Summary:

- EVA Air plans to transition the Taipei-Brisbane route from A330s to 787s, resulting in capacity increases and product improvements;

- The airline has lie flat business class seats with all aisle access on its new 787 Dreamliner fleet;

- The older A330-200s that are currently used to Brisbane have angled flat seats in an undesirable six abreast configuration;

- Brisbane is EVA's only destination in Australia and the airline has no plans to add other Australia cities due to the aggressive expansion from China Airlines.

In receiving its first 787-9, EVA stated the new type would be used on long-haul routes to Australia and Europe. However, it is also intending to operate the larger 787-10 to Australia. The airline could initially transition Taipei-Brisbane to 787-9s in 1H2019 and later introduce 787-10s as the larger variant aircraft are delivered. EVA could also potentially use a mix of 787-9s and 787-10s with the larger 787-10s operating during the peak season.

EVA currently operates four to five weekly flights to Brisbane (depending on the time of year) using A330-200s. EVA configures its A330-200s with 252 seats, including 24 angled flat business class seats in 2x2x2 configuration and 228 economy seats in 2x4x2 configuration.

The airline has configured its new 787-9 fleet with 304 seats, including 26 lie flat business seats in a 1x2x1 configuration (providing aisle access from all seats) and 278 economy seats in a 3x3x3 configuration. The 787-9 will therefore result in a 21% increase in capacity compared to the A330-200. Business class capacity will increase by a modest 8% but the product will improve significantly and should enable the airline to attract more corporate traffic.

https://corporatetravelcommunity.com/eva-begins-dreamliner-operations-plans-to-downgauge-amsterdam-and-vienna-from-777-300ers-to-787-9s/

EVA has not announced a configuration for the larger 787-10, which will be delivered from 2Q2019. EVA president Clay Sun said on the sidelines of the Association of Asia Pacific Airlines (AAPA) Assembly of Presidents that the airline is also installing lie flat business class seats on the 787-10 and will not be including a premium economy cabin as the type will only be used on regional routes within Asia Pacific.

Mr Sun said Taipei-Brisbane, which is about a nine-hour flight, will be the longest route for EVA's 787-10 fleet. The 787-10 would result in a significant capacity increase for the Brisbane market as EVA plans to maintain its current Brisbane schedule.

EVA has no plans to add frequencies to Brisbane or launch a second destination in Australia, according to Mr Sun. The airline doubled capacity on Taipei-Brisbane two years ago as prior to Oct-2016 it only operated two frequencies most of the year with a seasonal third frequency during peak periods.

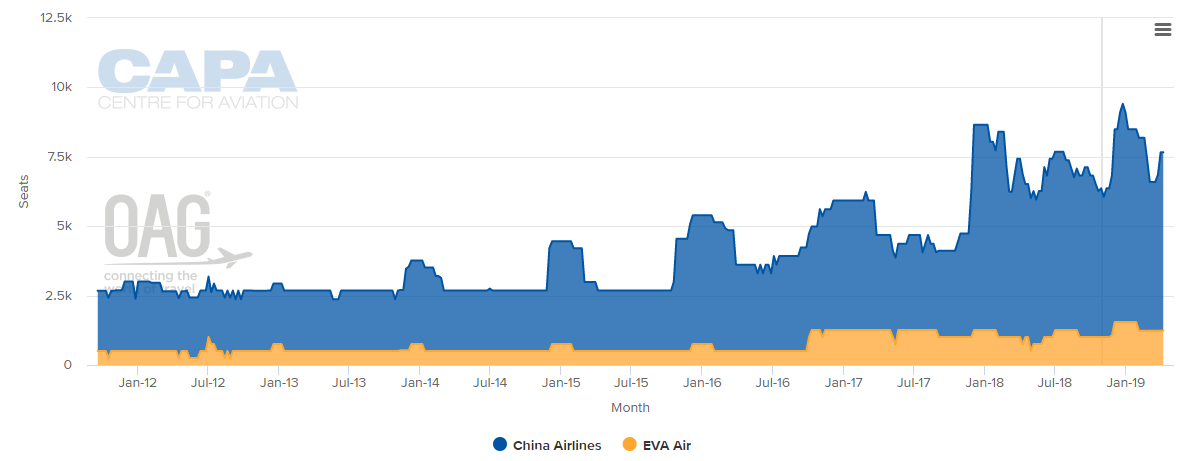

CHART - There has been a significant rise in nonstop capacity between Taiwan and Australia over the past couple of years Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

More recently its rival China Airlines (CAL) has pursued rapid expansion in Australia. In late 2017 CAL upgraded Taipei-Sydney from five weekly A330-300 to 14 weekly A350-900 frequencies. Similarly, Taipei-Brisbane was boosted from five to seven weekly A330-300 frequencies in late 2017 and the A350-900s introduced on this route in Mar-2018. The same month, CAL upgauged Taipei-Melbourne from three weekly A330-300 frequencies to three weekly A350-900 flights.

CAL is adding more capacity this winter as it upgauges Brisbane and Melbourne to 777-300ERs. Sydney will still be operated with A350-900s but the full schedule of 14 weekly flights is only being offered this winter for two weeks in December; CAL has cut Sydney back to as little as seven weekly frequencies during off peak periods.

EVA has noticed how CAL has struggled in Australia and is keen to avoid a similar experience. CAL has had to rely heavily on Australia-Europe traffic to fill up its additional Australia capacity. EVA is not interested in the kangaroo route, which is very competitive and low yielding, and by maintaining a relatively small presence in Australia (four to five weekly flights), it can focus on the higher yielding local market and profitability should improve as more efficient 787s are introduced with a significantly better inflight product.