These two factors were a key part of the airline's business model before Covid-19, in fact when it comes to ancillary revenue as a percentage of total revenue the Mexican LCC is among the leaders in the field securing more than 40% of revenue from ancillaries. The carrier believes this strength and the general offer of ancillary services represents a key factor to mitigate the effects of the health contingency.

It says it will allow "to preserve a partial level of the operations running, amid a passenger traffic that is expected to be significantly lowered, and on the other end, with the advance of the normalisation process, it will also allow to offer competitive base fares, to stimulate an agile reactivation of fare revenue".

Similarly, in a post-pandemic environment the airline is confident that its competitive fares will allow it "to stimulate a prompt recovery of the operation."

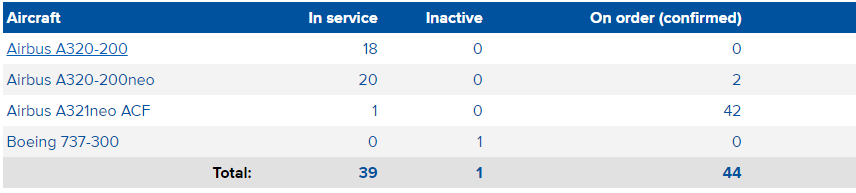

In late Jun-2020 VivaAerobus took delivery of its first A321neo as the airline bases its fleet renewal strategy on the A320neo Family. In 2013 the airline placed an order for 52 A320 Family aircraft, the largest Airbus aircraft order by a single airline in Mexico at the time. In 2017 the airline committed to the A321neo and signed a firm order for 25 additional aircraft. To date, VivaAerobus operates 37 A320 aircraft, including 19 A320neo.

