Egypt continues to employ strict protocols to safeguard the country from coronavirus and will in fact introduce tighter measures from 01-Sep-2020. Currently, Egyptians holding foreign passports along with any proof of Egyptian nationality such as (Egyptian Passport, Egyptian National ID, or Egyptian Birth Certificate) are allowed to travel to Egypt without PCR test, but that will become a requirement from 01-Sep-2020.

As is the case presently with all non-Egyptians nationalities, the negative PCR Test certificate for (Covid-19) must be issued not more than 72 hours prior to arrival in the country. This includes transit passengers (who are entitled for hotel accommodation and will not be staying at Cairo Airport till their onward flight) even if their final destination country doesn't require a negative PCR test in order for them to be cleared for hotel accommodation.

International Air Transport Association (IATA) has warned that Egypt could lose around 14 million annual passengers in 2020, a damaging -USD3.5 billion loss in GDP and putting almost 300,000 jobs at risk in the country as economies across its region are "brought to their knees by Covid-19".

The Centers for Disease Control and Prevention (CDC) still defines Egypt as a 'Warning - Level 3' environment where the Covid-19 risk is defined as still "high" and where it recommends travellers "avoid all non-essential international travel". As at 24-Aug-2020, there were 97,340 confirmed cases of Covid-19 and 5,262 deaths in Egypt.

AIRPORTS IN THE COUNTRY

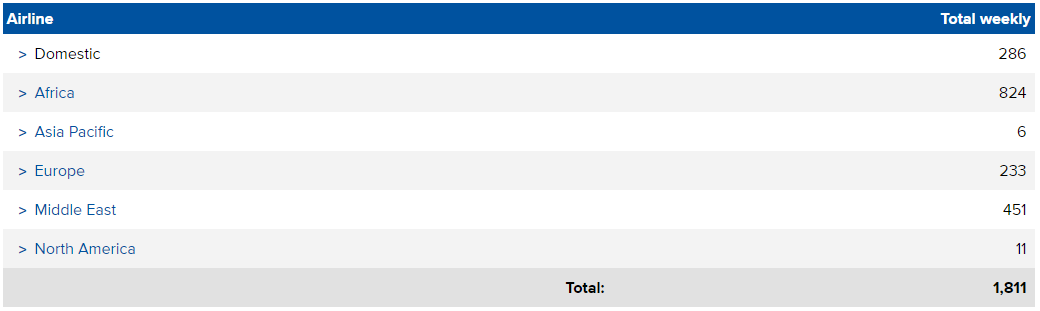

SCHEDULE MOVEMENT SUMMARY (w/c 24-Aug-2020)

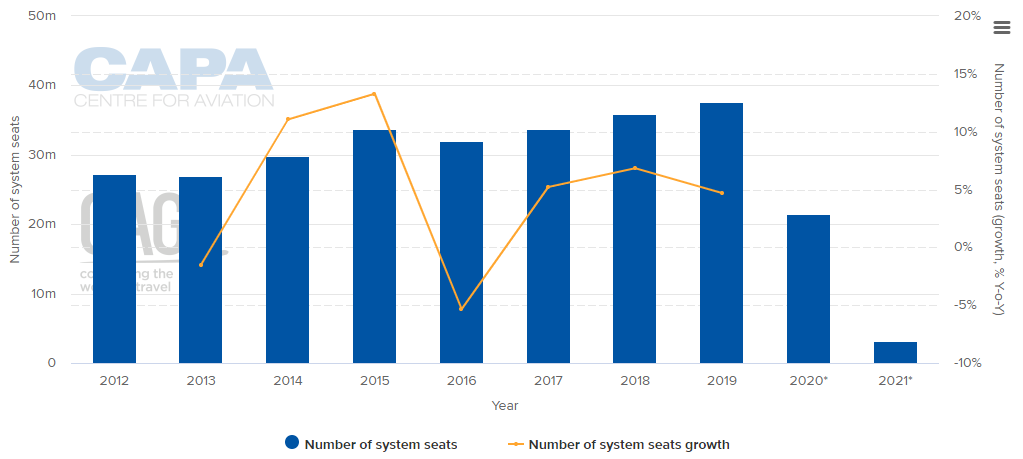

ANNUAL CAPACITY (2012 - 2021*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

