Summary:

- GMR Infrastructure's search for debt relief at its airport unit ends with three investors taking 45% of the equity;

- GMR Airports includes the Delhi and Hyderabad airport gateways among its local portfolio which also extends beyond India;

- The deal sees TATA Group, already involved in the airline sector, make its successful entry into airport ownership after more than a decade of trying.

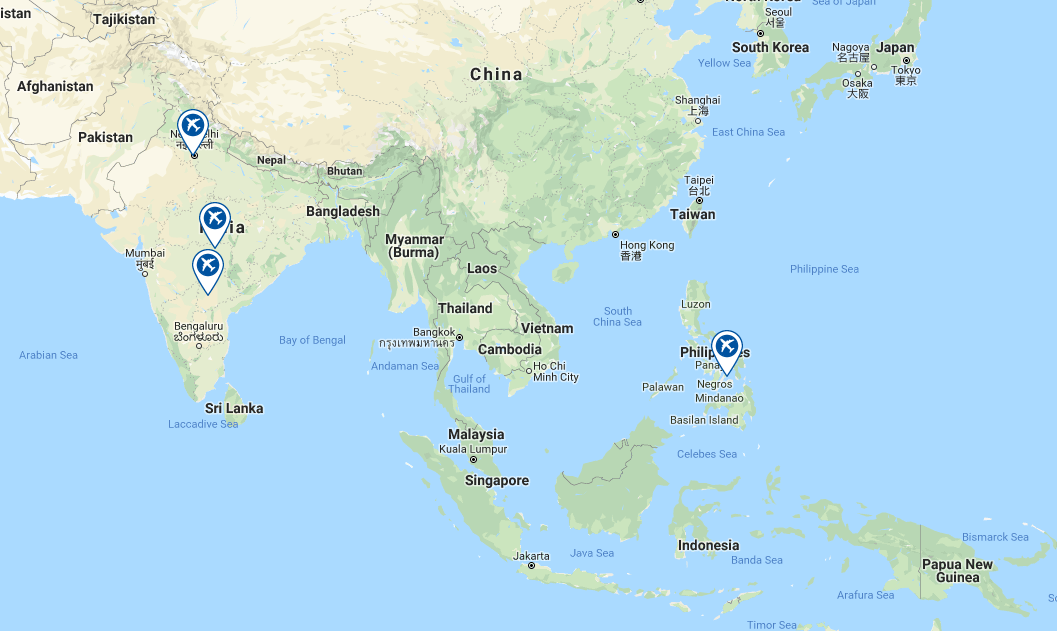

GMR Airports is, inter alia, the operator of Delhi's Indira Gandhi International airport and Hyderabad's Rajiv Gandhi International airport. It also has interests in the new Goa Mopa greenfield airport, in Mactan Cebu airport, the Philippines' second busiest, as operator, and in Ariadne Airport Group, which is building the new Kastelli airport on the Greek island of Crete. GMR also emerged recently as the highest bidder for an Indian greenfield airport at Bhogapuram, near Visakhapatnam.

Following the sale, GMR Infrastructure will hold a 54% stake in GMR Airports, while the TATA Group will hold 20%, GIC 15% and SSG 10% (and an investment ration of 44:33:22). The company's Employee Welfare Trust will own the remaining almost 2%. The three investors plan to infuse INR10 billion (USD145.2 million) in equity into GMR Airports.

GMR's stake will be boosted to 62% once certain milestones and performance metrics are achieved over the next five years. A pact will also include a non-compete clause between GMR and TATA Group in the airports business. About USD150 million of investment will come in the form of an equity infusion into GMR Airports Ltd, which will be used to retire the airport operator's debt. The three investors will use the remainder to buy GMR Airports shares from parent GMR Infrastructure and its units, which will also be used to pare debt.

MAP - The GMR Infrastructure portfolio includes airports across India as well as in the Philippines Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

After the completion of the deal, GMR has proposed to demerge its energy, highways, urban infrastructure and transportation businesses from the airports business, subject to board and regulatory approvals.

This investment is being seen as a lifeline to the debt-laden GMR Infrastructure, and is one it has sought for a long time. According to the CAPA - Centre for Aviation Global Airport Investors Database it was in the early part of 2014 that GMR first started to seek alternative funding for its airports unit, initially by way of a projected IPO. At the same time it introduced an 'Assets Light Assets Right' strategy, by divesting its 40% stake in Istanbul Sabiha Gökçen International airport in Turkey.

The transaction represents a strategic entry point for the TATA Group into the airport infrastructure business. TATA has investments in two domestic airlines, AirAsia India and Vistara. It is rare, though not unknown, for an airline operator also to own a majority stake in an airport and TATA's 20% is as big as it gets apart from obscure examples such as Bangkok Airways and its three Thai airports.

The specific reason for this in India is that airport slots tend to be influenced by lobbying and owning both an airport and an airline could lead to a conflict of interest and raise questions of antitrust and might attract attention from the Competition Commission of India.

TATA, one of India's biggest companies, has, in fact, being attempting to get into the airport business since the first set of Indian airport concessions in 2006. It set up a new division to operate airports in 2013, talking about investing USD8 billion in them, and since then has either bid for or looked into the operation through concession of various airports. These include facilities in Kolkata, Chennai, Ahmedabad, Guwahati, Jaipur, Lucknow and the Navi Mumbai project, as well as greenfield airports at Nagpur Sonegaon, Pune and Jamshedpur. Mostly it has done so on its own but it has occasionally attempted to form joint ventures with firms such as Ferrovial and Vinci.

The final pieces in this jigsaw are GIC, the Sovereign Wealth Fund that hitherto limited itself to investments in very big airports like London Heathrow and Beijing Capital International, and the Hong-Kong based SSG Capital Management Limited, a private equity firm specialising in credit and special situations investments and a new entrant to the business.

There are few large airport operators in India, other than AAI, GMR and GVK, and the government's recent auctioning of operating rights to six airports (as highlighted in the story below) is seen in some quarters as being just the start of airport privatisation, so interest from TATA, GIC and SSG is only to be expected.

https://corporatetravelcommunity.com/indian-airport-concessions-attract-strong-interest-including-some-new-players-but-few-foreign-companies/