ABOUT

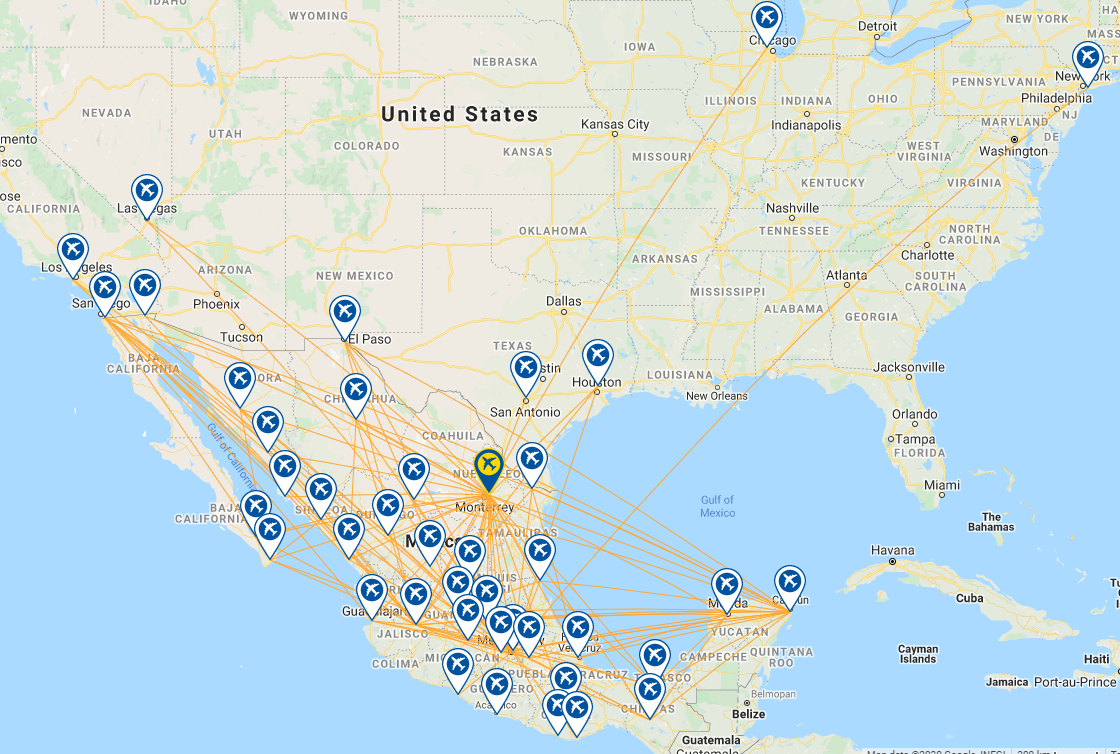

Viva Aerobus launched its first service in Nov-2006. The Mexican low-cost carrier operates from its main base at Monterrey Escobedo International Airport providing domestic services to Mexican Tier I cities and leisure destinations as well as to the US. The carrier also operates to other smaller regional centres. Viva Aerobus was formed as a result of a strategic alliance between Grupo IAMSA, one of Mexico's leading bus transportation providers and Irelandia Aviation, the investment vehicle of the Ryan family-founders of Ryanair. Grupo IAMSA secured Irelandia's 49% stake in Viva Aerobus in 2016. Irelandia, formerly a minority stake holder in Viva Aerobus, involved in starting sister carrier, VivaColombia, with both carriers forming part of multinational airline group; Grupo Viva.

GLOBAL RANKING (as at 07-Sep-2020)

NETWORK MAP (as at 07-Sep-2020)

DESTINATIONS (as at 07-Sep-2020)

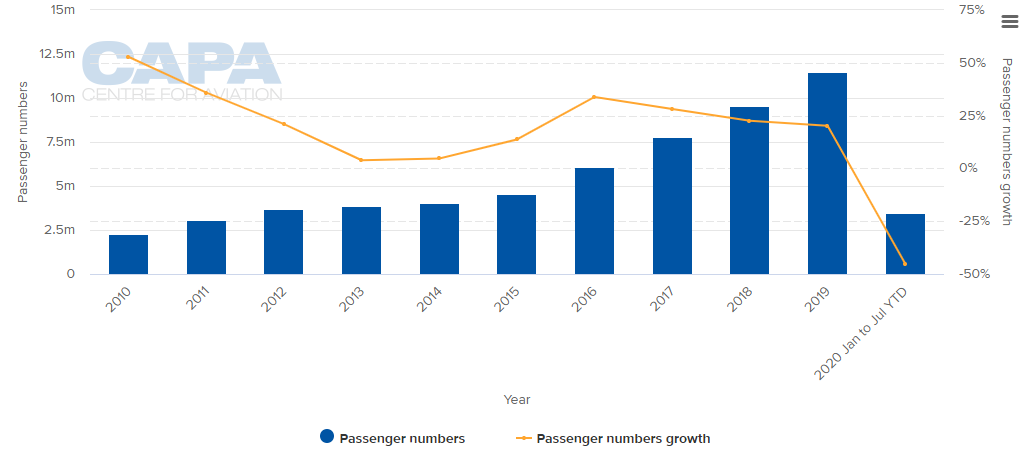

ANNUAL PASSENGER TRAFFIC (2014 - 2019)

CAPACITY SNAPSHOT (versus same week last year)

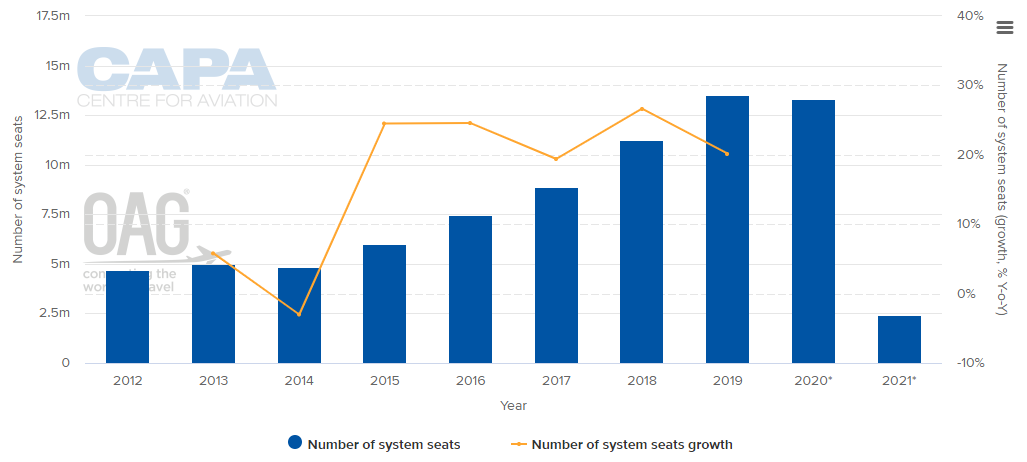

ANNUAL CAPACITY (2012-2020*)(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

