Following the opening of the 35 gate concourse A-west used by Delta Air Lines and which houses six international gates, the new 21 gate concourse B is now operational and will house Alaska Airlines, American Airlines, Delta Air Lines, Frontier Airlines, JetBlue Airways, Southwest Airlines and United Airlines. The two concourses are connected by al most 1,000 foot long tunnel - originally built in 2004.

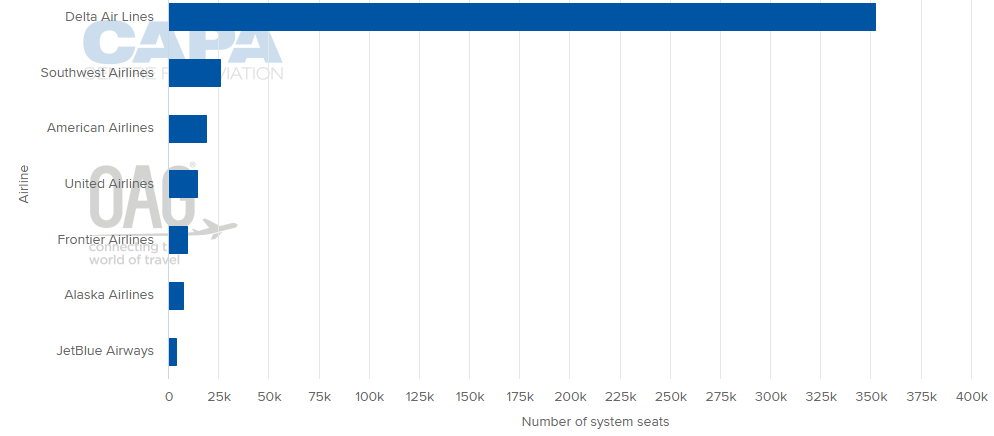

The 21 gates in the new concourse have been allocated as follows: Alaska-1, American-2, Delta-7, Frontier-1, JetBlue-1, Southwest-4, and United-2. In addition, there are three common use - or city gates - that will be used by various airlines as needed, while gates B21 and B24 will serve as access points to a hard-stand operation for primarily regional aircraft.

This concludes Phase I of a transformation project and will see the previous concourses demolished to support Phase II developments, which include the build out of concourse A to the east and construction of the concrete portion of a permanent tunnel to transport passengers between concourses A and B. This is all due to be completed by late 2024.

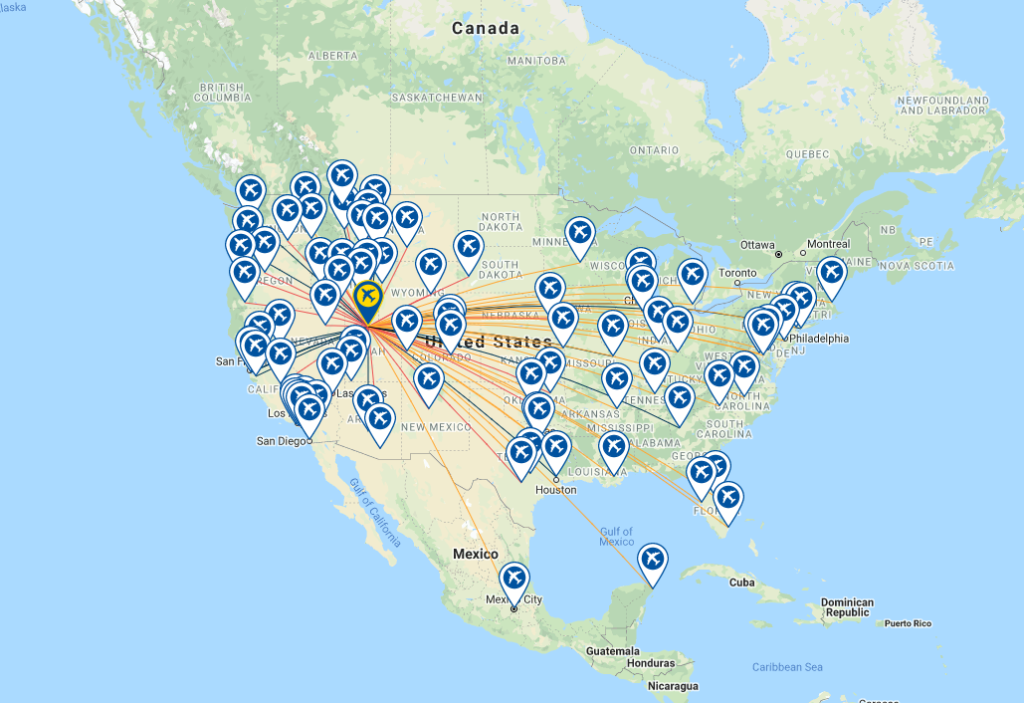

NETWORK MAP (as at 26-Oct-2020)

