The carrier launched as a LCC serving northern UK markets but has become a modern day leisure airline after re-engineering the tour operator model with a new low-cost base. While seat-only remains a proportion of its business, much of its capacity is now tied to its sister Jet2holidays business which has emerged as a major rival to the stablished travel brands serving the UK's high demand for breaks into the Mediterranean and emerging markets.

With non-essential travel restricted from the UK at the height of its Covid-19 lockdown, Jet2 was forced to sit idle for the entire second quarter of this year. After returning to the air with a flourish, it has been forced to swiftly modify its network, first suspending flights into parts of Spain after the UK added the country to its quarantine list, then quickly resuming services to Portugal as the neighbouring nation was removed from the same UK listing.

For the year ending 31-Mar-2020, Jet2.com flew 14.6 million aeronautical only and package holiday single sectors, up +14% year-on-year. Demand for Real Package Holidays grew, as Jet2Holidays handled 3.7 million passengers on package holidays, up +19%. Its aeronautical only product handled 7.1 million single sector passengers, up +9%. Its hotel portfolio in the 2019 summer extended to more than 4,000 properties, with 40% of package holidays sold on an all-inclusive basis.

GLOBAL RANKING (as at 24-Aug-2020)

NETWORK MAP (as at 24-Aug-2020)

DESTINATIONS (as at 24-Aug-2020)

ANNUAL PASSENGER TRAFFIC (2010 - 2020YTD)

CAPACITY SNAPSHOT (versus same week last year)

ANNUAL CAPACITY (2012-2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

WEEKLY INTERNATIONAL CAPACITY (2017 - 2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 24-Aug-2020)

LARGEST NETWORK POINT (w/c 24-Aug-2020)

LARGEST INTERNATIONAL MARKETS BY COUNTRY (w/c 24-Aug-2020)

BUSIEST INTERNATIONAL ROUTES BY CAPACITY (w/c 24-Aug-2020)

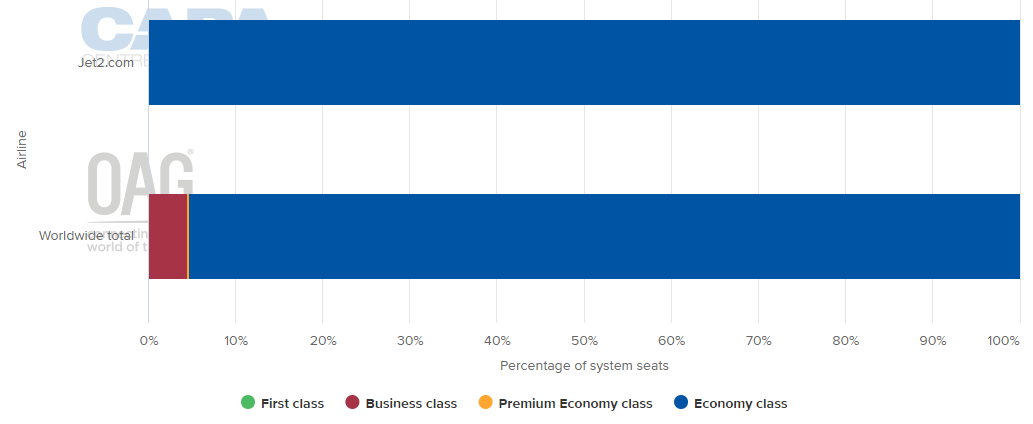

DEPARTING SYSTEM SEATS BY CLASS (w/c 24-Aug-2020)

AVERAGE FLIGHT LENGTH (w/c 24-Aug-2020)

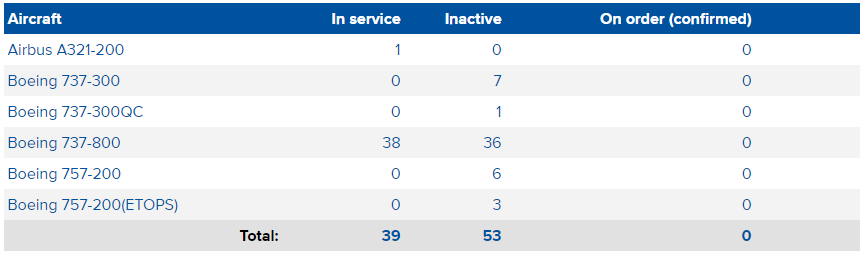

FLEET SUMMARY (as at 24-Aug-2020)

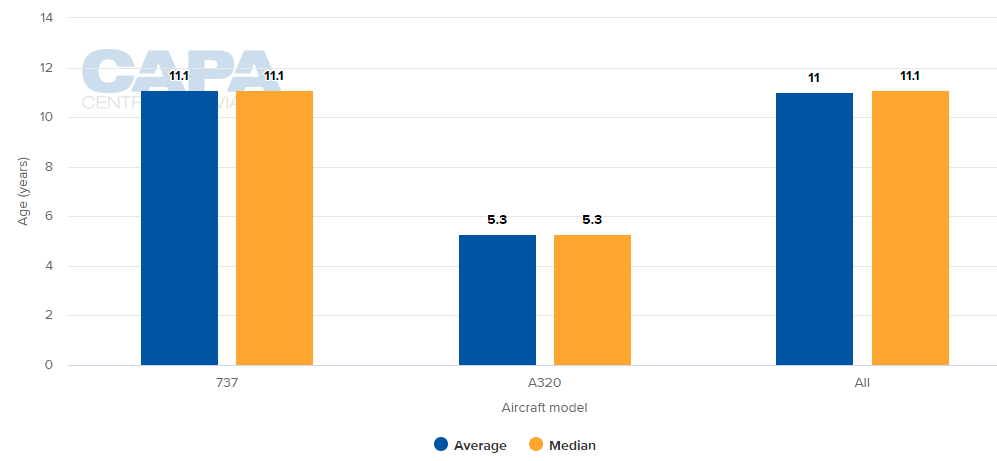

AVERAGE FLEET AGE FOR IN-SERVICE AIRCRAFT (as at 24-Aug-2020)

MORE INSIGHT...

European air traffic forecast cut. Capacity recovery loses momentum

COVID-19: Jet2 and TUI rely on IATA's U-recovery in Jun-2020

Jet2.com, easyJet take majority of Thomas Cook Airlines slots