Summary:

- Almost two years after first revealing its potential trans-Atlantic aspirations, JetBlue Airways still remains quiet over any plans to go long-haul;

- The airline continues to hold options to convert future A321neo deliveries to the A321neoLR long-range variant of the aircraft;

- JetBlue is seen as the preferred target airline by many airports across Europe for potential trans-Atlantic growth due to its strong Americas feed and Mint premium proposition;

- Any decision is directly linked to a cost reduction programme that seeks to eliminate USD250 million to USD300 million in structural costs by 2020.

The global airline industry, and particularly airports across Europe, have been waiting for JetBlue to firm up its plans. With the low cost long haul market across the Atlantic beginning to evolve, the US carrier is an attractive proposition to airports on the European side given the tremendous feed it can deliver across the Americas and passengers that could sustain even marginal trans-Atlantic city pairs.

The Blue Swan Daily has spoken to many senior air service development officials from across Europe since JetBlue first revealed it was exploring this potential growth market and all have agreed it would be their preferred target airline. Some have even suggested they are happy not to rush into the market with the likes of Norwegian and Primera Air and instead wait until all the potential options are on the table.

JetBlue's July-2016 deal that launched this proposition included 15 Airbus A321ceo (current engine option) and 15 A321neo (new engine option) aircraft, but for deliveries from 2019 it holds the flexibility to configure the neo equipment to the Longer Range version of the A321 - the A321LR, which would be well-suited to possible future transatlantic flights.

In an infographic released at the time to highlight its renewed aircraft commitment the airline highlighted the potential the A321LR could offer as 'new possibilities' with a line pointing from the US Eastern starboard out across the Atlantic. However, it said that while this option is open to the carrier from 2019, it has "not yet committed to this fleet type".

For roughly, two years, the global airline industry at large has been waiting for JetBlue to firm up its plans to cast its net in the trans-Atlantic market. But for now, the airline is still keeping its plans close to its chest. The A321neoLR with its 4,000 nautical mile range has been described as "a gamechanger" by the manufacturer opening up the potential to fly thinner long-haul city pairs in a more sustainable and efficient way to widebody equipment.

As the infographic highlights, JetBlue has made no secret of its potential interest in trans-Atlantic flying, while it similarly has also made no secret that its largest base by departing frequencies, Boston's Logan International Airport, would the launchpad for its long-haul flights. But as 2018 moves toward its mid-point, JetBlue has still not finalised any plans for trans-Atlantic service.

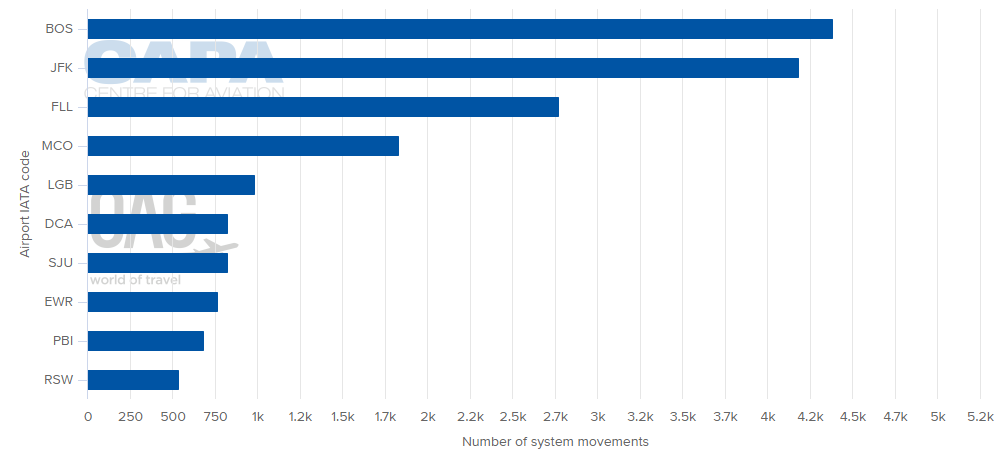

CHART - Boston Logan International Airport is the largest point in the JetBlue network by system movements with a 15.3% share of flight frequencies Source: CAPA - Centre for Aviation and OAG (data: w/c 23-Apr-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 23-Apr-2018)

It is not just the US feed that interests European airports but also the airline's lie-flat premium product Mint that could deliver the premium traffic that would help the profitability of any trans-Atlantic routes in what is a highly competitive market. JetBlue debuted the product on a sub-fleet of specially configured Airbus A321s and states publicly that its introduction has "surpassed expectations on every customer and financial measure".

This has seen the Mint offering expanded beyond the traditional US transcontinental markets to Las Vegas, San Diego and points in the Caribbean, but still JetBlue says it has only 'scratched the service" on what Mint can do to further disrupt markets. According to the CAPA - Centre for Aviation Fleet Database there are 16 Mint seats on the A321 sub-fleet, and four are blocked off as individual private suites.

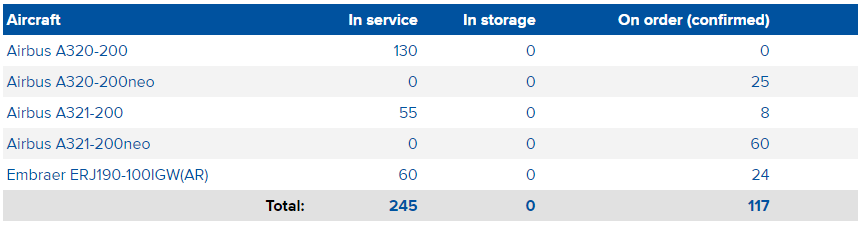

TABLE - JetBlue still has a small number of A321ceo deliveries to be fulfilled by Airbus ahead of the arrival of its A321neos and potentially A321neoLR variants from 2019 Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

As time passes and more new entrants jump into the market it could become a tougher call for JetBlue. Perhaps they are simply playing a waiting game as their remain severe anxiety in the industry over the advent of the low cost long haul model that is dominating the recent capacity growth across trans-Atlantic skies. IAG's recent acquisition of a small shareholding in Norwegian and possible future takeover of the carrier would have certainly sparked interest in the JetBlue boardroom.

But for now, JetBlue remains focused feverishly to slash its costs through a scheme to eliminate USD250 million to USD300 million in structural costs by 2020. At the end of 1Q2018, the airline had achieved USD90 million of those savings. The airline's unit costs excluding fuel jumped +4.8% year-on-year in 2017, and the airline has ambitions to cut its cost inflation to a range from down -1% to a +1% increase in 2018.

JetBlue's evaluation of possible trans-Atlantic service is obviously now being viewed within the lens of the company's cost cutting programme, and any decision to move forward cannot alter the airline's pledge to significantly cut its costs in 2018. But Mint has no doubt helped lift JetBlue's topline revenues. Its operating revenues jumped +5.8% in 2017 to USD7 billion even as it suffered hits to its focus cities of Orlando, Fort Lauderdale and in Puerto Rico in late 2017 from strong hurricanes.

So, as 2018 moves closer to its mid-point, there still remains an underlying excitement that JetBlue's trans-Atlantic ambitions could soon come to fruition, but the long silence and an ongoing cost saving programme may suggest it could now be 'if' rather than 'when'.