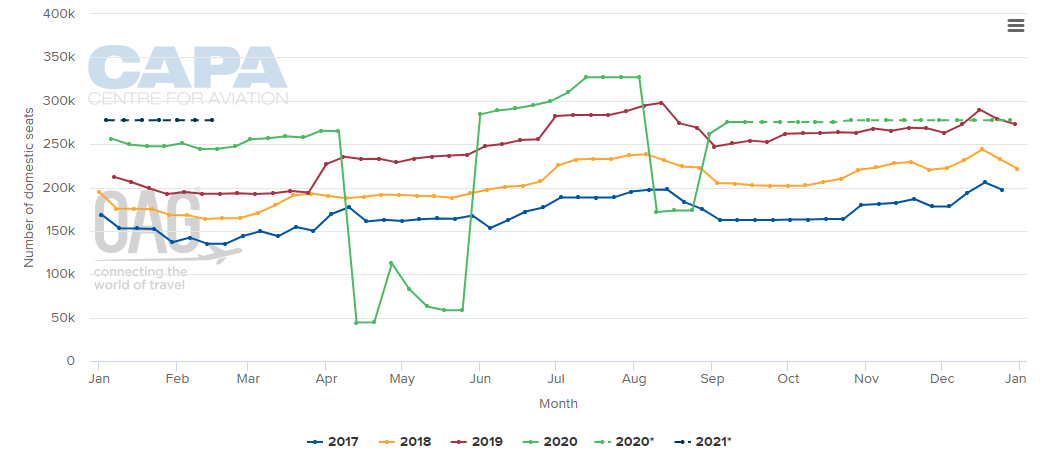

WEEKLY DOMESTIC CAPACITY (2017 - 2020*)(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

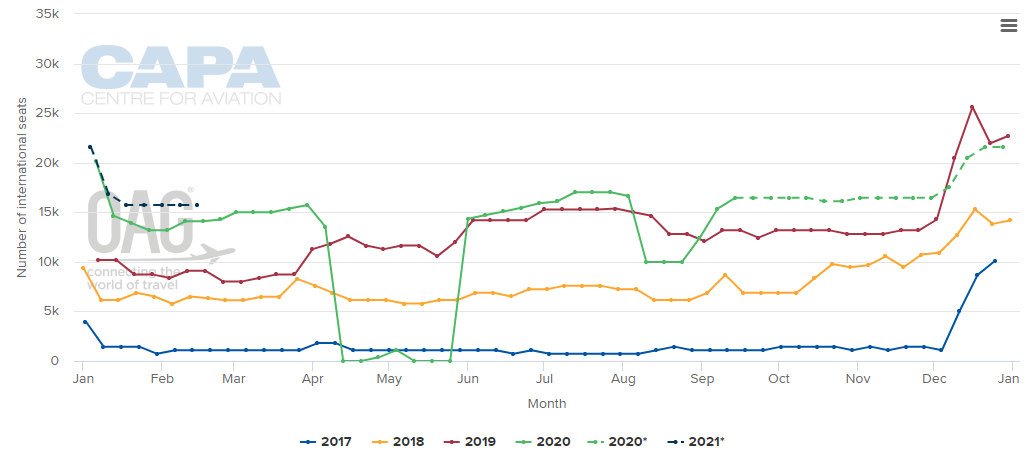

WEEKLY INTERNATIONAL CAPACITY (2017 - 2020*)(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

