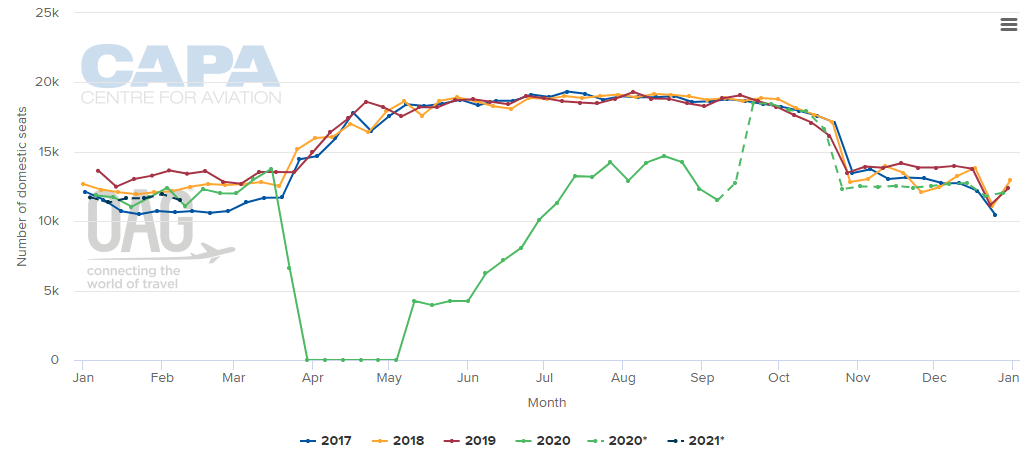

Croatia is one of Europe's most seasonally skewed markets and highlights the strong dependence of its aviation market on summer leisure routes, with only low demand during the winter season. This sees activity peak in July and August, with June and September acting as shoulder months. While this year has seen levels implicated by Covid-19 related issues that trend has continued, albeit at a much lower level than seen in recent years.

The short season is being compounded in 2020 by an increasing level of Covid-19 infections in the country and travel restrictions are once again being introduced on travellers to and from Croatia. Our knowledge of this pandemic shows that travellers react to the fast-changing travel restrictions.

Latest data from Sojern illustrates this has especially been the case in Croatia with an instantaneous impact on travel intent and confidence. Searches and bookings have decreased to -34% and -53% respectively, according to the digital marketing solutions provider.

These volumes reflect a significant negative impact on year-on-year volumes from the previous week - pre-announcement. This is a potential reflection of how volatile each market is, how quickly traveller's plans are changing, but also influenced somewhat by the market under consideration.