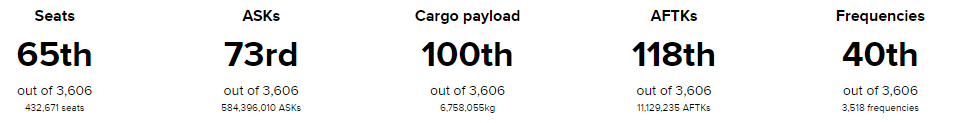

GLOBAL RANKING (as at 26-Oct-2020)

DESTINATIONS (as at 26-Oct-2020)

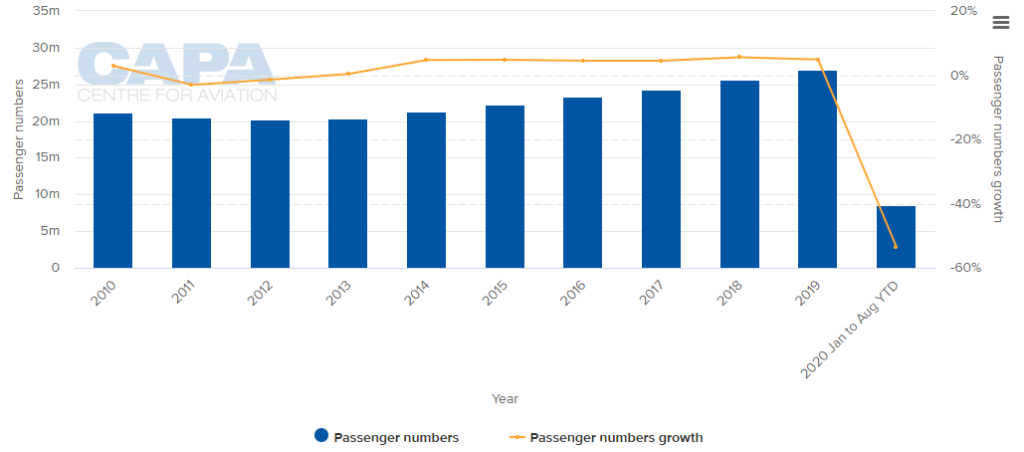

ANNUAL PASSENGER TRAFFIC DEMAND (2010-2020YTD)

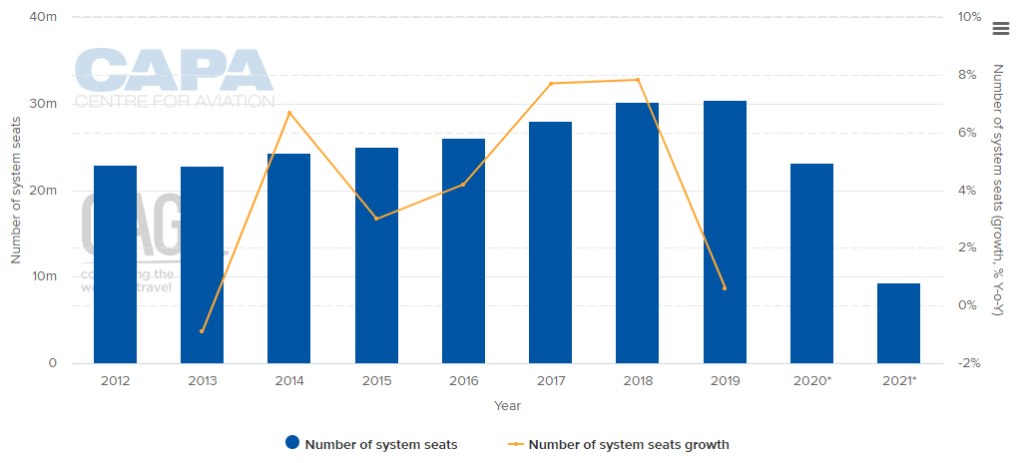

ANNUAL CAPACITY (2012-2020*)NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change

