There are some encouraging sounds coming from airlines, hotels and even destinations that demand is following capacity and business travel is also beginning to wake from its long slumber thanks to the return of flights and some improved travel sentiment. The removal of travel restrictions in some markets may still be in its infancy, but a worsening environment across Europe and new transmission in New Zealand has shown how swiftly those barriers can be reimposed.

How this will all impact the recovery of air transport remains to be seen. What is clear is that we have reached a key point. The Blue Swan Daily analysis of OAG schedule data for the week commencing 10-Aug-2020 shows that global flight frequencies have slipped just below the 413,500 figure recorded last week.

After week-on-week growth across seven successive weeks and in 12 of the past 13 weeks, global flight frequencies are down for the current week. OK, that reduction may be less than -0.1% - a mere 150 flight frequencies - and complemented by a capacity decline of less than half one per cent (-0.4%), the stalling of growth in a peak August travel week grabs attention.

We were here before back in the middle of June when the recovery previously stalled and flight frequencies dropped, again by less than -0.1%. That week was followed by a significant growth, a +17.2% rise, the only week-on-week rise in double-digits, but confidence that something similar will happen again next week is not so high.

Right now flight levels are projected to be higher next week, but that +3.5% increase according to the OAG schedules to almost 428,000 flights will not get any higher as we continue to see notable churn and short-notice cancellations that will influence the actual levels.

The question will be how much it will reduce? The past two weeks that level of churn has been -6.3% and -3.0%. While we may not hit negative growth for a second successive week, it will certainly show a flattening of the recovery curve, which admittedly hasn't actually had the highest gradient.

The recovery continues among the world's largest aviation markets with seven of the ten largest economies seeing a week-on-week rise in flight frequencies, the United Kingdom leading the rates at +4.0%. That level is diluted when you consider the top 20 aviation economies to just over half recording growth (12).

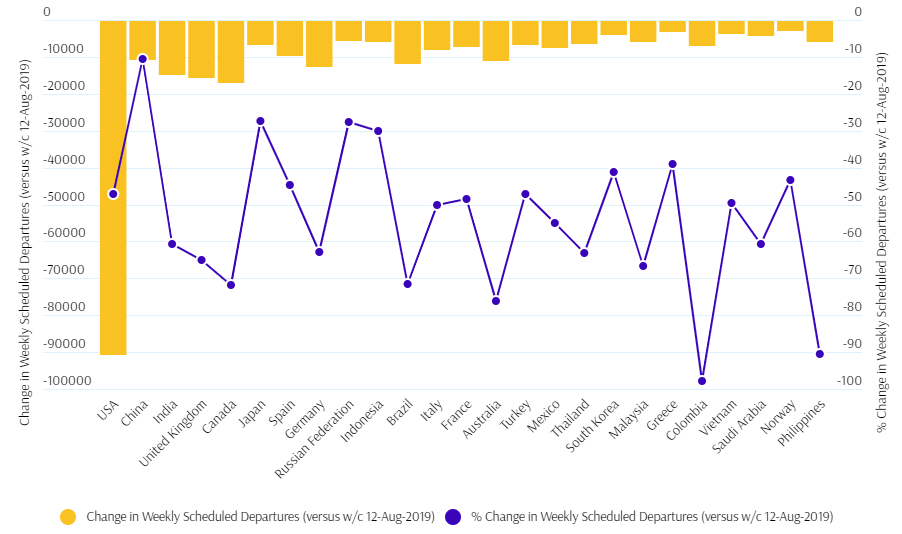

CHART - The reduction in the number of weekly flight departures from each of the 25 largest aviation markets in the world has stalled this week and still remains a long way down on levels seen last year Source: The Blue Swan Daily and OAG (data: 10-Aug-2020)

Source: The Blue Swan Daily and OAG (data: 10-Aug-2020)

Vietnam, which has been heralded in previous weeks for its fast recovery and an actual rise in year-on-year domestic performance, again shows a significant reduction in weekly flights due to rising infections in the country. Flight levels were again down more than a quarter at -25.2% following a -29.0% fall last week and a second week with a loss of more than 1,000 departures. From flight levels being down less than -10% in July they are now down almost half (-49.7%) just a month later.

Among the world's current top 25 aviation economies - based on weekly frequencies - Kenya sees the largest percentage rise with flights up +42.6% on last week. Outside of the major markets Morocco (+61.0%) and Nigeria (+45.1%) reported the largest rise in weekly flights.

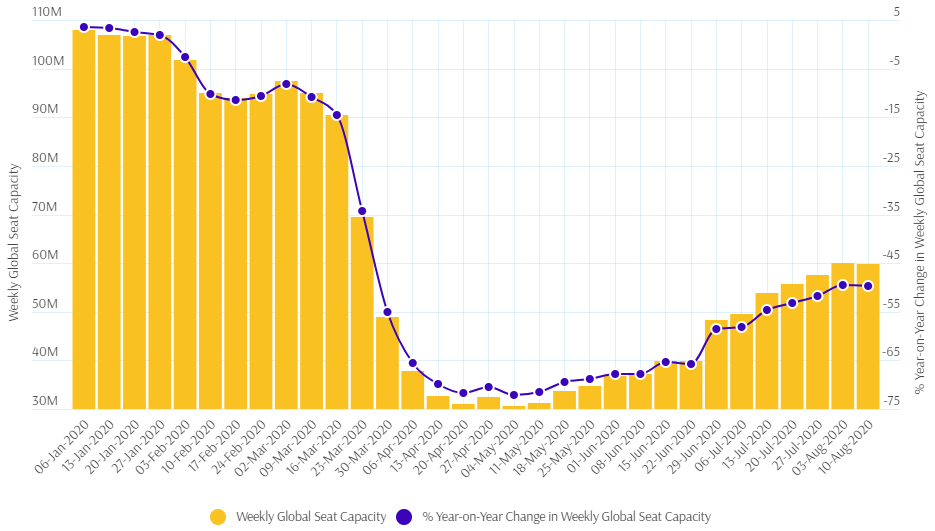

CHART - Global air capacity has collapsed as the Covid-19 pandemic has spread across the world and after an initial stabilisation stage we had until this week seen continued steps of recovery Source: The Blue Swan Daily and OAG (data: 10-Aug-2020)

Source: The Blue Swan Daily and OAG (data: 10-Aug-2020)

On a global level, despite the reductions in both flights and capacity, our comparison of this week's schedules with the comparable week last year (week commencing 12-Aug-2019), shows global flight frequencies and seat capacity still sit the right side of the half way mark, albeit capacity has once again slipped below the 60 million weekly seat threshold. Flight frequencies remain down -47.9%, as per last week, while global seat capacity levels are down -49.7%, a 0.2 percentage point decline on last week.

The handbrake has certainly been pulled, but will this week's decline in both frequencies and capacity translate into a bigger issue? This could just be an anomaly as was the case in June, it could represent a plateauing of the recovery as we hit what is a sustainable level of air service for the current circumstances, or worst of all it could mark the start of a new trend, a worryingly negative growth trend!