The publication follows the 'The Shift to Digital' report and provides some insights into the key trends across the G20 nations that reflect broader consumer spending patterns as travel restrictions on movement due to Covid-19 start to ease and economies begin showing signs of improvement. Most notably that local trips, boutique hotels and consumer travel will be leading trends in the Covid-19 recovery.

Although we have all been looking to Asia Pacific for recovery, the report notes that in terms of spending on air travel it is Europe that is actually leading the way as a result of the opening of corridors across the Continent. Many Asian countries are further along in navigating Covid-19 than their European counterparts, but recovery "is more contingent on domestic sentiment than regional arrangements," highlights the report.

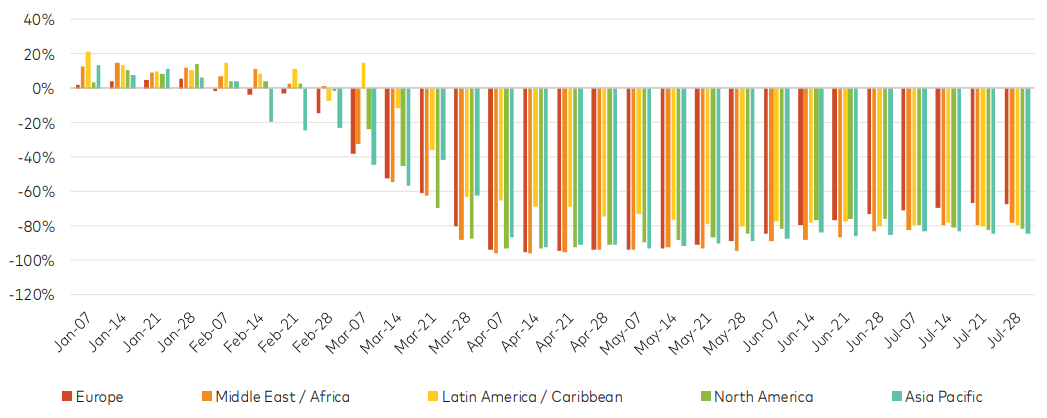

CHART - The percentage growth of airline spend by region in 2020 relative to the same time last year highlights the improvements in Europe air travel spendSource: Mastercard Recovery Insights: Travel Check-In

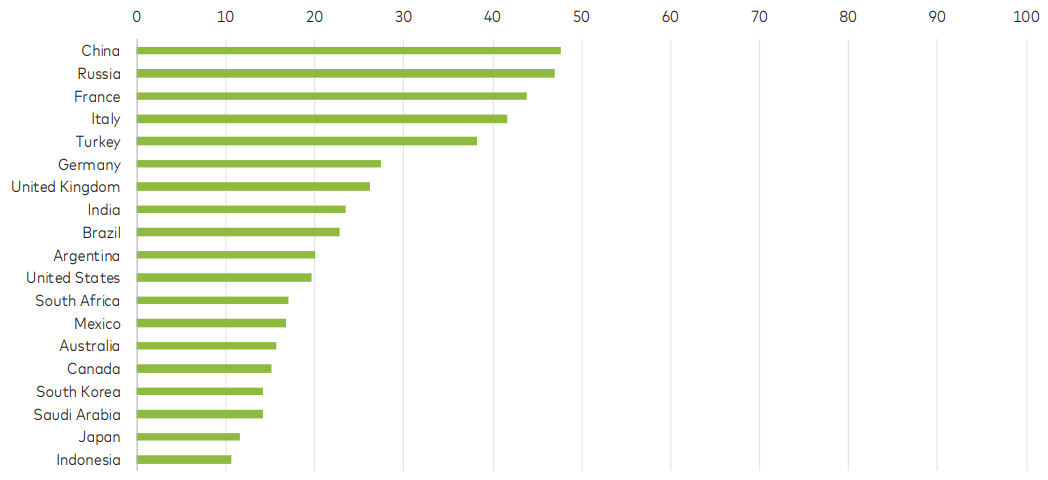

Still, while Europe might be leading the regional recovery through intra-regional travel, some larger individual countries are recovering relatively quickly in terms of domestic airline travel. That's noticeable particularly in the BRIC countries of Brazil, Russia, India and China, highlights the report, but the impact of domestic and regional considerations means recovery varies across the four. "China and Russia stand out globally, while Brazil and India are recovering quickly relative to overall regional levels," it says.

