It's an understatement to say 2020 has been an incredibly challenging year. COVID-19 and the travel bans and lockdowns have decimated the once thriving corporate travel industry. Sobering data around the industry is emerging, particularly in what was formerly the world's largest corporate travel market, the US, where business travel remains down more than -80%. We anticipate leisure travel will continue to re-emerge, but it is likely that corporate travel will continue to flatline, outside some key sectors of the economy, until we are deep into vaccine penetration.

Encouragingly, as we emerge into the first full week of Nov-2020, we can report a rise in global flight frequencies. CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 02-Nov-2020 shows that global flight frequencies have increased +0.5% with gain of just over 1,800 departures on last week. A positive step, but not enough to offset the -1.6% decline the previous week when nearly 6,500 departures were lost from the schedules.

Total global weekly departures increase from just under 389,000 back above 390,000, an improvement but still the second lowest weekly level since the week of 13-Jul-2020. This brings the loss of flight frequencies since the peak of the recovery in the week commencing 17-Aug-2020 back below 25,000 to just over 23,000, a -5.6% reduction.

This week's data highlights the geographical differences in the world more than any other previously. North America sees the addition of over 5,000 weekly flights (+5.2%), while Western Europe, where new country-wide lockdowns are being introduced, has seen a similar loss (-10.9%). Latin America continues its rise with departures in Upper South America and Lower South America up +24.4% and +15.5% week-on-week, respectively.

The Middle East has also seen weekly departures rise back above 10,000 with a +5.2% growth, while Southern Africa (+15.9%) and Central America (+7.8%) have seen notable week-on-week percentage rises. Western Europe leads the declines, but South Asia also sees the loss of over 1,500 weekly departures, a -8.0% decline on last week.

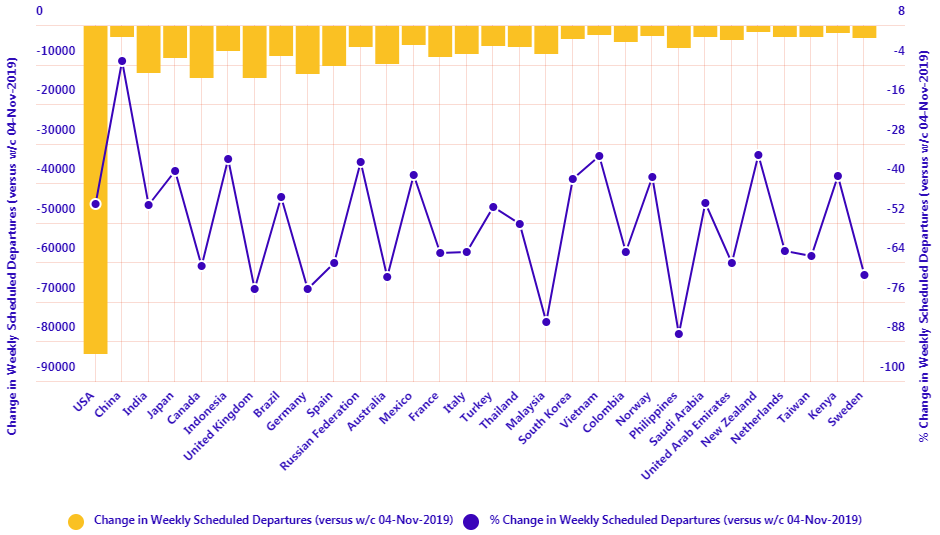

North America's weekly growth is mainly due to the 5,000+ additional frequencies in the United States of America (USA) week-on-week, a +5.5% rise, while the Latin economies of Brazil and Mexico both deliver double-digit rises - +13.6% and +10.2%, respectively. India's rise of recent weeks appears artificial as a -10.4% week-on-week decline in departures sees Japan rise back above it to be the world's third largest aviation economy currently by scheduled passenger flights.

Growing COVID-19 infections in Western Europe are already influencing schedules in the United Kingdom (-18.1%), France (-15.9%) and Germany (-17.8%) and reductions in departures in these countries will likely continue through Nov-2020 as airlines readjust schedules to meet further depressed demand.

On a brighter note, Saudi Arabia (+16.7%), the continued strong return of flights in Colombia (+33.1%), South Africa (+21.9%), Bolivia (+15.4%), Bangladesh (+12.2%) and Peru (+13.8%) are among the strongest performers among the world's top 50 current aviation economies. Meanwhile, the opening of air connectivity in Argentina sees a near doubling of flights compared to last week (+98.9%).

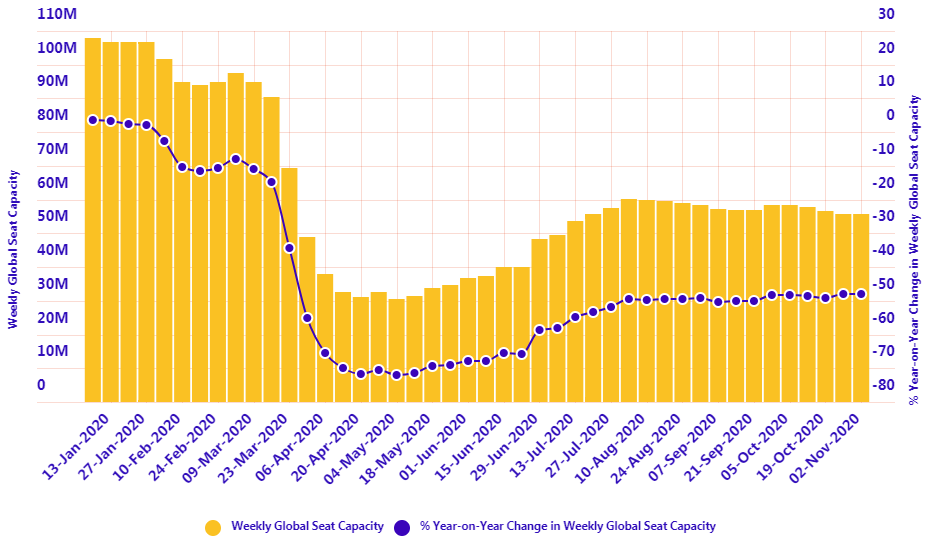

Last week's declines of -1.6% and -1.8% in flight frequencies and seat capacity, respectively actually showed a positive movement in year-on-year comparison and suggested seasonality rather than COVID-fuelled demand reductions are the reason for the movement.

In fact the year-on-year seat capacity performance was the strongest since the last week of the previous 2019/2020 northern winter schedule back in the week commencing 23-Mar-2020 when the global air transport industry was in freefall.

This week that situation has strengthened slightly. Flight frequencies are down -45.8% year-on-year, the same as last week, while capacity levels are down less than -48.0% at -47.99%, a +0.1 percentage point improvement on last week and the new best year-on-year comparison of the recovery.

The performance this week shows some positive signs, but for corporate travel the scale of the problem remains huge as industry experts suggest business travel will not recover until 2025 given the volatility of the coronavirus pandemic and the reaction of the global economy. It's a dire prognosis to say the very least!