Singapore has emerged as one of the leaders in the Asia-Pacific region in terms of easing cross-border travel restrictions imposed due to the coronavirus pandemic. The government has taken a range of steps to begin restoring traffic flows in selected markets, including negotiating travel corridors for official and long-stay workers and reducing quarantine requirements. Some transit flights via Singapore have also been allowed to resume.

While significant health-related restrictions still apply, these are significant steps. They stand out particularly due to the lack of progress by other states in restoring international links. Many Asia-Pacific governments say they are in discussions with other countries regarding travel corridors, but only a handful have resulted in formal agreements. A second wave of coronavirus cases across the region has helped cool enthusiasm on opening borders.

Singapore has shown a willingness to look for ways that international travel can be restored to certain markets in a safe manner. As an early mover on this front, Singapore represents an interesting case study for the rest of the Asia-Pacific region.

AIRPORTS IN THE COUNTRY

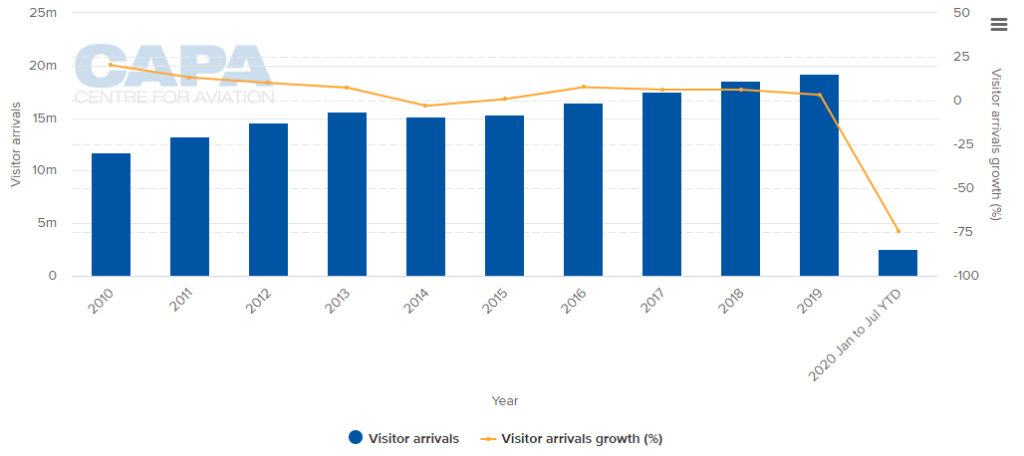

ANNUAL VISITOR ARRIVALS (2010 - 2020YTD)

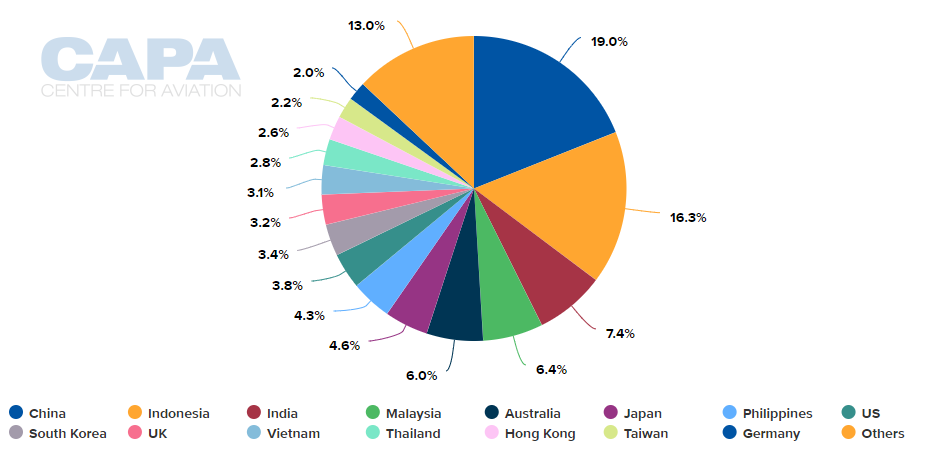

VISITOR ARRIVALS BY MARKET (2019)

