Summary:

- A new report by Carlson Wagonlit Travel (CWT) shows lead times for planning meetings in North America are projected to increase;

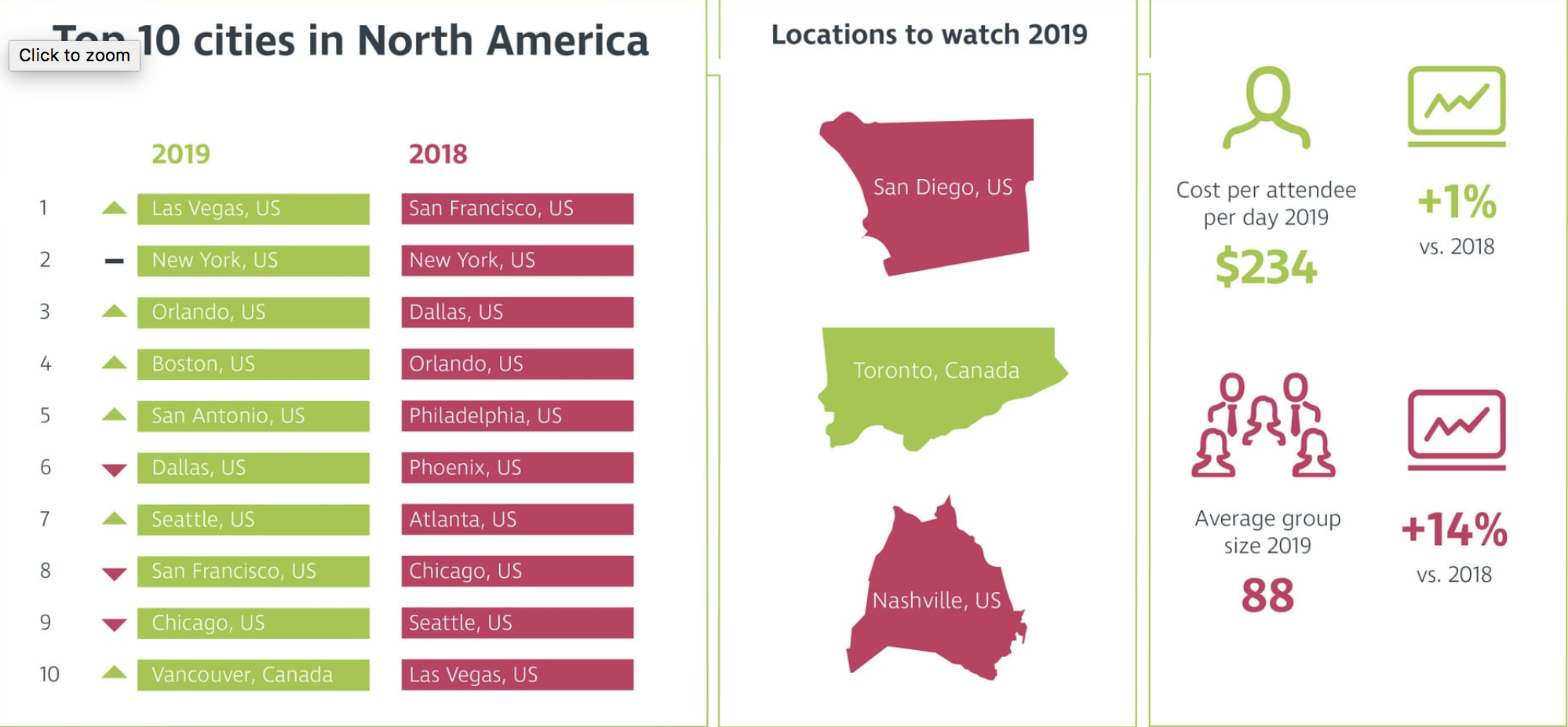

- The average cost per attendee a day for meetings in North America will grow +1% year-on-year in 2019 to USD234 while average group size should increase +14% to 88;

- Demand for meetings far outstrips supply of venues and hotels as the number of meetings and budgets increase in North America, according to CWT.

The company's 2019 Meeting and Events Trends report shows the average cost per attendee a day for meetings in North America will grow +1% year-on-year in 2019 to USD234 while average group size should increase +14% to 88.

The growth in group size for North America results in a longer lead time for meeting planners, says CWT. Its research showed lead times for 100-plus attendees requiring a ballroom and breakout spaces are now being booked between four and six months, while bookings for 400 to 500 delegates are now being handled six to nine months in advance.

"Demand for meetings far outstrips supply of venues and hotels as the number of meetings and budgets increase in North America, in response to the strength of the economy," said Tony Wagner, VP Americas, CWT Meetings and Events.

Average hotel rates in North America are expected to grow +2.8% year-on-year in 2019, according to the CWT study, which will push up costs for meeting buyers. Demand is already exceeding supply for hotel venues, especially for larger meetings and conferences.

CWT concluded there are few "big box" properties with 500 plus rooms as a large number of hotel firms focus on expanding mid-scale select service budget brands, which typically have limited events and meeting facilities.

The report singled out two locations - New York and San Francisco - for expanding and pressured hotel room capacity. New York has added 45,000 new hotel rooms during the last decade, with an additional 18,000 scheduled to be introduced by 2020. Additionally, a USD1.5 billion expansion of the Javits Center in Manhattan, will add 1.2 million square feet of new exhibition and meeting space from 2021, said CWT.

San Francisco is already the number one meeting destination in the US, which is creating a capacity squeeze in hotel rooms available. As a result, hotel rates in the region will remain high.