This will all be facilitated by the return of airline flight networks. But the routes operated over the remainder of 2021 will look very different from those seen in 2019 before the coronavirus pandemic hit. It is something of a cliché to say the world is a different place in 2021. When it comes to air travel you only have to look at airport aprons and flight departure and arrival boards to see that is precisely the case.

The International Air Transport Association (IATA) and Tourism Economics have this week released a long-term view for post-COVID-19 passenger demand recovery which demonstrates that people remain eager to travel in the short and long-term. It used the publication of the report to reiterate the point that to ensure that aviation can sustainably deliver its social and economic benefits as it meets this long-term demand, "it is critical that governments step-up their support for more efficient operations and foster an effective energy transition".

The main findings of the forecast are positive. It predicts that in 2021 global passenger numbers are expected to recover to 52% of pre-COVID-19 levels (2019), reaching 88% in 2022 and then surpassing the pre-pandemic levels and hitting 105% in 2023. By 2030 global passenger numbers are projected to have grown to 5.6 billion. That would be just -7% below the pre-COVID-19 forecast and an estimated loss of around 2-3 years of growth due to pandemic.

Beyond 2030 air travel is expected to slow, due to weaker demographics and a baseline assumption of limited market liberalisation, giving average annual growth between 2019 and 2039 of +3.2%. IATA's pre-COVID-19 growth forecast for this period was +3.8%.

"I am always optimistic about aviation," says Willie Walsh, IATA's director general. "We are in the deepest and gravest crisis in our history. But the rapidly growing vaccinated population and advancements in testing will return the freedom to fly in the months ahead."

When that happens, "people are going to want to travel," according to Mr Walsh. This makes the immediate challenge how to successfully reopen borders, eliminate quarantine measures and digitally manage vaccination/testing certificates, while at the same time minimising the risk of virus transmission. To be successful governments and industry need to work in partnership. "Aviation is ready. But I don't see governments moving fast enough," claims the irishman.

The damage of the COVID-19 crisis will be felt for years to come, but all indications are that people have retained their need and desire to travel. Any possibility for borders to re-open is met with an instant surge in bookings, notes IATA. The most recent example is the 100-percentage point spike in bookings from the UK to Portugal when the UK's "Green List" was announced in early May, it highlights.

New traffic light systems and travel corridors and bubbles that define mobility will dominate the summer travel environment. This will ultimately be driven by the successful deployment of COVID-19 vaccination programmes in individual countries.

The race for herd immunity and that magic figure that means a large enough proportion of the population of an area is immune to the disease will be key in when and where airlines can fly. In fact, vaccination rates in developed countries (with the notable exception of Japan) should exceed 50% of the population by the third quarter of 2021.

There is a lot to look forward to, it appears, but things can change very quickly, and predicting the outlook right now is perhaps harder than it has ever been before. As a warning, a forecast from Eurocontrol, the European organisation for the safety of air navigation, looking at the possible evolution of domestic and international air traffic in Europe, suggests it would be "an optimistic case" if European traffic recovers before 2025.

Its best case is that it will reach 95% of pre-pandemic levels in 2024 based on a coordinated easing of travel restraints being reached by 1Q2022 between global regions, with more long haul flows starting to return. However, it warned that a pessimistic viewpoint could see it being 2029 before that milestone is reached across the Continent, a scenario based on persistent restrictions over the coming years owing to patchy vaccine uptakes and/or renewed outbreaks of new virus strains, with passenger confidence negatively impacted.