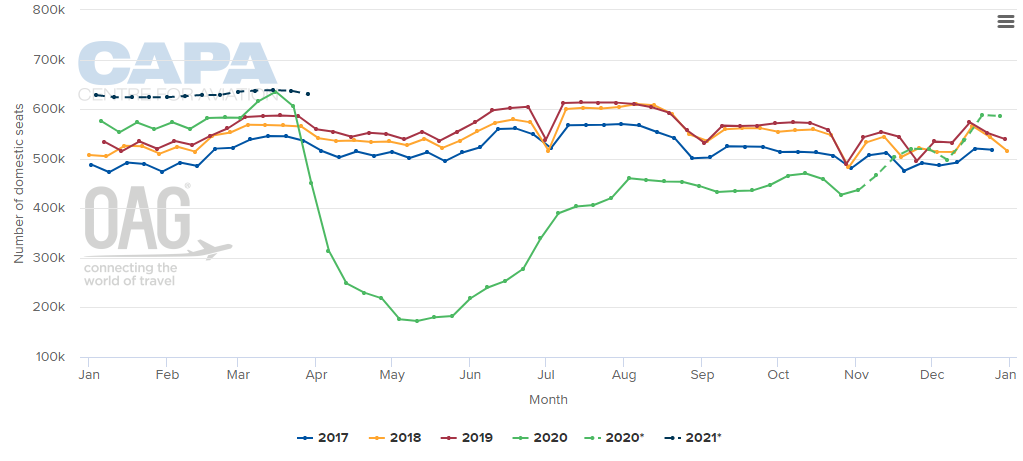

WEEKLY DOMESTIC CAPACITY (2017 - 2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

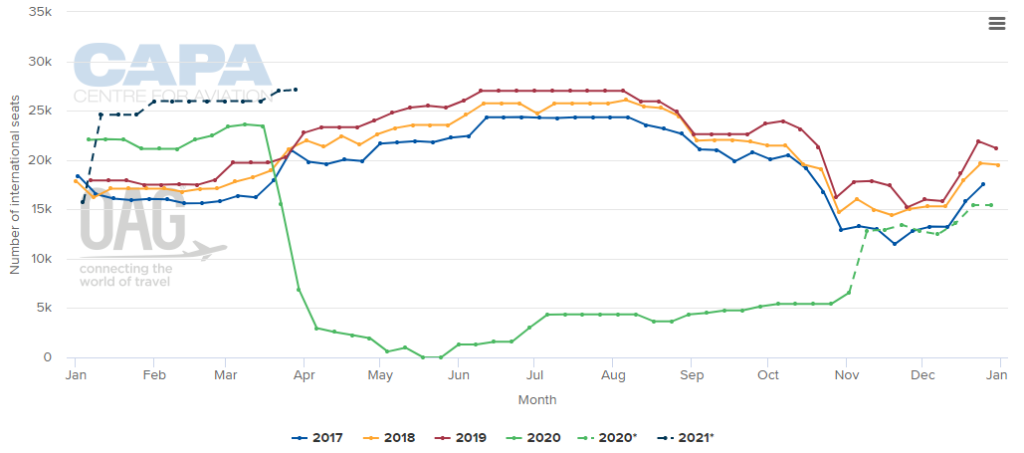

WEEKLY INTERNATIONAL CAPACITY (2017-2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

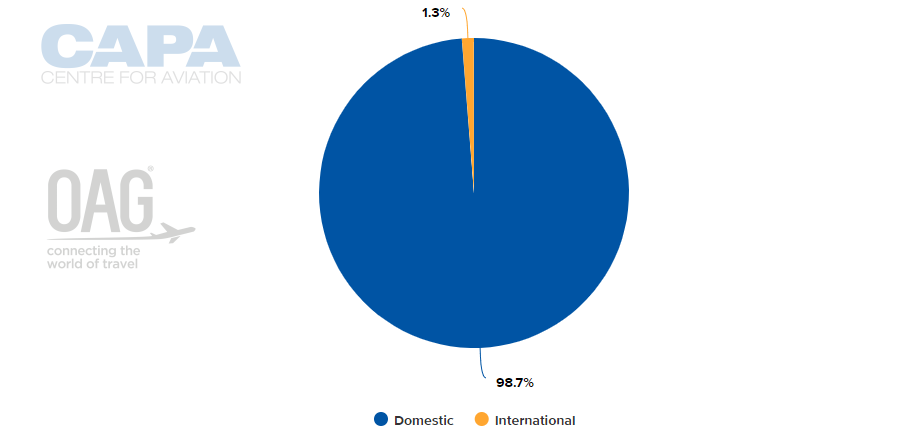

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 26-Oct-2020)

