'Privatisation' of airport assets there remains a work-in-progress but it has been since the Airport Privatisation Programme was initiated in 1996. To date there is still only one successful deal, for the lease of the San Juan Luis Munoz Marin airport in Puerto Rico (itself a PPP), which is controlled by Mexican and Canadian interests. Privatisation means 'lease' in the US. Wholesale private sector ownership is not permitted except under very specific circumstances though it is understood that impediment is under review.

There are many reasons why airport privatisation has failed to gain acceptance in the US while it has elsewhere but fundamental to them is the fear of loss of control by the municipalities and counties that own the airports. One of the benefits of the PPP is that to a greater or lesser degree those public authorities do not lose that control, while acquiring the external finance they need in the face of shrinking budgets of their own. The PPP modus operandi and scope is 'design, build, finance, operate, and maintain'. The model is well known in parts of Europe and South America, but has been little used in the US until recently.

There are already PPPs or P3s as they are known in the US to build or renovate terminals at New York's LaGuardia Airport (the Central Terminal replacement project), also at Denver, Austin and possibly Kansas City.

In Denver the project is the renovation of the main terminal, which long ago exceeded its design capacity of 50 million annual passengers. The redesigned terminal will be able to handle 80 million and will cost USD1 billion for a 34-year concession.

Austin, the state capital of Texas, had a smaller project to renovate a terminal which was previously built and managed under private contract but had to close down. The USD12.5 million renovation, for a 30-year concession (in an intriguing retro style), was being handled by a US company. Meanwhile at Kansas City another US company is negotiating a deal to replace the old multi-terminal design with a single terminal, using private financing to save USD500 million.

The interesting thing is that this spate of PPPs seems to have reinvigorated the market for the lease of airport buildings generally (runways are not part of the deal - they are financed by passenger taxes and Federal Aviation Administration grants).

For example both the St Louis Lambert International and Nashville International airports have expressed interest in partaking in the Airport Privatisation Programme, the first serious enquiries since the Puerto Rico deal and the projected lease on Chicago Midway Airport, which fell through for a second time in 2013. The problem now is a unique one: both airports would qualify in the 'major hub airport' category and there is only room for one in the schedule!

Also of note is the fact that in a political milieu that is becoming increasingly protectionist in the US (and which might explode if the government blocks trade with China over North Korea's military exploits) it is a European country that is leading the way both with airport PPPs and potential lease deals.

Spain's Ferrovial Aeropuertos signed a contract for the remodelling and commercial operation of the Jeppesen terminal at Denver International Airport in Aug-2017. The firm expects to complete financial closure in 4Q2017. Ferrovial has observed that the number of public-private partnership projects has expanded "rapidly" in the US, a trend it expects will continue.

Ferrovial is already the lead in the consortium FerroStar Westchester Airport Partners, which has submitted an ambitious management and operation proposal for the airport of that name in New York State. Moreover, it intends to submit proposals in respect of both the Nashville and St Louis airports at the appropriate moment.

The company is one of the world's leading privately-owned airport investors and operators and figures as one of only 53 'Major Global Investors' (out of 811 profiles) in the CAPA - Centre for Aviation Global Airport Investors Database. The company has invested in 33 airports since it entered the business in 1998. Its early investments were in airports such as what is now the Belfast George Best City Airport in Northern Ireland (UK) and at Antofagasta in Chile. Its portfolio is now much more diverse. It is currently the main shareholder of London Heathrow Airport (though its holding there has shrunk) and it owns 50% of Aberdeen, Glasgow and Southampton airports in the UK (with Macquarie Group). More than 90 million passengers used the group's airports in 2016.

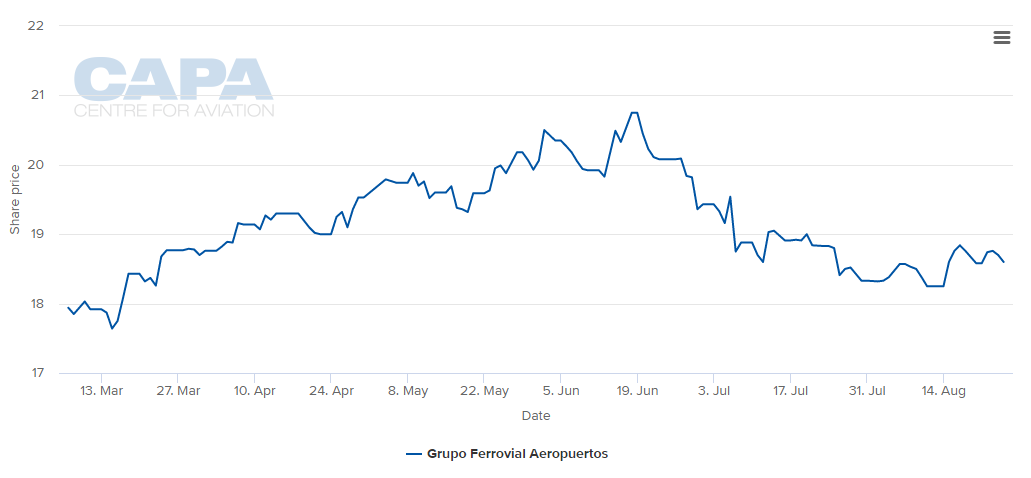

Grupo Ferrovial's share price had been on the rise during the second quarter of the year, but has declined over the last two months to levels last seen in March 2017 Source: CAPA - Centre for Aviation and stock exchanges

Source: CAPA - Centre for Aviation and stock exchanges

In the last year it has shown interest in Belgrade Airport, Sofia and Plovdiv airports in Bulgaria and in the most recent tranche of four airports that were privatised in Brazil.

CAPA - Centre for Aviation has a wealth of material on airport privatisation (news and analytical reports) going back to the early 2000s, together with the world's leading databases on investors and construction projects. Visit centreforaviation.com to find out more.