CHART - China and Russia top the G20 nations in airline spend recovery, while five geographically smaller countries - France, Italy, Turkey, Germany and the UK - also make the top ten benefitting particularly from the opening of intra-regional travel in EuropeSource: Mastercard Recovery Insights: Travel Check-In (data: Jul-2020 relative to last year, where Jul-2019=100)

But, notably consumer air travel is recovering faster than commercial air travel. Obviously, this is a potential concern for airlines because commercial travel is the more profitable for airlines of the two. We have reported widely on the reasons for this, but the report provides some numbers to support the observations. According to Mastercard, consumer spend in Jul-2020 was down -73% year-on-year, but commercial spend was down by -84%.

As we are particularly seeing with domestic travel across the United States of America, ground transport is playing a wider role in the recovery and in Europe that supports the international as well as the domestic markets. "The number of travellers crossing European borders by land means the actual travel recovery story there is better than the one told solely by the airlines," recognises the Mastercard report.

It cites that across Europe, cross-border gasoline sales are now surging relative to the rest of the world, likely influenced by the current "ease of driving across borders relative to flying, a perception of greater safety in an individual vehicle and the ability to control the entire journey door-to-door".

When looking at spending across all modes of transportation, it notes, car rentals in Europe have remained relatively steady compared to pre-Covid levels and now take a larger share of overall spend. Likewise, other transportation options in Europe have also grown in share, largely on account of domestic public transport.

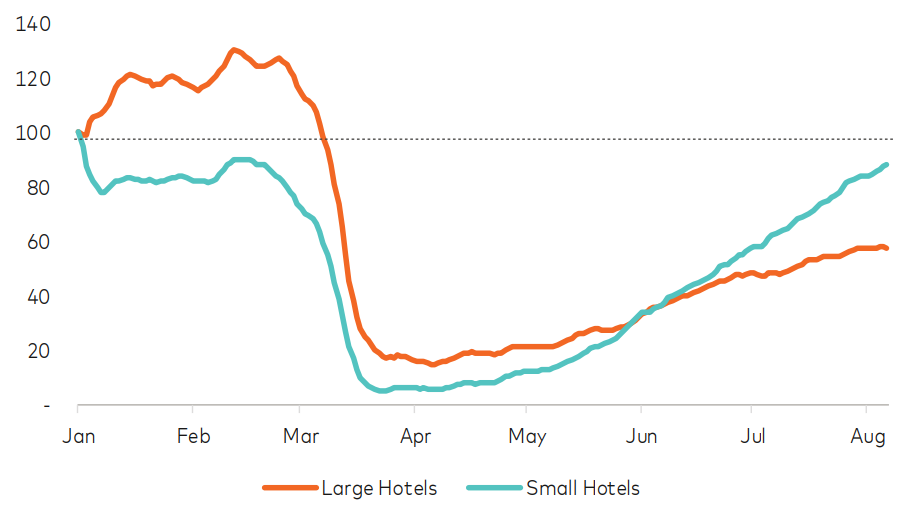

CHART - Mastercard's research shows the global recovery rate of small independent hotels has outpaced the recovery of large hotels by more than 50%Source: Mastercard Recovery Insights: Travel Check-In(data: 07-Jan-2020=100)

It is clear that global travel is bouncing back with a more local focus. The Mastercard report identifies three clear trends already emerging within the recovery - "localism takes off, boutique is chic and consumer travel leads the recovery.

It notes that "consumers are getting out and spending but maintaining a tighter footprint with a 'home-centred retail radius'" that "travellers are increasingly opting to stay small - with a rise in spending at boutique hotels" and that analysis of consumer cards compared to business cards shows "spending on consumer air travel and auto rentals is returning ahead of commercial travel".