In the Middle East and Africa, markets such as South Africa and United Arab Emirates (UAE) will see continued demand growth, but a varying impact on rates. In South Africa they are forecast to rise by +2% though 2019 and into 2020, outpacing predicted economic growth over this period with the ride-hail sector flourishing and homegrown platforms emerging to challenge the global brands.

Meanwhile, while the UAE economy is predicted to maintain a healthy growth rate driven by the active business and tourism sectors, car rental firms will not be able to increase rates, according to the report, due to "excess capacity in the country," the rise of ride-share players such as eCar and uDrive "further dampening prices" and "softening in the important oil and gas sectors". Ultimately, this could actually see rates fall by -3.5%, it predicts.

Across Asia and the Pacific, the report does not provide car rental rate forecasts for two of the biggest economies, China and India, due to insufficient data as a result of the prevalence of chauffeur drive and ride-hail in these countries. However, for Australia it predicts rental rates to decline -1.5% despite the expected robust growth of the economy.