Just like any rollercoaster ride there will be ups and downs. Most have survived the initial big drop, but there is a lot of track ahead and most remains hidden around a blind corner. Right now we are journeying along at a level with the shallowest negative gradient, but what is ahead is out of focus, but will likely include some climbs as governments start to put in place new international travel initiatives, but equally some falls as the novel coronavirus continues to remain a threat across the world.

Corporate Travel Community (CTC) analysis of OAG schedule data for the week commencing 14-Sep-2020 shows that global flight frequencies have again reduced, although the rate is significantly slower than last week with just over 1,500 less departures. This is a decline of less than half of one per cent (-0.4%) but notably takes weekly departures below the 400,000 figure to just over 398,500.

It is the large aviation economies that again head the weekly declines with Western Europe losing almost a further 2,900 departures this week, adding to the 2,750 last week. North America's loss this week is much less than the over 4,800 weekly flights removed last week, but the over 1,500 frequency reduction is significant. The Middle East has the largest week-on-week percentage decline, down -7.4%, while Central America (-3.8%), Eastern and Central Europe (-1.8%) and Eastern Africa (-0.9%) also have week-on-week reductions.

The rest of the world's aviation systems are actually in growth this week, Upper South America rising +13.2%, albeit from a very low base, while South Asia also has a double-digit rise, up +10.2% and the addition of almost 1,500 additional departures week-on-week. In fact this was only exceeded by North East Asia in terms of volume, albeit its growth translated into only a +1.3% rise due to its larger scale and more advanced position in the recovery timescale.

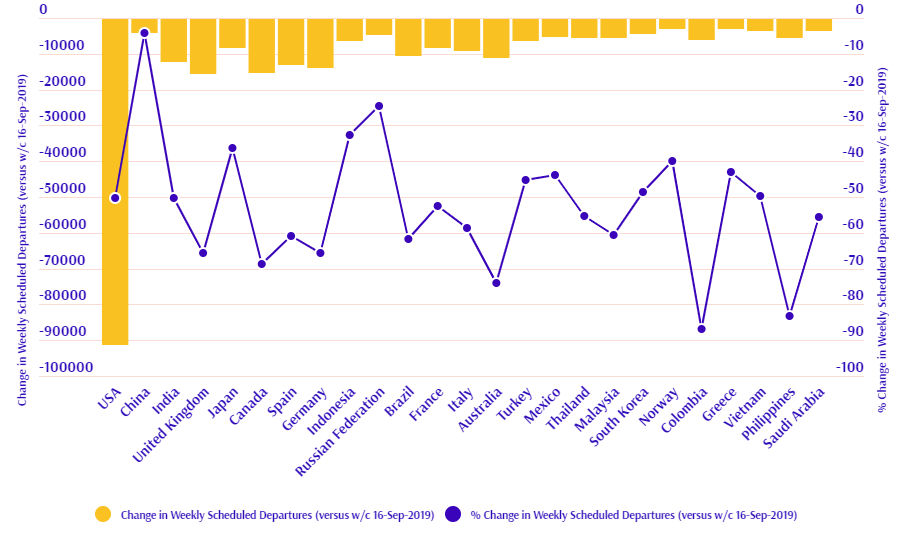

CHART - The reduction in the number of weekly flight departures from each of the 25 largest aviation markets in the world has stalled over recent weeks and still remains a long way down on levels seen last yearSource: Corporate Travel Community (CTC) and OAG (data: 14-Sep-2020)

The decline in North American frequencies has been driven by reductions in the US market (-1.8%), and with China seeing growth (+0.8%), it has once again overtaken the US as the world's largest aviation market by departures, a prize it holds alongside the title of world number one by capacity.

There is an almost equal split of those growing and those declining among the 25 largest aviation markets. Vietnam sees the largest week-on-week growth as it again quickly sees the return of flights which this week delivers a +22.7% rise in departures. India is the only other country with double-digit growth among these nations, +14.2%. Spain has the largest reduction in flights among this group, -11.8%, and which coincides with rising Covid-19 infection rates.