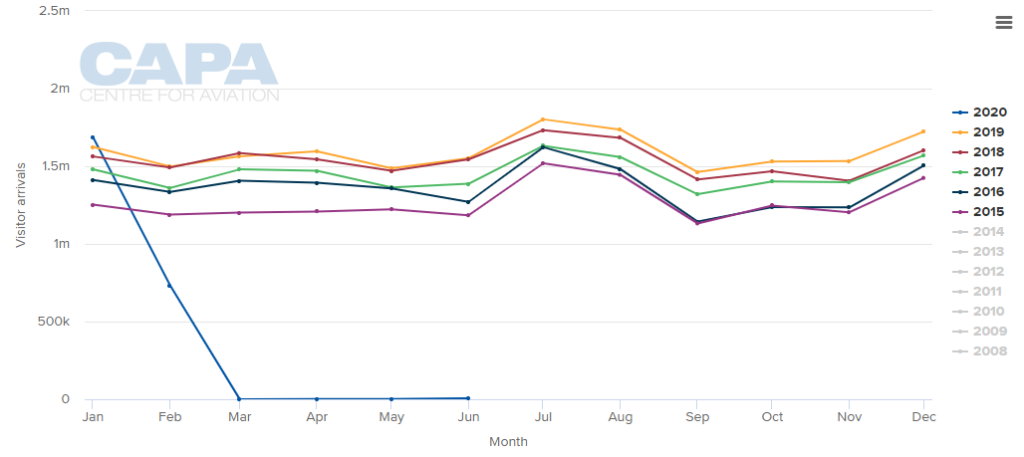

MONTHLY VISITOR ARRIVALS AND SEASONALITY IN DEMAND (2015 - 2020)

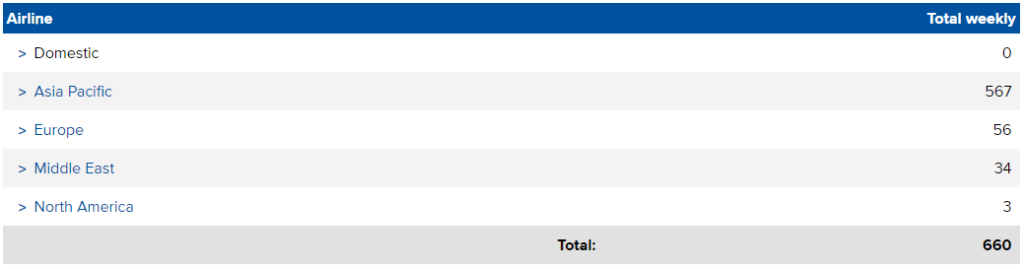

SCHEDULE MOVEMENT SUMMARY (w/c 14-Sep-2020)

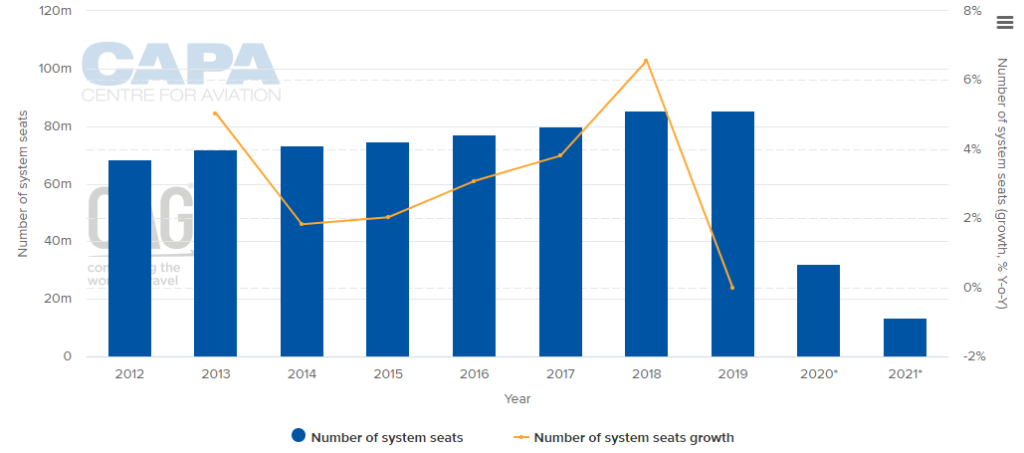

ANNUAL CAPACITY (2012 - 2021*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

