The company, which combines technology, knowledge and expertise in connectivity, market intelligence, revenue and distribution management for the hospitality and travel industries, says hoteliers continue to face new challenges due to this period of uncertainty. "The hotel industry will continue to remain cautious and focus on sustainability in 2021," it outlines.

The Hotel Sentiment Outlook 2021, based on a Dec-2020 online story, indicates varying levels of business confidence among hoteliers worldwide. It describes an overall cautious, adaptive, responsive set of actions.

"With the spread of the new COVID-19 strain and fresh lockdowns in certain parts of the world, the travel sector continues to remain unpredictable, with hoteliers focusing on staying resilient and putting together missing pieces in their technology and distribution puzzle, while optimising costs," it says.

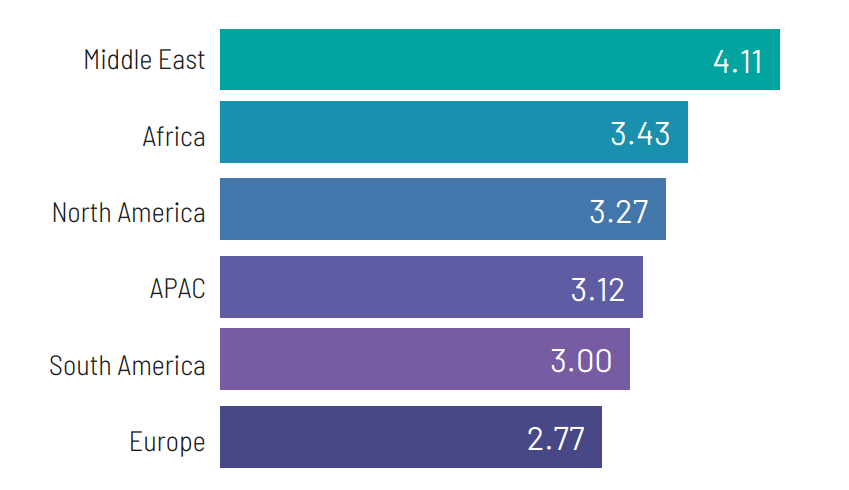

The survey suggests a positive business confidence from hoteliers for 2021, but it is clear that there remains caution. With the news of vaccine roll out, the industry is obviously starting to regain some optimism about the future, but this level of optimism varies regionally with the severity of the negative sentiment the highest in Europe.

The research finds that hotelier confidence has a direct co-relation with the region's response to the pandemic and dependence on inbound travel. "While regions like Middle East are starting to see a strong travel rebound, western markets in Europe and Americas are far from normalcy," it says.

While short term recovery has been witnessed in some regions, especially evident in markets like China, hoteliers feel that recovery would take longer with most people expecting it to reach 2019 levels, possibly by 2024. The consensus of opinion (40%) is that this will happen within two to three years, but 16% believe it will be over three years. An optimistic 16% see recovery in just one year, while 29% forecast one to two years for recovery.

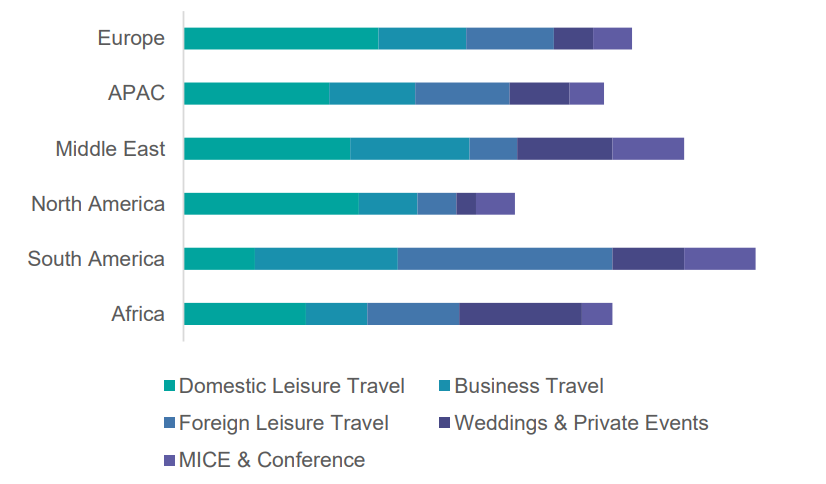

But, confidence in the traditional hotel market "has been decimated," says the report. Even with the arrival of vaccine, hoteliers "do not expect a sudden flip of demand" from international and business travellers. With international travel and the MICE segment coming to a grinding halt as the COVID-19 pandemic spread, the research shows that hotels are changing strategy to look more into the domestic segment.

Hotels have responded quickly to the changing environment. A move to smart contactless technology solutions has been seen across many industries and the report indicates most hotels would prioritise their technology investment to drive occupancy and revenue. The survey findings show that hotels are prioritising online sales to drive demand with channel management and booking engine selected as the technology priorities.

Again, the results show clear regional differences by region - while channel management and booking engine remain top priorities in Europe and Asia Pacific, in North America, hoteliers are likely to invest in their central reservation system (CRS).