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 26-Oct-2020)

LARGEST AIRLINES BY CAPACITY (w/c 26-Oct-2020)

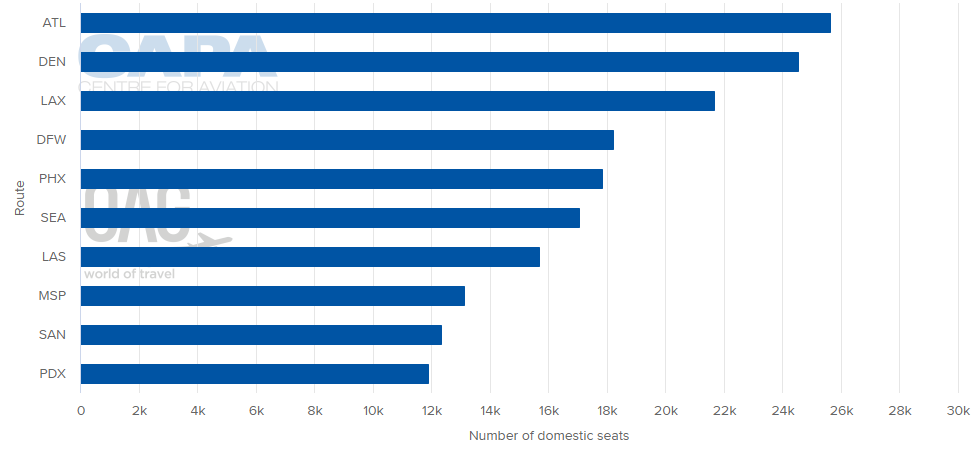

LARGEST DOMESTIC DESTINATION MARKETS (w/c 26-Oct-2020)

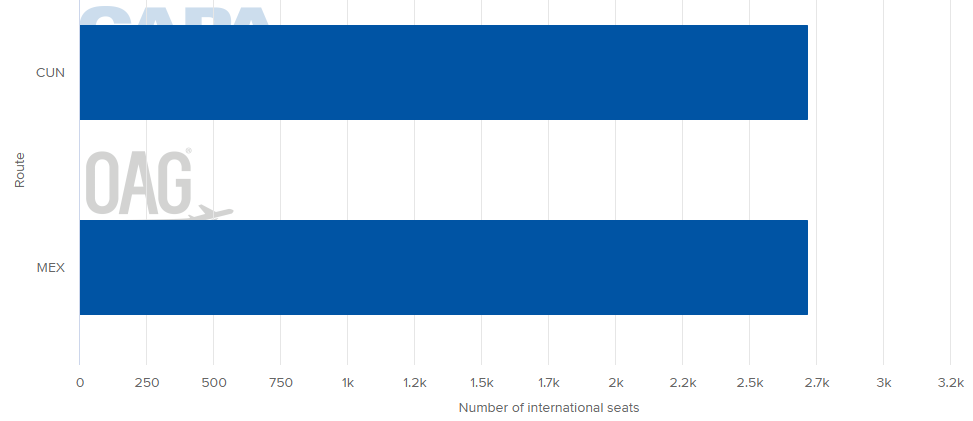

LARGEST INTERNATIONAL DESTINATION MARKETS (w/c 26-Oct-2020)

