Summary:

- KLM Cityhopper managing director Warner Rootliep says a regional airline can benefit from competition by LCCs on certain routes as they create "a lot of noise about the destination";

- A CAPA report shows that there is very little overlap in the number of routes that are operated by both regional airlines and LCCs within Europe;

- CAPA analysis shows for regional airlines, LCCs on average overlap on only 5% of routes. However, in the case of KLM cityhopper that level is 38%;

- Although it is more or less impossible for a regional airline to close the unit cost gap to the LCCs, KLM cityhopper is example that regional and LCCs can happily (and profitably?) co-exist in European markets.

With a focus on point-to-point markets, LCCs have certainly entered many routes previously served by the smaller regional operators. Their lower costs and larger aircraft have competed with greater frequencies and smaller aircraft from the regionals. In direct markets the regionals would have to sustain the necessary high yield demand that it can generate from its frequency and convenience driven business traveller.

But, rather than just fighting against the LCCs, KLM Cityhopper managing director Warner Rootliep has said that his airline can benefit from competition by LCCs on certain routes. He said that the presence of an LCC on a route "creates a lot of noise about the destination". The airline is a major player in the regional market, albeit is not independent and has the backing of flag carrier KLM Royal Dutch Airlines for whom it operates.

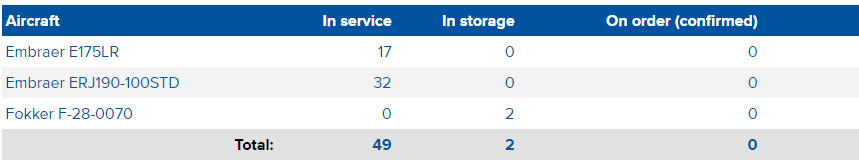

CHART - KLM cityhopper currently operates the largest fleet of Embraer E-Jets in Europe including the E175 and E190 variant Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

Traditionally regional airlines typically operate much shorter routes and face direct LCC competition on only a very low proportion of their routes, but KLM Cityhopper has a much bigger than average overlap with LCCs. The comments from Mr Rootliep make interesting reading and appears to suggest the Dutch carrier has devised ways to compete, or perhaps the fact it is feeding traffic into the hub of its parent at Amsterdam Schiphol, one of Europe's largest airports, could be providing a key lifeline.

A report by CAPA - Centre for Aviation dubbed 'Can LCCs and regional airlines co-exist? In Europe it seems so' adds some further weight on the subject. Its analysis of OAG data for the week of 13-Aug-2018 shows that there is very little overlap in the number of routes that are operated by both regional airlines and LCCs within Europe.

"For regional airlines, which operate close to 1,000 airport pairs between European destinations, LCCs overlap on only 5% of these routes. When analysed by city pair, regional airlines face LCC competition of approximately 8% of their intra-European routes," it says. "For LCCs, the overlap with regional airlines on intra-Europe represents less than 1% of their airport pairs and less than 2% of their city pairs."

This would suggest that the two sectors should be able to co-exist, especially as regional airlines tend to operate with much lower average trip lengths than airlines with other business models and therefore tend to face less direct competition from other airlines. In fact, their main competition generally comes from other forms of transport, and in particular from rail services (but also coach and private car).

But as highlighted earlier, KLM cityhopper is not your traditional regional carrier and although it does have its own Air Operator's Certificate it flies exclusively for KLM under its own 'KL' code. CAPA analysis discovers that as such it faces direct LCC competition on 26 routes from Amsterdam, or 38% of its network. That number increases to 29 routes when you consider indirect city competition.

CAPA says that KLM's focus on profitability (it consistently makes higher operating profit margins than its sister Air France) "probably means that Cityhopper makes a positive contribution to its result". This offers strong evidence that would seem to support Mr Rootliep's observations.

On the majority of the routes where KLM Cityhopper overlaps with LCCs (and across its network), CAPA notes that the destination attracts a significant element of business traffic, for whom frequencies are important. "This may help it to defend itself against LCC competition," it says, while it acknowledges its use of 88-seat E175s and 100-seat E190s means its average aircraft size is a third higher than the 72-seat average for all European regional airlines. In fact, the airline is considering bolstering its E190 capacity to 106 or 108 seats when its oldest aircraft shortly undergo heavy maintenance.

Although it is more or less impossible for a regional airline to close the unit cost gap to the LCCs, KLM cityhopper is an example that shows that market dynamics mixed with the right operational factors suggest that regional and LCCs can happily (and profitably?) co-exist in European markets.

READ MORE on regional and LCC operations in Europe: Can LCCs and regional airlines co-exist? In Europe it seems so. CAPA members have access to unrivalled industry analysis, a customised selection of up to 400+ News Briefs daily and access to comprehensive industry data, reports and company profiles. FIND OUT how a CAPA Membership can deliver all the information and connections you need to inspire and keep you ahead of the game.