Its latest projections put net industry losses for 2022 at a reduced USD11.6 billion, but this will follow inflated losses for 2021, an estimated USD51.8 billion, down from the USD47.7 billion estimation in Apr-2021). Net 2020 loss estimates have also been revised to USD137.7 billion (from USD126.4 billion), meaning total industry losses across the three year period are expected to exceed USD200 billion.

This year, traffic levels remain heavily subdued and IATA projects that annual demand (measured in RPKs) is expected to stand at around 40% of 2019 levels for 2021. There will be an improvement in 2022, but not significant movement and demand is expected to still remain down more than a third of the pre-pandemic level at around 61% of 2019 levels. This will see passenger numbers reach 2.3 billion in 2021 and grow to 3.4 billion in 2022 which is similar to levels seen back in 2014.

"The magnitude of the COVID-19 crisis for airlines is enormous," says Willie Walsh, IATA's Director General, but he acknowledges that we are now "well past the deepest point of the crisis" and heading in a positive direction. "While serious issues remain, the path to recovery is coming into view. Aviation is demonstrating its resilience yet again," he says.

Notably, the air cargo business is performing well, and domestic travel is anticipated to return to near pre-crisis levels in 2022. The robust demand for air cargo is expected to continue with 2021 demand estimated to finish the year +7.9% above 2019 levels, growing to +13.2% above 2019 levels for 2022.

But, the challenge remains the international markets which remain severely depressed as government-imposed restrictions continue. "People have not lost their desire to travel as we see in solid domestic market resilience. But they are being held back from international travel by restrictions, uncertainty and complexity," says Mr Walsh.

IATA contends that re-establishing global connectivity, the 11.3 million jobs (pre-COVID-19) in the aviation industry, and the USD3.5 trillion of GDP associated with travel and tourism should be priorities for governments. "Aviation is resilient and resourceful, but the scale of this crisis needs solutions that only governments can provide," notes Mr Walsh.

The return in demand is slower than the provision in capacity which is expected to reach 50% of pre-crisis levels for 2021, according to IATA projects and will mean the average passenger load factor in 2021 is expected to be just 67.1%, a level not seen since 1994. This trend will continue into 2022, but load factors are expected to recover to 75.1%, a level still exceeded in every year since 2005 until this crisis hit, and far below the 82.6% record set in 2019.

Domestic demand, with fewer restrictions in most countries, is currently driving the recovery. Economists believe global GDP is expected to grow by +5.8% in 2021 and a further +4.1% in 2022. Additionally, accumulated consumer savings (worth 10-20% of GDP in some countries) is "supporting the alleviation of pent-up demand in unrestricted domestic markets," according to IATA.

It projects that in 2021 domestic demand is expected to reach 73% of pre-crisis (2019) levels, while in 2022 it is expected to reach 93% of pre-crisis levels. It is a very different story for international demand which IATA projects will only reach 22% of pre-crisis (2019) levels in 2021 and 44% in 2022.

But, there are some positives for airlines identified in IATA's outlook. It estimates the air passenger business will contribute USD227 billion to industry revenues in 2021, rising to USD378 billion in 2022. While, passenger yields have declined each year between 2012 and 2020, 2021 levels are expected to grow by +2.0% and a further +10% in 2022.

The global projections remain heavily influenced by regional variation. IATA believes that all regions of the world will improve their collective financial performance compared to 2020, with the strongest performing being North America which is expected to see a USD5.5 billion loss in 2021 transform to a USD9.9 billion profit in 2022.