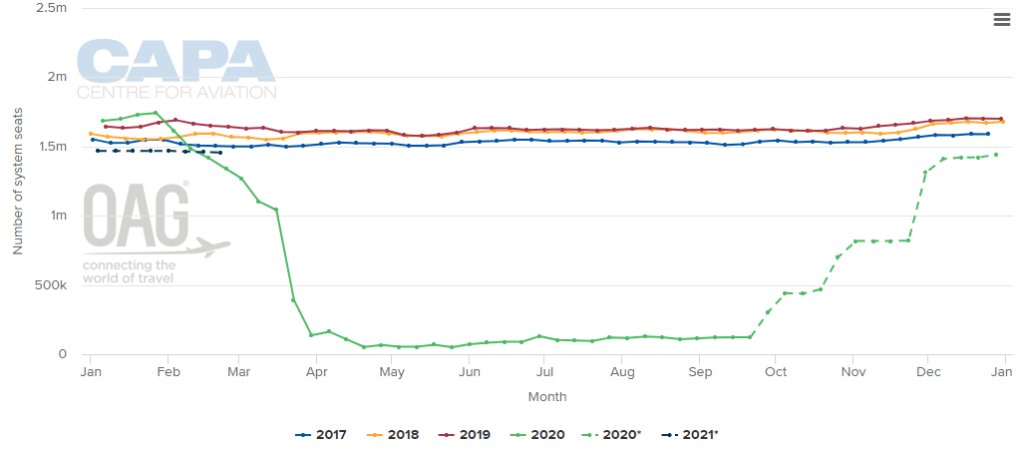

WEEKLY INTERNATIONAL CAPACITY (2017-2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

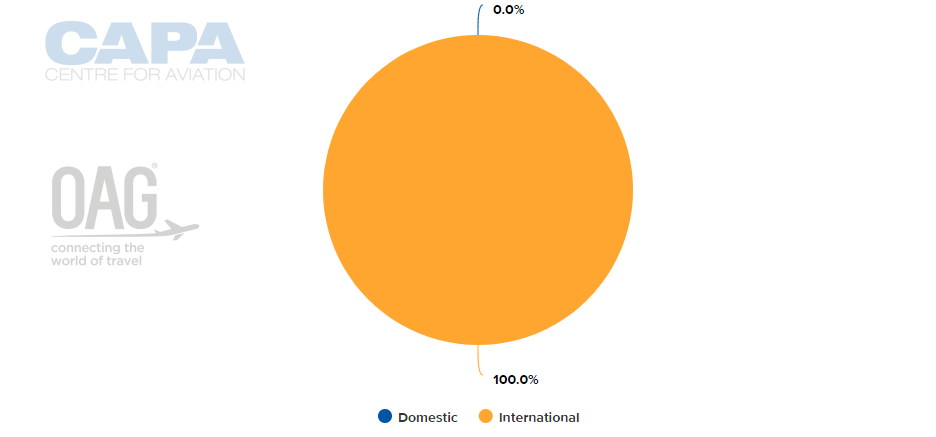

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 14-Sep-2020)

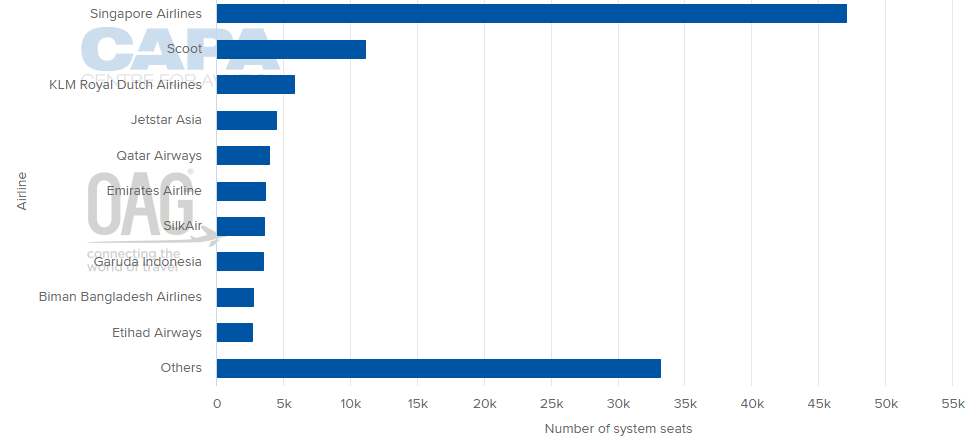

LARGEST AIRLINES BY CAPACITY (w/c 14-Sep-2020)