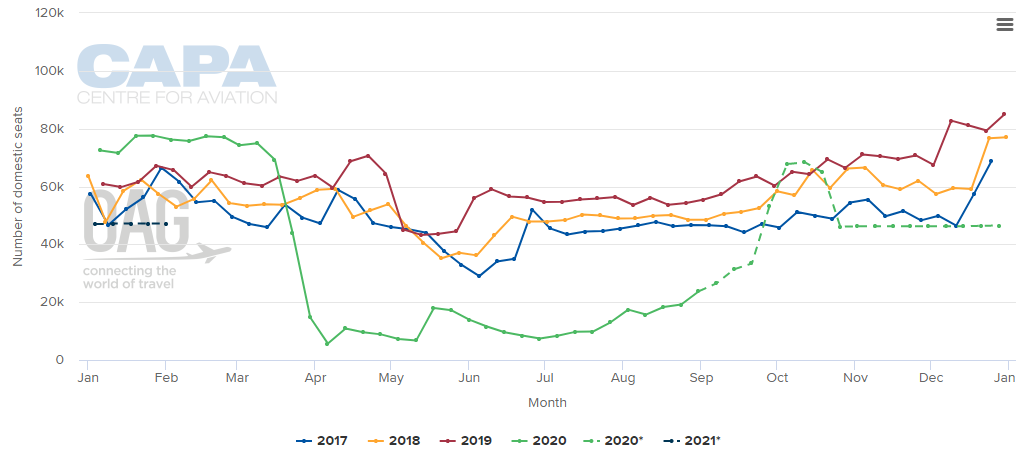

WEEKLY DOMESTIC CAPACITY (2017 - 2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

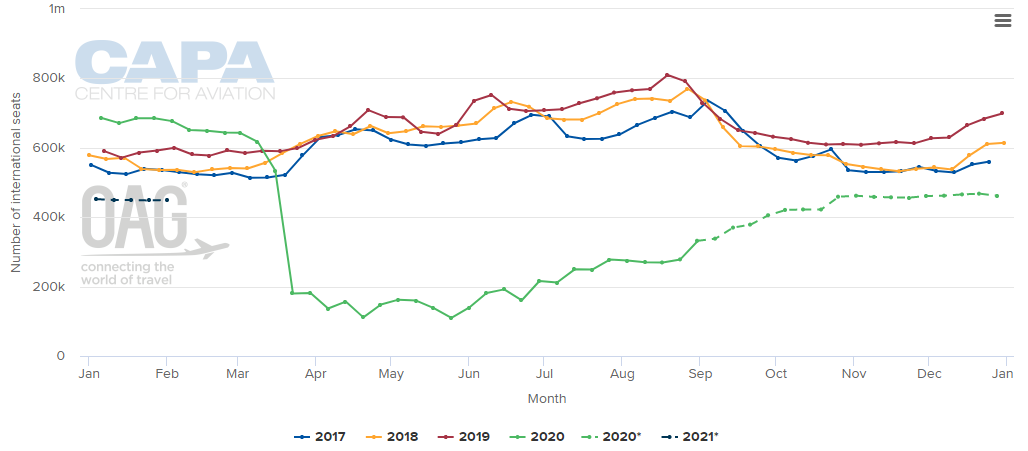

WEEKLY INTERNATIONAL CAPACITY (2017-2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

