CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 30-Nov-2020 sees global flight frequencies rising +0.1% with the addition of just 575 departures on last week. Total global weekly departures edge above 388,500, a third successive week-on-week growth, but still not enough to recover to the levels seen at the start of Nov-2020 and we end the month with less daily flights than we entered with, but only just.

The flat, stable performance is most welcome in a year that has seen such unpredictability. Most of the world sees rises in flight frequencies that offset the reductions of North America (-5.7%). In fact, without those declines it would have been a much more positive week with the Upper South America region (+9.3%) and the Southwest Pacific (+9.8%) recording close to double-digit growth and Southern Africa breaking that barrier (+14.1%).

South East Asia (+6.9%) sees just under 2,000 additional departure this week, while the Southwest Pacific region sees just over 1,000 more, mainly due to the continued growth of domestic flight activity in Australia.

Welcome news is that the significant weekly reductions that we have seen in Western Europe (+2.9%) have stopped with almost 900 additional flights scheduled for this week, albeit the reductions in Central and Eastern Europe (-3.5%) continue as approaching 400 flights are shaved from last week's level.

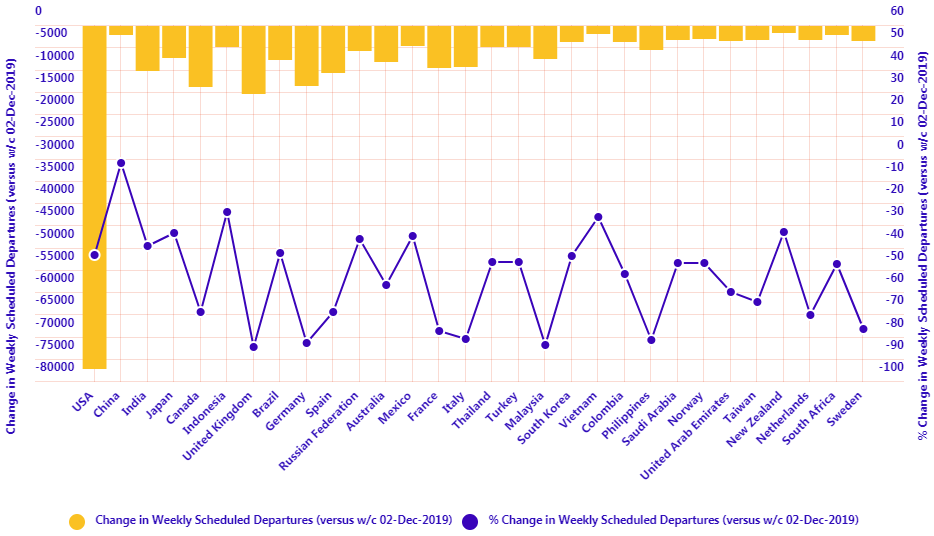

There is more notable movement at the country level with all but the North American representatives - United States of America (-5.9%) and Canada (-3.0%) - in the top ten seeing week-on-week growth. Australia sees flight frequencies rise by almost a fifth (+18.7%) and pushes it back into the world's top ten aviation markets by flight frequencies at the expense of Turkey (-2.8%). Brazil sees flight departures exceed 10,000 for the month (+5.2%) and moves above Russian Federation (+0.6%) to become the sixth largest market.

Western Europe's improved performance sees the return of flights among some of the major markets that have seen frequencies shrink in light of lockdowns, including Spain (+12.8%) and the United Kingdom, up almost a quarter (+23.8%) and the largest week-on-week rise among the world's top 30 markets by departures.

Looking further down the list and Myanmar sees departure double (+101.7%), while South Africa (+17.8%), Malaysia (+14.7%), Peru (+18.6%), Philippines (+37.1%), Argentina (+25.0%), Singapore (+29.8%), Israel (+13.0%), Vanuatu (+24.1%), El Salvador (+17.5%), Cuba (+16.2%) are among the small number of markets with double-digit week-on-week growth. Poland (-20.7%), Romania (-10.2%), Serbia (-11.9%) and Maldives (-23.4%) all see double-digit week-on-week declines.

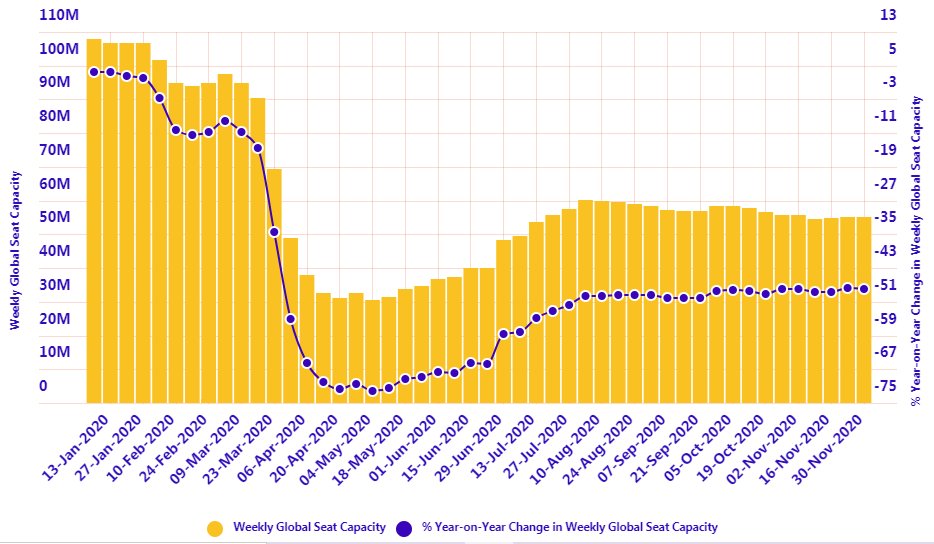

Last week we saw a strong performance on a year-on-year basis with capacity levels actually delivering the best year-on-year comparison since the end of Mar-2020 when global air travel was in freefall. Although we have seen flight levels rise +0.1% and capacity increase +0.2% this week the year-on-year performance has taken a slight turn for the worst. This week, flight frequencies are down -45.8%, a -0.6 percentage point decline on last week, while capacity levels are down -48.1%, a -0.4 fall on last week.

The week may have commenced in November, but we have now passed into December, a time to look back at the year behind us and look forward to the one ahead. We can obviously start to look forward to some positive year-on-year performance parameters, but still notably down on the 2019 levels, the benchmark for the foreseeable future.

There is renewed optimism though that we could see a surge of industry growth from the start of 2Q 2021 as we enter the new northern summer schedules. This will still be dominated by domestic and international leisure and VFR flows, but also the valuable return of business travellers. That is a positive outlook for the world's airlines and airports… but there is still a tough few months before we get there!