Many retailers have already embraced new digital solutions for payments and some had already removed cash from the payment menu entirely. COVID-19 has certainly accelerated this trend as consumers have move away from using cash in fear over potential virus transmission.

The World Health Organisation even acknowledged in the early stages of the pandemic that banknotes may be spreading the new coronavirus and that people should try to use contactless payments instead. But, cash is still seen as an easy solution and one that provides anonymity of payments and is why the transition to a cashless society remains a complex journey.

There challenges can - and will - be overcome with measures such as offline digital wallets and smartcards examples. The technology needed to go cashless is already available - it now needs to be seamlessly integrated into everyday life before it is more widely accepted as the new normal.

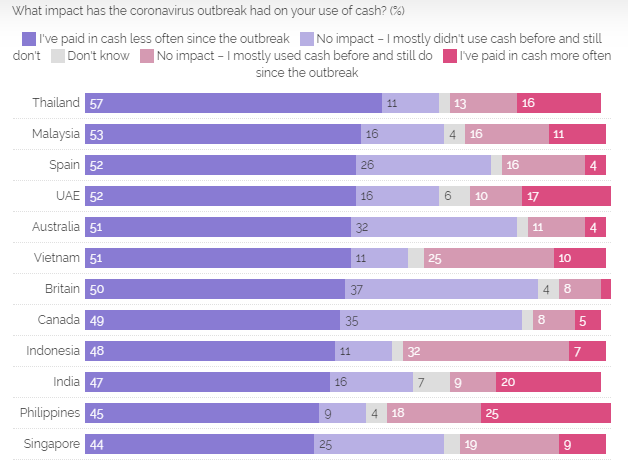

A recently published YouGov survey from Jun-2020 and Jul-2020 of nearly 26,000 people across 21 countries and regions found that at least half of respondents in a third of the locations have been using cash less often because of the COVID-19 pandemic. These include Thailand (57%), Malaysia (53%), Spain (52%), United Arab Emirates (52%), Australia (50%), Vietnam (51%) and Great Britain (50%).

But that isn't necessarily the case everywhere. In the United States just one-quarter (25%) of Americans say they've been using cash less often during the pandemic, while almost twice as many (46%) say they mostly didn't use cash before the pandemic and still don't. Just under one in ten (8%) of US adults have actually been using cash more often during the pandemic.

Only Sweden among the country markets surveyed saw a smaller percentage who said they've been using cash less often during the pandemic, at just 11%. Like the United States this was due to there already having been a move away from cash payments with three quarters (75%) saying they didn't use cash before and still don't, the largest proportion among the countries analysed.

Looking in more detail at American trends and the data from this study suggests that Americans tend to use cash only for small purchases. About three in five (62%) say they use cash for "very cheap" purchases (like a pack of chewing gum), but fewer than half use cash for purchases that are more expensive than this. By 52% to 41%, Americans are more likely to use electronic payments for "somewhat cheap" purchases, like buying lunch. Similarly, fewer than one in five use cash for "somewhat expensive" (18%) or "very expensive" (12%) purchases, according to the YouGov findings.

This logical trend of using cash for cheap purchases and electronic payments for more expensive ones is largely reflected in most of the other places surveyed, save for China. About three-quarters (76%) of respondents in China say they use electronic payments even for very inexpensive buys.

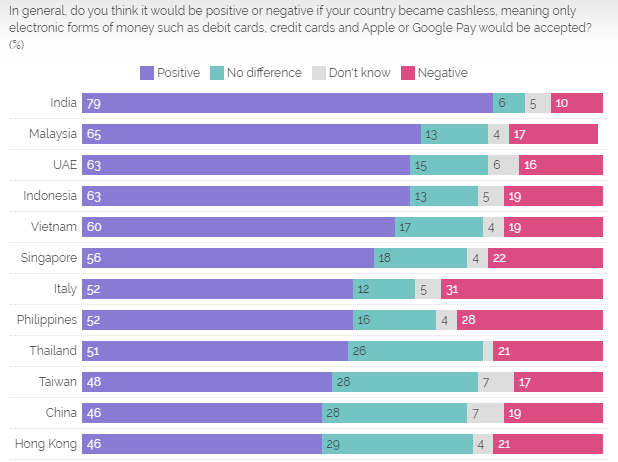

But although Americans appear to not be using cash as much as they use electronic payments, they aren't particularly interested in the idea of a cashless society. While a quarter (24%) think it would be a positive development if the US became a cashless economy, about twice as many (50%) would see this as a negative shift. This is a view shared by more than half the survey respondents in Canada (50%), Germany (50%), Sweden (50%), France (52%) and most heavily in Spain (53%).

However, there are others that clearly believe that a cashless economy would be a positive movement. More than half the respondents in Thailand (51%), Philippines (52%), Italy (52%), Singapore (56%), Vietnam (60%), Indonesia (63%), United Arab Emirates (53%) and Malaysia (65%) see that as the case, while in India that level was over three-quarters (79%).