ALTA's executive director and CEO Jose Ricardo Botelho recently commented that the Latin American aviation industry emerging from the Covid-19 pandemic "[will be] a smaller industry, comparable to the region's aviation in 2009, which certainly could generate inconveniences to tourism and supply chains which directly rely on air transport". That is not a positive sign for markets such as Mexico and others where over 15% of the economy depends directly on travel and tourism.

He warned that airlines are expected to offer 50% of initially planned capacity in the region and "recovery will be slow… only in 2025 we would see 2019 levels" of passenger traffic, but that air transport "will play a fundamental role in the economic recovery" of countries.

Mexico's coronavirus outbreak is growing quickly and shows no signs of slowing down. Reported cases and deaths have risen every week for the last couple of months, although President Andres Manuel Lopez Obrador said the coronavirus had been "tamed" a month ago. Of course, health crisis are nothing new as eleven years ago the country was then the epicenter of the A-H1N1 influenza virus outbreak and then there has been chikungunya and Zika viruses, along with dengue fever.

The health emergency declared in late Mar-2020 almost brought air travel to a standstill, but skeletal operations remained and it appears that these are already starting to grow, but Mexico's economy was already on shaky ground before the COVID-19 crisis and this crisis may be one too many for the country's aviation infrastructure, which could look very different as it emerges from this global health crisis.