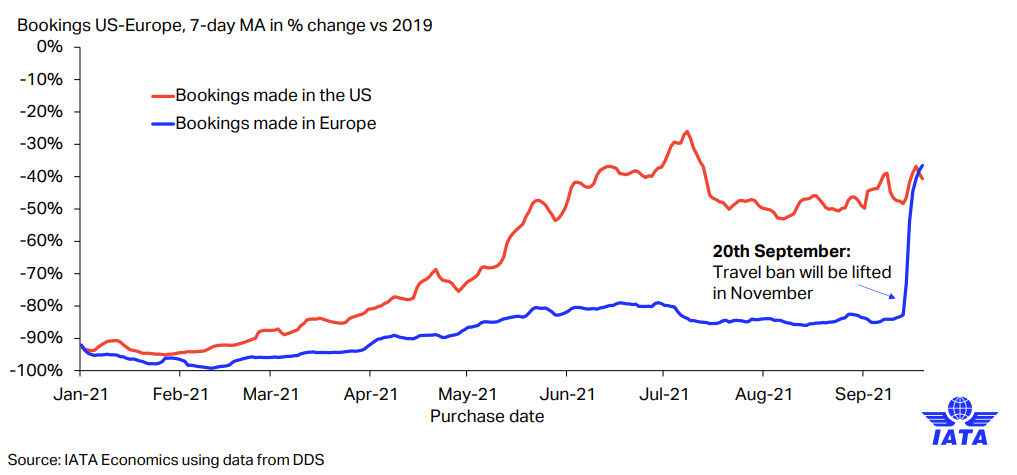

They say 'a picture paints a thousand words'. In this regular section CTC - Corporate Travel Community offers an illustrative insight into a key industry observation or trend, this week highlighting a chart presented at IATA's AGM that illustrated a huge surge in trans-Atlantic air bookings from Europe following the announcement that the travel ban entering the US is to be lifted from Nov-2021. This suggests a substantial pent-up demand for travel.

This regular section also now incorporates and expands on the charts produced in the 2020 air capacity series 'Coronavirus Statistics Snapshot'. These are based on an analysis of OAG schedule data and include a weekly look at how the pandemic is impacting global flight levels in the world's largest markets; a week-on-week and year-on-year comparison of flight departures by geographical region and a look at how weekly capacity is trending: the latter comparing levels to 2020 and also to the 2019 baseline performance.

HEADLINE FIGURES FOR WEEK COMMENCING 04-Oct-2021:

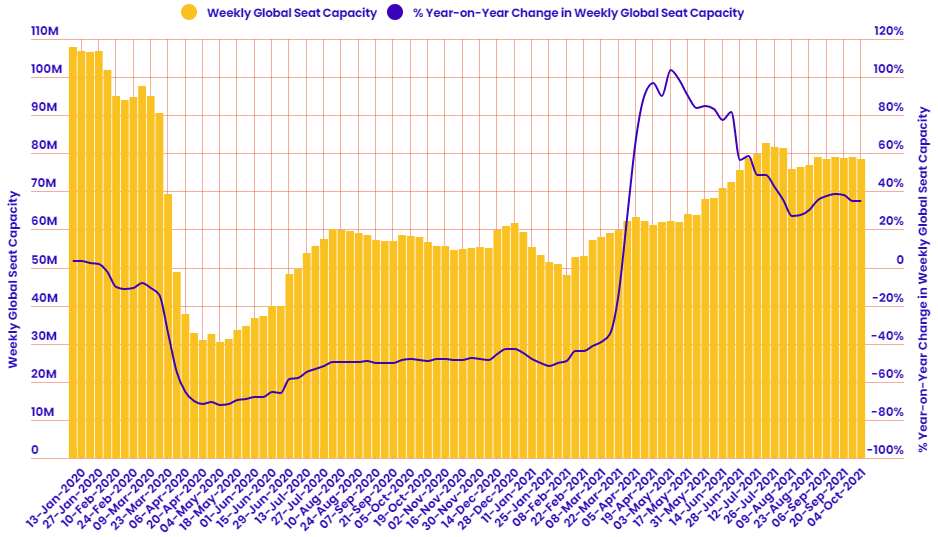

Departure frequencies down -0.47% versus last week; up+31.34% versus 2020 and down -29.43% versus 2019.

