Summary:

- Investment Corporation of Dubai (ICD) has taken a 25% stake in Corporación América's Tuscany airports, a deal that represents Dubai's return to the airport investment fraternity;

- Jointly the two organisations will seek to expand in Italy, Eastern Europe and the Middle East and add to Corporación América's eclectic 52 airport portfolio;

- ICD joins local rivals Abu Dhabi Investment Authority, and Qatar Investment Authority as major airport investors;

- Those investments remind us that sovereign wealth funds typically seek out big prestigious ones.... suggesting these could still be early days for ICD.

Corporación América Airports claims to be the largest private sector airport operator in the world by number of airports, and the tenth largest in terms of passenger traffic. It operates 52 airports in seven countries across Latin America and Europe and in 2017 it hosted 76.6 million passengers.

Originally a textile company, Corporación América has spread outwards from its Argentina base to embrace airports in Brazil (Natal, São Gonçalo do Amirante and Brasilia), Uruguay (Montevideo), and Ecuador (Guayaquil), and is one of the world's most eclectic operators with smaller airports including Galapagos Islands Seymour Airport and Marina di Campo, on the Island of Elba, where Napoléon Bonaparte was exiled.

Corporación América held an IPO on the New York Stock Exchange on 01-Feb-2018. Since then it has acquired an additional 11% stake in Toscana Aeroporti, increasing its stake to approximately 62%. Toscana Aeroporti was born in 2015 for the purpose of managing the Florence and Pisa airports. It was created from the fusion of Aeroporto di Firenze (ADF), the concessionaire of the Florence Airport, and Società Aeroporto Toscano (SAT), the concessionaire of the Pisa Airport.

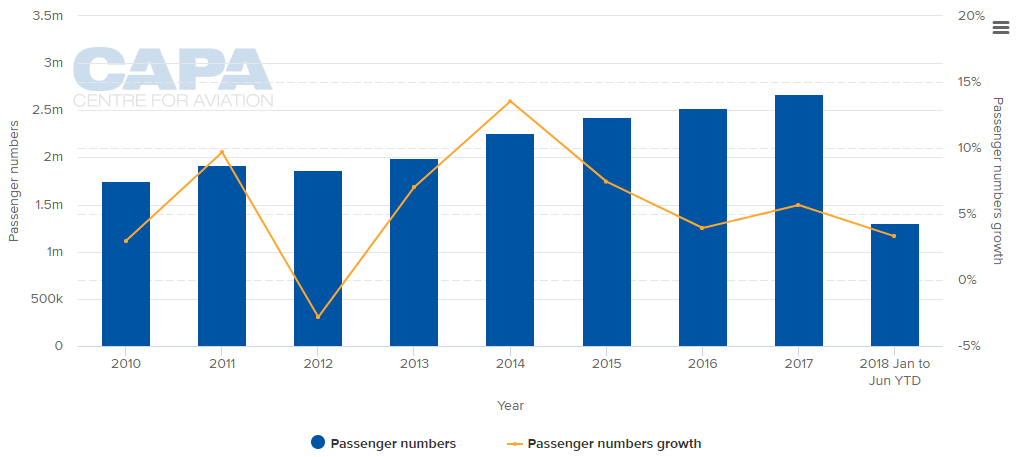

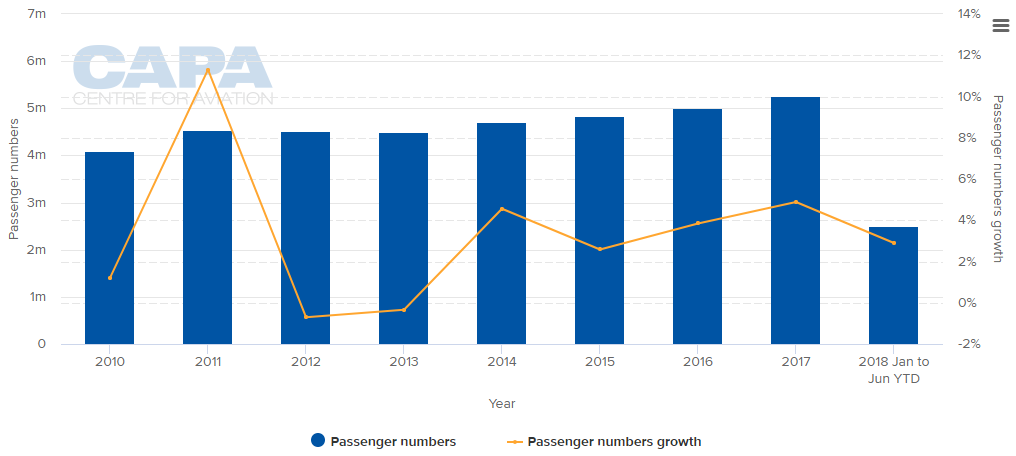

CHARTS - Both Florence Peretola (top) and Pisa Galileo Galilei (bottom) airports have shown if not dynamic growth over the past five years

Source: CAPA - Centre for Aviation and Assaeroporti

Source: CAPA - Centre for Aviation and Assaeroporti

And it is essentially these airports - which make up Corporación América Italia (CAI) - to which Investment Corporation of Dubai (ICD) has been attracted, at least in the first instance. In the first agreement, ICD opted to acquire a 25% share of CAI, leaving Corporación América with 75%. The deal is expected to conclude by 31-Aug-2018, subject to terms and conditions.

Additionally, ICD signed an agreement with the main organisation, Corporación América Airports, to explore new airport opportunities in the Middle East, Eastern Europe (but not Russia) and Italy. These are not the regions that Corporación América declared itself to be interested in, in its most recent statement on the matter in Mar-2018, rather Brazil and India.

Moreover, as part of the statement on the ICD investment in the Italian division, the company stressed it would maintain its focus on delivering on its growth strategy in other key markets, primarily Argentina and Brazil, also Jamaica where it is participating in the concession process at Kingston's Norman Manley Airport.

This suggests that operational responsibilities might even be split in future, with the main company focused on Latin America while the Italian operation takes responsibility for other opportunities in Italy, also Eastern Europe where Sofia Airport for example is to be concessioned, and the Middle East.

Where the latter is concerned, further opportunities could arise in Saudi Arabia (concessions), or P3 projects to (build and) operate terminals elsewhere in the region, such as the example in Kuwait.

For its part, Investment Corporation of Dubai fills a gap which Dubai Aerospace Enterprise/DAE Airports was supposed to in airport investment and management activities from 2006 but it exited the sector instead. Other sovereign wealth funds from the region have been active though, notably the Abu Dhabi Investment Authority, which is an investor in London Gatwick Airport (15.9%) and the Qatar Investment Authority, which has a minority stake at London Heathrow (20%).

Those investments remind us that sovereign wealth funds typically seek out big prestigious ones.... suggesting these could still be early days for ICD.