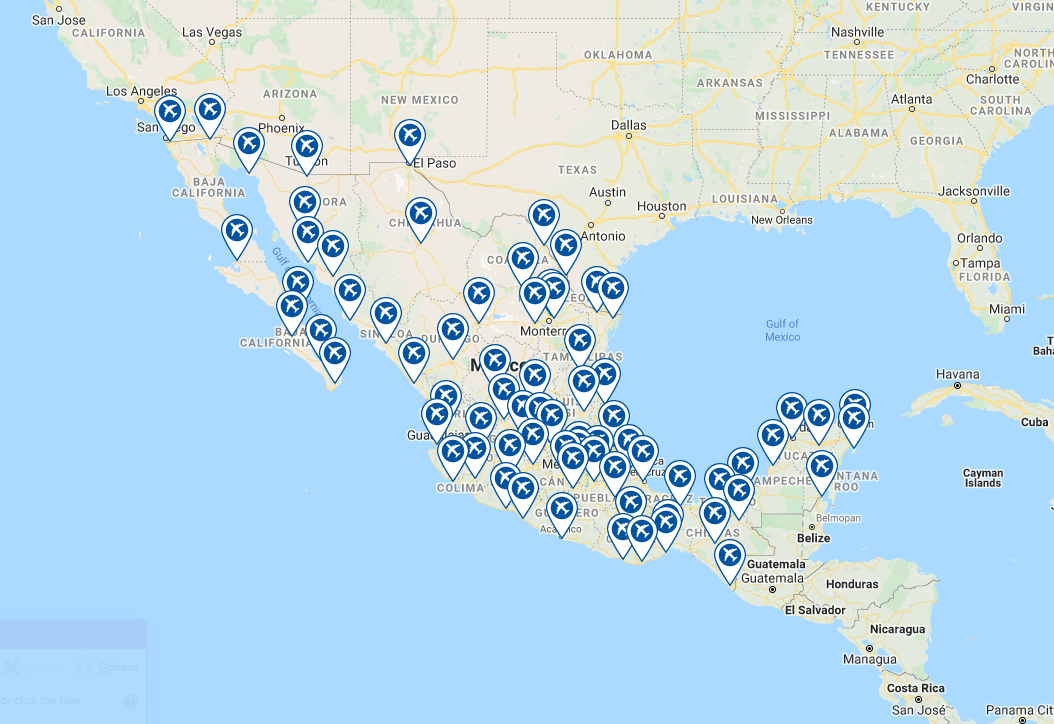

AIRPORTS IN THE COUNTRY

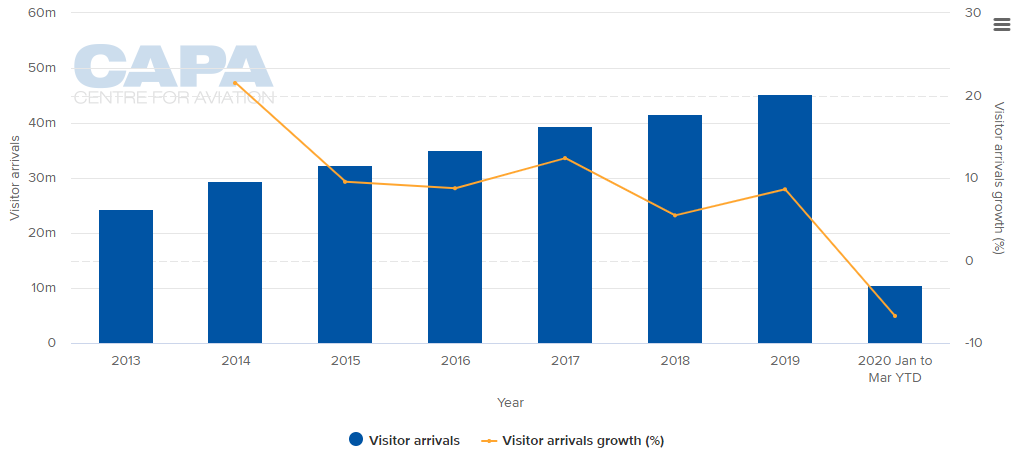

ANNUAL VISITOR ARRIVALS (2010 - 2020YTD)

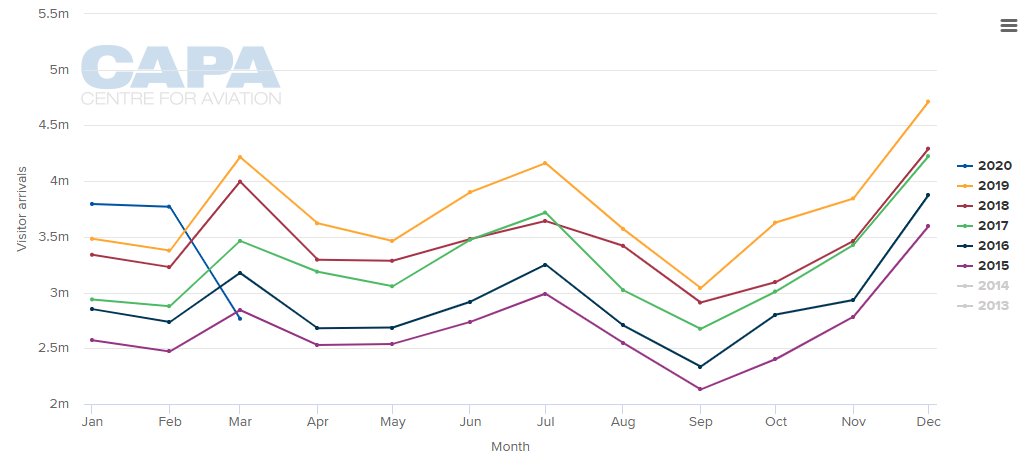

MONTHLY VISITOR ARRIVALS AND SEASONALITY IN DEMAND (2015 - 2020)

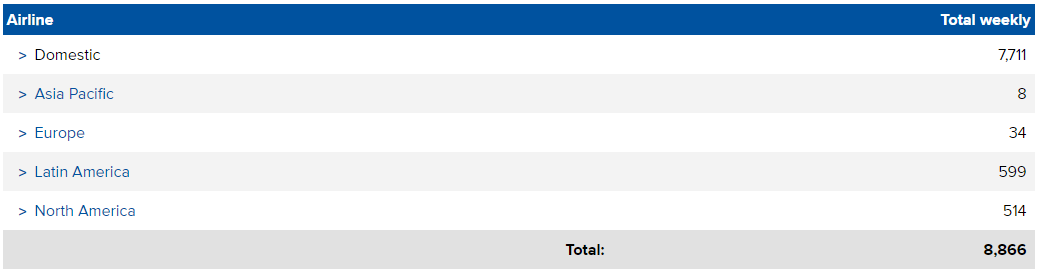

SCHEDULE MOVEMENT SUMMARY (w/c 08-Jun-2020)

