Forecasts indicate seats from Brazil to western Europe will be markedly higher in early 2019, and some of that is driven by LATAM's introduction of flights from Brazil to Rome, Lisbon and Tel Aviv in 2018. LATAM is also introducing new flights from São Paulo to Munich in Jun-2019.

LATAM appears to be closing in on finalising JVs that it tabled with its fellow oneworld partners American and IAG in 2016. Chile's antitrust tribunal has approved the arrangements but the country's Supreme Court is hearing appeals to the decision. Even as those appeals move forward, LATAM appears to have a level of confidence that it can progress with its proposed immunised tie-ups.

GOL, LATAM and Azul all seem to have a reasonably positive view of Brazil's domestic market. As 2018 drew to a close, LATAM has characterised domestic demand as healthy. Most of the country's largest airlines have managed their capacity rationally and seats in the domestic market, while up slightly in 2018, remain below levels reached in 2012 and 2015.

A focus on the Brazilian market will be one the discussion topics at the forthcoming CAPA Latin America Aviation & LCCs Summit. CAPA - Centre for Aviation will examine the current dynamics in Brazil with valuable insight from both the airline and airport sectors.

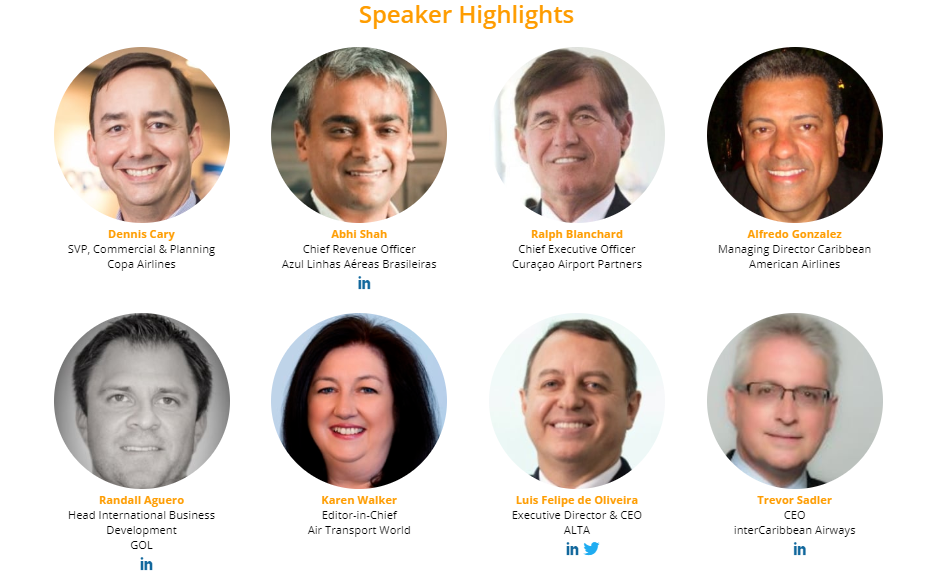

As the foremost authority on aviation in the world, CAPA - Centre for Aviation's events provide cutting edge knowledge about strategic market trends and dynamics to help attendees make informed decisions, delivering the information and connections needed to inspire and improve business. The CAPA Latin America Aviation & LCCs Summit will take place in Curaçao on 16-17 September 2019.

The Latin American aviation industry is undergoing some dynamic changes. Airport and airspace infrastructure is improving, and airline operating efficiencies are rising. Airport privatisation processes are well underway and the global alliances framework is well established. Open access arrangements are taking hold and regional economies are recovering, driving a buoyant travel demand picture.

But Latin American's full service airlines could be performing better, particularly in the mission to unlock top line revenue improvements. What are the strategies the region's airlines should be adopting, based on best practice from other regions and other sectors? Can they better leverage data, loyalty, distribution and ancillaries to produce better revenue outcomes and thereby drive improving profitability?

Meanwhile a crop of new low cost carriers continue full steam ahead, opening up exciting new markets in their efforts to stimulate traffic in the region. But like their full service counterparts, they too face their own hurdles, with infrastructure constraints, high costs and an underbanked population potential stumbling blocks to further growth.

The CAPA Latin America Aviation & LCCs Summit returns for a third year to explore the key strategic issues impacting the Latin American aviation sector, with Day 1 focusing on the regional aviation outlook and Day 2 dedicated specifically to issues affecting the region's LCCs. This event, hosted at the Santa Barbara Beach & Golf Resort Curaçao, is a must attend for those seeking to learn from, network and collaborate with today's travel industry leaders!

FIND OUT MORE… visit the CAPA Latin America Aviation & LCCs Summit homepage to find out more about this not-to-be-missed opportunity to discuss relevant issues impacting the aviation sector and learn meaningful insights from your industry peers.