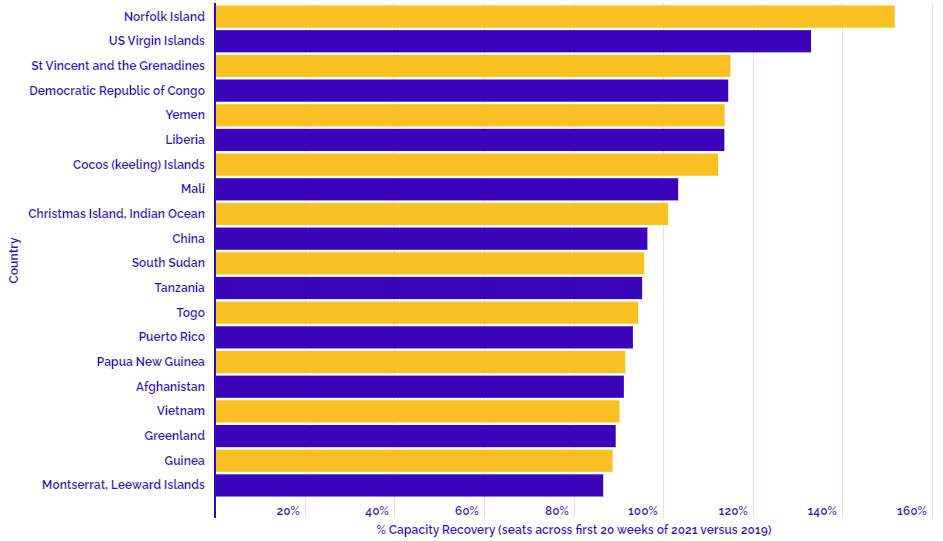

They say 'a picture paints a thousand words'. In this regular section CTC - Corporate Travel Community offers a graphical insight into a key industry observation or trend, this week producing our own analysis using OAG schedule data to look at the recovery of air capacity at a country level. The data snapshot compares capacity (arrival and departure seats) for the first 20 weeks of 2021 and compares them to the same period in 2019.

There are nine nations where capacity exceeds the levels seen over the same period in 2019 - which is seen as the benchmark parameter for pre-pandemic reporting. These are mainly smaller aviation economies and comprise: Norfolk Island; US Virgin Islands; St Vincent and the Grenadines; Democratic Republic of Congo; Yemen; Liberia; Cocos (keeling) Islands; Mali and Christmas Island, Indian Ocean.

A further 29 countries have seen air capacity rise above 75% of pre-pandemic levels over the first 20 weeks of 2021, including some of the world's largest country markets. This list includes China, Vietnam, Iran, Mexico and the Russian Federation, and all of which have strong domestic markets that are supporting the performance.

In total, 54 countries had seen capacity recovery above the two-thirds figure during this data snapshot, with 93 passing the half way point along the recovery path. The analysis shows there are still more than 130 nations below half of 2019 capacity levels, over 80 less than a third of 2019 capacity levels, over 50 less than a quarter of 2019 capacity levels and even a double-digit number to have seen capacity levels recover to less than 10% of the pre-pandemic levels, based on this first 20 weeks of the year analysis period.