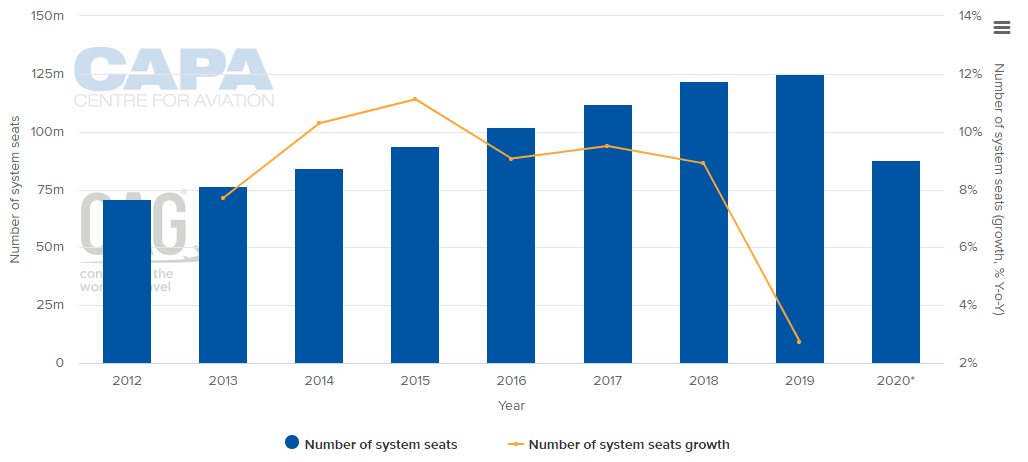

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

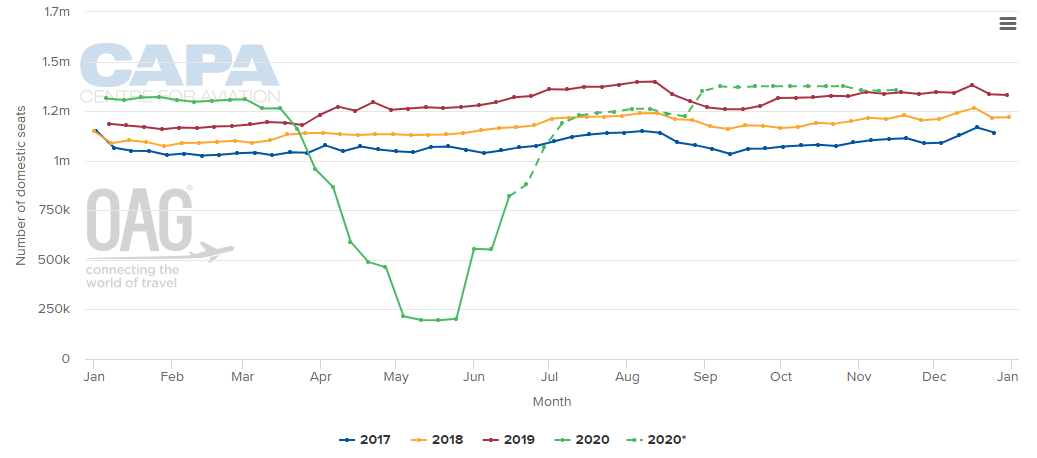

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

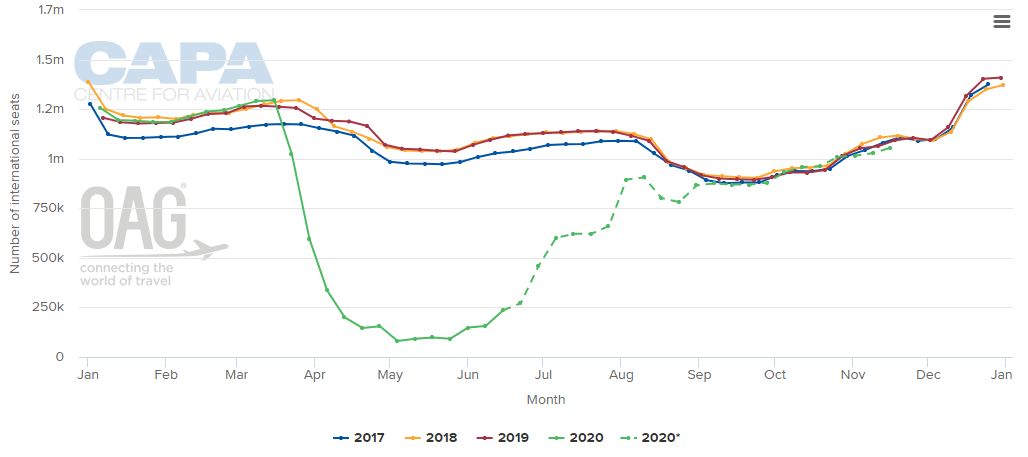

WEEKLY INTERNATIONAL CAPACITY (2017-2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