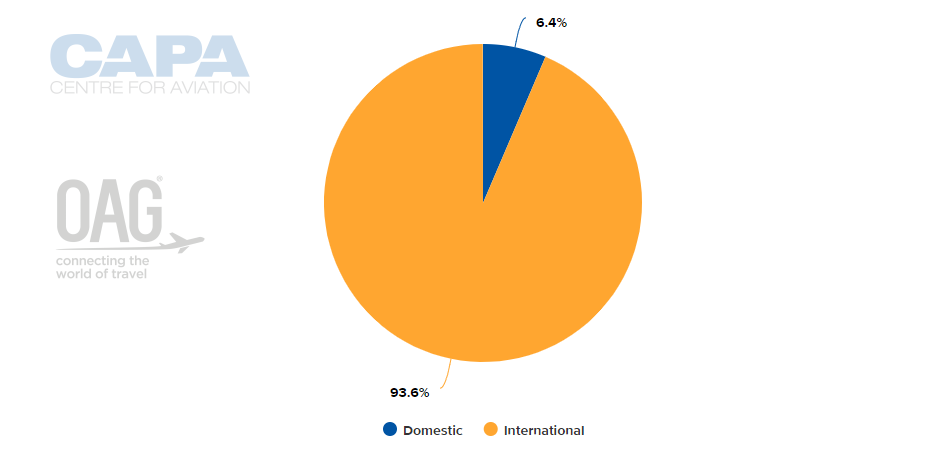

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 24-Aug-2020)

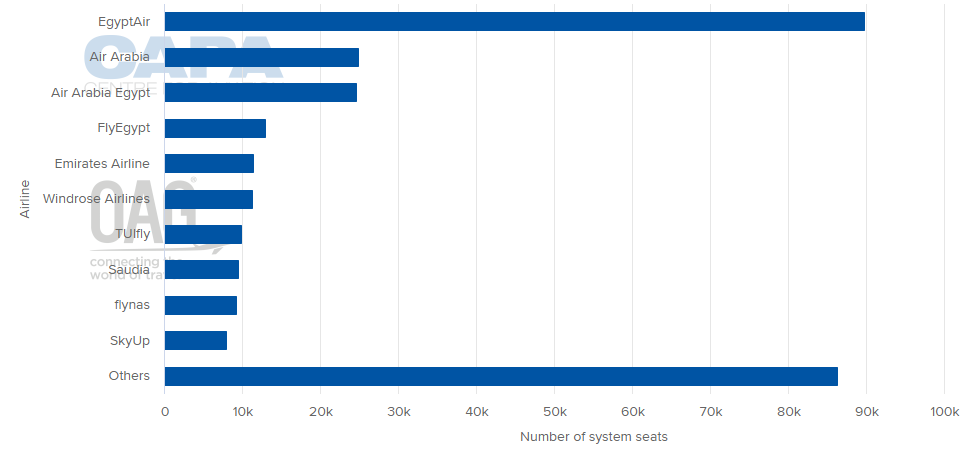

LARGEST AIRLINES BY CAPACITY (w/c 24-Aug-2020)

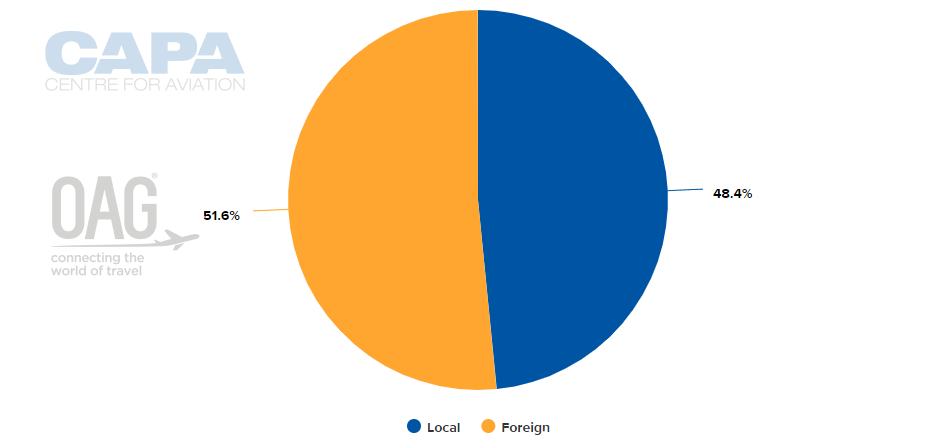

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 24-Aug-2020)