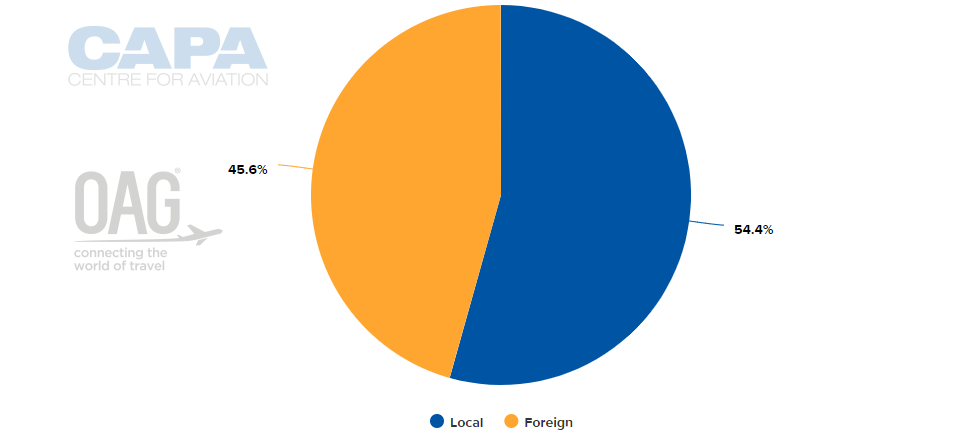

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 14-Sep-2020)

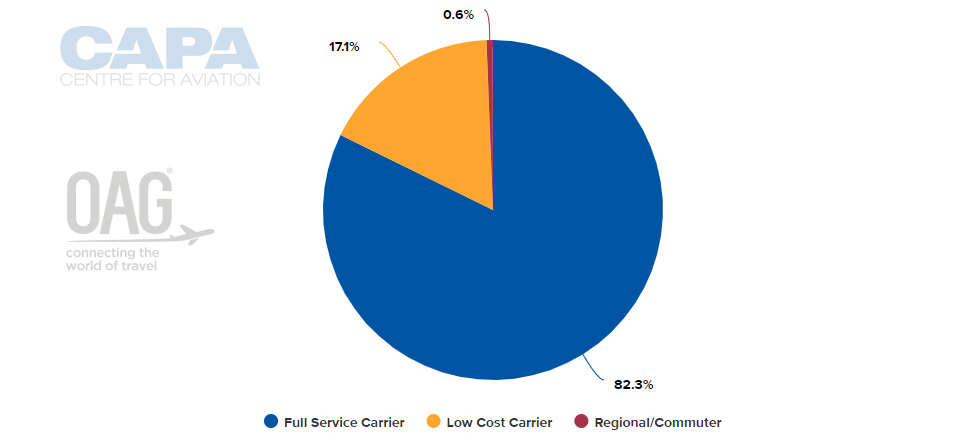

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 14-Sep-2020)