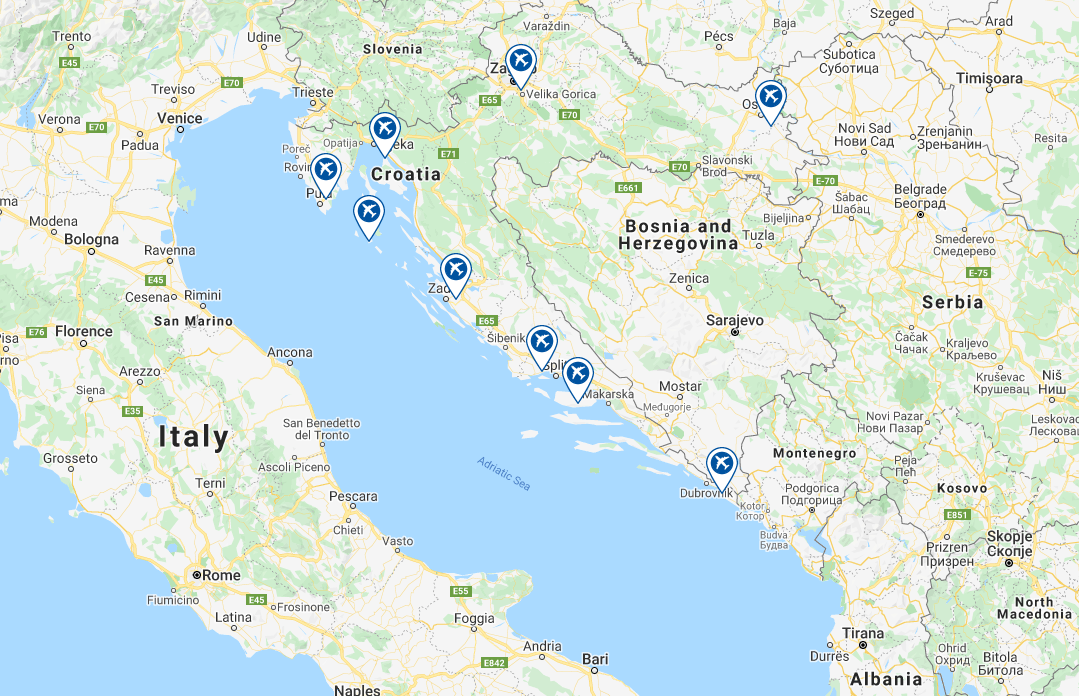

AIRPORTS IN THE COUNTRY

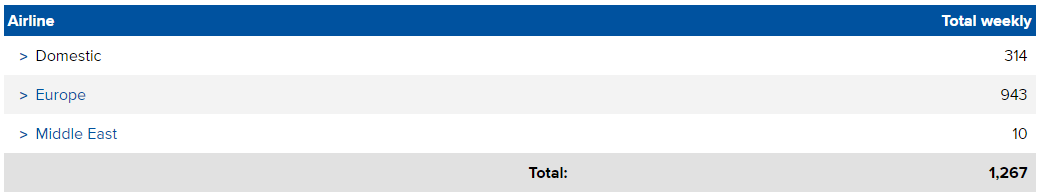

SCHEDULE MOVEMENT SUMMARY (w/c 31-Aug-2020)

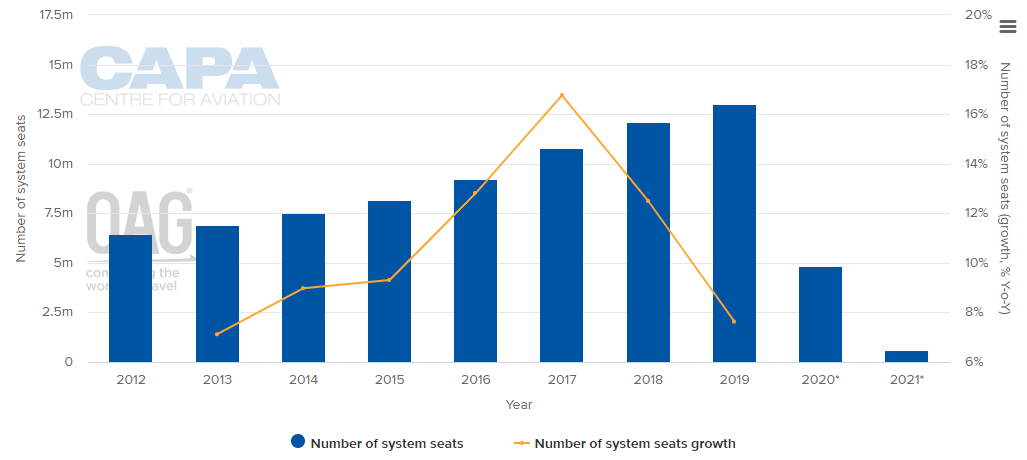

ANNUAL CAPACITY (2012 - 2021*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

WEEKLY DOMESTIC CAPACITY (2017 - 2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

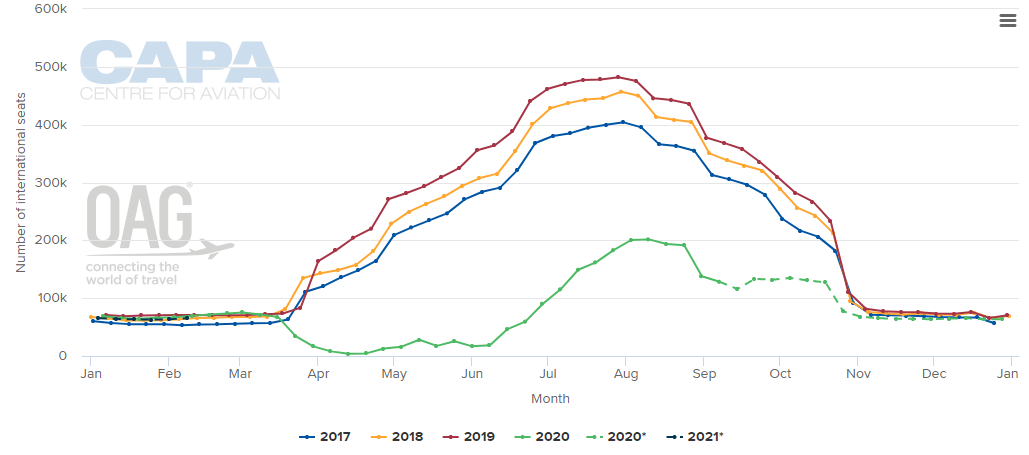

WEEKLY INTERNATIONAL CAPACITY (2017-2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