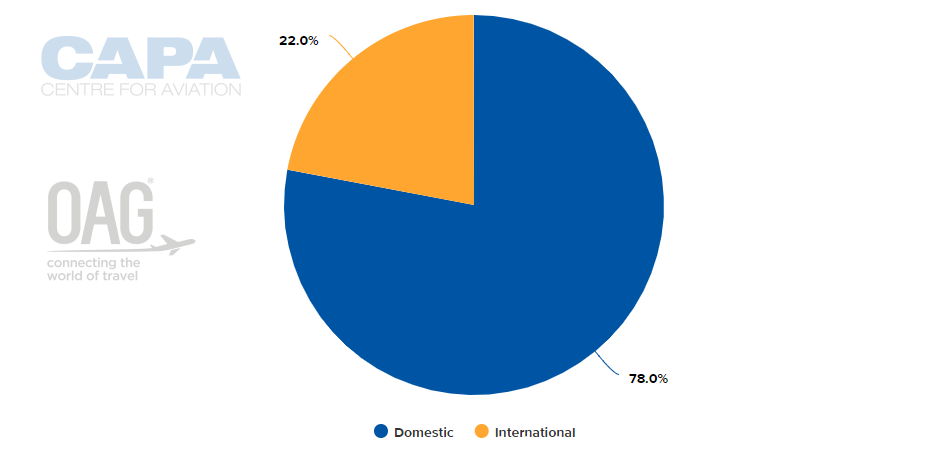

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 01-Jun-2020)

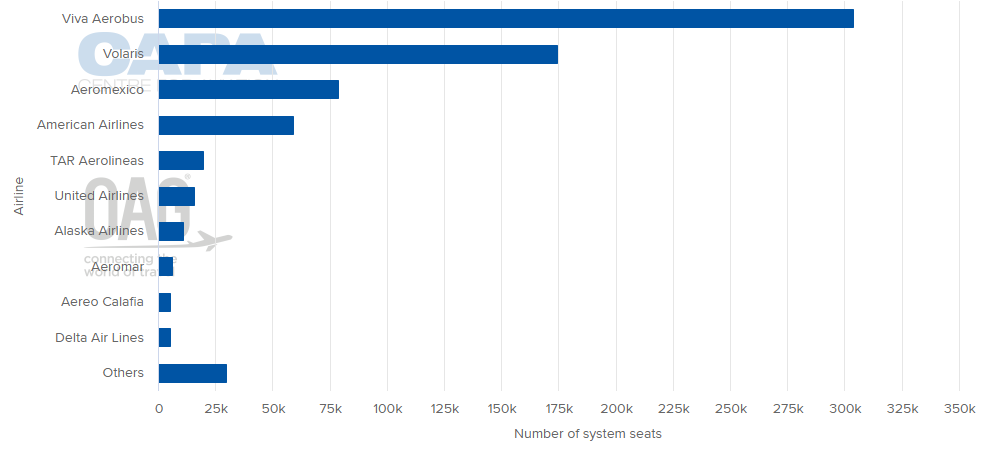

LARGEST AIRLINES BY CAPACITY (w/c 08-Jun-2020)

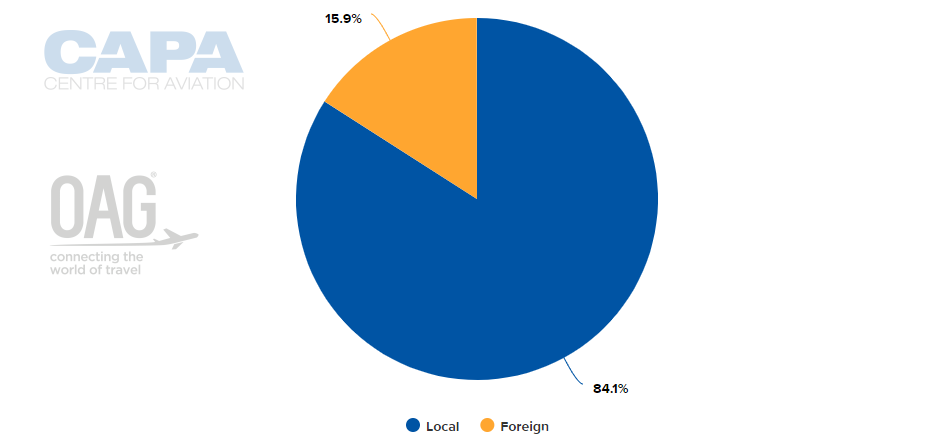

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 08-Jun-2020)