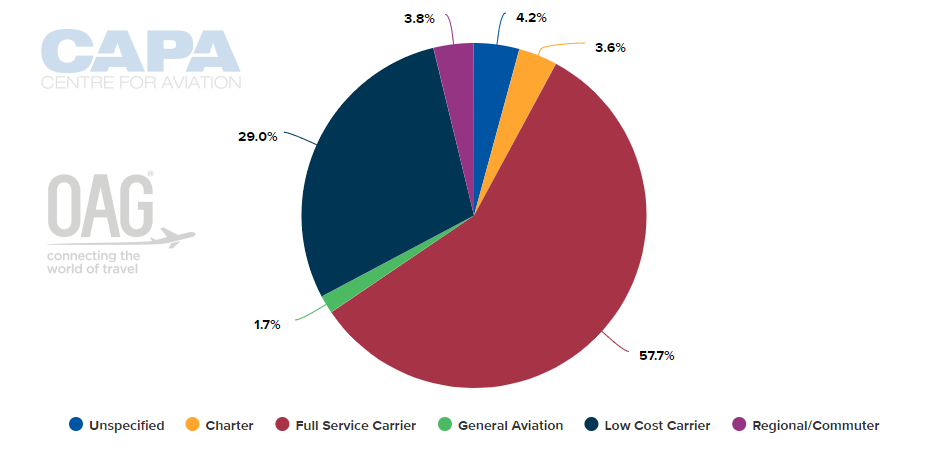

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 24-Aug-2020)

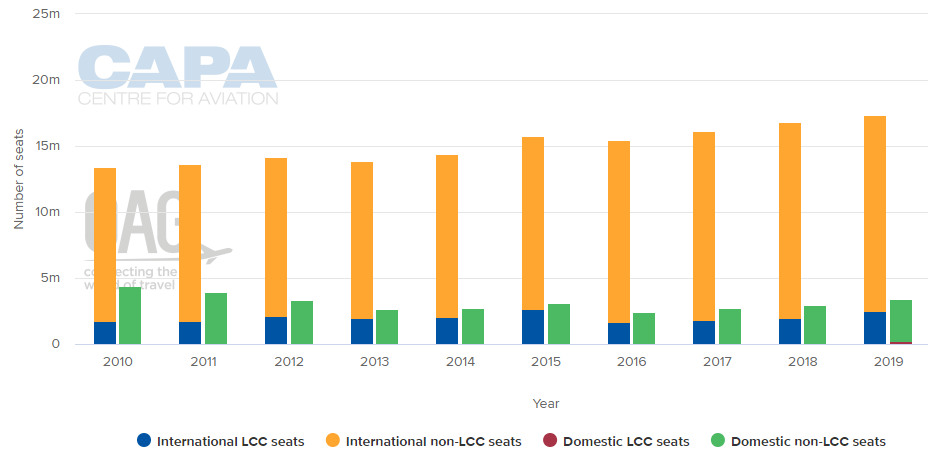

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

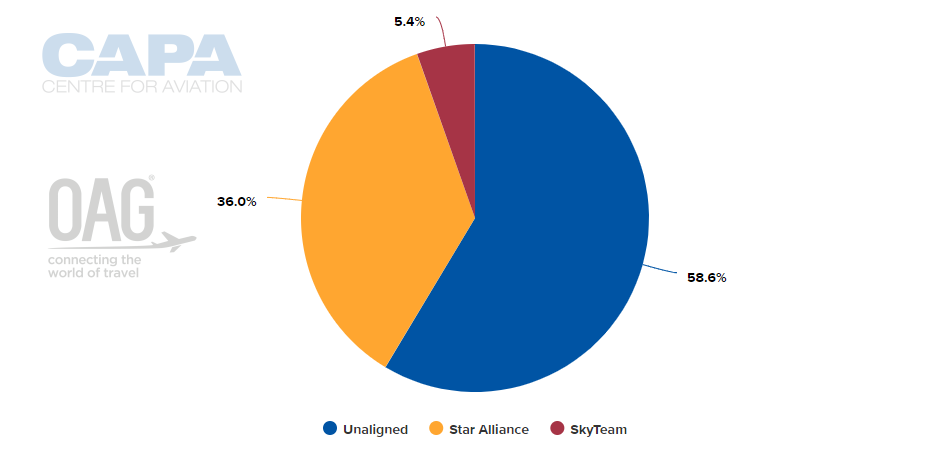

ALLIANCE CAPACITY SPLIT (w/c 24-Aug-2020)