Looking further down at smaller aviation markets, Algeria sees a near doubling in weekly flights (+93.8%), while the Latin markets of Colombia (+14.0), Peru (+53.6), Chile (+14.1%) and Argentina (+23.3%) are climbing from their low base levels. Additionally, South Africa (+10.6%) and Nigeria (+15.0%) are among the countries to record at least double-digit week-on-week rises in flights. Other standout performers are Myanmar where flight levels are down a third (-34.3%) and United Arab Emirates, where they are down by a fifth (-20.3%).

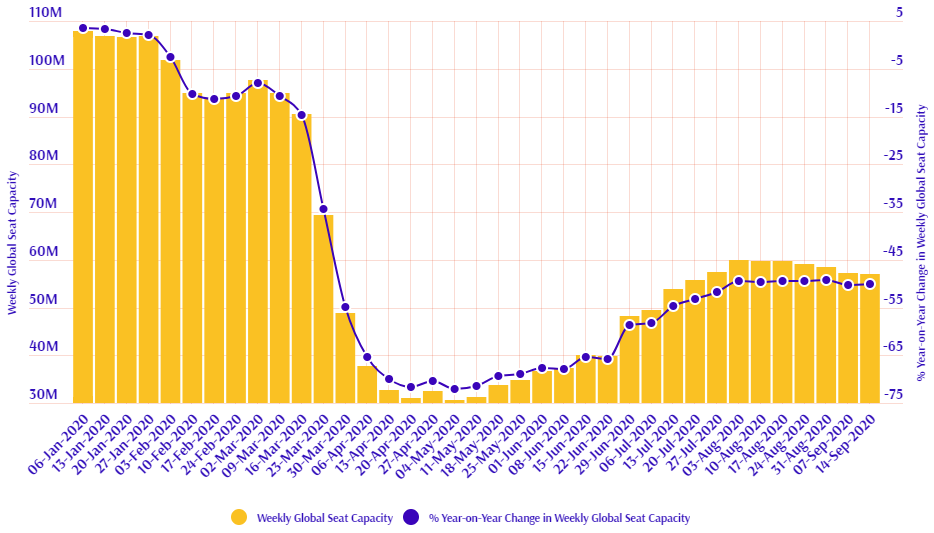

CHART - Global air capacity collapsed as the Covid-19 pandemic spread across the world. After an initial stabilisation stage we had until this month seen continued steps of recovery, but now a plateauing and even a continued slip in capacity is becoming more evidentSource: Corporate Travel Community (CTC) and OAG (data: 14-Sep-2020)

The -0.4% decline in flight frequencies for the week translates into a nominal -0.1% reduction in capacity, again taking it below the levels seen in the week commencing 27-Jul-2020 and a sixth consecutive week-on-week decline. If we see even half this level of reduction next week it will take weekly capacity below 57 million again. The 60 million seat milestone achieved in the week commencing 03-Aug-2020 is now looking like an increasing peak as we continue the slow descent.

In recent weeks seasonality had played a key role in reductions and year-on-year performance had been fairly positive and neutral at worst. That is again the case this week. Flight frequencies remain down -47.9%, the same as last week, while capacity levels are down -50.1%, a 0.1 percentage point improvement on last week. Notably, they remain below the -50% figure for a second successive week.

Just like any good rollercoaster, you never know what is coming next, but at least you can easily identify when there is a climb approaching. Unfortunately, the same cannot be said should you be approaching another steep drop.

Right now, with government support underwriting many airlines, the sharp edges of the pandemic impact have not yet cut deep. Once the safety of that seat restraint is removed, the process of merely borrowing to reduce cash losses will quickly need to be replaced by genuine profitability, and probably higher fares. But what price will we ultimately pay for achieving that?