In the current challenging world Low Cost Carriers (LCCs) are seen best placed in the short- and medium-terms. With a business model - mainly based on short-haul flying and with a strong leisure focus - offering a distinct competitive advantage over legacy operators they are growing market share and building customer loyalty at the expense of mainline carriers, whose networks have been crippled by the subdued travel demand and especially the collapse in corporate travel.

LCCs have long targeted secondary level, and even tertiary level. But a sea-change in LCCs' circumstances has resulted in many of them flying increasingly from primary and even major hub airports. the trade off: passenger yields can be considerably higher, even if loads are lower and costs higher. On the downside, a rapid turnaround is more difficult to achieve.

COVID-19 will accelerate this trend. In fact we are already seen this with Romanian LCC Blue Air a good example as it switches some flights into London from Luton to Heathrow after successfully securing slots at the UK's largest airport. Similarly, in Paris, it is switching flights from Beauvais to Charles de Gaulle. It is not alone.

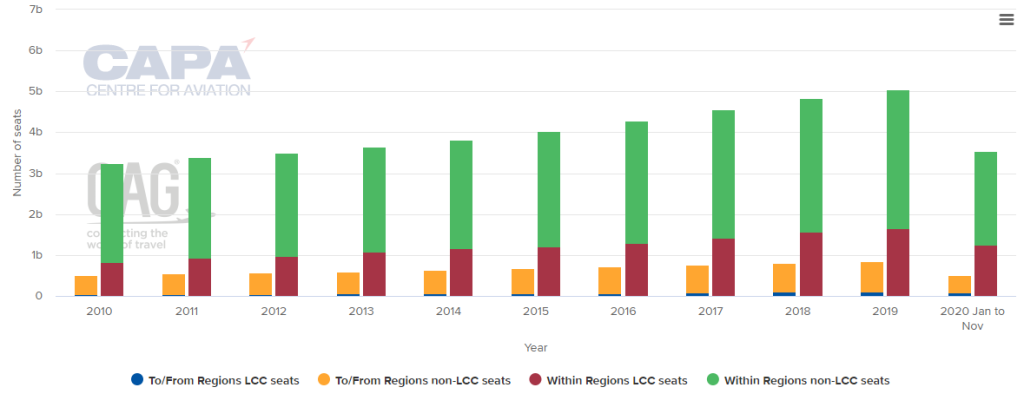

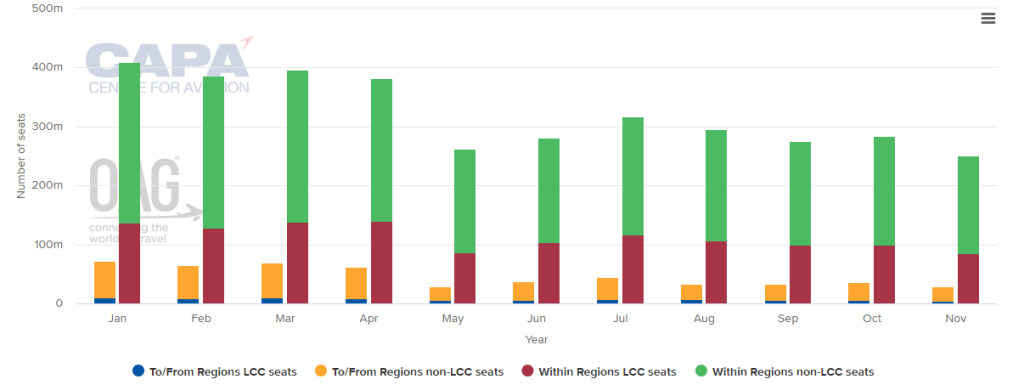

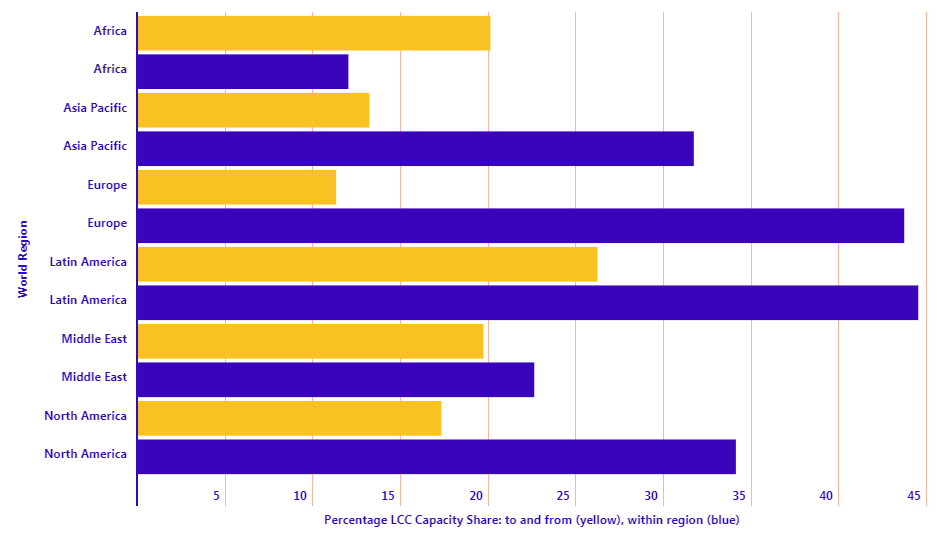

They say 'a picture paints a thousand words'. In this new regular section CTC - Corporate Travel Community offers a graphical insight into a key industry observation or trend. In this fifth edition we use OAG schedule data and CAPA interiors information to look at the increasing role LCCs are playing in the global market and how this unprecedented year has seen their role increase in importance.