On the outside the post-COVID world may not physically look any different from the one that entered the pandemic over a year ago, but the biggest health crisis of modern times has left an indelible mark on how we will look to book, travel and how and where we will do business.

"We know people are eager to start traveling again, but how they engage with travel brands, and what they expect, has changed," highlights Ms Olson Killion. This new report spotlights some of the latest trends with data positively indicating traveller confidence is growing.

The 'Q1 2021 Travel Recovery Trend Report' features data from custom research and Expedia Group first-party data combined and makes five key observations that global vaccine rollouts will spur the return of travel, global search windows stay short, domestic travel remains in favour, longer trip durations dominate and health and hygiene expectations continue to evolve, but are not such a priority.

The start of 2021 may not have marked a miracle, but it saw travel turn a corner with monthly search volumes showing strong growth throughout 1Q, according to Expedia data, with a clear correlation between the increase in searches and traveller demand and growing momentum for the rollout of COVID-19 vaccines and travel guidelines.

As one of countries leading vaccine rollouts data on US search trends provides a good example of this. The report highlights that in week-over-week searches, the week of 15-Mar-2021 saw the largest spike in searches - an increase of +30% - following the Center for Disease Control's (CDC) release of guidelines for fully vaccinated individuals.

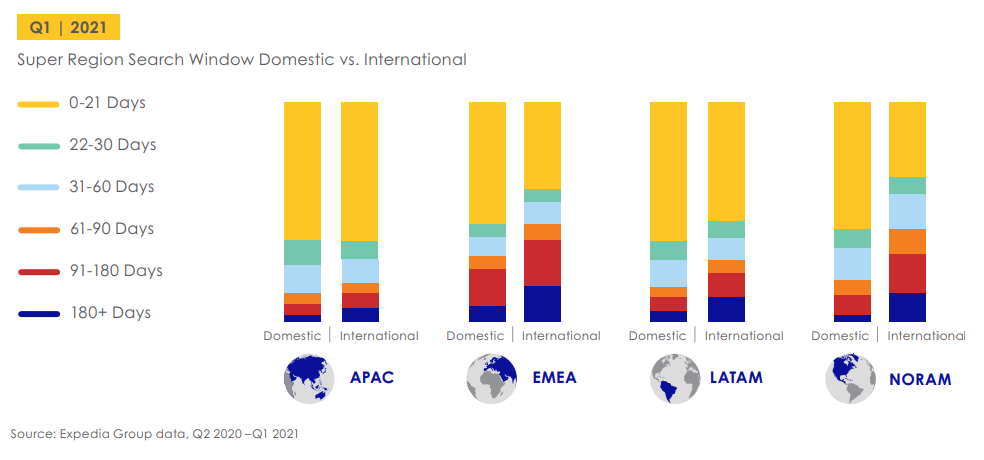

But uncertainty abounds and that means that the global search window remains short. Continuing a trend seen throughout much of last year, the majority of global 1Q 2021 searches fell within the 0 to 21 days search window, according to the report, as uncertainty around global travel saw travellers opt for more opportunistic, short-term trips, often close to home.

While this trend seems to be strengthening for domestic trips, longer search windows for international trips are beginning to emerge, acknowledges Expedia in the report. This trend is particularly pronounced in the EMEA region, where searches 91 days out or longer represented almost 40% of international searches made in 1Q 2021, up from around 25% in 4Q 2020, according to its data.

Even with COVID-19 vaccine distribution ramping up, international borders being reopened and bubbles, corridors and traffic light systems introduced for travel, many still continue to prioritise domestic over international travel, and are taking trips closer to home.

In 1Q 2021, the report highlights that beach and city destinations made up the top 10 booked destinations around the world. At a regional level, the top 10 booked destinations also reflect beach and city destinations, though within the same region.

As such, as travellers look ahead to late spring and summer trips, "car travel will continue to eclipse air travel and other transportation methods," notes the report. Expedia cites recent custom research that found for both domestic and international travel to a neighbouring country during the Apr-2021 to Sep-2021, travellers still consider driving their own car or a rental car, finding it safer than other modes of transportation.

Having not had the freedom to travel, many travellers are making up for lost time this year by taking longer trips, planning to fully use holiday entitlements and continuing to work remotely while travelling with "flexcations" - longer stays that include work and play, says the report.

Quarter-over-quarter, in 1Q 2021, holiday rental demand increased and the global average length of stay for vacation rentals jumped 30%, according to Expedia's insights. It cites data from online rental marketplace Vrbo that shows vacation rental travellers are 75% more likely to book more stays of at least 7 nights at vacation homes this summer, exceeding pre-pandemic levels.

As consumer confidence continues to grow, there are signs that more traditional decision-making drivers, such as cost, financial peace of mind and convenience, are beginning to reassert themselves, but short- and even into the medium-term health- and hygiene-related factors will remain important.

When comparing the top five topics searched for when booking flights from the last 12 months against the top 5 from 1Q 2021, the report shows that health- and hygiene-focused considerations have now dropped from the list with 'popular' 2020 searches on topics such as overall safety, cleanliness and crowding being replaced with cost, the ability to change flights and navigation, among others.