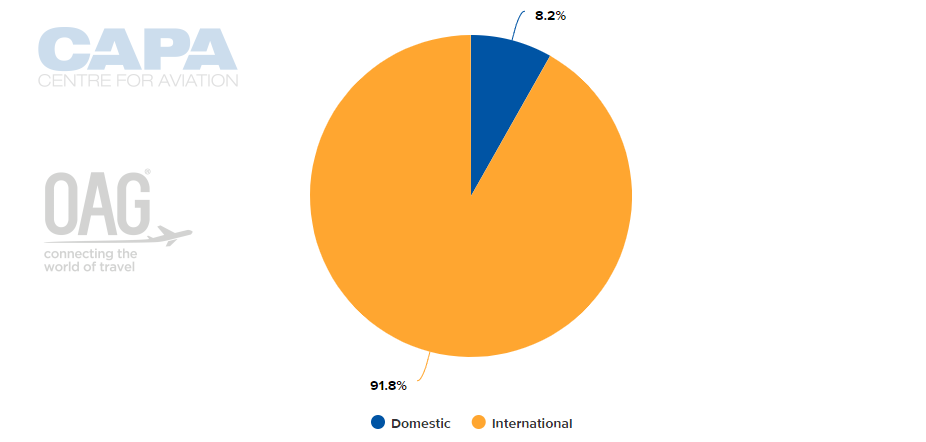

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 31-Aug-2020)

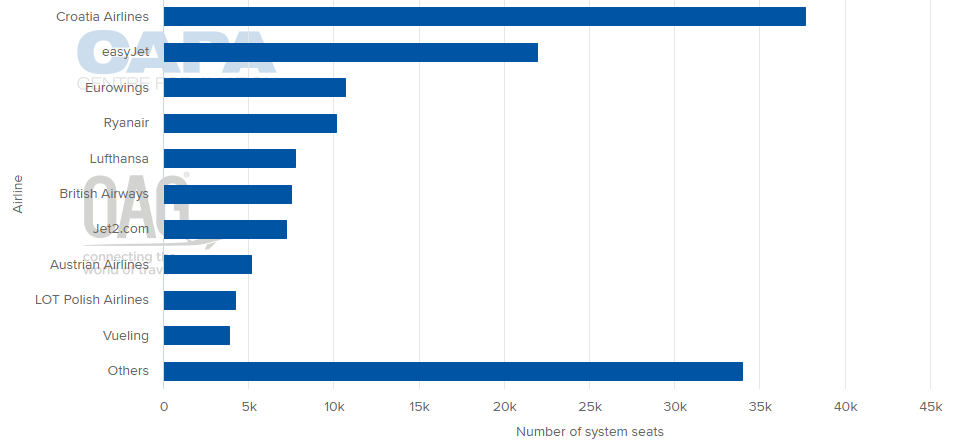

LARGEST AIRLINES BY CAPACITY (w/c 31-Aug-2020)

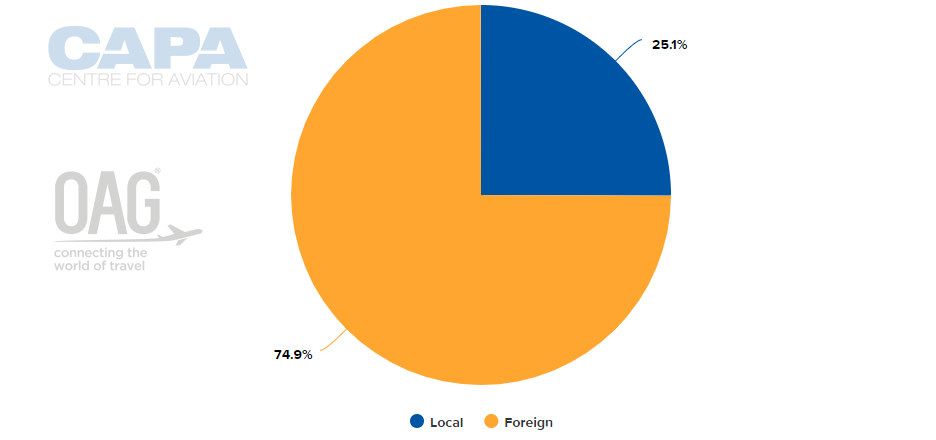

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 31-Aug-2020)