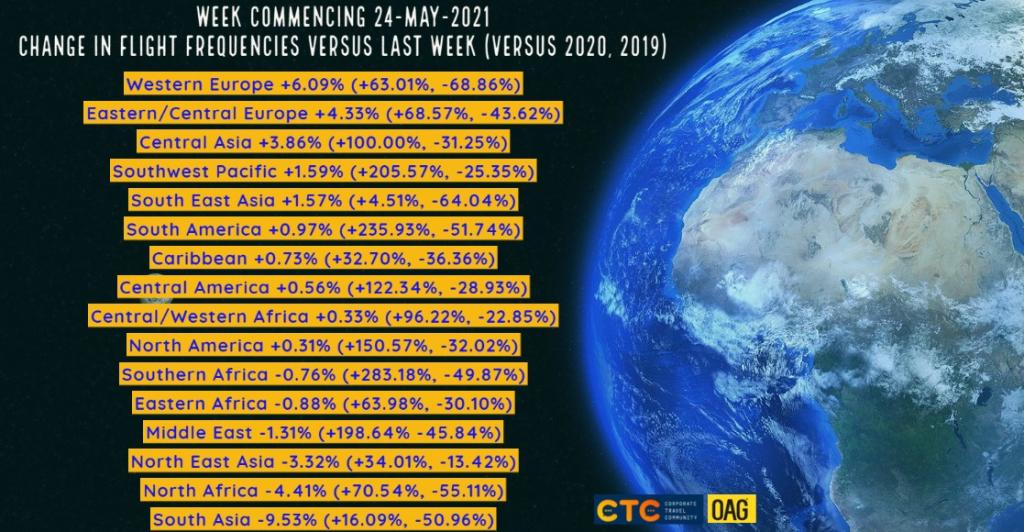

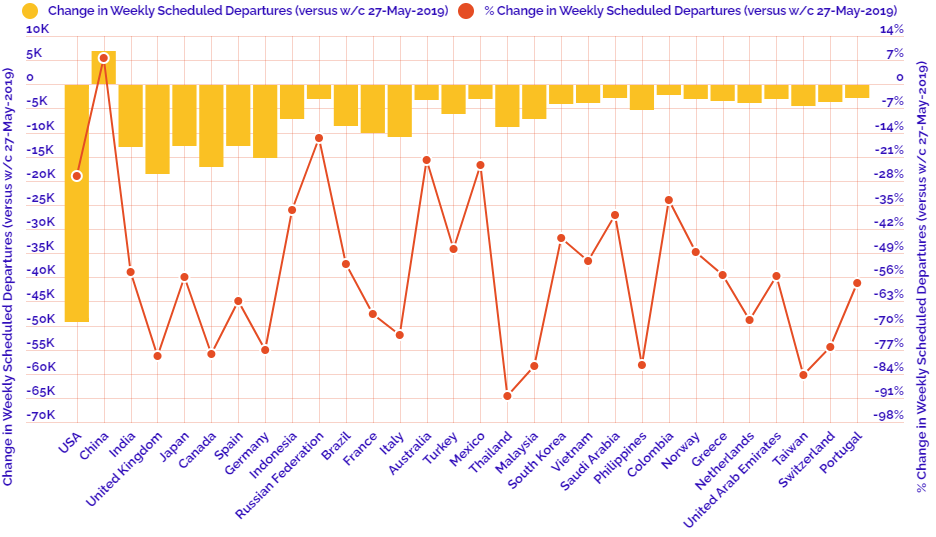

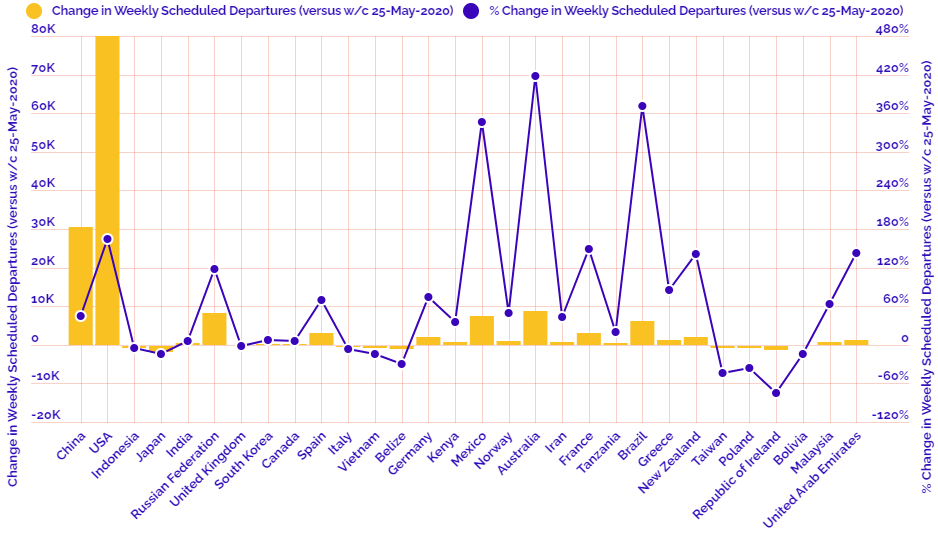

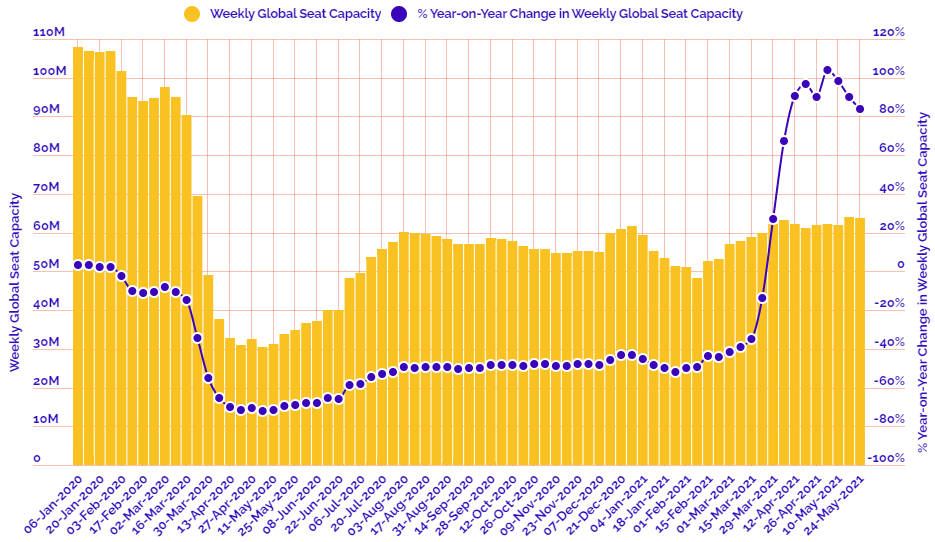

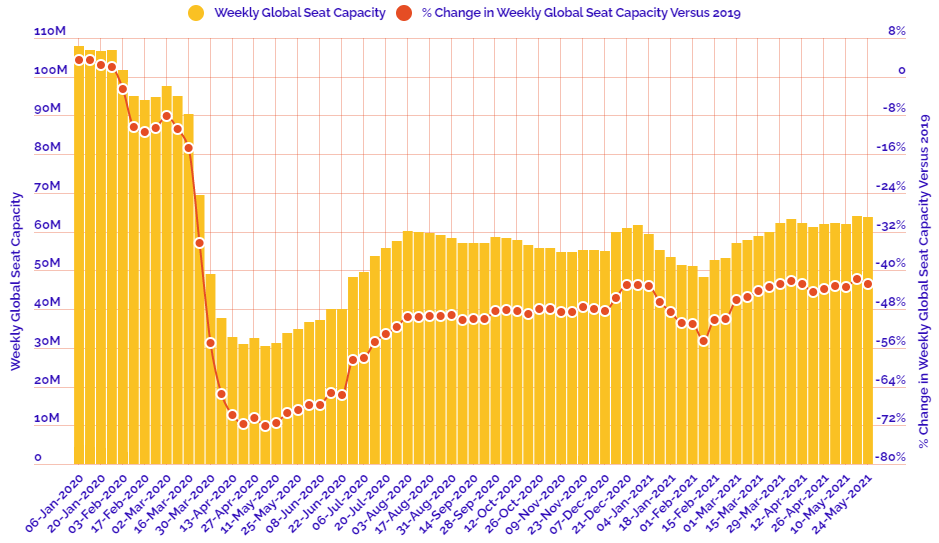

This regular section also now incorporates and expands on the charts produced in the 2020 air capacity series 'Coronavirus Statistics Snapshot'. These are based on an analysis of OAG schedule data and include a weekly look at how the pandemic is impacting global flight levels in the world's largest markets; a week-on-week and year-on-year comparison of flight departures by geographical region and a look at how weekly capacity is trending: the latter comparing levels to 2020 and also to the 2019 baseline performance.

HEADLINE FIGURES FOR WEEK COMMENCING 24-May-2021:

Departure frequencies down -0.25% versus last week; up+76.37% versus 2020 and down -41.19% versus 2019.

Seat capacity down -0.37% versus last week; up +83.71% versus 2020 and down -42.89% versus 2019.

CHART: Week-on-week change in flight departures by region

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2019

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2020

CHART: Departure capacity trends with year-on-year performance

CHART: Departure capacity trends versus 2019

CHART: The world's biggest aviation markets by departure seats