They say 'a picture paints a thousand words'. In this regular section CTC - Corporate Travel Community offers a graphical insight into a key industry observation or trend, this week taking a chart from Expedia Group's 'Q1 2021 Travel Recovery Trend Report' that highlights travel search information during the quarter by region and by domestic and international intent.

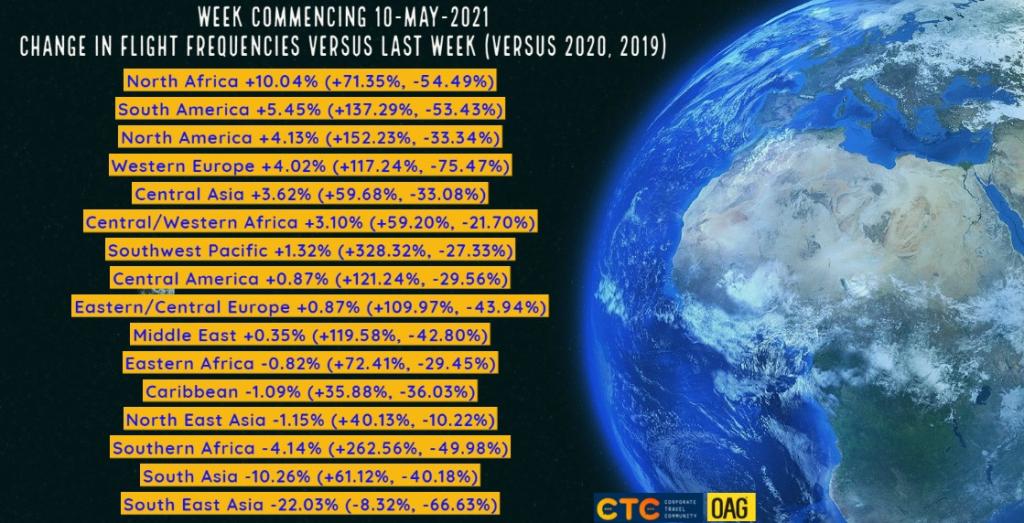

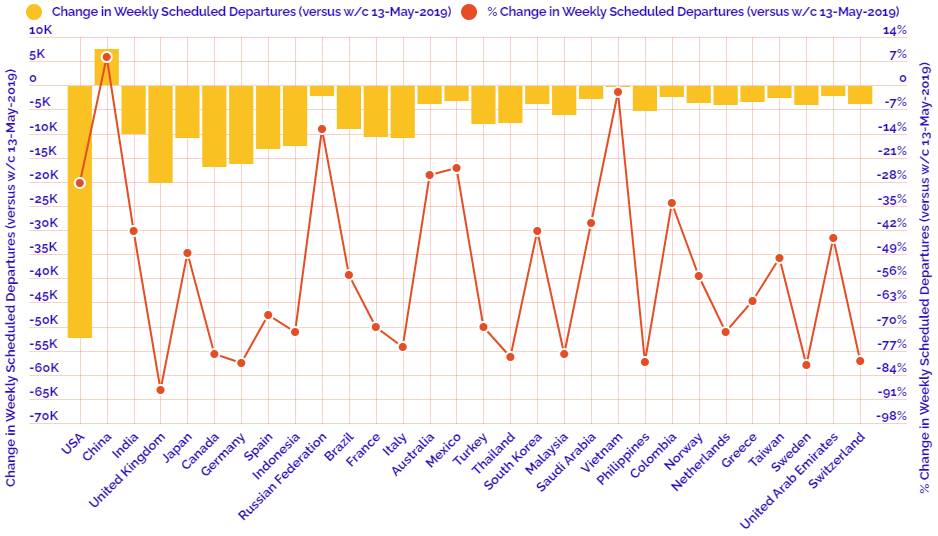

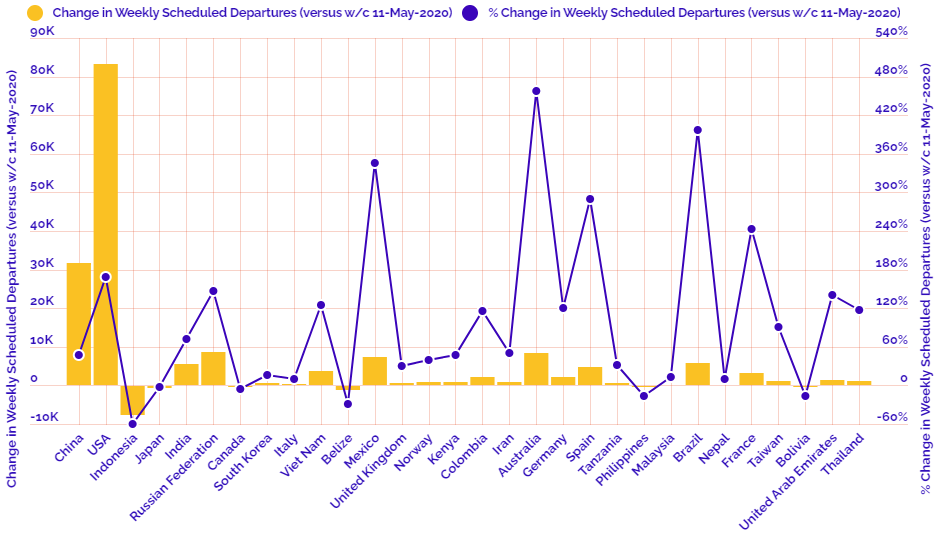

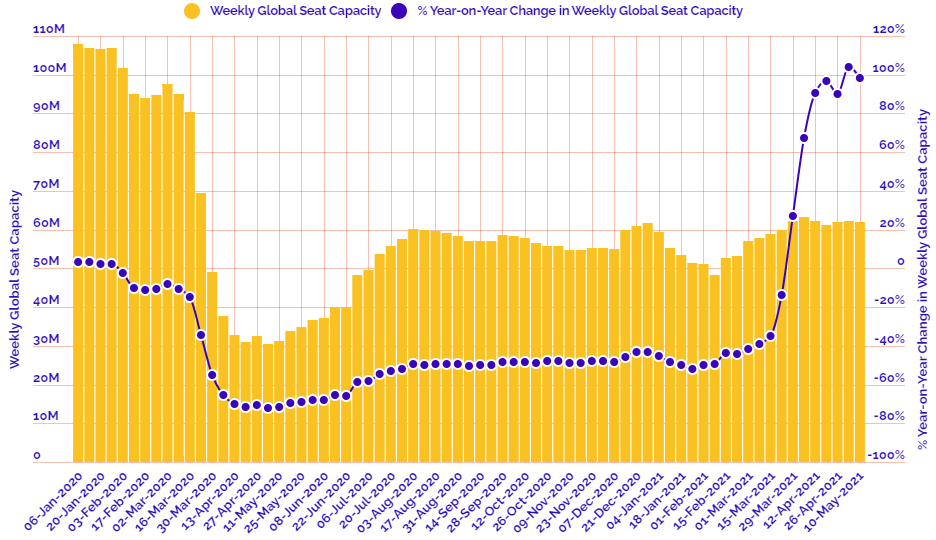

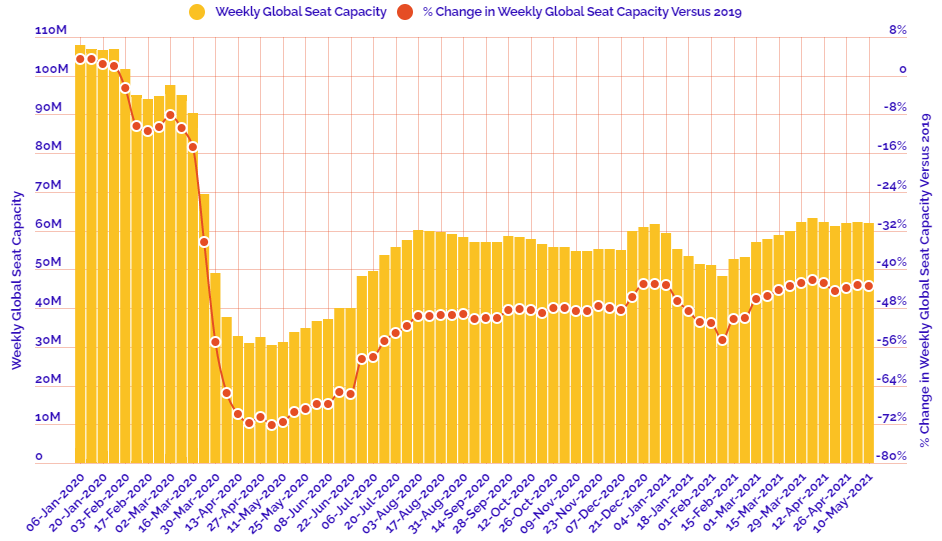

This regular section also now incorporates and expands on the charts produced in the 2020 air capacity series 'Coronavirus Statistics Snapshot'. These are based on an analysis of OAG schedule data and include a weekly look at how the pandemic is impacting global flight levels in the world's largest markets; a week-on-week and year-on-year comparison of flight departures by geographical region and a look at how weekly capacity is trending: the latter comparing levels to 2020 and also to the 2019 baseline performance.

HEADLINE FIGURES FOR WEEK COMMENCING 10-May-2021:

Departure frequencies down -0.04% versus last week; up+84.33% versus 2020 and down -41.93% versus 2019.

Seat capacity down -0.38% versus last week; up +98.38% versus 2020 and down -43.41% versus 2019.

CHART: Week-on-week change in flight departures by region

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2019

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2020

CHART: Departure capacity trends with year-on-year performance

CHART: Departure capacity trends versus 2019

CHART: The world's biggest aviation markets by flight departures