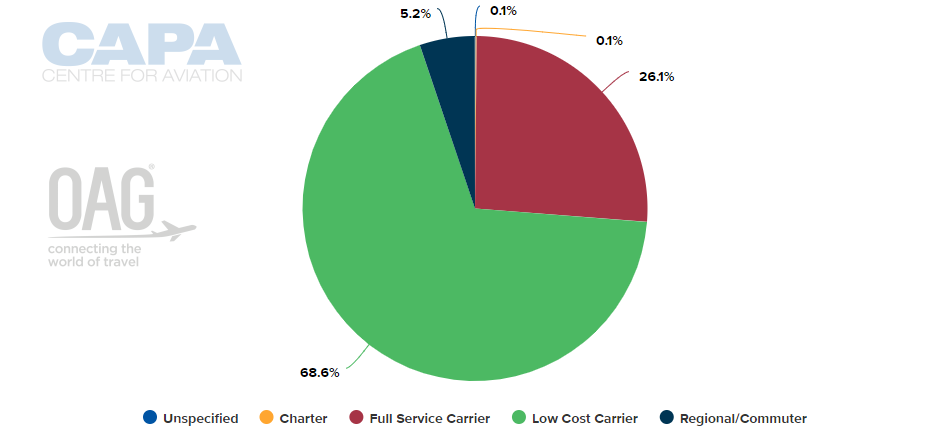

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 08-Jun-2020)

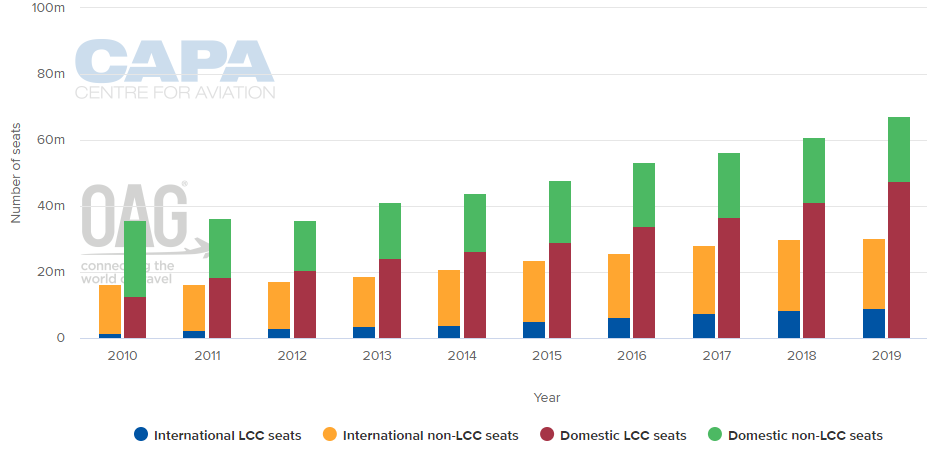

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

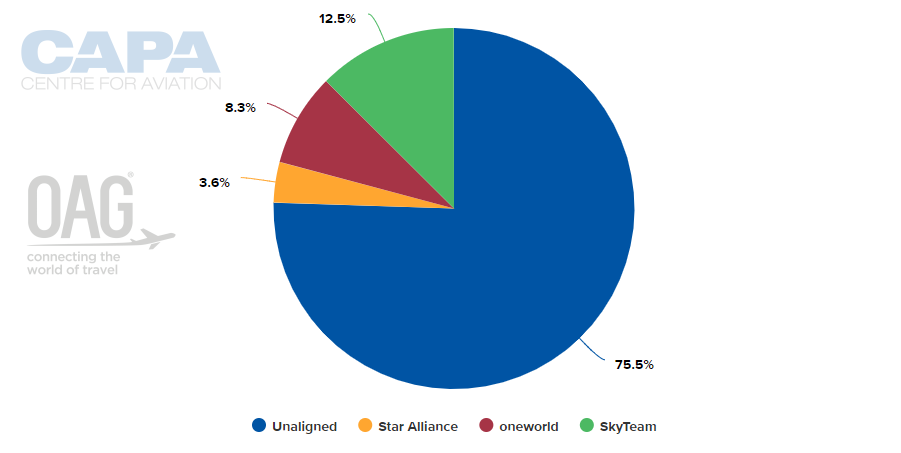

ALLIANCE CAPACITY SPLIT (w/c 08-Jun-2020)