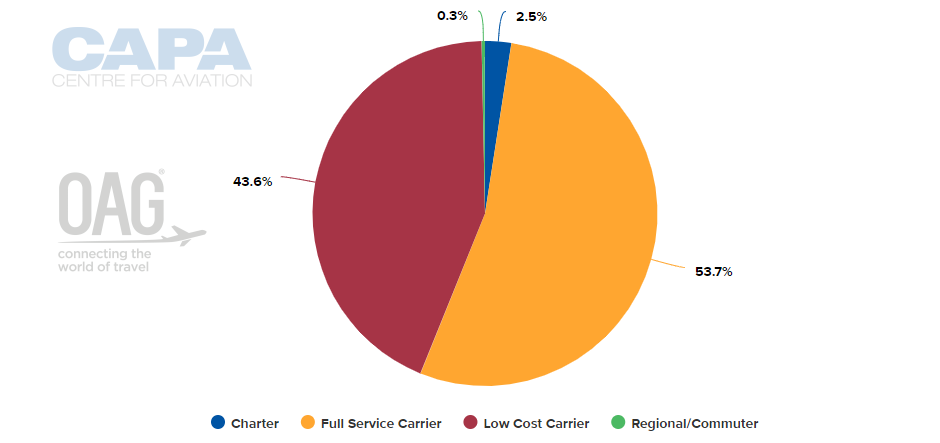

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 31-Aug-2020)

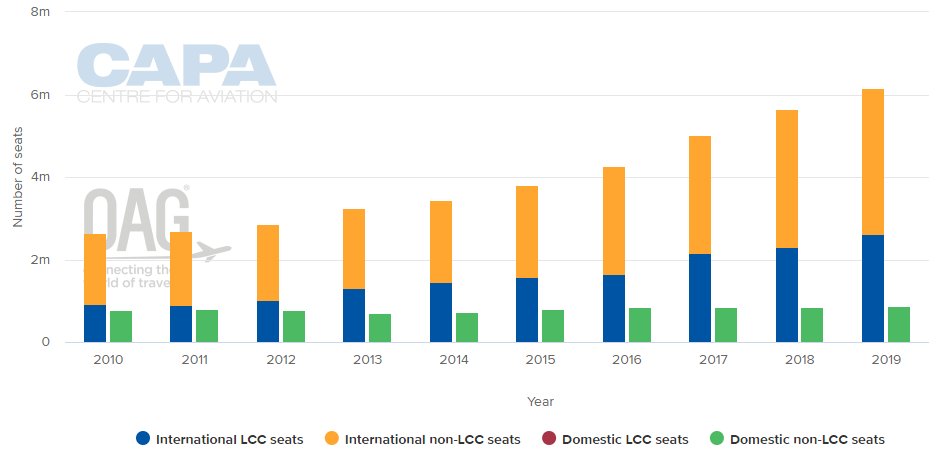

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

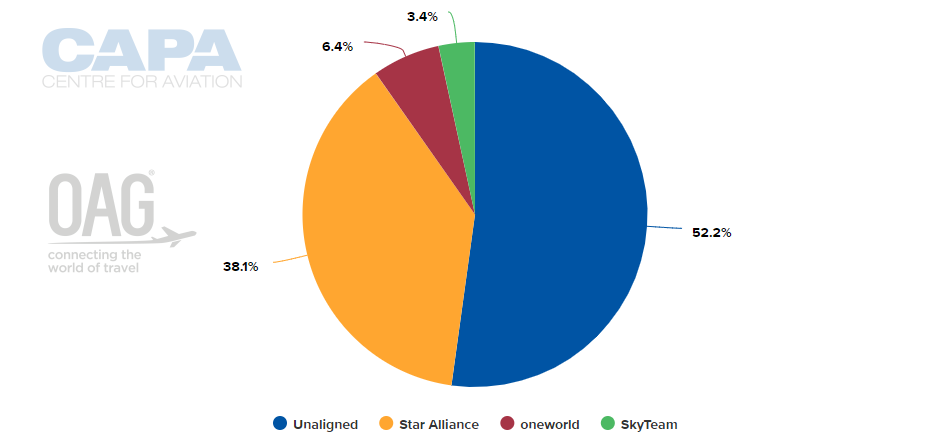

ALLIANCE CAPACITY SPLIT (w/c 31-Aug-2020)