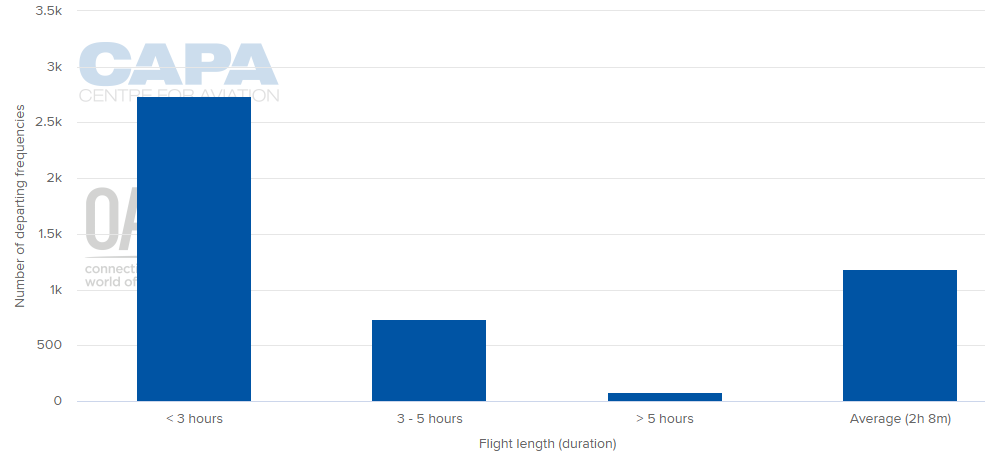

AVERAGE FLIGHT LENGTH (w/c 26-Oct-2020)

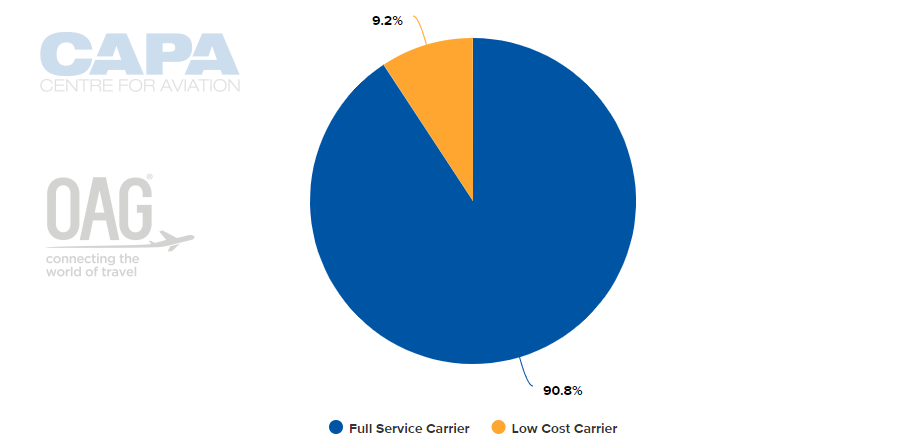

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 26-Oct-2020)

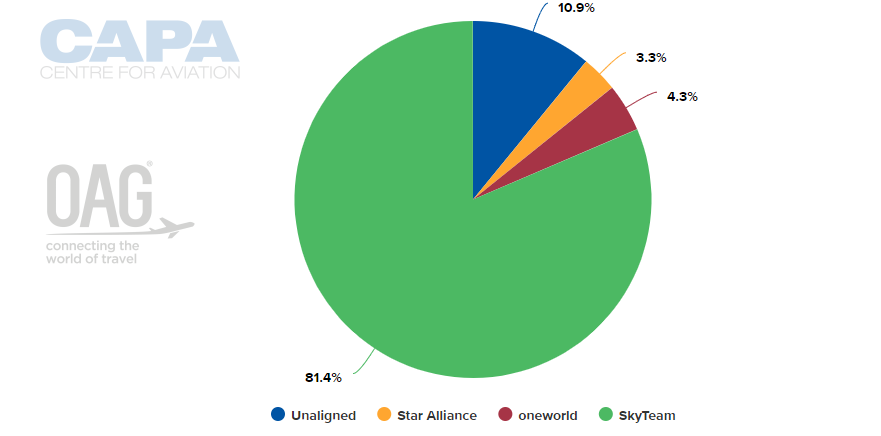

ALLIANCE CAPACITY SPLIT (w/c 26-Oct-2020)