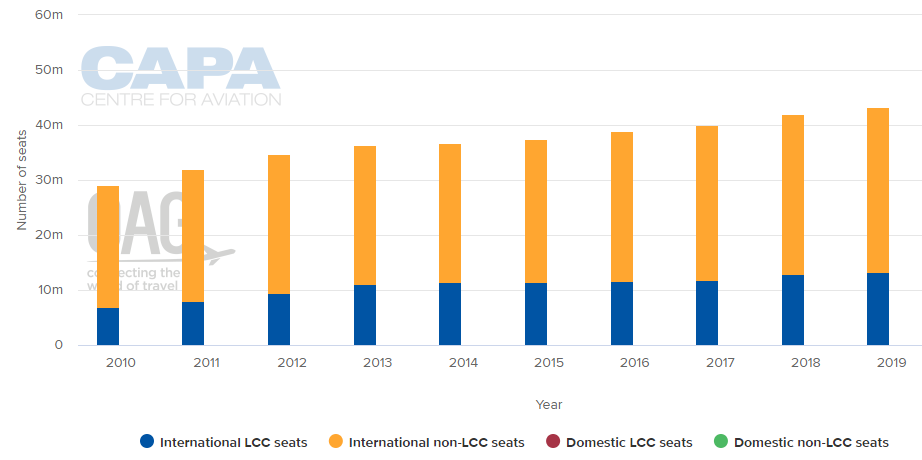

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

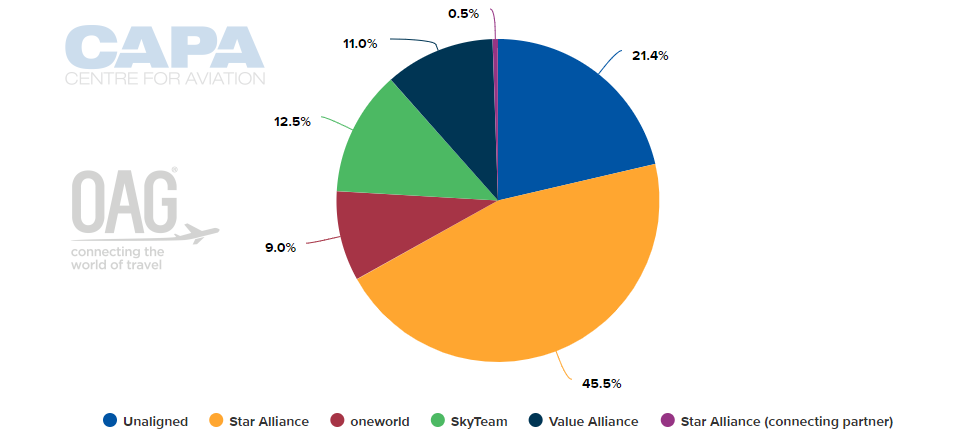

ALLIANCE CAPACITY SPLIT (w/c 14-Sep-2020)

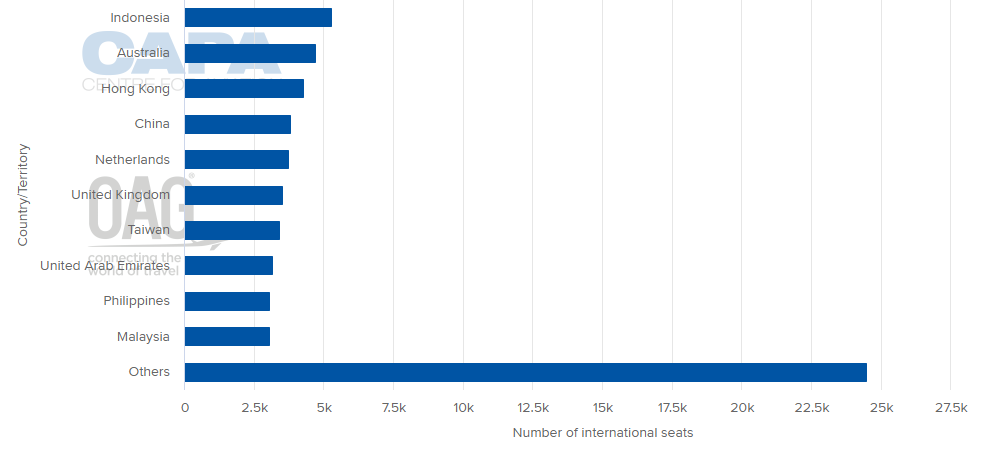

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 14-Sep-2020)