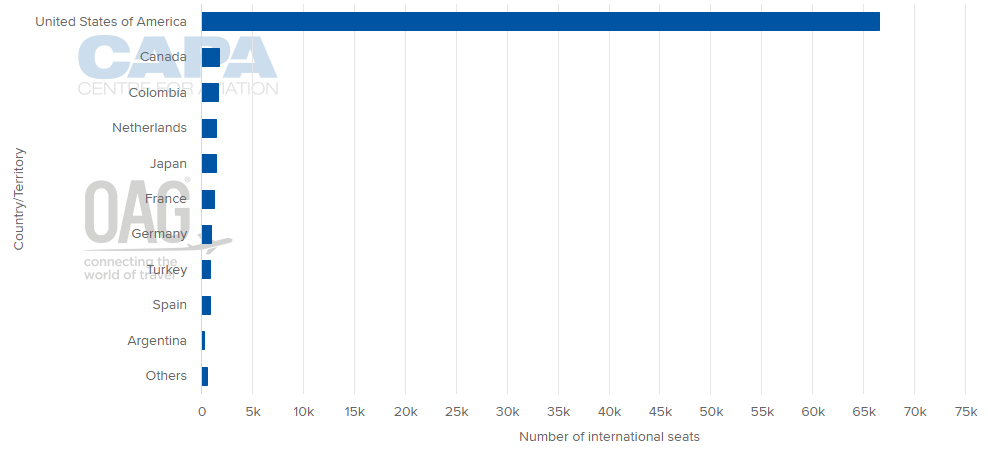

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 08-Jun-2020)

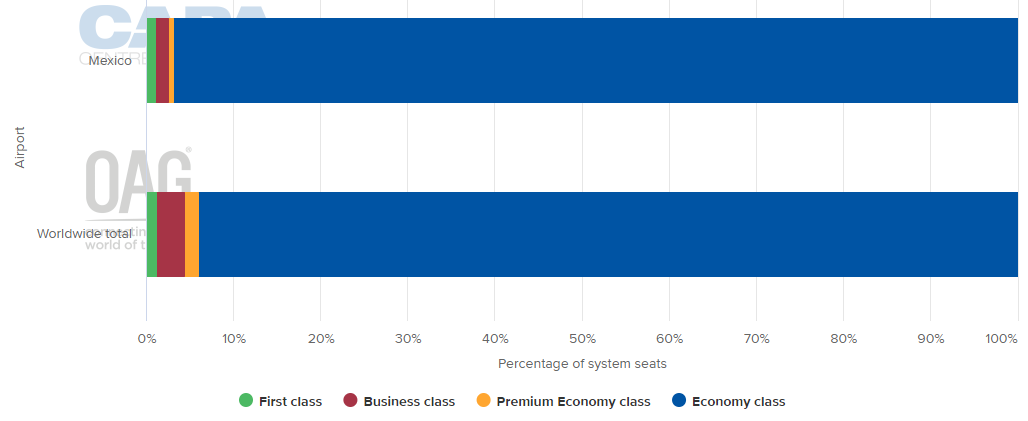

DEPARTING SYSTEM SEATS BY CLASS (w/c 08-Jun-2020)