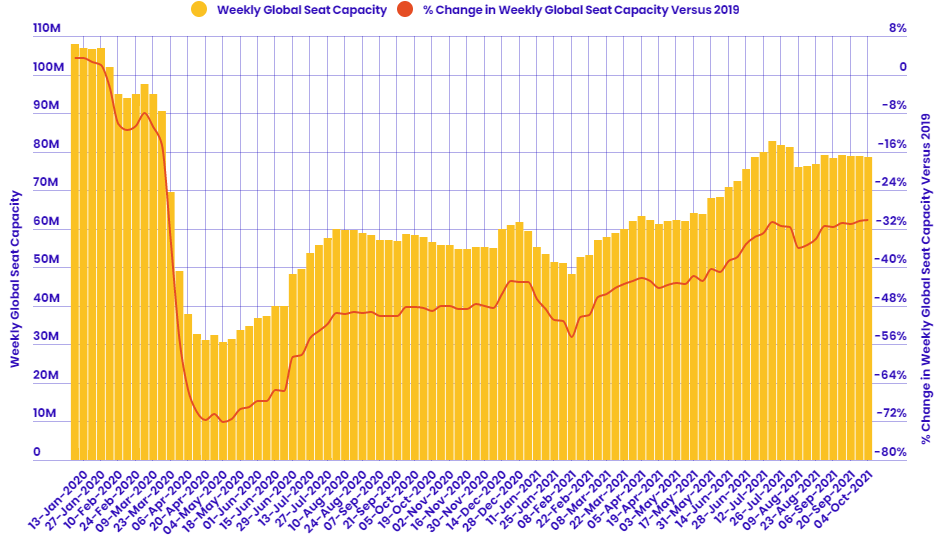

Seat capacity down -0.48% versus last week; up +34.72% versus 2020 and down -30.24% versus 2019.

