Summary:

- Full abolition of Austria's air passenger taxes would increase GDP by EUR320 million per annum and create 1,000 new jobs by 2030, says PricewaterhouseCoopers LLP report;

- PwC says a full abolition scenario would also see the Austrian aviation sector become EUR160 million larger by 2030;

- In the shorter term, full abolition would enable 2.3 million new arrivals and EUR460 million in additional tourism spending by 2020;

- In Mar-2017 the Austrian government took an initial step towards removing its air passenger tax by introducing a 50% reduction in the levy from 01-Jan-2018.

The PwC study 'The economic impact of abolishing aviation taxes in Austria' reveals sizeable increases in Austrian GDP in the years following a complete abolition of the Air Transport Levy passenger tax. Based on 2017 data, PwC says a full abolition scenario would also see the Austrian aviation sector become EUR160 million larger by 2030. In the shorter term, full abolition would enable 2.3 million new arrivals and EUR460 million in additional tourism spending by 2020 and having spillover effects on other associated industries, such as agriculture, transportation, manufacturing and financial services sectors.

In Mar-2017, the Austrian Government reduced its air transport levy by 50%, with new rates effective 01-Jan-2018. While the industry has welcomed this cut, many believe nothing but a full removal of the levy will enable Austria to see the maximum economic benefits from its aviation sector.

"The reduction does not go far enough," says Thomas Reynaert, managing director of Airlines 4 Europe. "The PwC findings reinforce our call for a complete abolition of the tax in order to maintain a competitive travel market and continue to drive future growth."

The PWC study shows that under both tax cut scenarios, real GDP increases the year immediately following the tax cut (relative to the baseline scenario of no change) - however with clear differences in terms of the impact. For example, under the full abolition scenario, net tourism expenditure would increase to EUR196 million per year in 2030 compared to EUR91 million in the half scenario.

Tourism data from Vienna, Austria's capital city, shows that over the past ten years the growth in overnight stays "from overseas has been twice as high as growth from Europe," says the city's director of tourism, Norbert Kettner. "This shows how extremely dependent tourism in particular - but also the associated economic sectors are, on being reachable by air."

Mr Kettner acknowledges "the boom in city tourism in recent years would not have been possible without airlines." He adds: "Abolishing the ticket tax would be one means of achieving many benefits for the location, the economy and the labour market, as well as ensuring fairness in global competition.

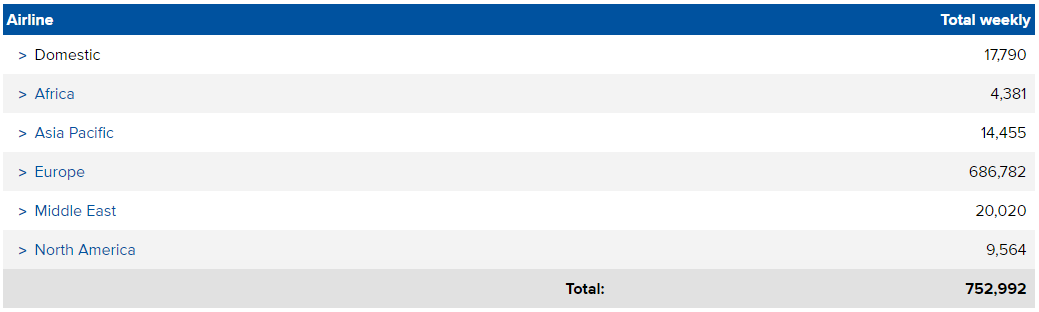

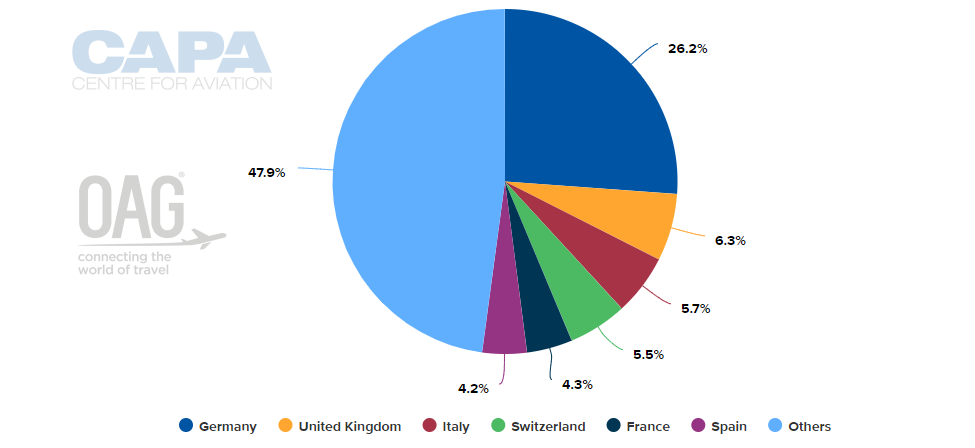

The Austrian market is dominated by national carrier Austrian Airlines which accounts for just over one in every two (50.5%) system seats, based on OAG schedules for the current week. In fact the Lufthansa Group airlines account for more than two thirds of system seats. Despite the departure tax, total system capacity in Austria increased +4.0% in 2017, its fastest annual year-over-year rise since 2014, with levels for 2018 trending ahead of last year.

CHART - The Austrian market has a heavy focus on the European market (top) with Germany, United Kingdom, Italy, Switzerland and France its largest markets (bottom) in terms of capacity

Source: CAPA - Centre for Aviation and OAG (data: w/c 07-May-2018)

An earlier PWC study on the Italian market suggested sizeable increases in Italian GDP in the years following the abolition of the Council City Tax ("Addizionale Comunale"). Most notably, GDP would increase by EUR880 million in the first year alone, growing to reach EUR1.74 billion per year by 2030 (compared with no changes to the current baseline/taxes levied).

The study additionally found that more than 3,750 jobs across all sectors of the economy would be created in the first two years following the implementation, with 7,500 new jobs created by 2030. Finally, Italy's aviation sector would also see an uplift - reaching EUR480 million per year in 2020, and EUR590 million per year by 2030.

In fact, a wider PwC study on the impact of abolishing aviation taxes across the whole EU as of January 2018 reveals that Europe's tourism industry would be the largest beneficiary. Under this scenario, the full abolition of all air passenger taxes in Europe could add more than 45 million arrivals between 2018-2020, some 25.4 million of them tourists, according to the study.

Currently, Austria, Croatia, France, Germany, Greece, Italy, Latvia, Luxembourg, Norway and the UK levy air passenger taxes. Sweden (2018) and the Netherlands (2021) are planning to introduce them in the future.