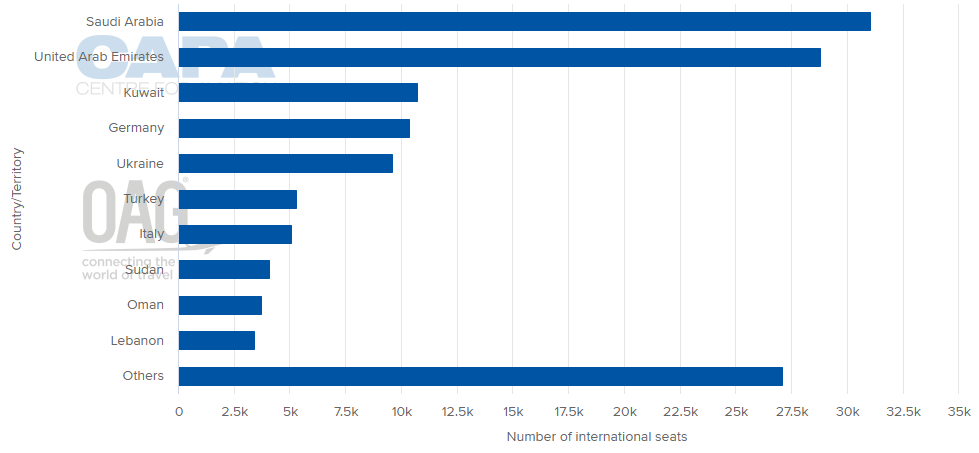

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 24-Aug-2020)

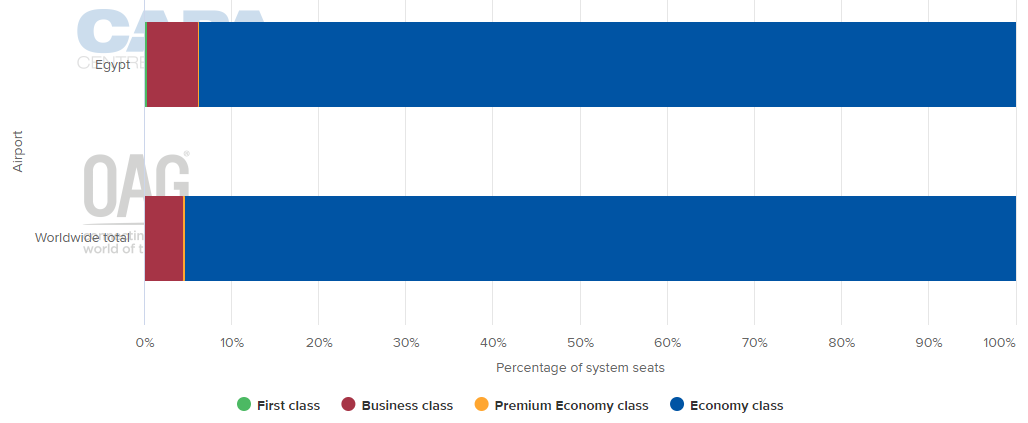

DEPARTING SYSTEM SEATS BY CLASS (w/c 24-Aug-2020)