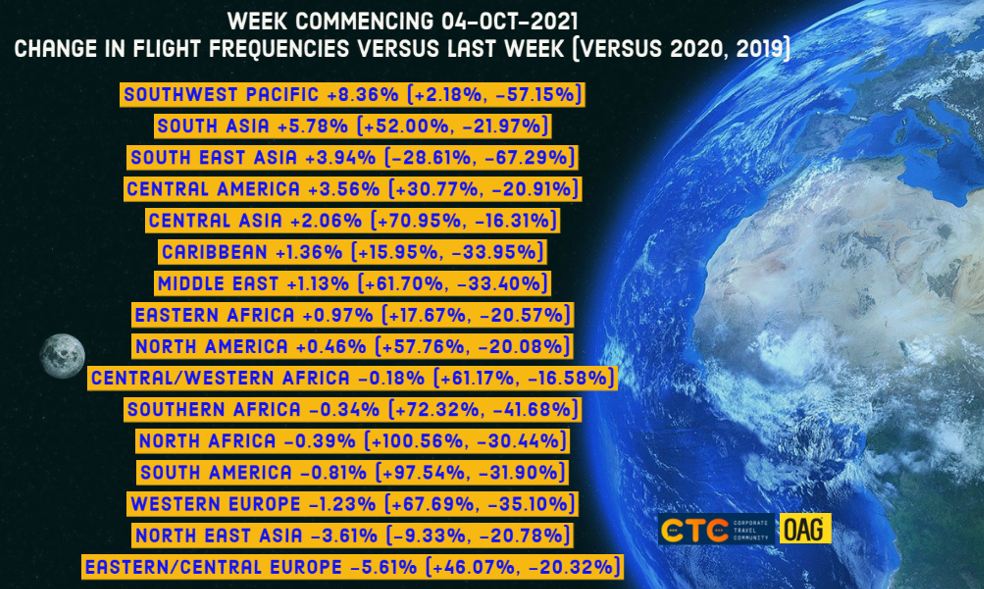

CHART: Week-on-week change in flight departures by region

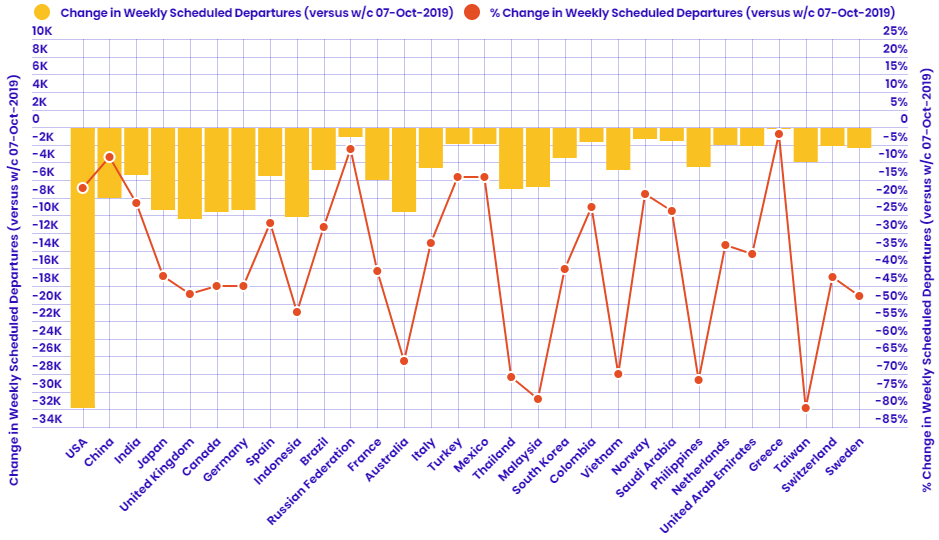

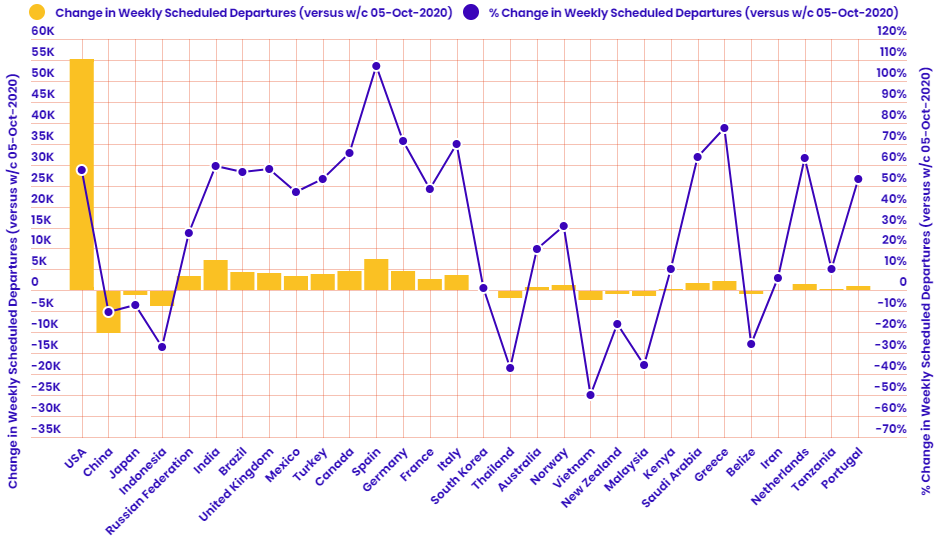

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2019

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2020

CHART: Departure capacity trends with year-on-year performance

CHART: Departure capacity trends versus 2019

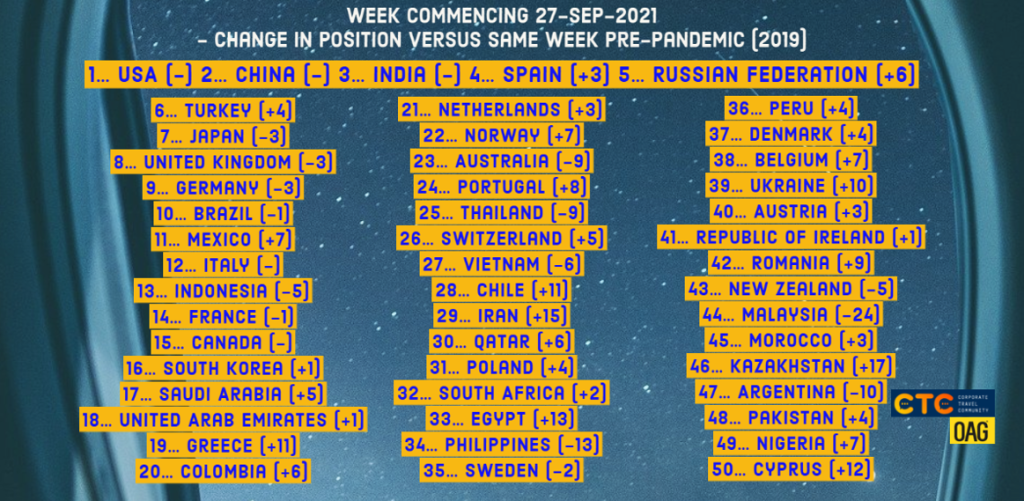

CHART: The world's biggest aviation markets by departure seats