However, with the exception of a few key players, Asian carriers have not yet fully taken advantage of the range of new aircraft technology. This is about to change though with the likes of: Cebu Pacific, Saudia, and Qantas Airways (for subsidiary Jetstar) ordering A321XLR at the 2019 Paris Air Show.

As one the discussion topics at the forthcoming CAPA Asia Aviation Summit and CAPA Asia Corporate Travel Summit, CAPA - Centre for Aviation will delve into this subject and look at successful examples of implementation of new aircraft types around the world??

The panel discussion will explore what opportunities still exist to tap into new aircraft types, what routes will be opened up from Asia into the Americas thanks to new aircraft technology and how much reliance is there on premium traffic to make ultra long haul routes sustainable.

As the foremost authority on aviation in the world, CAPA - Centre for Aviation's events provide cutting edge knowledge about strategic market trends and dynamics to help attendees make informed decisions, delivering the information and connections needed to inspire and improve business. The CAPA Asia Aviation Summit and CAPA Asia Corporate Travel Summit will take place in Singapore on 14-15 November 2019.

Over recent years we've been through a period of relatively benign external inputs, with low fuel prices supporting lower fares and a solid global economy supporting demand. This has propelled the industry into a period of unprecedented profitability (although US airlines, mostly operating domestically, have accounted for around half of this).

The period of high profitability is unlikely to continue as oil prices, currently in the mid-USD60s/barrel for Brent Crude, creep up and as business and consumer confidence - at least, outside the US - slips rapidly.

The IMF recently issued a warning that the global economy is weakening "faster than expected" and downgraded GDP growth forecasts for 2019, and the European Central Bank has "substantially" revised downwards its economic growth projections for 2019, implying a slackening of demand in markets which have become increasingly price sensitive.

At the same time, the entire aviation system is undergoing a technology-led upheaval of volcanic proportions, challenging conventional norms and demanding new solutions to new problems (and opportunities).

Airline management's role is to prepare for and manage the airline prudently through good times and bad; in a downturn this means minimising the impact on profitability while remaining competitive.

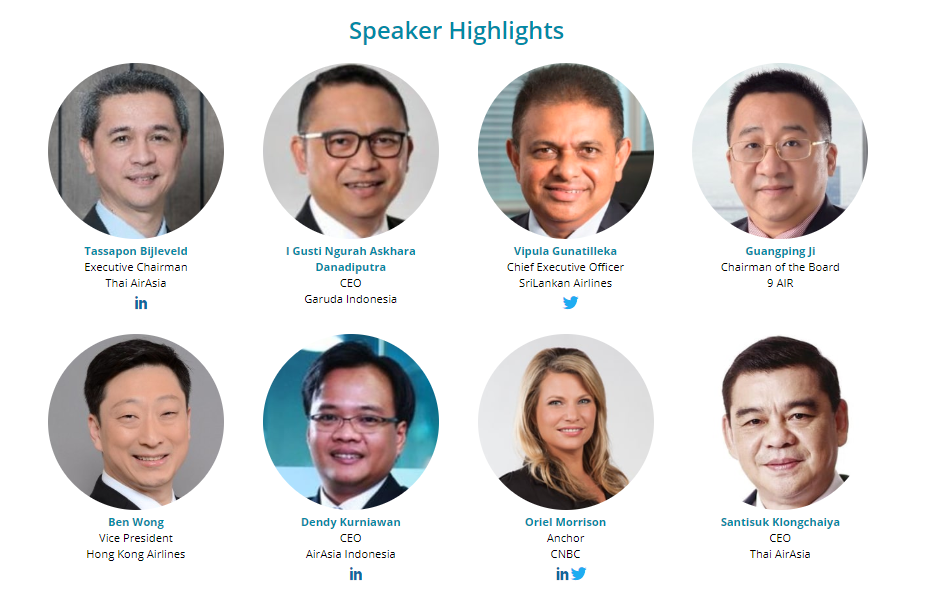

The CAPA Asia Aviation Summit and CAPA Asia Corporate Travel Summit will be held on 14-15 November to explore these issues, as well as the commercial and operational pillars underpinning strategic decision making at local and international carriers. It will gather 200+ aviation and corporate travel experts including CEOs from airlines and airports across Asia plus a selection of leaders serving the region.

The Summit is the ONLY platform that delivers a true end to end knowledge and networking experience for the aviation and travel industry, attracting players from across the entire travel ecosystem - from airlines, airports and hoteliers through to intermediaries and travel managers.

This event, hosted at the Capella Singapore, ranked as one of best hotel experiences in Singapore, is a must attend for those seeking to learn from, network and collaborate with today's aviation and travel industry leaders!