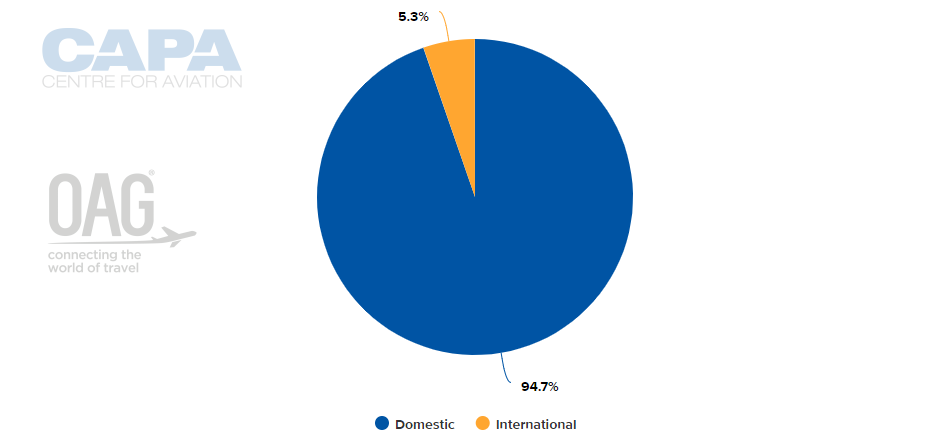

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 07-Sep-2020)

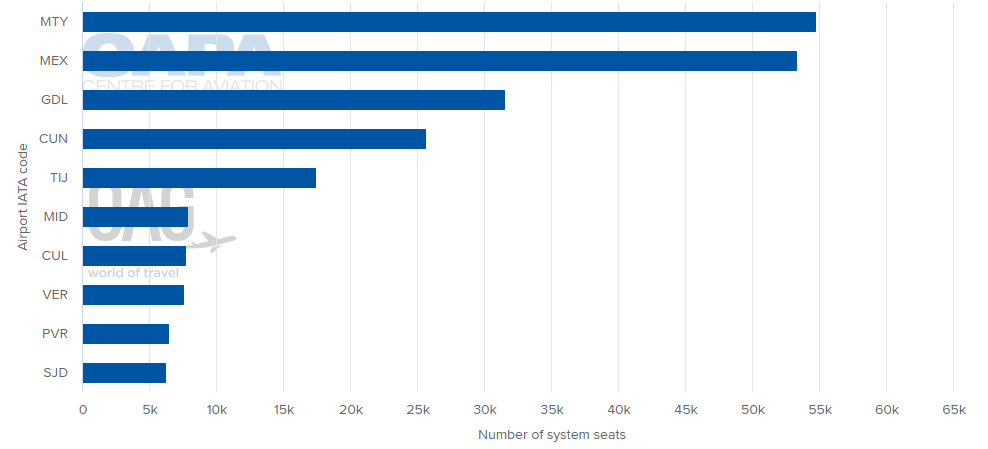

LARGEST NETWORK POINT (w/c 07-Sep-2020)

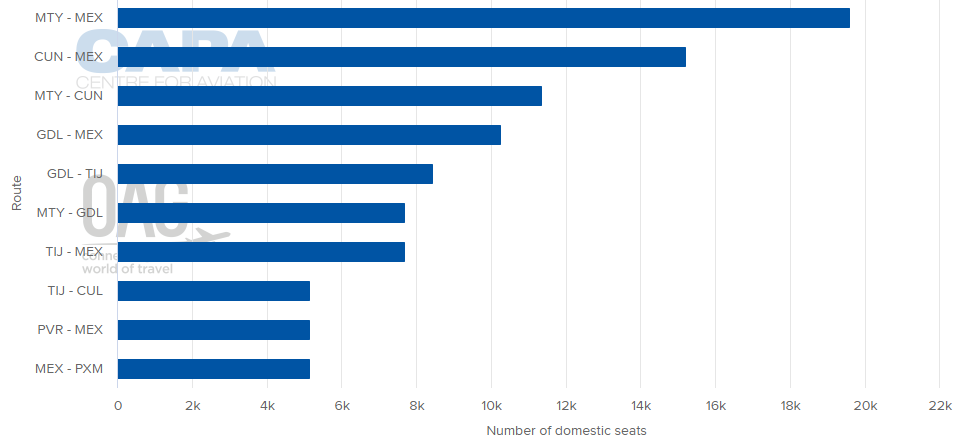

BUSIEST DOMESTIC ROUTES BY CAPACITY (w/c 07-Sep-2020)