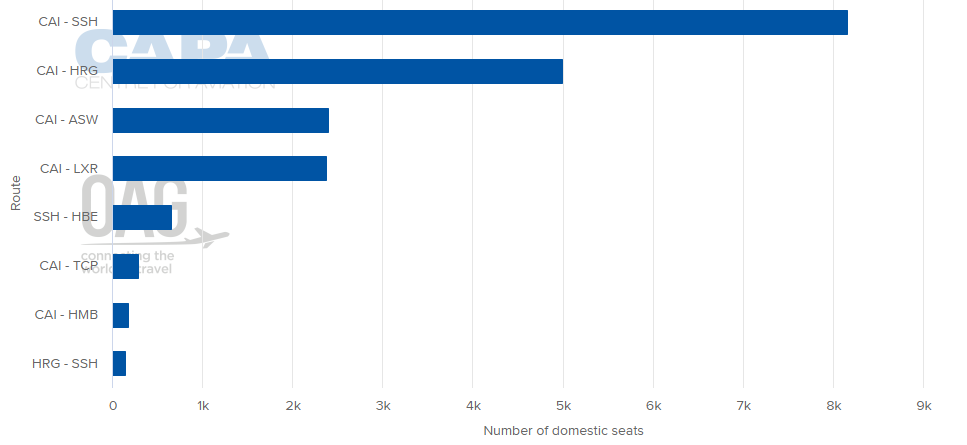

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 24-Aug-2020)

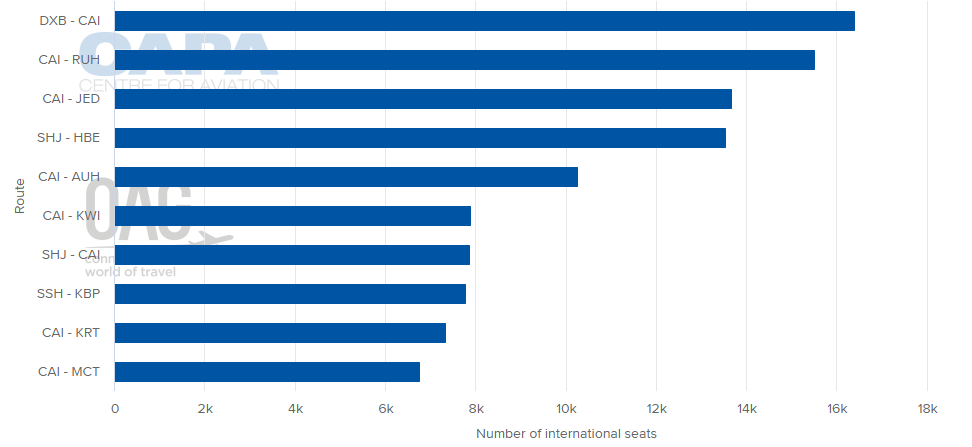

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 24-Aug-2020)

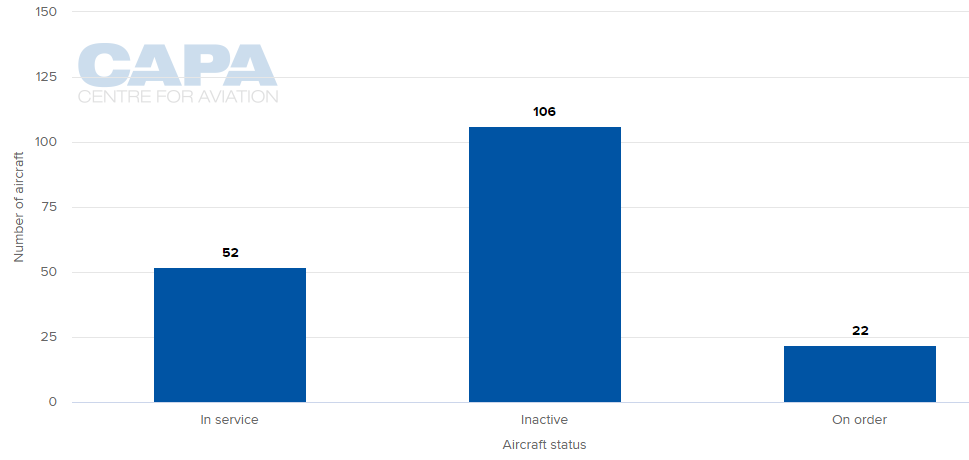

LOCAL AIRLINES' AIRCRAFT FLEET (as at 24-Aug-2020)

MORE INSIGHTS:

COVID-19: No more 'normal' for aviation

Egypt to Western Europe aviation: easyJet leads LCCs back

COVID-19. Data on virus case numbers are aviation's lead indicator

A new Cairo Airport is set to open… and another is already in the pipeline