CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 07-Dec-2020 sees global flight frequencies slipping -0.6% with the loss of approaching 2,300 departures when compared to last week. Total global weekly departures fall above 386,500, a return to reductions after three successive weeks of growth, albeit at nominal levels.

Almost all of the world sees rises in flight frequencies, but that is not enough to offset the reductions of North America (-5.2%) - an improvement on the -5.7% recorded last week, but still a loss of over 5,500 weekly departures - and North East Asia. The latter's small -0.9% decline still equates to over 1,000 weekly departures removed since last week. Eastern Africa is the only other region to see a week-on-week reduction in flights, slipping -1.4% and the loss of just over 100 frequencies.

The resumption of activity in North Africa means it leads the positives this week with flight levels increasing by a quarter, up +25.3%, while Southern Africa (+9.9%) and the Southwest Pacific (+9.4%) are regions seeing close to double-digit week-on-week departure gains, a second week of strong performance. Across most other regions levels are more stable (between +0% and +2%).

After a tough Nov-2020 influenced by lockdowns to combat second waves of COVID-19 infections, Europe is starting to see a rise in flight levels. Western European levels are up +3.0% week-on-week and Central and Eastern Europe levels rise +2.4% together adding 1,200 departures versus the previous week. While positive these levels are still well down on what was seen at the start of Nov-2020 before widespread restrictions were introduced.

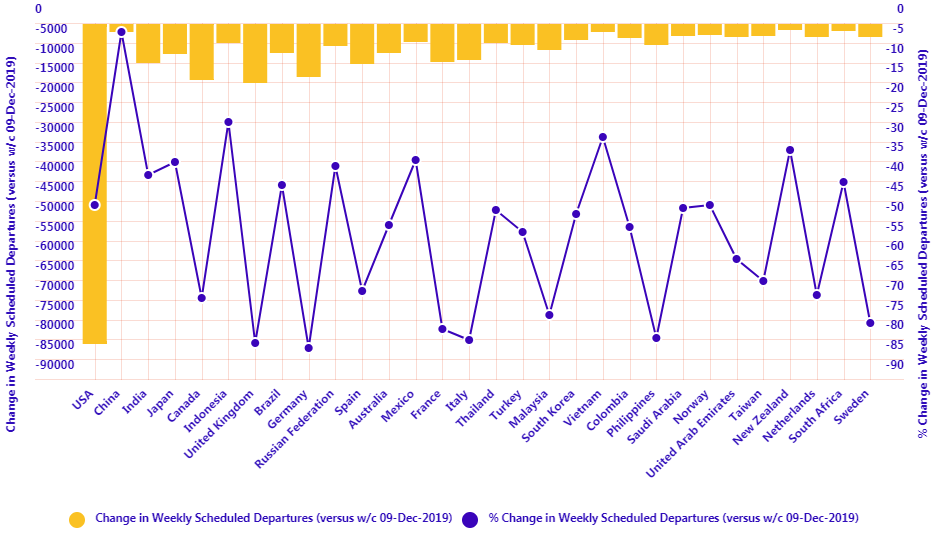

At a country level there are some quite strong shifts in flight levels, with four of the five largest markets seeing reductions week-on-week, dominated by the United States where a -5.7% reduction translates into the loss of over 5,700 departures and sees weekly levels once again fall below 100,000 to now sit just above 95,000. The decline is shallow enough for it to remain above China where weekly departure levels sit around 89,500 after a -0.2% drop. Indonesia also sees a shallow regress (-0.6%) and Japan a -3.0% decline with India the only of the top five markets to deliver week-on-week frequency growth with a +1.2% rise.

The bottom half of the top ten sees a more positive aspect with four of the five markets seeing growth week-on-week. This is dominated by Australia - after last week +18.7% rise elevated it back into the world's top ten aviation markets by flight frequencies, a +15.2% rise this week sees it leapfrog Canada into ninth position.

The switch from a country-wide lockdown across England into a tiered restriction model has allowed the resumption of many flights from the United Kingdom and sees levels grow by more than a quarter versus last week (+28.9%), boosting the country from outside the top 20 markets to 16th position. But, even its strong growth was exceeded by Malaysia where departure levels were up by almost two thirds this week (+61.9%).

Looking further down the list and the resumption of domestic air services in Algeria - albeit still limited - helps deliver a +3630.8% increase versus last week and is the main reason for North Africa's strong performance this week. Meanwhile, after Myanmar saw departures double last week (+101.7%), a more than 50% reduction follows this week (-53.8%).

South Africa (+13.7%), Philippines (+12.5%), Dominican Republic (+15.1%), Poland (+11.1%), Romania (+15.5%), Honduras (+17.0%), Greenland (+15.3%), Bulgaria (+16.5%) and Haiti (+10.0%) are among the small number of markets with double-digit week-on-week growth. Turkey (-12.5%), Ethiopia (-13.9%), Argentina (-18.2%) and Vanuatu (-10.0%) all see double-digit week-on-week declines.

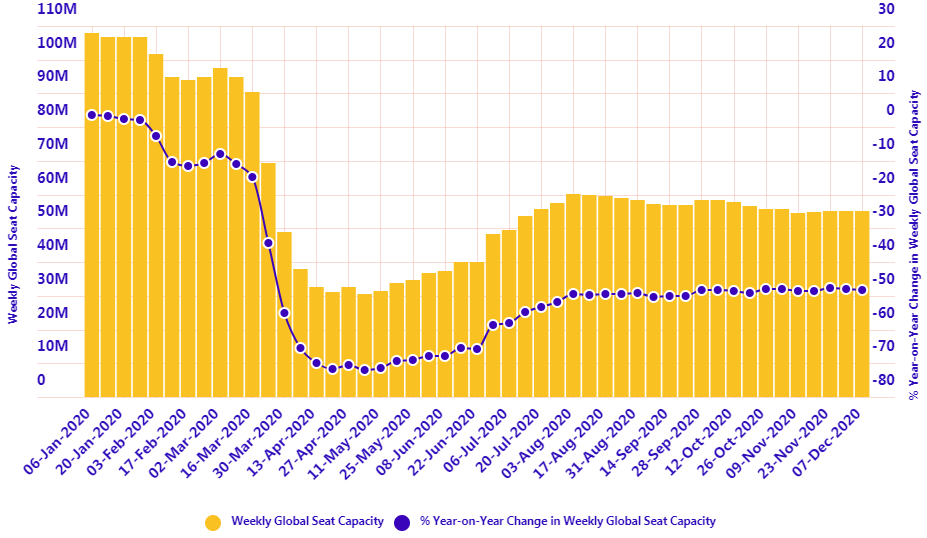

This week's -0.6% reduction in flights and -0.3% reduction in capacity means year-on-year performance takes another turn for the worst. This week, flight frequencies are down -46.1%, a -0.3 percentage point decline on last week, while capacity levels are down -48.4%, also -0.3 fall on last week.

What is predicted to be a tough cold winter shows little sign of thawing, but we are still seeing a renewed optimism from airlines that we could see a genuine rise in activity from the start of 2Q 2021 as we enter the new northern summer schedules. As we have highlighted previously, the question remains who can hold their breath that long as despite major restructuring airlines continue to bleed heavily over what has always been a tough season for the industry. Things could still get worse before they get better!