As CAPA - Centre for Aviation founder and chairman and emeritus Peter Harbison highlighted during the recent inaugural CAPA Live - a new monthly virtual summit offering insights, information, data and live interviews across a next-gen virtual event platform - it has become a case of how long the industry's actors can hold their breath and if that is long enough to survive the crisis.

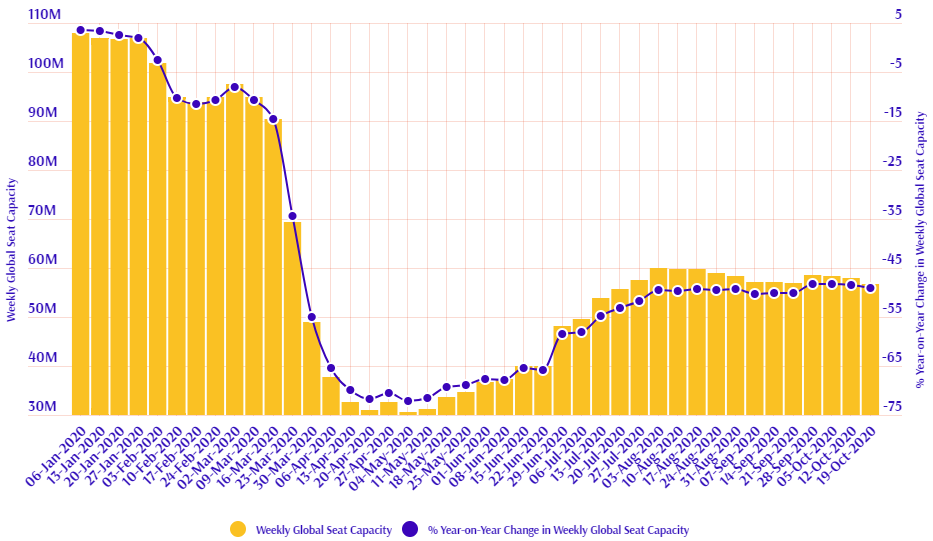

The latest week's flight schedules highlights the problem. We want to be optimistic, but sometimes the data does not allow us to be. In the case of the week commencing 19-Oct-2020 and as we reach the conclusion of the northern hemisphere summer schedules, we witness a reduction in flight frequencies to levels that take us back 13 weeks to levels last seen in mid-July and a percentage week-on-week decline at a rate not seen since the week commencing 04-May-2020 when the industry hit its pandemic floor.

Corporate Travel Community (CTC) analysis of OAG schedule data for the week commencing 19-Oct-2020 shows that global flight frequencies have declined -2.0% with the loss of over 8,000 departures than the previous week. Total global weekly departures slip from nearing 403,750 to just under 395,500, there lowest weekly level since the week of 20-Jul-2020.

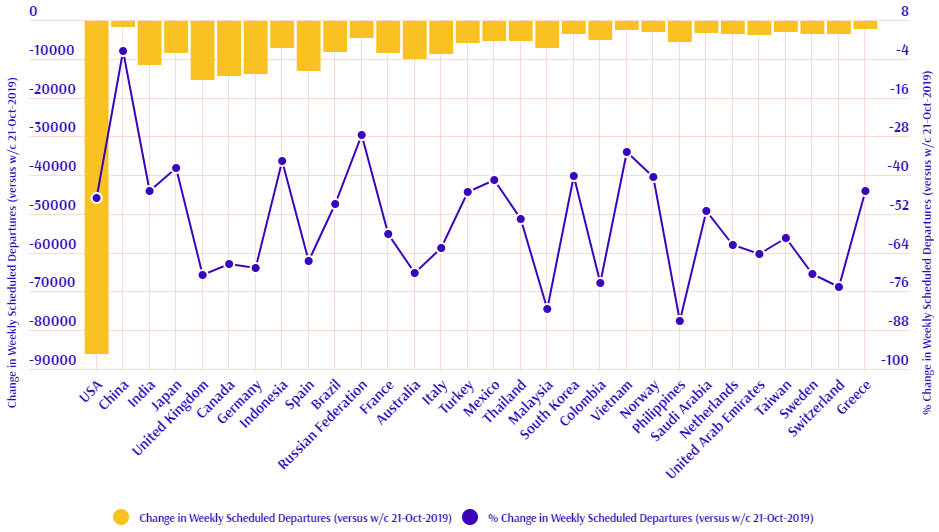

It is a story of declines across most of the world versus last week, but not all of it. The falls are dominated by the leading economies of North East Asia (-2.0%), North America (-2.0%) and Western Europe (-4.4%) where more than 2000 weekly flights have been cut out of each region's schedules. Central and Eastern Europe (-6.9%) also sees flight levels decrease by more than 1,000 and the largest week-on-week percentage decline.

But, it is not all negative. South Asia sees frequencies rise +3.9%, while more modest increases are also recorded in the Southwest Pacific (+1.7%), Central and Western Africa (+1.6%), Southern Africa (+0.4%) and the Middle East (+0.4%).

Without a notable growth in air connectivity in India this week's performance would have been much worse. The country has edged ahead of Japan to be the world's third largest aviation market by flight departures with a +8.8% rise week-on-week. It is the only country among the ten largest aviation markets to see a rise this week and one of just two among the top 15 - the other is France with a +0.3% rise.

India's weekly performance is only bettered by Ethiopia (+10.1%), the Philippines (+13.0%) and Nigeria (+12.8%) among the world's top 50 aviation markets by departures, while Peru (+10.3%), Panama (+17.8%), Oman (+21.5%), Jordan (+22.1%), Bahrain (+36.9%) were among the few others to record double-digit week-on-week rises in departures.

While not hitting the same scale of growth there are a number of major Asian and Pacific markets showcasing flight frequency growth this week, including South Korea (+2.2%), Thailand (+2.8%), Vietnam (+5.8%), Australia (+1.5%) and New Zealand (+2.2%).

But it is the declines that dominate this week with the Russian Federation (-4.0%) and Canada (-4.0%) seeing the largest week-on-week declines among the top ten aviation markets. The leading Western European, with the exception of France, all see notable reductions led by Spain (-7.2%) and a move that sees it replaced by Turkey in the top ten, United Kingdom (-6.1%), Italy (-6.2%) and Greece (-7.4%).

Elsewhere, Argentina has seen levels cut in half (-57.9%) and Malaysia has seen flight levels reduce by almost a third (-30.1%) versus last week, while Switzerland (-11.8%), Ukraine (-10.6%), Nepal (-11.5%), Israel (-15.4%), Iraq (-13.0%), Croatia (-11.5%), Czech Republic (-16.1%) and Hungary (-29.1%) are among those recording double-digit week-on-week declines.

Last week's -0.5% and -0.8% declines in flight frequencies and seat capacity, respectively, translated into modest declines in year-on-year levels. This week's larger -2.0% and -2.1% declines have had a more notable impact on year-on-year performance. Flight frequencies are down -47.0% year-on-year, a -0.4 percentage point fall on last week, while capacity levels are down -49.1%, a -0.6 percentage point decline on last week.

As the COVID storm shows no signs of tiring and continues to envelop the travel and tourism industry, the question is how long can airlines hold their breath and will it be long enough to lift them back above the waterline when we finally emerge into better times.