Most airlines in Southern Africa - as well as Africa overall - have struggled to achieve profitability. AASA believes low average profit margins is the biggest issue confronting airlines in Southern Africa.

Scale is one of the main impediments to achieving sustained profitability as almost all of the region's airlines are small. The proposed SAATM would enable airlines from across Africa to cooperate and launch more routes within the vast continent, resulting in better economies of scale.

"Size is very important in terms of ensuring you get unit costs down," AASA CEO Chris Zweigenthal told CAPA TV on the sidelines of the IATA AGM in early Jun-2019. "So when you talk about single Africa transport market and liberalisation there is no doubt that there has to be cooperation across borders and there has to be alliances - not only with the big global alliances but also alliances within Africa - to increase the size and get the unit costs down."

The African Union officially launched the SAATM project in early 2018. However, the initiative to liberalise African skies dates back to 1988, when the Yamoussoukro Declaration was first made by the African Union.

Airlines in southern Africa need to expand their African networks in order to achieve better economies of scale but the lack of liberalisaton continues to impede growth within Africa. "Only about 30% to 35% of the city pairs are served in Africa so there is a huge potential to be able to find different growth markets within Africa," Mr Zweigenthal said.

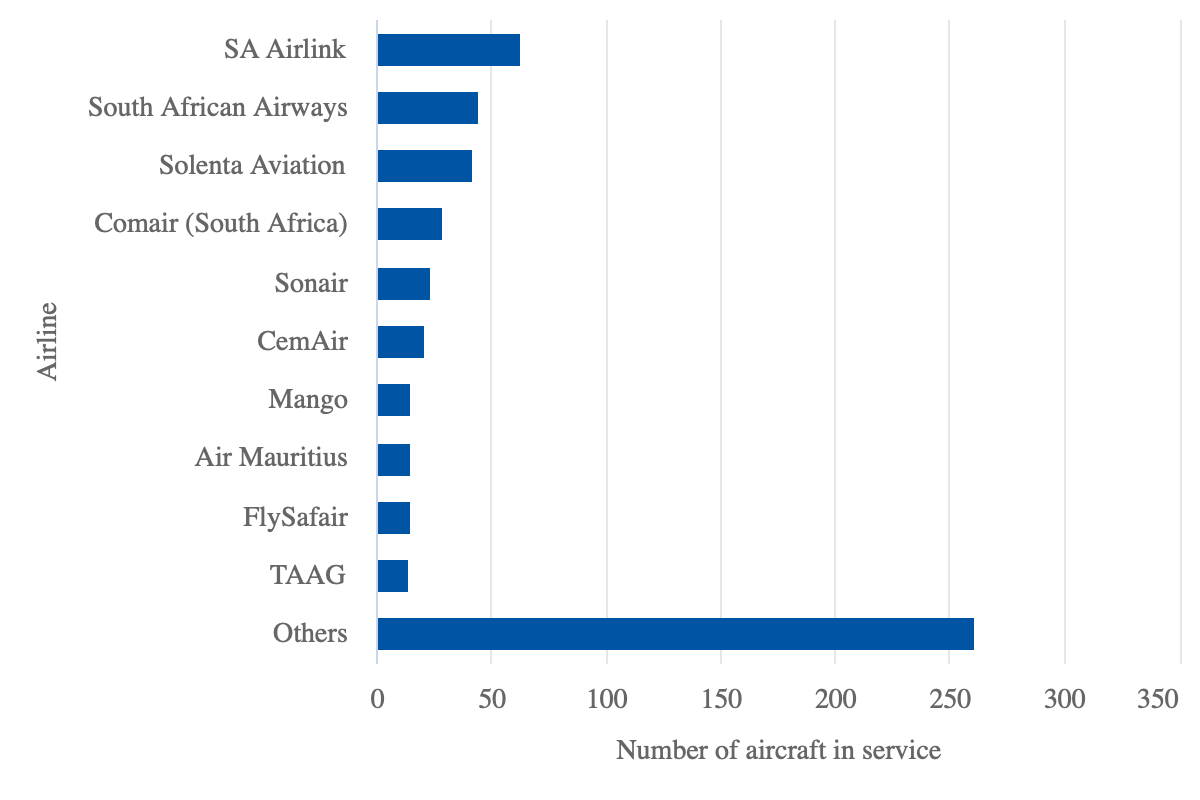

AASA represents 20 airlines in 10 southern African countries. These include most of the main airlines based in the region but only half operate at least 10 aircraft. There are 100 airlines based in Southern Africa including air taxi, cargo and charter operators (according to the CAPA Fleet Database). However, over half of these airlines have only one or two aircraft. Only six of Southern Africa's airlines have at least 15 aircraft.

CHART - Of the six airlines based in Southern Africa that have a fleet of at least 15 aircraft four only operate regional aircraft Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

Total seat capacity in Southern Africa has grown by less than 10% over the last two years, according to CAPA and OAG data. The slow growth is due mainly to a sluggish economy in South Africa, which drives Southern Africa's overall economy.

South Africa's GDP grew by slightly less than 1% in 2018 and is projected to again grow by less than 1% in 2019. GDP growth was slightly higher in 2017, at 1.3%, but was only 0.6% in 2016.

Mr Zweigenthal noted that in recent years passenger growth in southern Africa has averaged only 2% to 3%. Passenger growth in Africa overall has been 4% to 5%.

"In southern Africa at the moment we have a bit of work to do to get to that average," Mr Zweigenthal said. He added that the relatively slow passenger growth Southern Africa is due mainly due to "the poor economic growth in South Africa, which impacts the region."

AASA is hopeful that following the May-2019 election of a new government in South Africa "there will better growth within the region and within the domestic market itself".

HEAR MORE… AASA CEO Chris Zweigenthal discusses the outlook for Southern African carriers and the issues that have made it difficult for most of the region's airlines to achieve profitability, in this exclusive interview filmed on the sidelines of the IATA AGM in early Jun-2019.