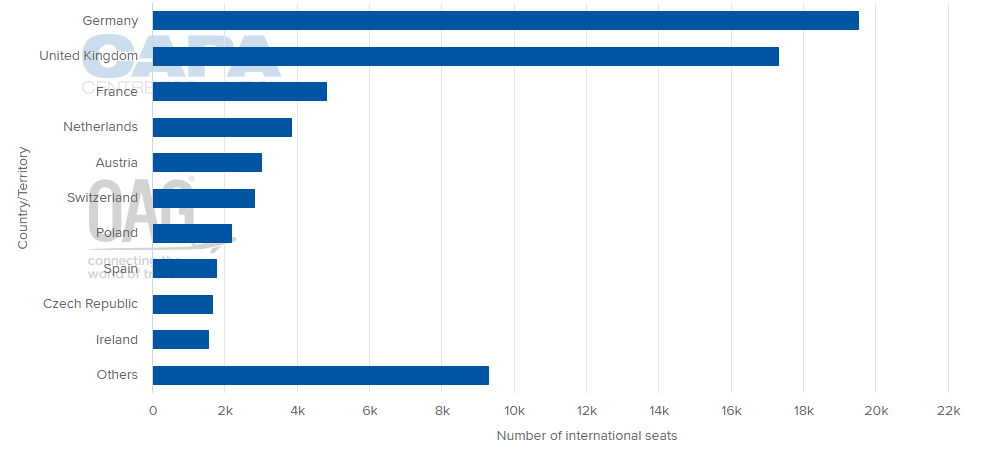

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 31-Aug-2020)

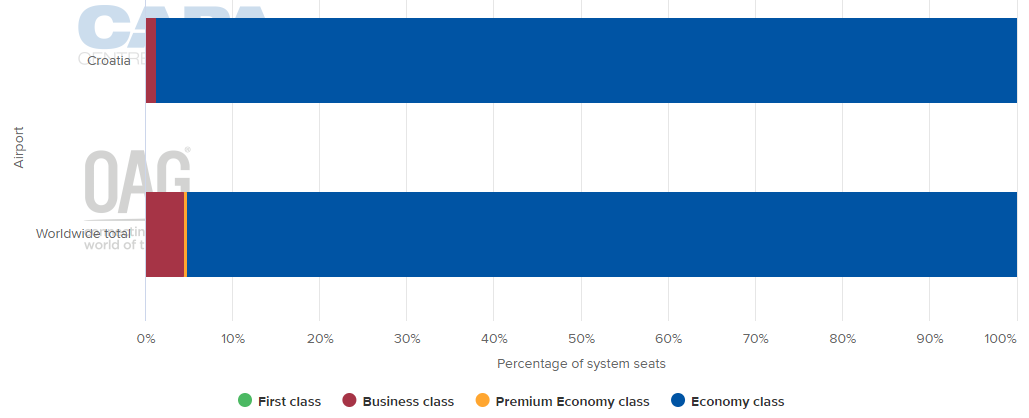

DEPARTING SYSTEM SEATS BY CLASS (w/c 31-Aug-2020)