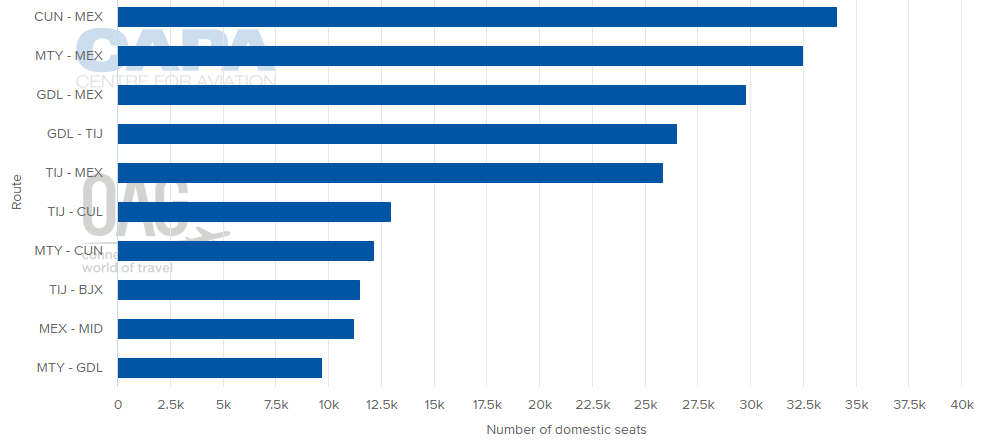

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 08-Jun-2020)

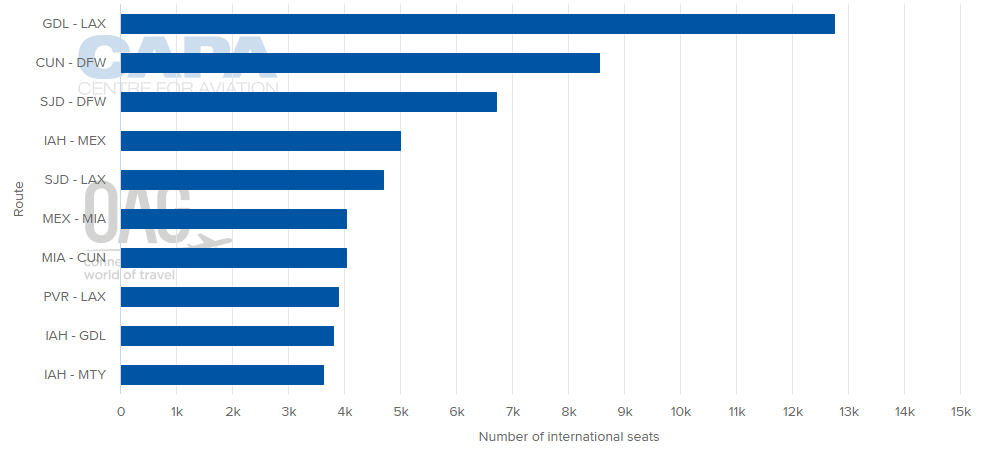

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 08-Jun-2020)

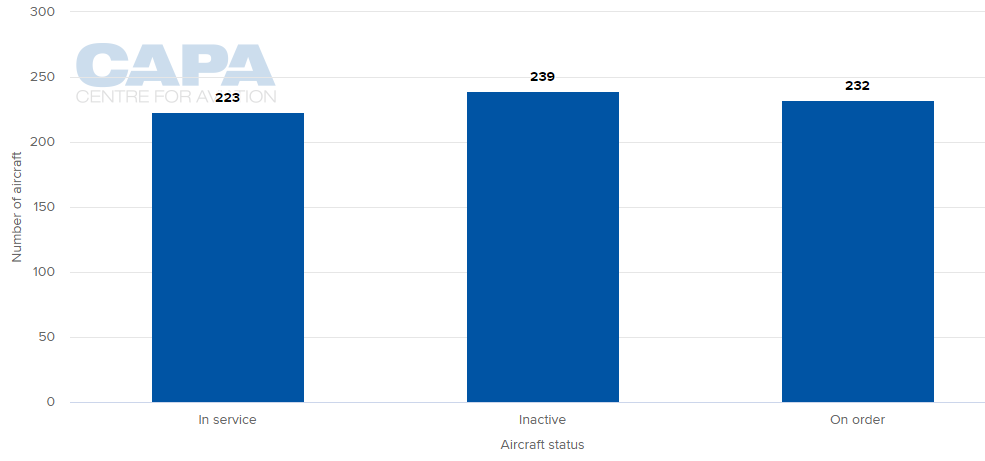

LOCAL AIRLINES' AIRCRAFT FLEET (as at 08-Jun-2020)

MORE INSIGHTS:

COVID-19: Mexican airports not so badly affected - yet

COVID-19: government aid for Latin airlines still patchy

Interjet's challenges rise as Mexico market competition intensifies