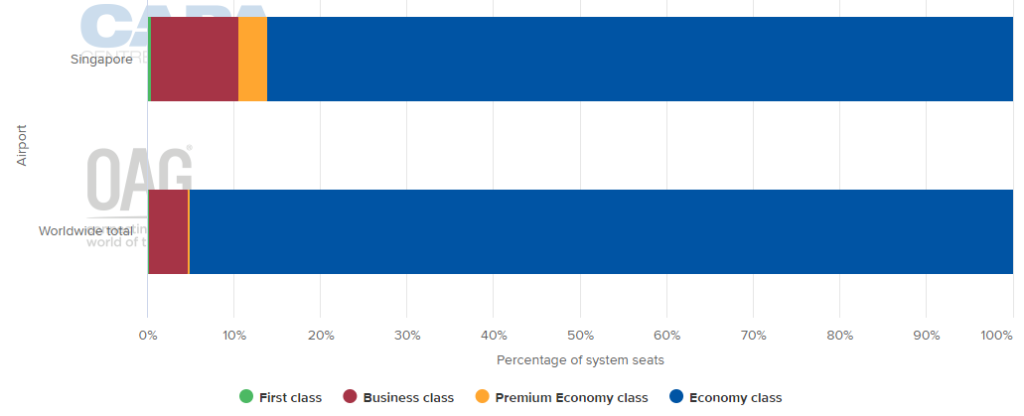

DEPARTING SYSTEM SEATS BY CLASS (w/c 14-Sep-2020)

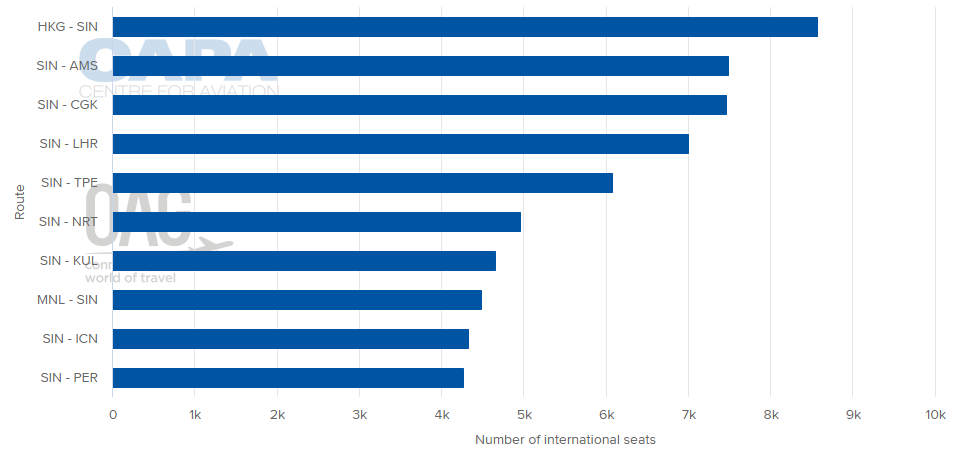

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 14-Sep-2020)

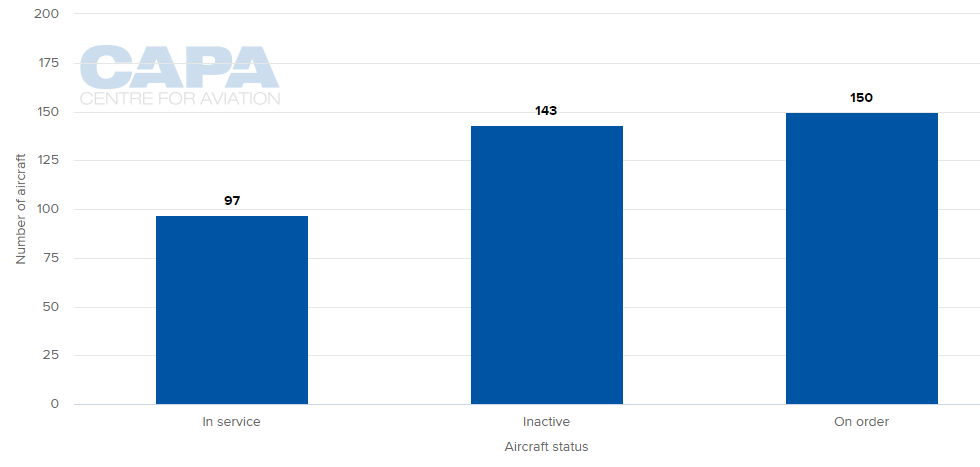

LOCAL AIRLINES' AIRCRAFT FLEET (as at 14-Sep-2020)

MORE INSIGHTS:

Singapore an early mover in restoring international aviation links

COVID-19 forces major change across Asia-Pacific airline industry

COVID-19 disrupts Asia-Pacific airline fleet strategies

Singapore Changi Airport's Terminal 5: government review is ominous