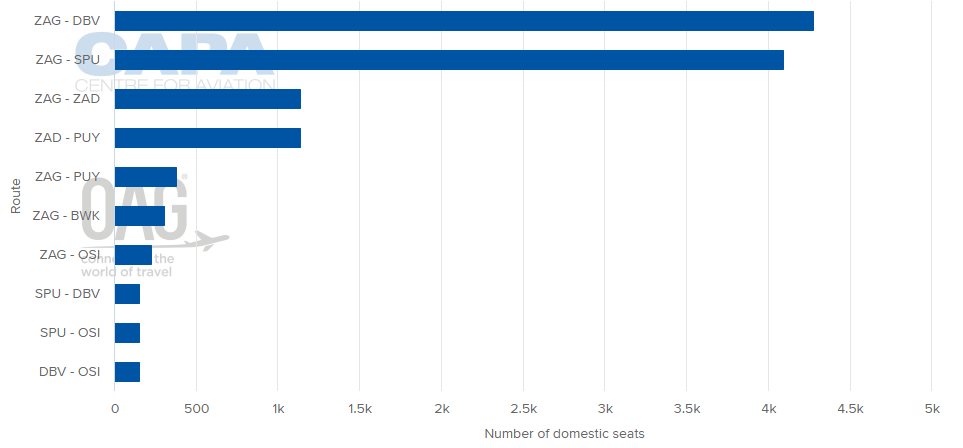

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 31-Aug-2020)

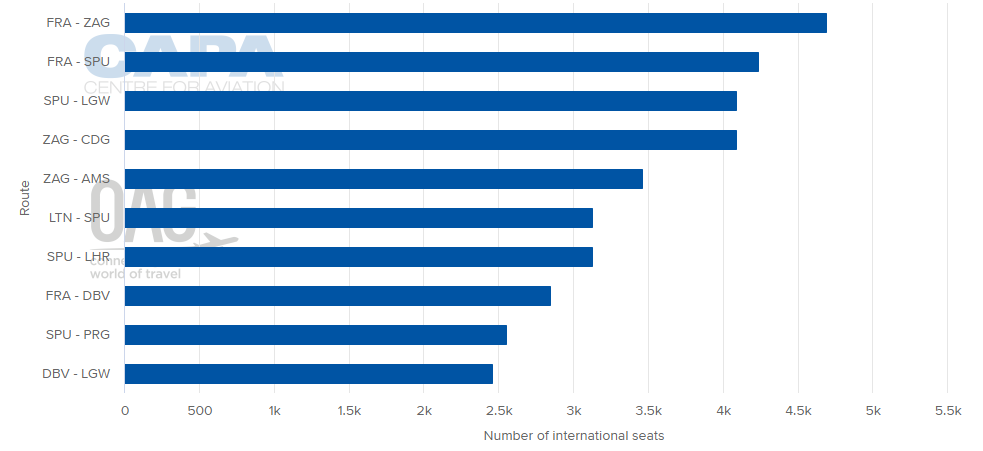

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 31-Aug-2020)

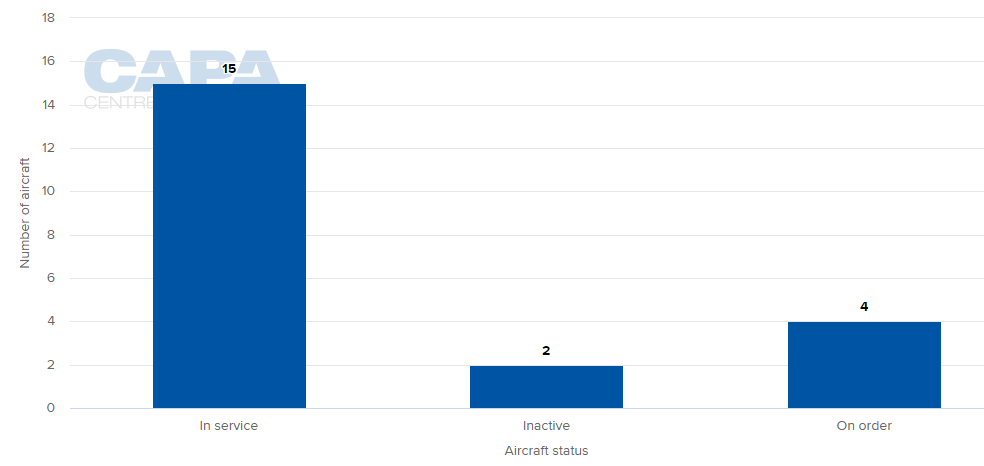

LOCAL AIRLINES' AIRCRAFT FLEET (as at 31-Aug-2020)

MORE INSIGHTS:

Europe only manages a piecemeal approach to airline state aid

Croatia Airlines: Aegean Airlines and Air Nostrum submit bids

Croatia aviation: highly seasonal tourist market grows, driven by LCCs

Croatia seeks to ease the seasonal nature of its tourist traffic; to work with airlines accordingly