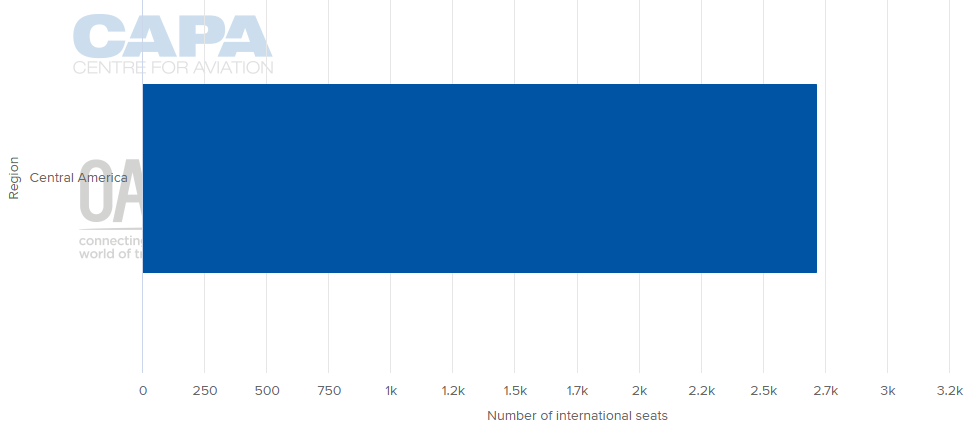

INTERNATIONAL MARKET CAPACITY BREAKDOWN BY REGION (w/c 26-Oct-2020)

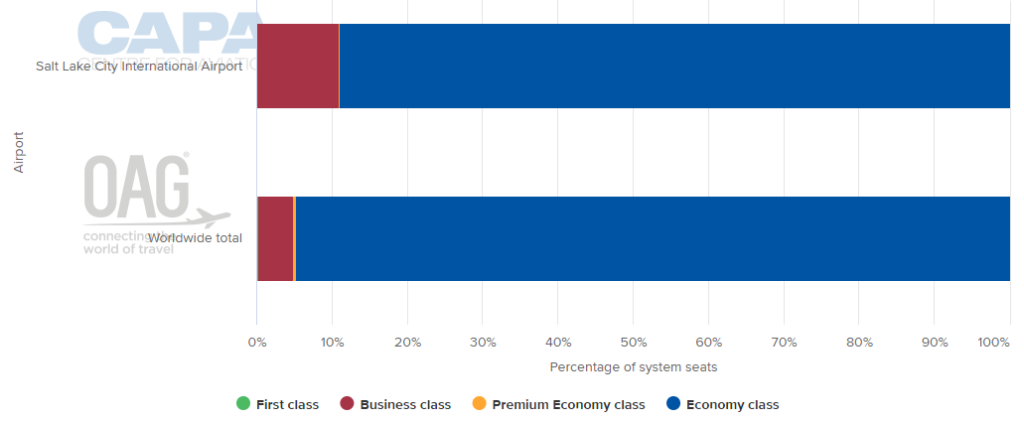

DEPARTING SYSTEM SEATS BY CLASS (w/c 26-Oct-2020)

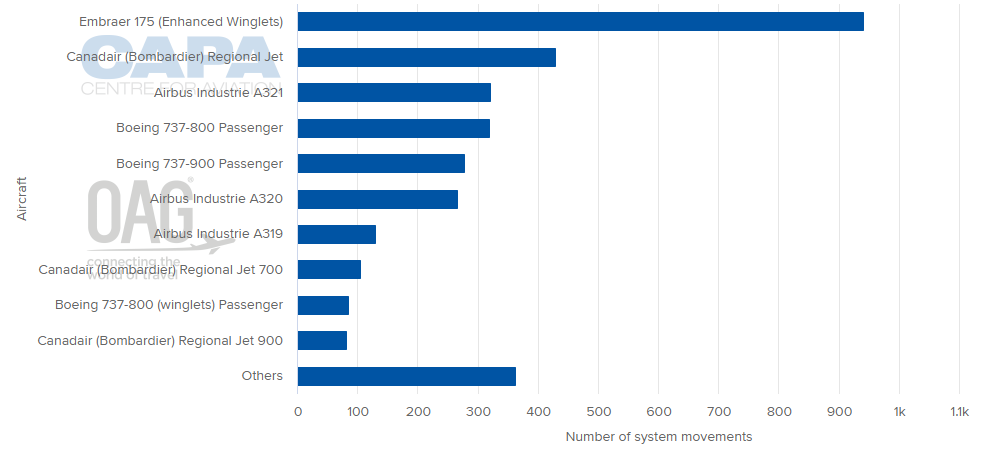

AIRCRAFT OPERATIONS BY MOVEMENTS (w/c 26-Oct-2020)

MORE INSIGHTS...

CAPA Live: US airline operators brace for the long road back

Alaska Air & JetBlue exploit network opportunities as they shrink

Delta Air Lines: return to domestic core hubs after coastal build-up