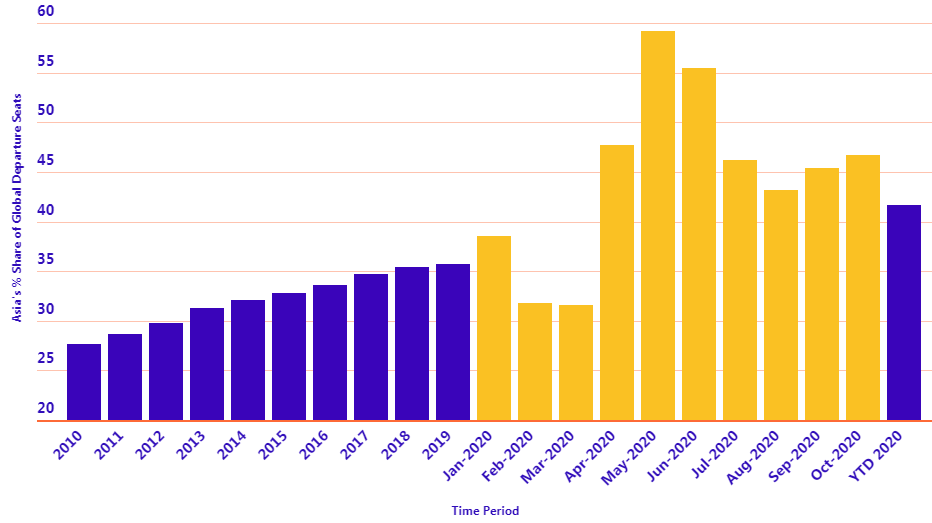

The eight percentage point rise from 27.7% in 2010 to 35.7% was delivered with a positive trend of nine successive year-on-year increases in which departure capacity almost doubled (+99.4%), rising from 1.03 billion in 2010 to 2.06 billion in 2019. South East Asia (+113.4%) and Central Asia (+109.9%) saw the largest growth, but South Asia (+103.7%) and North East Asia (+93.1%) were not far behind.

Into the 2020s, IATA projected Asia would drive the biggest growth with more than half the total number of new passengers over the next 20 years coming from its markets as growth is driven by a combination of continued robust economic growth, improvements in household incomes and favourable population and demographic profiles.

Its models showed China would displace the United States of America as the world's largest aviation market (defined as traffic to, from and within the country) in the mid-2020s; India would take 3rd place after the US, surpassing the UK in around 2024; Indonesia predicted to be a standout performer would climbing up to the fourth largest by 2030; and Thailand would enter the top 10 markets in 2030, pushing Italy out of the ranking.

Those forecasts are now irrelevant given the seismic impact of COVID-19 on the air transport sector during 2020 - some of them have actually already come true in a matter of months rather than years as the biggest global health crisis of modern times turned the sector upside down.

For Asia, its prominence on the world stage has only grown. The signs were already evident in Jan-2020 when its share of global departure seats rose to 38.5% and while levels slipped to 31.7% in Feb-2020 and 31.6% in Mar-2020 as COVID-19 took hold in the region.

As things stabilised and coronavirus spread across Europe and later across the Americas, Asia became responsible for more than half of global seat capacity in May (59.2%) and Jun-2020 (55.2%). These levels settled back down in Jul-2020 (46.2%) and started to reduce as other regions started to remove travel restrictions (Aug-2020: 43.2%), but the return of country lockdowns in Europe has pushed the level back up (Sep-2020: 45.4%; Oct-2020: 46.7%). Year-to-date, up until the end of Oct-2020 it stood at 41.7%, a significant six percentage point rise on 2019.

In this new regular section CTC - Corporate Travel Community offers a graphical insight into this key industry trend.