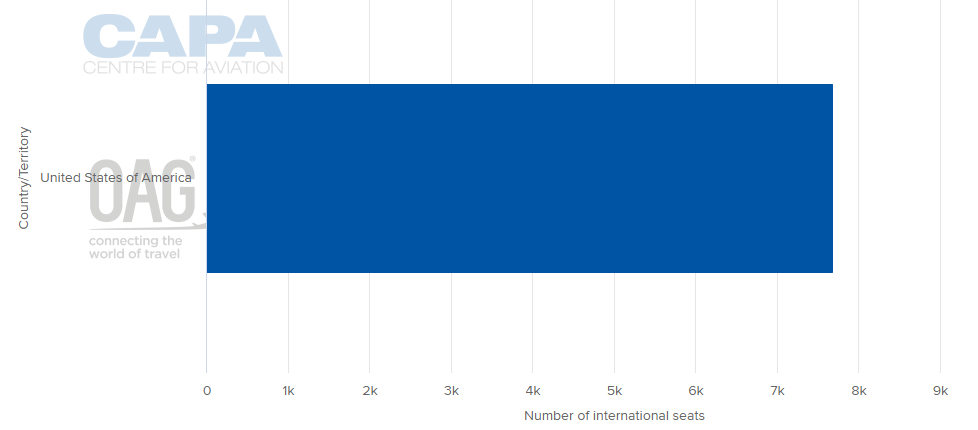

LARGEST INTERNATIONAL MARKETS BY COUNTRY (w/c 07-Sep-2020)

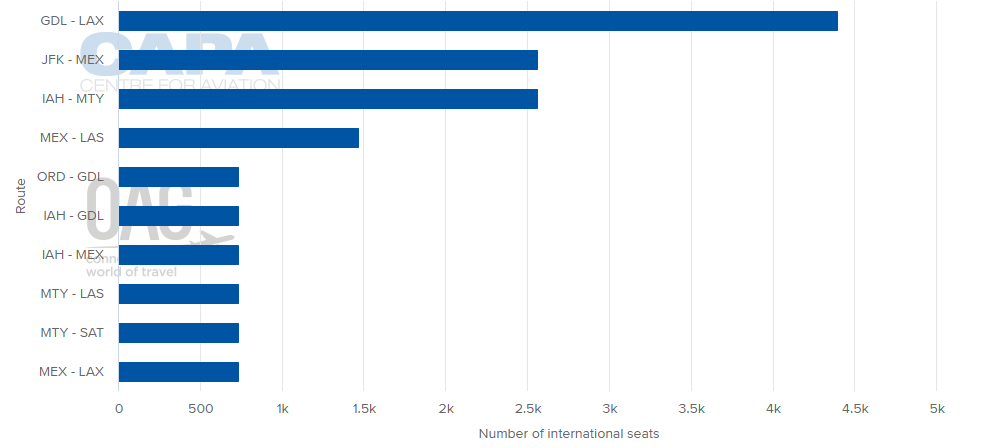

BUSIEST INTERNATIONAL ROUTES BY CAPACITY (w/c 07-Sep-2020)

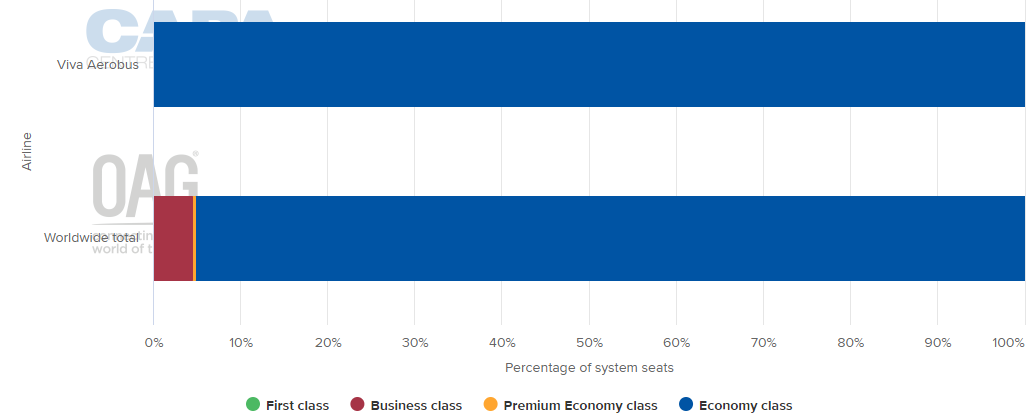

DEPARTING SYSTEM SEATS BY CLASS (w/c 07-Sep-2020)

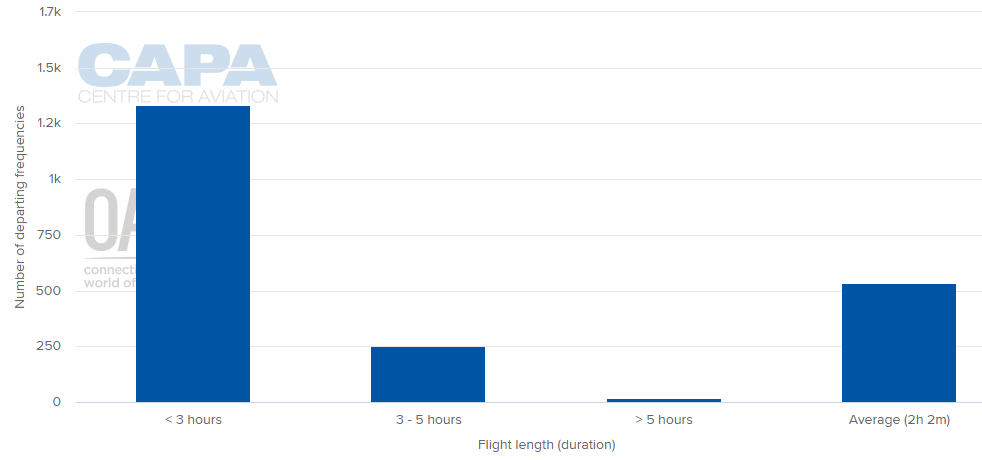

AVERAGE FLIGHT LENGTH (w/c 07-Sep-2020)

FLEET SUMMARY (as at 07-Sep-2020)

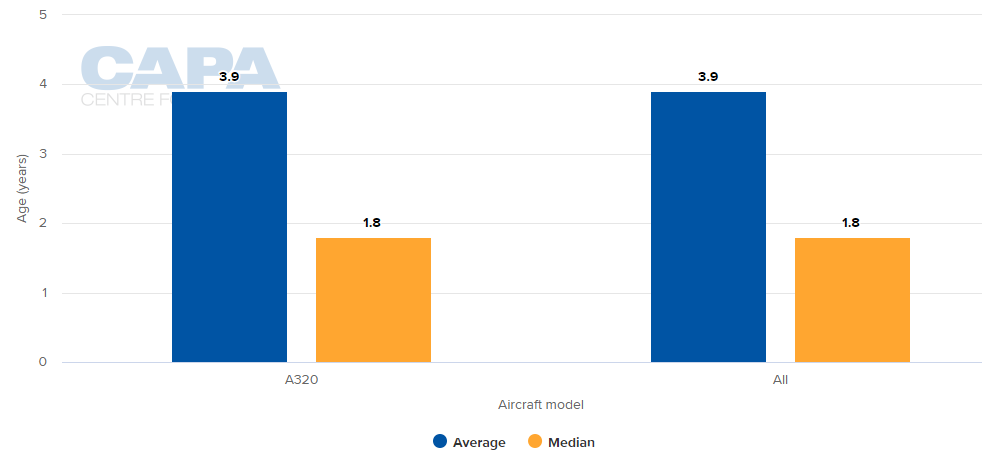

AVERAGE FLEET AGE FOR IN-SERVICE AIRCRAFT (as at 07-Sep-2020)

MORE INSIGHT...

Latin American LCCs take 58% market share as COVID-19 bites

COVID-19: Mexico's airlines - government support and/or consolidation?

COVID 19: Mexico's airlines could face major changes

COVID-19: will the virus pandemic hasten consolidation in Mexico?